Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Blockchain has been capturing the imagination of businesses and government organizations, alike. But it can be difficult to sort between the hype and the real potential of this technology. With that in mind, we wanted to take a systematic approach to evaluate it. To do so, we have used the Emerging Technology Analysis Framework (ETAC), which takes a broad view of emerging technology by probing impact, feasibility, risks and future timelines.

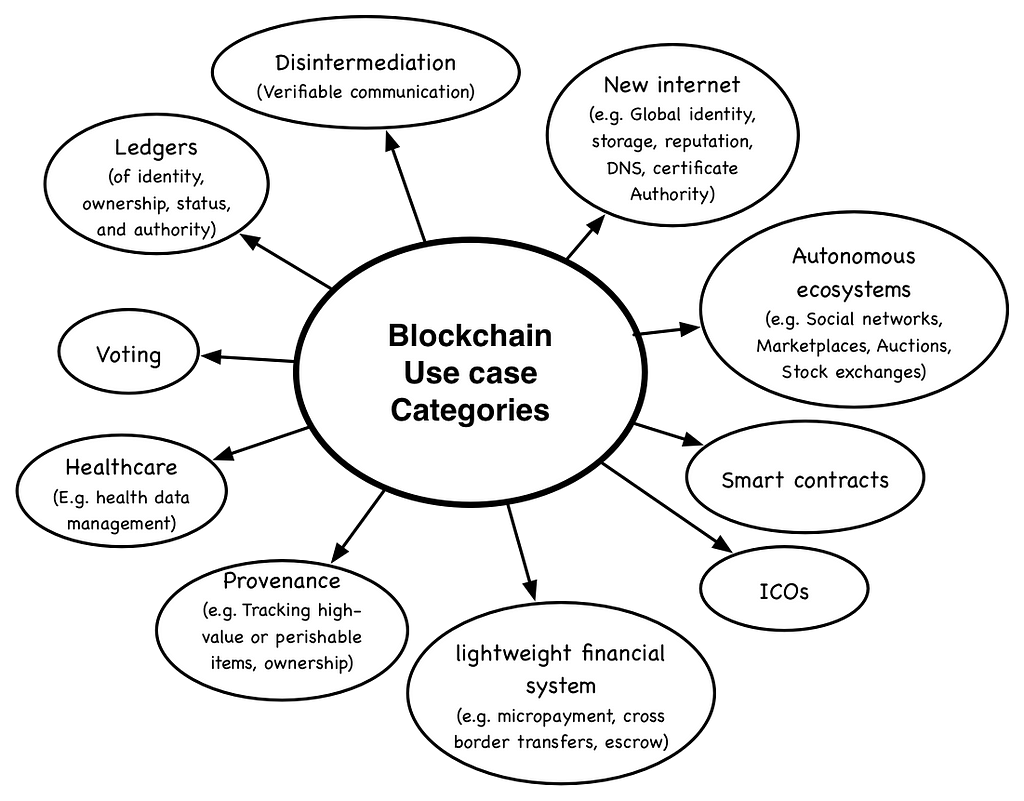

Additionally while doing our research, we soon understood that blockchain is many things, and it is hard to talk about blockchain holistically. Therefore, identified 10 categories of blockchain use cases to focus on in our evaluation.

These use case classes are identified in the following figure.

Here then is a summary of our observations around the impact, challenges, and risks of adopting blockchain, and how each of the above use cases is affected.

Impact

Blockchain provides an immutable decentralized ledger. We can use this ledger to improve trust. This happens in three key ways.

First, blockchain provides each participant with an identifier and means to manage verifiable claims, such as certificates of his name, education qualification, and birthday, among others. For example, we can use the blockchain can use two W3C specifications: decentralized Identifiers (DID) and verifiable claims to implement the above security scenarios. This enables two parties, who do not know each other, to verify the other and know his attributes, thus establishing trust. This has several advantages.

- It lets us replace current alternatives to trust that are time-consuming, expensive, and weaker, such as intermediaries and government inspections.

- It is faster, often establishing trust within a second.

- It is much more secure, guarded by cryptography algorithms and census data.

- The resulting system is cheaper and more agile.

Blockchain provides a way for multiple parties to communicate or work together in an auditable manner. This again removes costly processes (e.g. lawyers or other intermediaries) to establish trust between two parties. This also contributes to the resulting system being more cost-effective and agile.

The blockchain is decentralized. No single user or small group of users can change the blockchain, giving us a trustable source to manage ultra-critical systems. This elevated level of trust enables use cases that were not possible before, for example, global reputation and voting).

Challenges and Risk

In evaluating blockchain, we distinguish between challenges and risks. What we call challenges are technical limitations, which are likely to be fixed in the future. In contrast, risks are inherent to the nature of the blockchain and are unlikely to change.

Technical challenges

For blockchain, we have identified four technical challenges: limited scalability and latency, limited privacy, storage constraints, and unsustainable consensus. Let’s take a closer look at each of these.

Limited scalability and latency. At the time of writing, a bitcoin transaction takes about 8 minutes and can support only about 2 to 3 transactions per second. Most use cases that we evaluated are not feasible under these limits. For example, to handle global-scale systems, such as a decentralized internet, blockchain needs to handle tens of thousands of transactions per second. However, it is worth noting that this is decided by the choice of consensus algorithm. Private blockchain implementations have proposed faster algorithms although they provide lesser guarantees.

Limited privacy. Blockchain provides pseudo anonymizations. However, by analyzing the transaction graph and other related information, it is often possible to link users to transactions. Once one transaction is linked to a user, all his transactions become known.

Storage constraints. With current algorithms, each node must store the full history of the blockchain. This leads to high transaction latencies. The need to store the full history also forestalls lightweight nodes, such as IoT devices, from joining a blockchain network. As time passes, the history becomes larger aggravating the problem.

Unsustainable consensus. The current consensus method is cumbersome and consumes a significant amount of energy. For example, if considered as a country, Bitcoin energy consumption would be 39th in the world, which is higher than in Australia.

Risks

Next, we identified five risks with bitcoin: irrevocability, regular absence, misunderstood side effects, fluctuations in bitcoin prices, and unclear regulatory responses.

Irrevocability. The irrevocability of transactions is a significant risk. For use cases, such as bitcoin and land registry, a resource is passed from one owner to another, and only the current owner has the ability to assign it to a new owner. For this and similar use cases, irrevocability can have devastating consequences. However, for most other use cases, this can be addressed via a recovery transaction that undoes the original transaction.

Regulator Absence. Another risk is regulator absence. A regulator plays a key role in some use cases. For example, in the case of a stock market or share offering, oversight makes sure that all parties are protected. Without a regulator, it might not be easy to detect and avoid pyramid schemes and other types of fraud. Although not popular, regulators play a crucial role in many systems. Blockchain-based systems, in their current form, do not support a regulator. Also given irrevocability, it can either be impossible or expensive to fill the missing regulator’s role.

Misunderstood Side Effects. The impact of blockchain extends beyond computer science. We need to understand the economics, social, and political side effects of the blockchain.

Fluctuations in Bitcoin Prices. Another risk is fluctuating bitcoin prices. However, many believe that this is because it is new; its intrinsic value is hard to judge, and it will stabilize over time (see Barker (2017)). With high bitcoin values, transaction charges are also high, making them unattractive for many use cases, such as micropayments. It seems that the deflationary nature of Bitcoin and broad transformative use cases are in conflict due to the transaction costs. This problem will escalate with time.

Unclear Regulatory Responses. As we discussed under impact, blockchain changes many interactions and transactions that are currently governed by regulations and laws. Therefore, we are likely to see future regulations and laws governing blockchains and their use. The responses of those institutions are not clear, and the associated uncertainty creates risks for anyone adopting bitcoin.

Analysis of Use cases

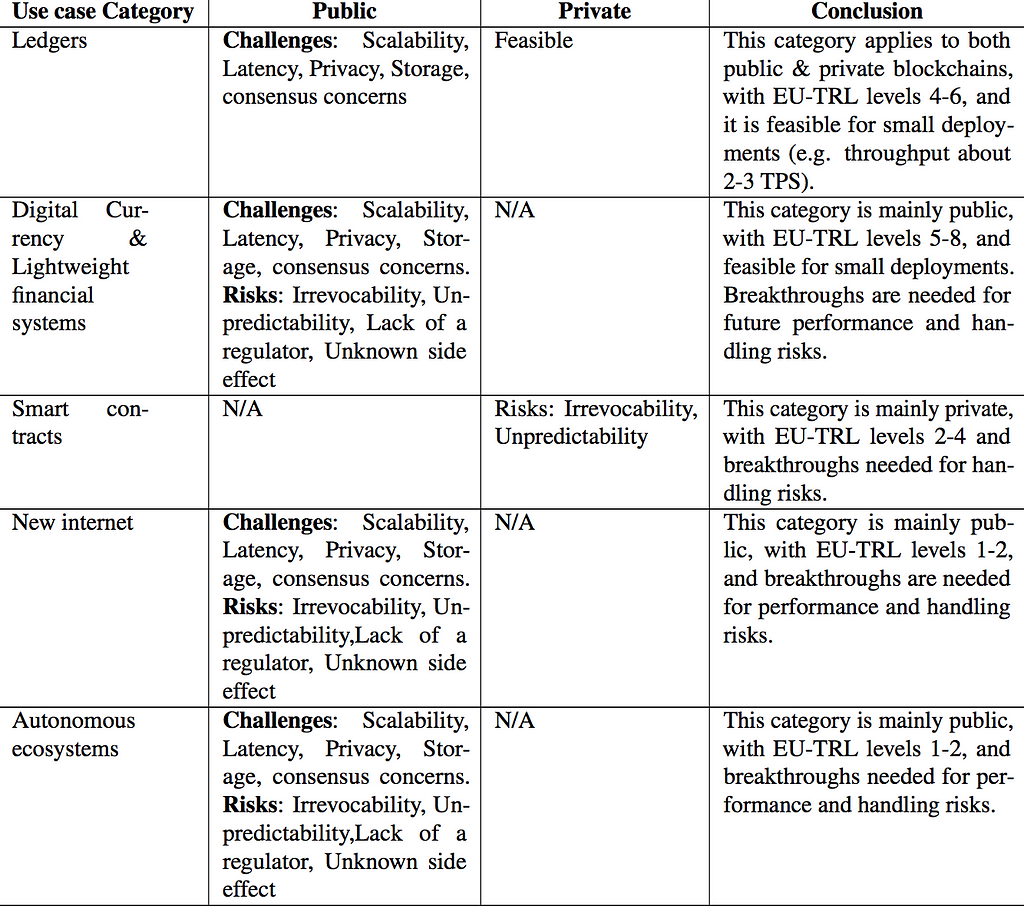

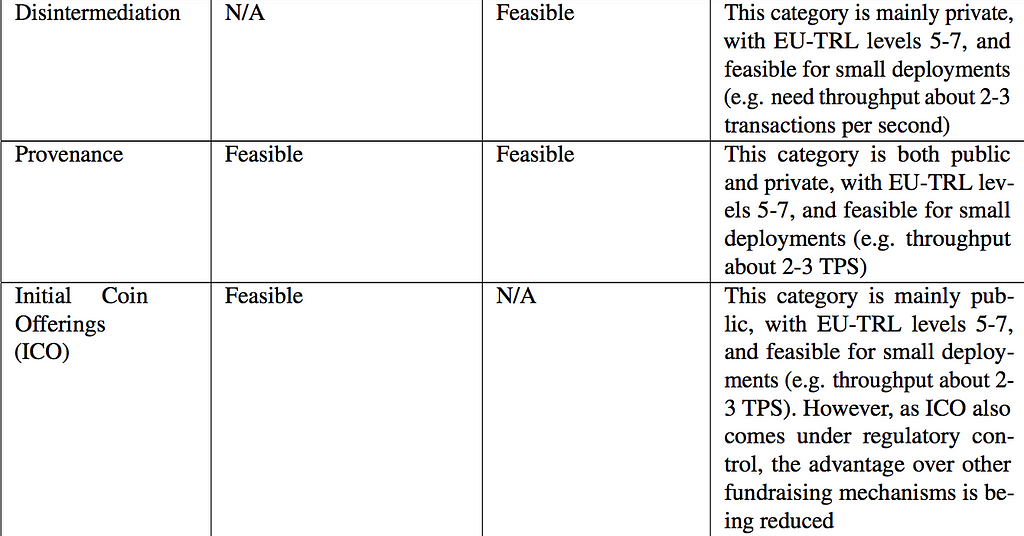

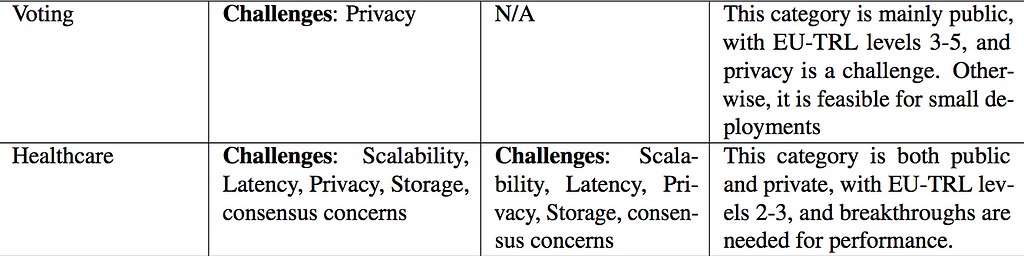

For each of the ten use cases we focused on, we identified the challenges and risks associated with both public and private implementations. Additionally, in our conclusions, we include the European Union Technology Readiness Level (EU-TRL) for each use case. The following table summarizes our analysis.

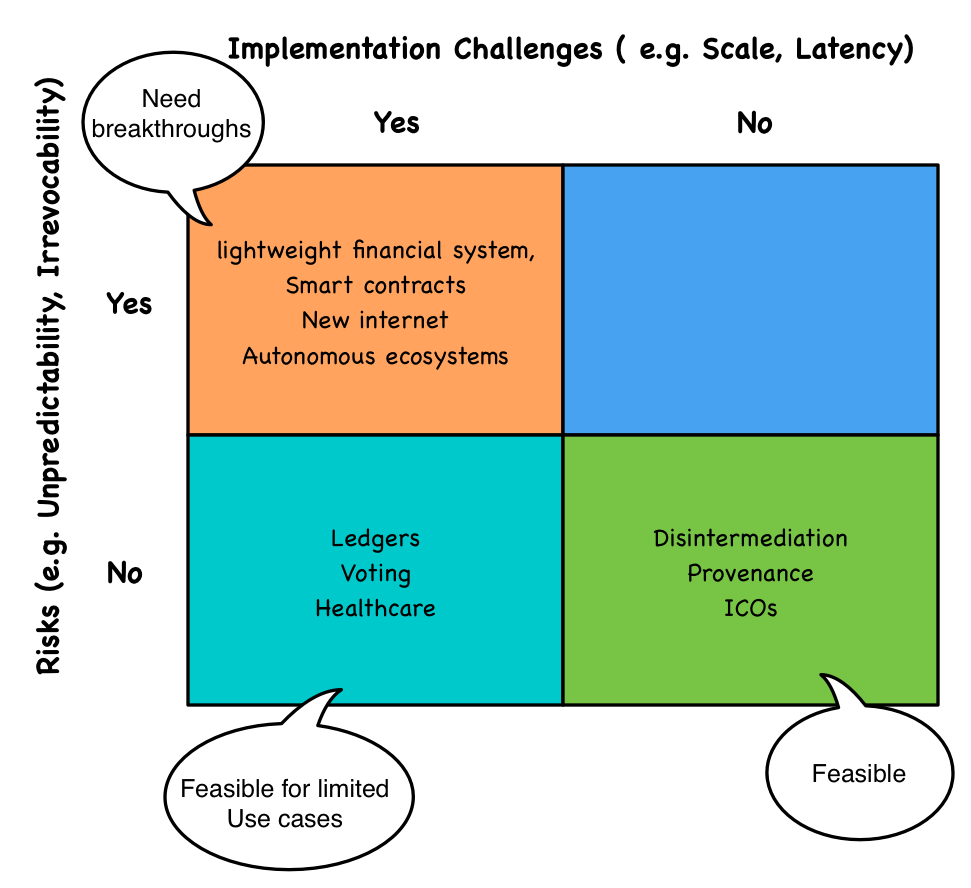

The following picture shows the same information visually.

From the analysis above, we have made six assertions.

- Blockchain’s potential impact is real. If successful, blockchain technologies can transform the way we live our day-to-day lives.

- We believe the technology is ready for limited applications in digital currency, lightweight financial systems, ledgers (of identity, ownership, status, and authority), provenance (e.g. supply chains and other B2B scenarios) and disintermediation, which we believe will happen in next three years.

- With other use cases, blockchain faces significant challenges, such as performance, irrevocability, the need for regulation, and the lack of census mechanisms. These are hard problems, and it could take at least 5 to 0 years to find answers to those problems.

- It is unclear whether blockchain can sustain the current level of effort for an extended period of 5-plus years. There are many startups, and they run the risk of running out of money before markets are ready. The failure of startups can inhibit further funding and investments.

- Value and need for decentralization provided with blockchain compared to centralized and semi-centralized alternatives are not clear.

A detailed review of our blockchain analysis using ETAC can be found in our recently published paper, “A use case centric survey of Blockchain: status quo and future directions”.

To receive updates to ETAC and ETAC-based emerging technology analysis, subscribe to our Global Technology Outlook Updates Newsletter.

Forecasting the Future of Blockchain: a Systematic Analysis was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.