Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Designing a Token Economy — Incentives

The reason why incentive design is such a powerful tool for the design of software solutions is because when incentives are aligned correctly, they will push the solution to grow indefinitely. This article will introduce a method for the design of economic incentives, used by economies to deliver value to all participants through time.

Call it what you will, incentives are what get people to work harder. — Nikita Khrushchev

Introduction to this article

This article is the third part of a series on how to design a token economy, with lessons learnt from my work as a Lead Blockchain Architect for TechHQ. My goal is to produce a framework that can be reused for the analysis and design of token economies in a structured and comprehensive approach.

The previous articles in this series introduced how to define the goal of an economy as a single driving vision, how to define the economy participants and their transactions, and the design of the environment that allows participants to transact, which is closely related to the go-to-market strategy.

This article will introduce a method for the design of economic incentives, used to keep an economy in the goal path as it evolves through time. My knowledge of Game Theory is not at a PhD level so I’m sure that my method could easily be improved with some tools and techniques drawn from academia. As usual all feedback is very welcome.

For this part, as I did for the second part on Stakeholder Mapping and Market Design, I will take the TechHQ product for the Pioneers.io Energy Hackathon done in Bern in November, Strea. This solution had a very simple technological layer as a document registry with some auditing functions, and a carefully designed economic layer that theoretically allows Strea to easily reach a global scale.

About Incentive Design

One skill that is commonly listed as a requirement for the design of blockchain solutions is Game Theory, which relates to the research field of Mechanism Design. These areas of knowledge allow to understand why groups of individuals act in the way they do in the search for the fulfilment of their personal goals. To take an example from Bitcoin, the reason that the miners mine new blocks is because they are incentivized to do so by receiving a monetary reward in bitcoins every time they do so.

Academic knowledge in Game Theory will certainly help with incentive design, but from my own experience some common sense and critical thinking can produce an approximation that is good enough for prototypes and pitches. If you get your idea funded then you should definitely find a way to formalize it and give you more confidence.

The reason why incentive design is such a powerful tool for the design of software solutions is because when incentives are aligned correctly, they will push the solution to grow indefinitely. In the Bitcoin case this reward has attracted more and more miners for as long as the incentive mechanism remained within a certain region, with the capitalization of Bitcoin growing stratospherically.

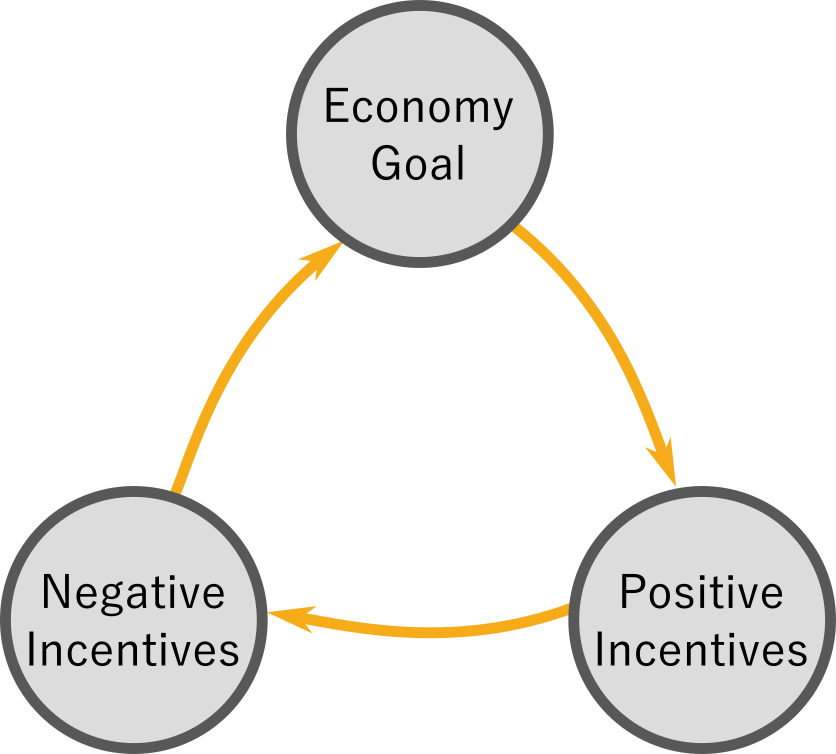

Designing Incentives

Economic incentives and value transfers are a powerful tool, since they can be used to motivate stakeholders to act in the greater good of the solution. By harnessing the will of the users the amount of management required is greatly reduced, which renders the solution more scalable. In part 1 of this series this was introduced as the decentralization goal that should always be part of a blockchain solution.

The essential prerequisite to design effective incentives is to work from the value transfer network that shows the desired transactions between our economy participants. This value transfer network will act as the goal for the incentive design, but at the same time the incentive design will produce a refinement of the targeted value transfers, and maybe the whole product to pivot.

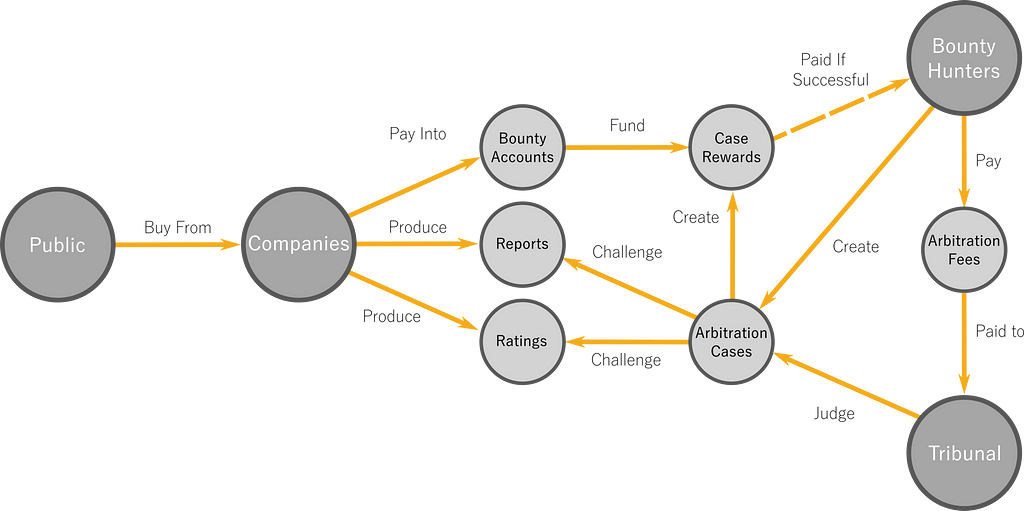

Economy goal: The goal for Strea is transparent reporting of carbon emissions. Successive incentive design iterations made us refine how much data should the companies be forced to make public, and what could they keep private. After a few iterations the solution reached was the simplest possible: All data reporting is completely voluntary, but there is no private data.

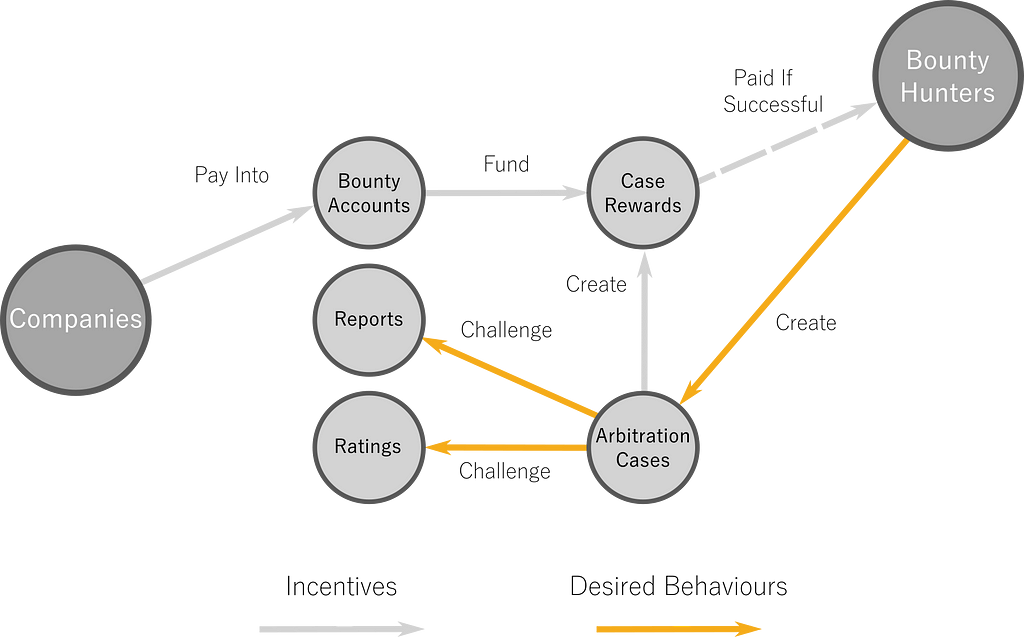

Positive incentives: These mechanisms are aimed to incentivize some economy participant to do something. In Bitcoin it is the block reward to incentivize miners to sign blocks. In Strea they were Bounty Hunters to find non-transparent reports, paid with fees from the Companies reporting.

In most solutions the number of roles can be reduced to five or less, and specific incentives will often include only two or three of them. In a first pass of the solution as shown above most roles and positive incentive mechanisms will be identified, which will probably contribute to a clearer definition of the value transfers between stakeholders.

Negative incentives: These mechanisms are aimed to disincentivize abusive behaviours. In Bitcoin all the disincentives are built into the blockchain platform that it runs on, but that is not an option for solutions that for example run on the Ethereum mainnet, and it isn’t necessarily the best strategy for all disincentives.

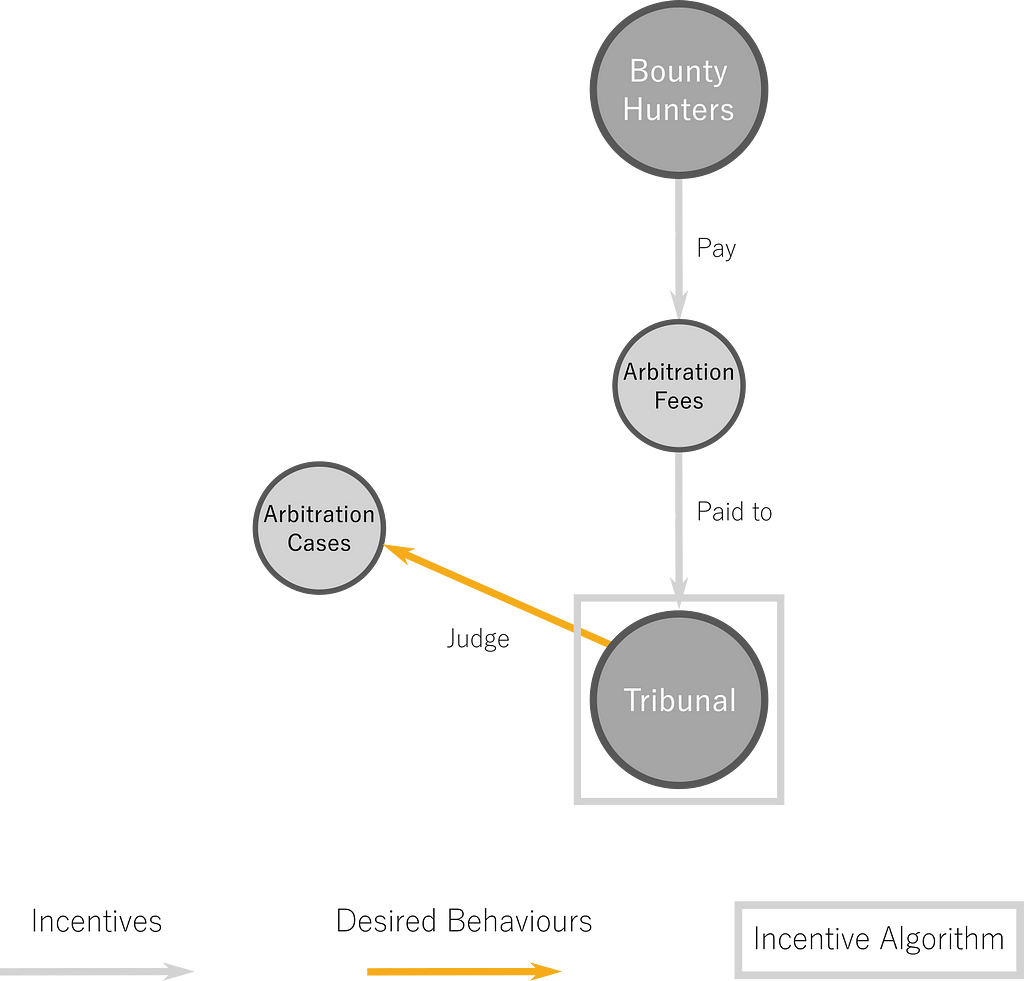

In Strea the first disincentive that we wanted to implement was that Bounty Hunters needed to be held accountable themselves and produce enough information so that the breach in transparency would be clear and fair. For this purpose we decided that the Bounty Hunters would only be paid when they would be providing verifiable transparency breaches and lacking low level consensus protocol options we implemented an independent tribunal.

We immediately realized that the tribunal members might not be unbiased themselves, so we implemented randomized tribunal selection, tribunal isolation, penalties for being in the minority side of the tribunal decision, and penalties for not taking a decision. All these features are not detailed in this article.

A second iteration of the incentive design process yielded tweaks to the economy goal, to the value transfers between stakeholders, insight on abusive behaviours and a more complete incentive design. Each successive iteration should yield less changes and converge to a final solution. If this is not the case maybe a deeper look into the economy goal should be considered.

Conclusion

Economic incentives are a powerful tool for the design of decentralized solutions, allowing for economy participants to be trusted to work together towards the economy goal without the need for manual supervision. This produces more scalable solutions, which in turn makes it easier to achieve the necessary critical mass of participants for the solution to be self-sustaining.

The design of economic incentives is not a new field of study, but their mass application to the development of software products is, and the tendency for short implementation windows and frequent pivots requires a loose framework that can be widely used for this purpose. Deep academic knowledge and support is always welcomed, but not always readily available or easily integrated.

In this article we have presented how the incentive design can be facilitated by relying on a stakeholder value transfer network and an iterative process that focuses on the economy goal and the network of positive and negative incentives that steer the economy participants to work together.

An economy designed using these tools can be easily portrayed using simple diagrams, which in our experience do a great job of helping potential investors understand the solution during a pitch. An economy designed using these tools can be easily portrayed using simple diagrams, which in our experience do a great job of helping potential investors understand the solution during a pitch. For proof, please follow future developments in Strea.

Article originally published in the TechHQ blog.

Designing a Token Economy — Incentives was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.