Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

This is not my typical article about security tokens. Normally, I prefer to focus on technological topics because is where I feel I can contribute the most and I tend to write in a positive sentiment as I am optimist by nature. Today, I would like to make a small deviation and raise awareness about one of the phenomenon’s I think is becoming somewhat toxic in the nascent security token industry. For the lack of a better term and borrowing a page from the Bitcoin space, I am going to refer to this tendency as “security token purism”. Before we start, let me clarify that the intention of this article is not to criticize any company or person in particular but rather to write down some reflections about a tendency that is becoming more prevalent in industry forums and conferences.

Security token purism sounds like an exaggeration. Do we really have purists in an industry that is less than two years old? Well, they do exist. In an industry so new and disruptive, the most logical position to adopt is to remain humble and accept that there are many things we don’t know and most of the answers will be dictated by the technological evolution of the space. Instead, security token purists seem obsessed with drawing imaginary boundaries to constraint the evolution of the space to fit their particular product or service. It’s almost as they are too afraid to discover the real potential of security tokens. Security token purism would be almost laughable if it wasn’t because many of those ideas are becoming the central point of discussion in security token forums. How to identify a security token purist? Here are a few symptoms that might help:

· They like blockchain but hate Bitcoin.

· They always knew that ALL ICOs were fraudulent and doom to fail.

· They can’t differentiate utility tokens from ICOs to save their lives.

· They believe that decentralization is a principle of blockchain anarchists.

· They LOVE regulation and believe that the evolution of crypto-securities will be absolutely driven by regulation.

· They think most of the processes for the issuance and management of crypto-securities should be kept off-chain as they are today.

· They don’t understand the value of open source.

· They love security token standards.

Sounds familiar? I believe some of those ideas are counterproductive to a movement that is trying to reimagine the foundations of the securities industry. Besides, they are factually wrong, and they contradict everything we know about the history of technology and financial markets. For all the issues with ICOs, they validated the Ethereum network and showed that it was possible to create new forms of economics in applications not to mention that they were a few successful ones. No ICOs, no STOs. The security token space is going to evolve guided by technology breakthroughs that are pushing the boundaries of regulation and many of the traditional principles of the securities industry will be reimagine with programmability. That’s what security tokens give us. Everything else is creating a digital wrapper for a paper certificate. Useful but not particularly groundbreaking.

Instead of debating abstract points, let’s get a bit more practical and demystify some of the core ideas that we hear from security token purists.

Challenging the Key Ideas of Security Token Purism

If you follow the crypto-securities industry you must have come across some of the ideas of security token purism. Although those ideas take all sorts of shapes and forms, they are rooted in some fundamental principles that I would like to challenge in this section:

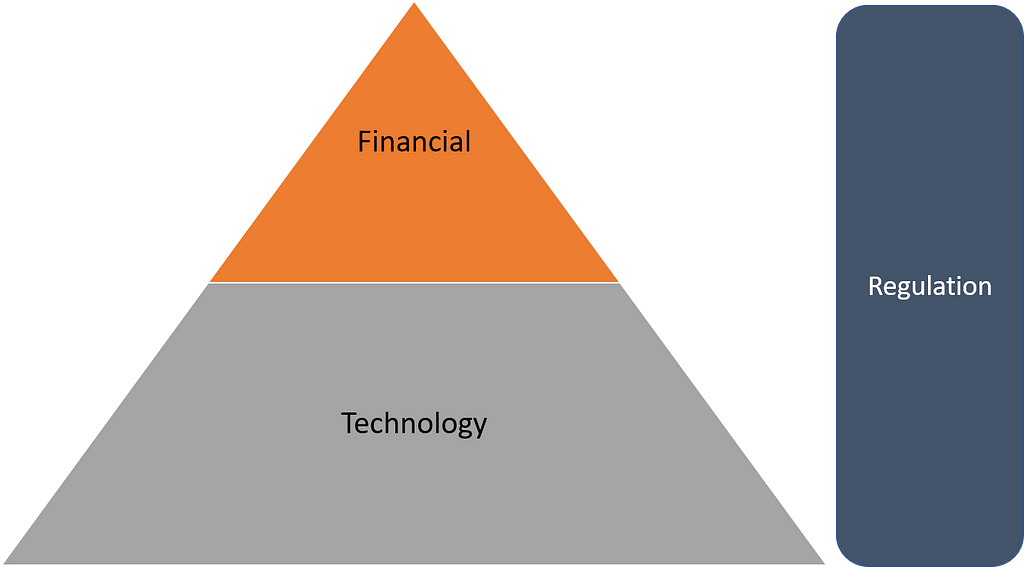

Regulation Before Technology

This slogan: “regulation before technology” is regularly used in many security token conferences and numerous articles as a way to explain the evolution of crypto-securities. The idea of regulation before technology is not only absurd and illogical but it also contradicts the history of technological and regulatory movements. British-Venezuelan scholar Carlotta Perez is one of my favorite thinkers in technological and socio-economic development. In her famous book “Technological Revolutions and Financial Capital”, Ms. Perez explains any technology revolution in four fundamental stages: irruption, frenzy, synergy and maturity. Regulation only appears in the synergy phase as a way to prevent inequality of the use of the technology for a benefit of a privileged minority.

Regulation is absolutely needed in the security token industry but as a way to guide the evolution of new technologies not to dictate what technologies can be created. Regulation should evolve and adapt in parallel to the technical and financial improvements unlocked by security token technologies. Saying “regulation before technology” is like saying “marriage before dating”; It happens but is not recommended.

Compliance is the Enemy of Decentralization

Another of the common principles of security token purism is the idea that compliance and decentralization cannot coexist. Compliance is seen as an intrinsically centralized activity based on trust of a specific authority so how can it possibly be decentralized? Although there are many circumstances in which compliance checkpoints need a centralized authority generalizing that statement seems like a really constrained position to take.

The biggest breakthrough of blockchain technologies is that gave us a model in which we can trust match and computer science instead of humans to make group decisions. Neglecting that value would be ignoring the most valuable asset of the foundation of the entire security token industry.

A significant percentage of compliance rules in security token transfer can be expressed in the form of smart contracts and that’s a first step towards decentralized compliance. At the moment, most compliance checkpoints in security token remain vastly centralized because most products operate in isolation in the absence of a network. However, to remain defensible, security tokens might start slowly evolving into network models with increasing levels of decentralization. I am not saying that all compliance will be decentralized. The future of security tokens is likely to include a hybrid of centralized and decentralized compliance models and those can totally coexist.

Off-Chain Processes versus Programmability

One of the key promises of security tokens is the potential of disintermediating many aspects of the current securities ecosystem. Contradictorily, security token purism seems obsessed with the idea of wrapping existing off-chain processes around every security token. Pick any area of the securities industry that you think can be disintermediated by security tokens and you are likely to find a product or service that applies those processes to crypto-securities. Not surprising, many of those off-chain services

Programmability is the number one value of security tokens and one that allow us to expand the horizon of the securities industry with products that are not possible today. Moving more functional blocks of securities into smart contracts seems like an inevitable step in the evolution of the space. Off-chain processes are still going to be required by less and less relevant.

Open Source is not Necessary

Security token purism is notorious for ignoring the value of open source. I think the idea of other people reviewing and validating their code seems foreign to them. Open source is not only one of the fundamental ethos of the blockchain but creates incredible defensive network effects. One of the things that security token purists fail to understand is that Github repos speak louder than press releases.

Well, there you have it, this are some of my thoughts against security token purism. I tried to express those thoughts in the most respectful way. I am afraid that security token purism is becoming one of the dominant narratives in the space and one that can be incredibly harmful. At this nascent moment in the security token industry we need ambition and creative thinking not dogmas and self-impose restraints.

Against Security Token Purism was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.