Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

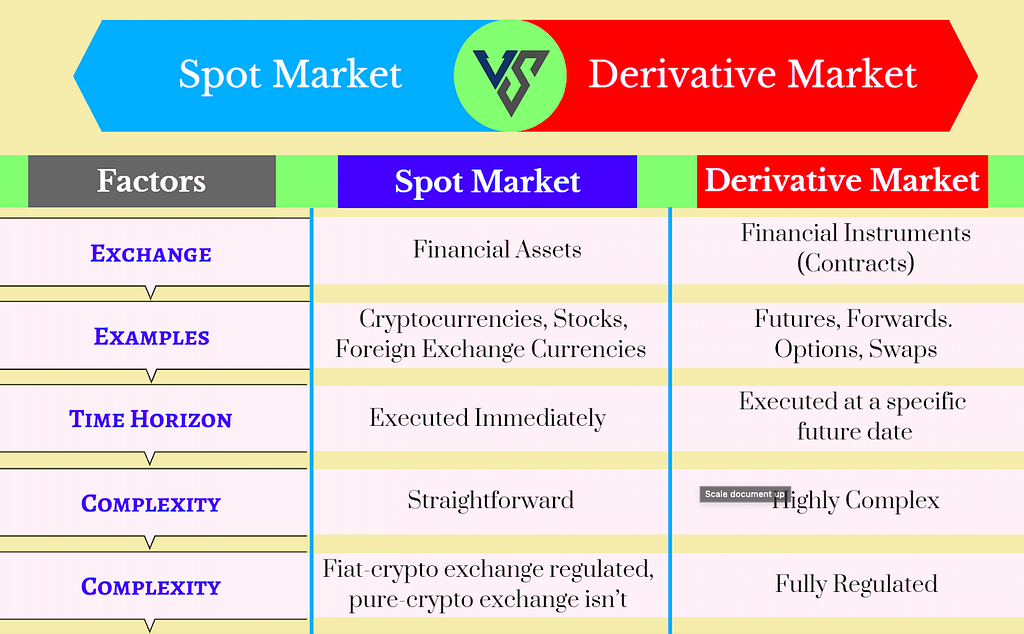

A derivative is a financial contract between two or more parties that derives its value from an underlying asset ie. stocks, commodities or cryptocurrencies. An agreement to buy or sell a particular asset at a predetermined price and a specified time in the future. Derivatives do not have inherent or direct value by themselves. The value of a derivative contract is purely based on the expected future price movements of the underlying asset.

Cryptocurrency tokens are special kind of virtual currency tokens that reside on their own blockchains and represent an asset or utility. Tokenizing assets via Blockchain is maturing and we are already seeing great traction in the industry. You can find all the info you need about STOs in these articles:

Adoption is happening daily — most recently with Facebook launching their Cryptocurrency. And so are derivative markets with physical delivery that can actually reduce volatility in the price of Bitcoin, which was the original intention of derivative markets in the 18th century.

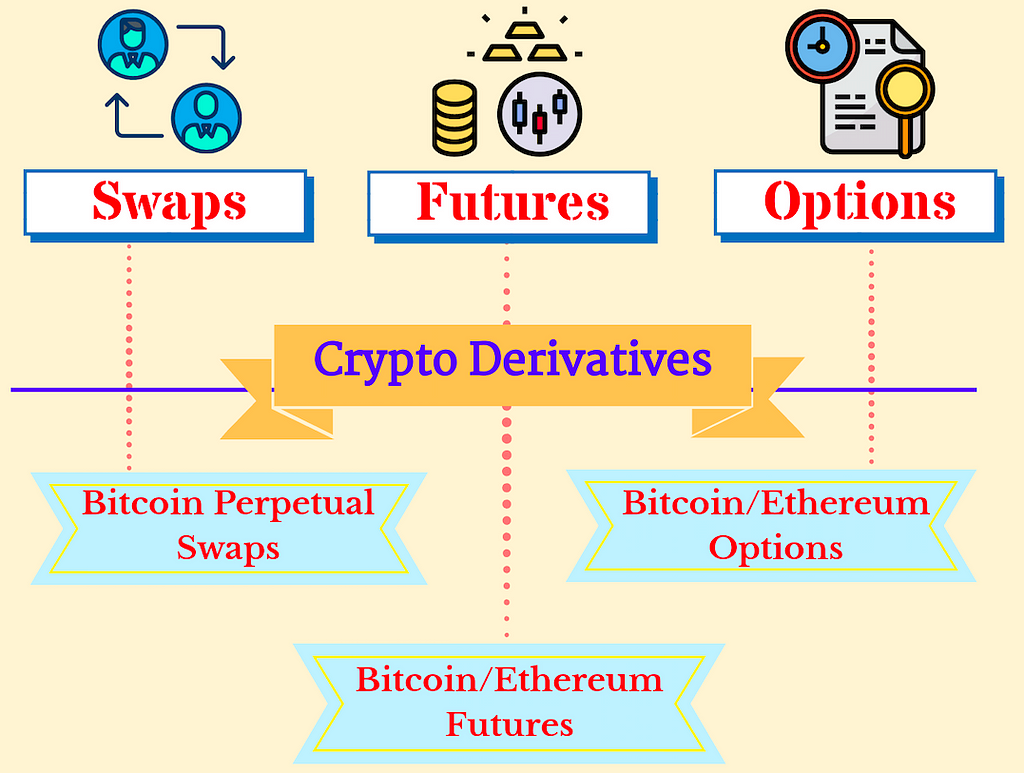

Crypto Derivatives

The main forms of derivatives are:

- Swaps: A swap is an arrangement between 2 parties to exchange a series of cash flows in the future. They are usually based on interest-bearing instruments such as loans, bonds or notes as the underlying asset. The most common form of swaps are interest swaps. It involves the exchange of a future stream of fixed interest rate payments for a stream of floating rate payments between 2 different counter-parties.

- Futures: A financial contract where a buyer has an obligation for a buyer to purchase an asset or a seller to sell an asset at a fixed price and a predetermined future price.

- Options: A financial contract where a buyer has the right (not an obligation) to purchase an asset or a seller to sell an asset at a predetermined price by a specific timeline.

Volatility on Volatile Assets

Keep in mind crypto-derivatives represent the second layer of speculation on top of an already volatile crypto-asset. One of the main factors that drive the price of cryptocurrencies is news and market speculation. Hence, there are no easy ways to predict any of those. In an article written by Moonwhale, traditional market trading/ investing strategies may not be applicable. Complex hedging strategies or rebalancing function did not stop Crypto Hedge Funds from experiencing massive losses. If we add a mathematical model (derivatives) on top of that, we are essentially adding a speculative vehicle on top of a volatile vehicle.

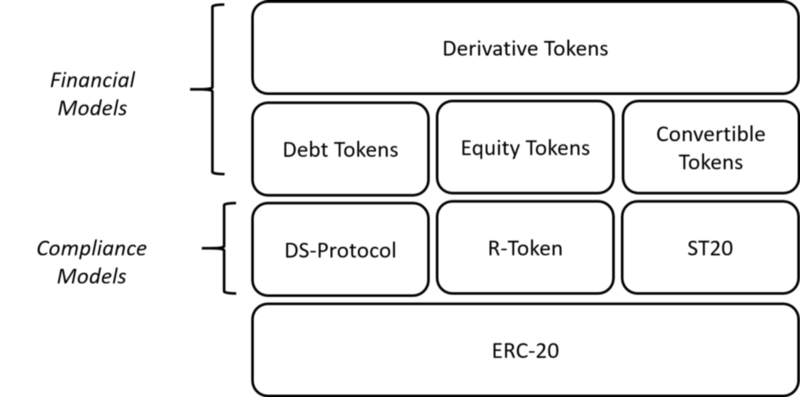

Are Security Tokens a Derivative?

Any form of security token can be considered a derivative because it derives value from the performance of an underlying asset. However, traditional derivative models include other aspects such as time constraints, obligation symmetry or settlement model. They do not quite fit the profile of security tokens. Therefore, security tokens can behave like derivatives while others trade more like first-tier asset classes.

Types and Models of Security Token Derivatives

As the security tokens market evolves, there are several derivative products that are likely to surface.

- Derivatives that Represent Security Tokens

These are mathematical models that speculate on the price of underlying security tokens that can represent alternative assets such as real estate, art, shares, gold or others.

- Security Tokens that Represent Market Derivatives

We can tokenize everything so tokens could represent market derivatives such as options or futures.

- The Forward-Futures Model

Smart contracts can specify the criteria to buy or sell a security token at a specified future time and at a previously agreed price. It follows the model of forward or futures derivatives in financial markets. These security token derivatives can follow the futures model if traded in centralized exchanges or the forward model if traded in decentralized exchanges.

- The Options Model

The owner of the security token option will have the right but not the obligation to buy or sell the underlying security token at a specified price on a specified date.

- The ETF Model

Exchange-traded-funds are viable for security tokens. ETF-like security tokens could represent the value of an underlying group of assets such as real estate leases, loans or private shares of different companies.

- The Swap Model

Security token derivatives can be similar like swap models in financial markets. It exchanges the dividends or cash flow produced by two different security tokens. By doing so, it can serve as a hedge or insurance against future market conditions.

- The Mutual-Fund Model

The mutual-fund model is better suited for enterprises. such as financial institutions that are looking to issue their own security tokens. Just like ETFs, Mutual-Fund tokens will aggregate a pool of security tokens. However, unlike ETFs, they won’t be actively traded and only priced at regular intervals.

“Derivative markets foremost value will be the implied risk information that can help investors make allocation decisions.”

Conclusion

The rise of Stablecoins has granted investors a way to hedge their investments. Most exchanges have already included various stablecoin pairings to Bitcoin and Altcoins. However, for larger funds, it can still prove to be an obstacle. Crypto derivatives can address an obvious need for large institutions to leverage on. It is only a matter of time when Cryptocurrencies can truly be considered as an established financial market.

To read more on two other types of security tokens, here’s my other article

Security Tokens — Three Types You Should Know Of

About me:

Iliya Zaki is the Head of Business Development and Marketing Officer for Moonwhale Ventures.

Follow us on our various social media platform —

Twitter | LinkedIn | Facebook | Telegram

An Overview of Security Token Derivatives was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.