Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

What Is NULS?

NULS is a modular blockchain that implements a proof of credit (POC) consensus protocol. The team behind it is on a mission to provide enterprise-level blockchain infrastructure with a focus on pluggability and customization. They plan to do so through customizable modules that include smart contracts, subchains, and cross-chain consensus, among other things. Let’s dig in.

In this guide, we break down:

- How Does NULS Work?

- Team and Progress

- Trading

- Where to Buy NULS

- Where to Store NULS

- Final Thoughts

- Additional Resources

How Does NULS Work?

The NULS design consists of two functional parts:

- The microkernel is the foundation of the network. It renders the project’s underlying mechanisms.

- The functional modules are the plug-and-play compartments of the blockchain. They have low coupling among each other, so you can swap them in and out as you see fit.

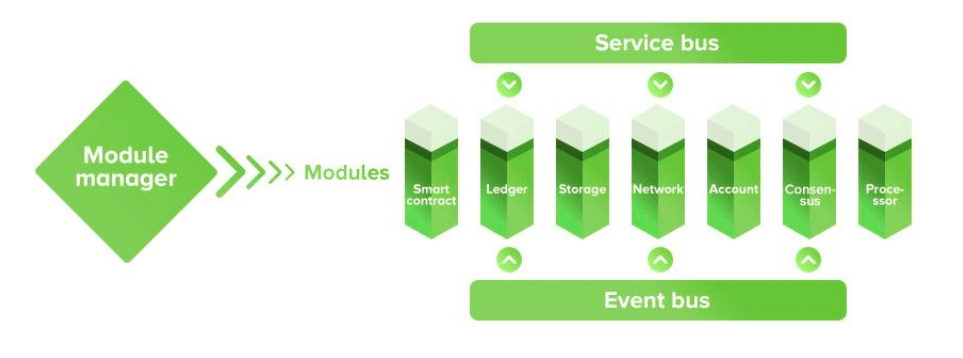

Modular Structure

From the microkernel-powered module manager, you can connect different modules to your blockchain. For instance, you have customizable control over smart contracts, storage, consensus, and accounts. Think of the relationship between modules and your blockchain as something akin to the relationship between WordPress plugins and your website.

NULS Modular Architecture

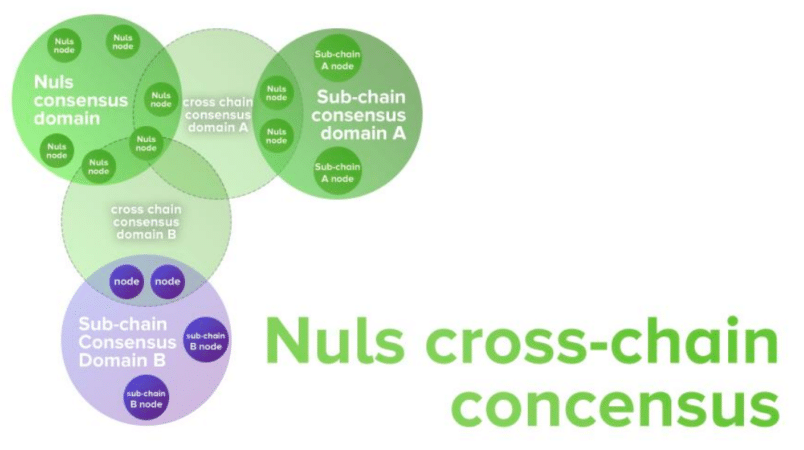

Multi-Chain System

Instead of hosting all applications on the main chain, the network uses subchains in a multi-chain system. For block verification, the subchains report to the main chain, which, in turn, verifies their block headers. Therefore, the system needs some cross-chain communication.

NULS C3D

To accomplish the cross-chain verification, NULS has a cross-chain consensus domain (C3D). Simply put, each subchain has a set of nodes specific to itself. They also have a set of nodes that communicate cross-chain with the main blockchain. Nodes that take part in the cross-chain consensus need to load modules that work across both chains.

Proof of Credit (POC) Consensus

Although you’re able to set the consensus of your subchain to whatever you’d like, the main NULS chain utilizes POC consensus. Similar to proof of stake (PoS), POC requires you to lock a certain number of tokens to run a network node. The project also implements masternodes.

You need 2,000 NULS to vote for masternodes and 20,000 coins to create a node. If your node receives 200,000 votes, it becomes a masternode.

Now, the idea of nodes/masternodes isn’t anything new. However, NULS is unique in its use of a credit rating alongside them. The network calculates a credit coefficient for each node, which determines their consensus reward. The calculation is:

Credit Cardinality = Coefficient of Capacity + Coefficient of Duty

Coefficient of Capacity: Calculated based on the number of blocks generated in the past

Coefficient of Duty: Calculated based on violation cases and accuracy of blocks generated

Five million tokens enter circulation each year, and the total supply started at 100 million at launch.

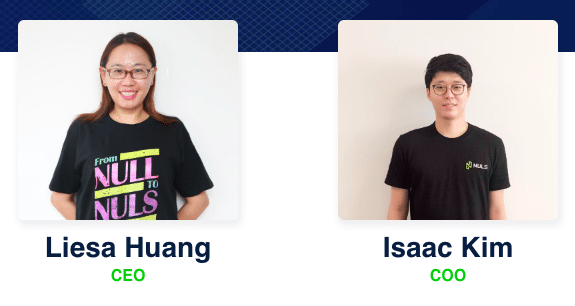

Team and Progress

The NULS team is surprisingly large for the project’s current market cap, consisting of over 30 members. Led by CEO Liesa Huang and COO Isaac Kim, the project has contributors around the globe including team members from China, England, France, America, and Australia.

Leadership Team

Unfortunately, the roadmap on the project’s website is somewhat out-of-date. However, it looks like the team launched the mainnet in July 2018. Now, they’re working on NULS 2.0.

This next iteration includes multi-language modules, cross-chain functionality, and better interfaces across associated products. Version 2.0 is currently going through alpha testing and should be available on testnet sometime in Q2 2019.

Competition

At its core, NULS is a decentralized app (dapp) platform, so it’s competing with similar projects. Ethereum is the most well-known competitor in the space. Lisk is a similar project with its use of sidechains. Additionally, NEO and Cardano bring substantial opposition.

NULS’s unique value proposition comes with its modular design and implementation of the Proof of Credit consensus mechanism.

Trading

Since launching in October 2017, NULS has followed the market to a tee. The coin’s USD price reached an all-time high of over $8.00 during the height of the crypto bull market in January 2018. Following that, the price has steadily fallen. Although, it hit an all-time BTC price high of around 0.0006 BTC in May 2018. The price has seemingly found a bottom at $0.40 (~0.0001 BTC).

Like most altcoins, adoption is critical to positive price movements. For NULS, however, this may take some time. The project’s roadmap lists a goal of just 15 NULS-based application as their next milestone. So, you probably shouldn’t expect a price jump anytime soon.

Where to Buy NULS

The majority of the NULS trading volume occurs on Bit-Z, as a pair with Bitcoin. However, we recommend that you look to Binance instead as it’s a more popular option for most other coins. You can trade Bitcoin, Ethereum, Tether, and Binance Coin for NULS on the platform.

You can also earn coins by operating a node and voting in the project’s ecosystem.

Where to Store NULS

The NULS team provides an official wallet for Windows, Linux, and Mac operating systems. On top of that, they’ve created a light wallet that enables you to store your coins without having to download the entire blockchain.

If a mobile wallet is what you’re looking for, the NULS team suggests the third-party AnyBit wallet.

Final Thoughts

NULS’s modular structure is undoubtedly unique in the dapp platform space. Even though the project hasn’t gotten the adoption or recognizability to merit it a success yet, the development team is continuing to push code to the Github repo and publishes regular updates.

The launch of NULS 2.0 and a market turnaround could be just what this project needs to put it in the spotlight. Even though it sits low in the market cap rankings, it may be something you want to keep your eye on.

Additional Resources

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.