Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Overview:

- Blockchain technology is still at its early stage, with a lot of undiscovered potentials. VCs, corporate VCs, and corporations are investing in blockchain initiatives looking to transform traditional use cases.

- Similar to the Internet Revolution, central authorities won’t be replaced.

- According to Gartner, the business value-add of blockchain will grow to slightly more than $176 billion by 2025, and then it will exceed $3.1 trillion by 2030.

I) Looking into the Past:

1.Brief History of Blockchain:

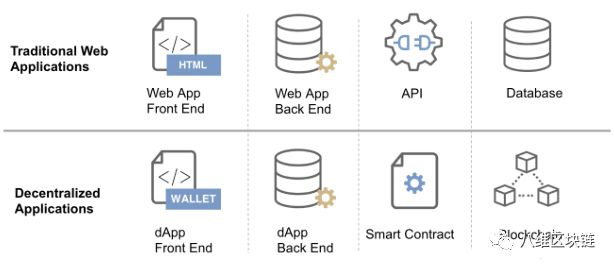

Blockchain was first introduced in 2009 with its first application, Bitcoin. In its simplest form, Blockchain is a decentralized digital database, in which untrusted parties can share a digital history and reach consensus without an intermediary. Blockchain 2.0, introduced by ethereum with smart contracts, allowed its utilization to grow from cryptocurrencies to inter-organizational use cases. This enabled the exchange of value in a truly peer-to-peer fashion, without the involvement of middlemen, and the potential for a programmable economy. Compared to traditional apps, decentralized apps (dApps) built on blockchain have a different infrastructure. Blockchain is used as the database, and smart contracts replace APIs, see Figure 1.

2) Similar to the Internet Revolution, central authorities won’t be replaced:

Contrary to popular beliefs, companies built on public blockchains won’t replace central authorities. When the Internet came out, there was also a utopian idea of peer-to-peer communication without a middleman, enabling transfers of texts, images, programs, and videos. However, nowadays, these services are mainly controlled by web giants such as Facebook (Facebook Research), Amazon (Amazon App Developer), Google (Google Developers), YouTube, and Dropbox as they provide the quality service, and convenience we need in our day-to-day life.

Today, blockchain technology allows us to transfer ownership of money, contracts, patents, and assets. While these transactions can happen digitally on a technical level without intermediaries, society will still require central authorities to play the role of guarantors. For instance, the ownership of a piece of real estate on the blockchain wouldn’t completely make people feel secure and protected unless there is a central authority in the physical world who can also act as a guarantor and protect them in case of disputes. According to Maslow’s Hierarchy, humans are innately selfish and need to fulfill their basic needs. As our society is becoming more and more complex, humans need more and more controlled and regulated social interactions to sustain their needs. Although in theory, we could completely cut off middlemen to perform transfer of files and ownership in the digital world, but we would prefer to utilize services offered by central authorities who can act as guarantors in society.

While it is possible for central authorities to abuse their power, blockchain’s auditability and immutability can serve as an additional mechanism to keep their actions in check and make them legally accountable.

II) Looking into the Present:

1) Overview of enterprise blockchain:

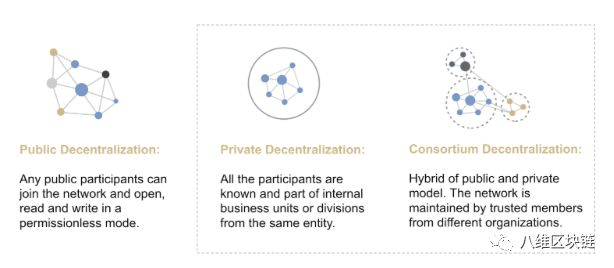

Enterprises have a set of needs and requirements that cannot be satisfied by public blockchains. Public blockchains allow any participant to read and write in a permissionless manner.

Figure 2: Enterprise Blockchains can Private or a Hybrid

Figure 2: Enterprise Blockchains can Private or a Hybrid

In private and hybrid blockchains, all the participants are known from one entity or multiple organizations. Instead of public blockchains, enterprise blockchains are mainly private and hybrid (consortium) blockchains, see Figure 2. Some of the advantages of Private and Hybrid blockchains are:

- Scalability — with a smaller set of nodes and different consensus mechanism, Hyperledger can run up to 1000 TPS versus Ethereum’s 7 TPS.

- Trusted members — all the network participants are known and legally accountable, decreasing the risks of network attacks.

- Privacy — only trusted and relevant members can access and write data as enterprises cannot afford to have all their data open to the public and competitors.

- Easier governance and policy enforcement — rules are easier to change and implement compared to public blockchains.

- Cheaper transactions — without the need for Proof-of-Work that requires a large amount of energy to maintain the distributed database, transactions only need to be verified by a few trusted nodes versus over 13,000 nodes in Ethereum.

- No cryptocurrency — no cryptocurrencies are involved because there is no reward requirement in a network with all the participants known.

- Easier fault intervention — faults can quickly be fixed through manual intervention since the consensus algorithms offer finality after much shorter block times, close to “instant” confirmation time versus 2 hours for the Bitcoin network.

- Open to regulatory oversights -Enterprises are collaborative with regulations with new laws such as GDPR and DSCSA.

On the other hand, compared to the public blockchain, enterprise blockchains have some disadvantages such as the lack of transparency (not open source) and limited developer resources from being a closed community. Additionally, consortiums can lead to fragmented networks (which works against blockchain since its value derives from the size of the network), while increasing the size of the consortium can also lead to security vulnerability as more nodes are part of the network. Consortiums also require corporate partnerships that can be challenging to achieve with the dilemma of cooperation versus competition.

2) Large players disrupting large industries:

Blockchain technology is still at its early stage, with a lot of undiscovered potentials. VCs, corporate VCs, and corporations are investing in blockchain initiatives looking to transform traditional use cases. Some examples include:

- IBM’s Blockchain World Wire looking to disrupt the global transaction market by offering a new financial rail that simultaneously clears and settles cross-border payments in near real-time through blockchain and Stellar protocol (10–15 seconds versus several days).

- IBM (IBM Research) and Maersk established a joint venture, TradeLens, to increase the efficiency and transparency of global trade through blockchain technology. Their tamper-proof supply chain management software digitizes documents and simplifies trade workflow, potentially saving $180 B annually from a more efficient process.

- Finastra (finastra labs), the third largest financial technology company in the world, is releasing its new product, Fusion LenderComm, a syndicated lending platform built on @R3’s Corda distributed ledger technology, allowing agents to publish loan data on the ledger, and lenders to access direct information with self-service capabilities. Global syndicated lending totaled $4.6 trillion from 9,887 transactions during the full year 2017 (Thomson Reuters).

- OpenBazaar, backed by a16z (Andreessen Horowitz), Union Square Ventures, and Bitmain (Top Bitmain Miners), is an eCommerce P2P marketplace built on Blockchain. In 2017, retail e-commerce sales worldwide amounted to $2.3 trillion, and e-retail revenues are projected to grow to $4.88 trillion in 2021 (Statista 2018).

3) Current State of Adoption and Obstacles:

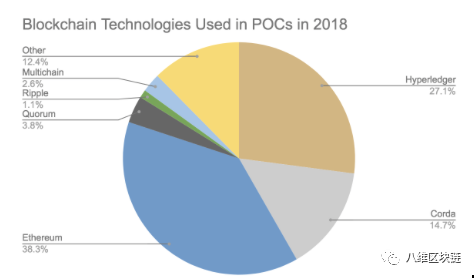

Currently, the most popular blockchain solutions for Proof-of-Concepts (POCs) are ethereum, Hyperledger Fabric and R3’s Corda, see Figures 3 and 4.

Figure 3: Enterprise Blockchain Solutions Landscape

Figure 3: Enterprise Blockchain Solutions Landscape Figure 4: Blockchain Technologies Used in POCs in 2018

Figure 4: Blockchain Technologies Used in POCs in 2018

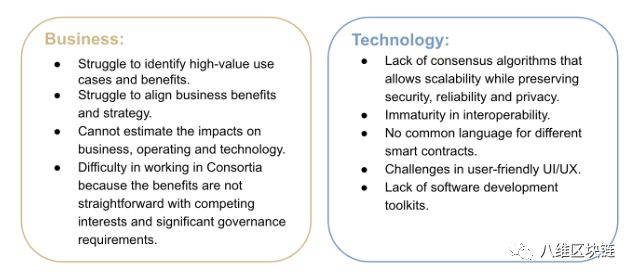

Among all the Proof-of-Concepts built by enterprises, almost none have been deployed. This is due to some current business and technological obstacles: on the business side, enterprises struggle to identify high-value use cases, align blockchain with their current business strategy and estimate the benefit and impact it will have from a business, operating and technology perspectives. Additionally, a consortium is hard to be achieved when they involve competing interests, and the benefits are not clear enough. From a technology perspective, there are also many limitations, see Figure 5.

Figure 5: Current Obstacles Preventing Enterprise Blockchain Adoption

Figure 5: Current Obstacles Preventing Enterprise Blockchain Adoption

III) Looking into the Future:

1) Tech Evolution Forecast:

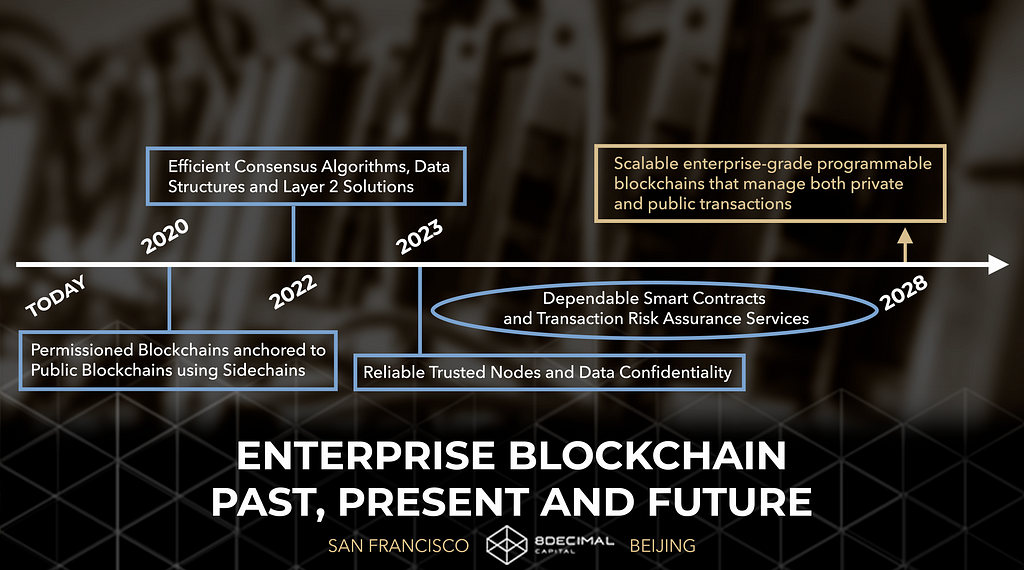

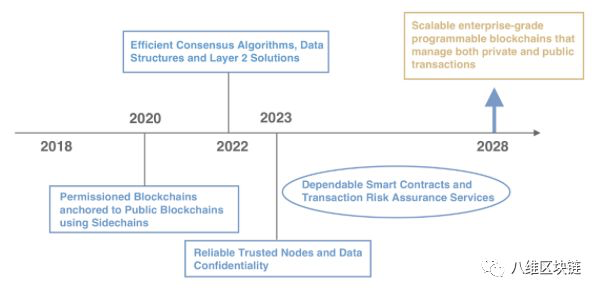

Figure 6: Forecast of blockchain technology evolution

Figure 6: Forecast of blockchain technology evolution

By 2020, permissioned blockchains will start to be anchored to public blockchains using sidechains.

By 2022, to satisfy the scalability required to integrate both private and public blockchains, it is important for the consensus algorithms, mainly used in public blockchain, with more efficient Sybil resistance (ex: POW, DPOS, POS, etc.) and consensus protocol for data structures (ex: Nakamoto, Avalanche, Algorand, etc.). Second layer solutions will become more mature so that not all the nodes need to process the transactions but through “off-chain” protocols (ex: Lightning Network, Plasma, State Channels, etc.) or side-chain solutions (i.e. Ethereum’s “child chains”, Polkadot, etc.).

By 2023, permissioned blockchain will be able to ensure that entities running the nodes are trustworthy, fair and reliable without utilizing cryptocurrency as an incentive. Data confidentiality will allow enterprises to preserve privacy while integrating while sharing information with competing companies (i.e. Zk-SNARK).

As dependable smart contracts can securely manage transactions among businesses, transaction risk assurance services will begin to emerge to help assess risk scores for transactions and keep members in consortium legally accountable.

By 2028, scalable enterprise-grade blockchain will emerge and fully integrate both public and private blockchains on an infrastructure level.

2) Blockchain Business Value Forecast:

According to Gartner, the business value-add of blockchain will grow to slightly more than $176 billion by 2025, and then it will exceed $3.1 trillion by 2030.

The growth of the industry will go through different phases: during the first phase, (2018–2021) enterprises will be exploring different use cases through Proof-of-Concepts, in which 80% of enterprise blockchain-based applications with the goal of reducing costs will fail to do so. In the second phase (2022–2026), successful use cases will be discovered, bringing back the confidence in the technology and triggering rapid growth and adoption. In the third phase (2027–2030), blockchain will become more prominent in society, providing a value of $3 trillion worldwide from cost reductions and revenue gains, see Figure 7.

Figure 7: Blockchain market value growth in 3 phases

Figure 7: Blockchain market value growth in 3 phases

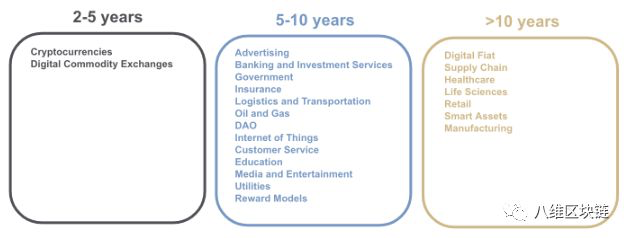

Additionally, blockchain adoption will happen at a different pace for different industries, see Figure 8.

Figure 8: Forecast of industry adoption of blockchain technology

Figure 8: Forecast of industry adoption of blockchain technology

3) Growth Factors:

The growth of blockchain will be influenced by a couple of factors:

- Technology maturity: more mature technology will enable for more complex, viable applications to be created, opening up for adoption.

- Successful use cases: as the benefits of impactful use cases are becoming proven, more organizations would be incentivized to adopt the technology.

- Government policy: laws and regulations can strengthen the dependence on blockchain technology or challenge its growth (i.e. GDPR).

- Ecosystem adoption: the value of blockchain is driven by the size of its network. As more companies join the network, it will create a network effect and attract others to join.

- Community: cryptocurrencies will remain in society, playing an important role in growth and market confidence. The demand for blockchain will increase as the demand from the community increases.

Conclusion:

Blockchain 2.0 enabled the possibility for inter-organizational use cases beyond cryptocurrency. Similar to how the Internet evolved — in the new blockchain revolution, central authorities will not cease to exist because humans have a need for protection and guarantors. Enterprises have needs and requirements that are satisfied by private and hybrid blockchains, providing scalability, trusted participants, privacy, easier management, regulatory flexibility, and cheaper transactions.

Currently, the impact of blockchain for different use cases is not fully understood, with many undiscovered potentials that are being explored by corporations and VCs. Very few enterprises have deployed their Proof-of-Concepts due to existing obstacles on both the business and technology side.

Enterprise blockchain will continue to evolve to be scalable and develop the capabilities to integrate both private and public blockchains. The growth of blockchain will happen in different phases in which the winning use cases are being explored, discovered, then implemented on a more massive scale. Despite the early stage, blockchain will be a disruptive technology that will fundamentally transform various industries in the next 5–10 years, bringing $3 trillion of market value worldwide by 2030.

Please let me know your comments, and feel free to reach me out at remi@8dcapital.com if you have any more questions about this topic.

Enterprise Blockchain: Past, Present and Future was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.