Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

It’s more important than you might think

This is the article version of a talk I gave to kick 2019 off for a few Bitcoin meet-ups in and around Australia.

The video version of the article is here, but if you don’t want to see my ugly head (nor Jeff’s), please continue.

Thank you Jeff Bezos for the wonderful introduction.

There’s a lot more than meets the eye when it comes to Bitcoin, and coming into 2019, I’m glad to see a broader push back toward the Bitcoin narrative, especially after a solid 2yrs of shit-coinery, ICOs, Bcashing, Wrighting, wronging, Verring, blockchaining for the sake of blockchain & whatever other stupidity we saw..

It could be the echo-chamber effect in that I’ve narrowed my focus; but I’m hopeful that it’s something more, and shall err toward that as being the truth.

Either way; I hope this article helps to drive the narrative forward even further, and reinforce why this thing called Bitcoin is so important.

If we’re to move toward a society & world that’s more functional, where unfair asymmetries & rent seeking are made more difficult and where the labour we transform into some unit of value (that’s able to be stored or exchanged) is impossible or at least impractically hard to manipulate or undermine, then we need to take Bitcoin a whole lot more seriously.

There’s some further reading and a few reference articles I’ll include at the bottom, which should help you get a better grasp of some of the concepts throughout.

Other than that, let’s dive in.

The Societal Stack

I’m going to quote myself a few times throughout, because…well why not..

“Nothing great was ever built on shit foundations”

-Aleks Svetski

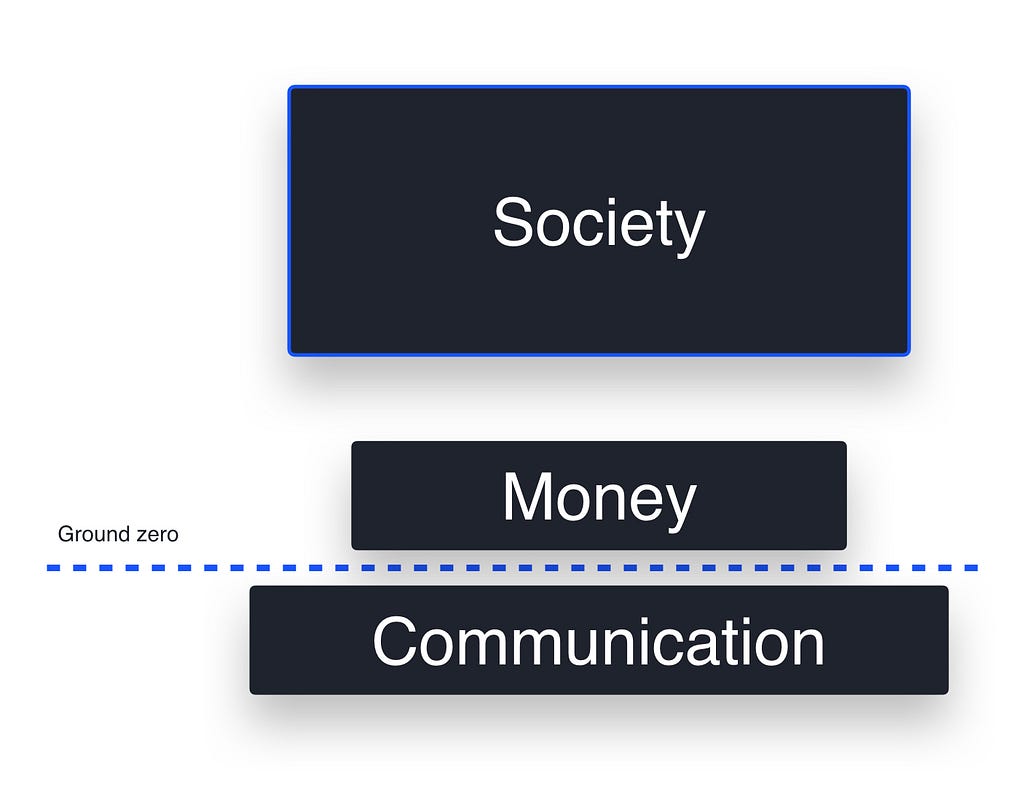

To understand money & Bitcoin, we need to go back in time and go down what I like to call “the societal stack” (as per my sophisticated diagram below).

It’s only when you understand the foundations of what we see around us, that things start to make sense.

You’ll note, we have communication as the lower foundation, or the basis for everything. I like to call it the “Societal Sub-Strata”

Communication is the prerequisite for cooperation, which in turn; is the predicate for society.

Money as a mechanism via which we can exchange, specialise, measure, collaborate, cooperate & organise sits directly on top.

Everything else, I’ve called “society” then sits above it.

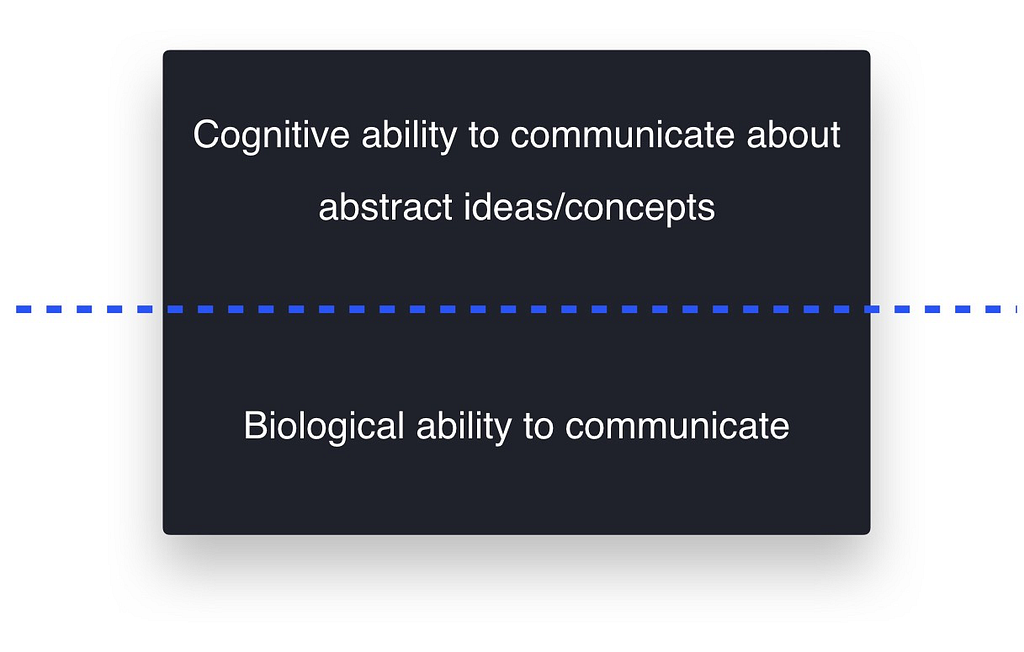

Let’s take a moment to explore. If we look deeper into the “communication layer” we can split it into two, broad categories.

The (broad) layers of communication

The (broad) layers of communication

1) The lower foundation.

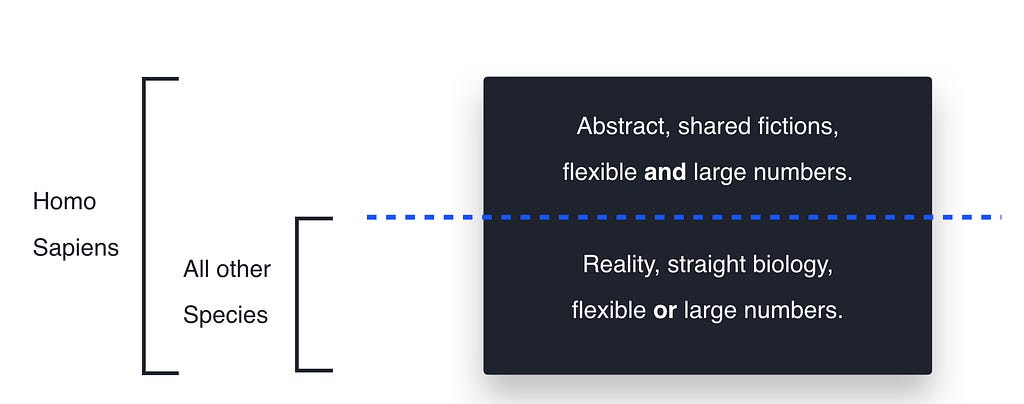

This is the biological ability to communicate, and we share this ability with every other species on the planet (at least that we know of). All species communicate…somehow.

2) The upper layer.

This is Homo Sapiens ability to communicate on abstract concepts & ideas. This is unique to us, and it’s this layer that allows for broad-based coordination.

Yuval Noah Harari, in his seminal book “Sapiens” termed those abstract concepts & ideas; “Shared Fictions”, and via that inspiration, I’ll quote the following:

In communicating about fantasies/imaginary concepts & fictions, we are able to “hack” our biology & attain the trust required for us to cooperate in numbers that exceed our biological limits.

This is an important thing to understand. Homo sapiens “hacked” trust, and thus became the dominant species on planet earth.

We’re the only species able to cooperate both flexibly & in large numbers, and this is all thanks to the stories we tell each other & choose to collectively believe.

This unique function has allowed us to build the complexity in society that we often take for granted today.

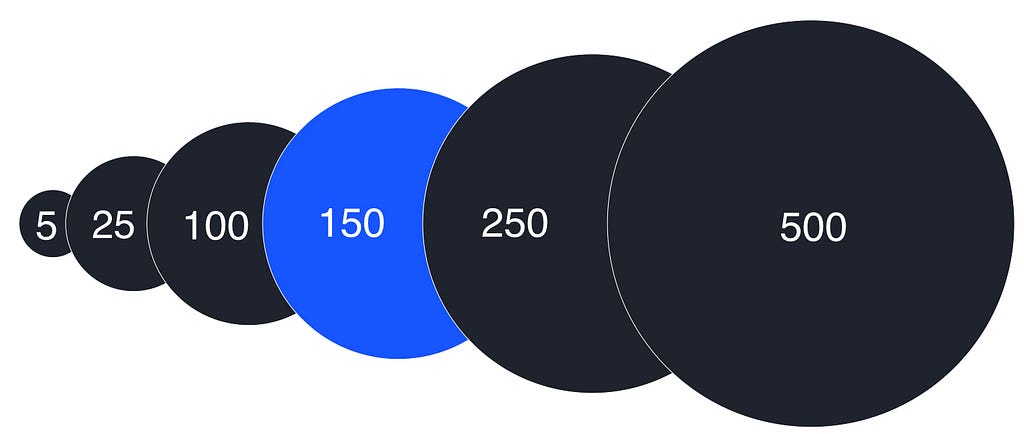

It’s allowed us to cooperate in numbers that exceed what’s called “Dunbar’s number”.

Dunbar’s number is a suggested cognitive limit to the number of people with whom one can maintain stable social relationships.

Dunbar’s number is a suggested cognitive limit to the number of people with whom one can maintain stable social relationships.

And as a result, we’ve evolved from some insignificant ape, sitting somewhere in the middle of the food chain, to the apex species, at the top of the food chain, who rule the world & have created what scientists now call the “anthropo-sphere”: The layer of the planet planetary ecosystem associated with us.

This is an extraordinary feat; made possible (at least as far as we understand) by our ability to hack trust via shared fictions & complex communication.

Now for those of you who think you might not be familiar with any of these so called “shared fictions”, here’s a few examples; that you’ve either heard of, buy into daily or live by:

- Gods

- Kings

- Religion

- Corporations

- Laws

- Nations

- Human Rights

- Race

They are all, by definition; fictions.

And what’s the most important and long-standing story / shared fiction of all? That’s right….

Money

But, before we move onto Money, let’s just have a look at that stack again:

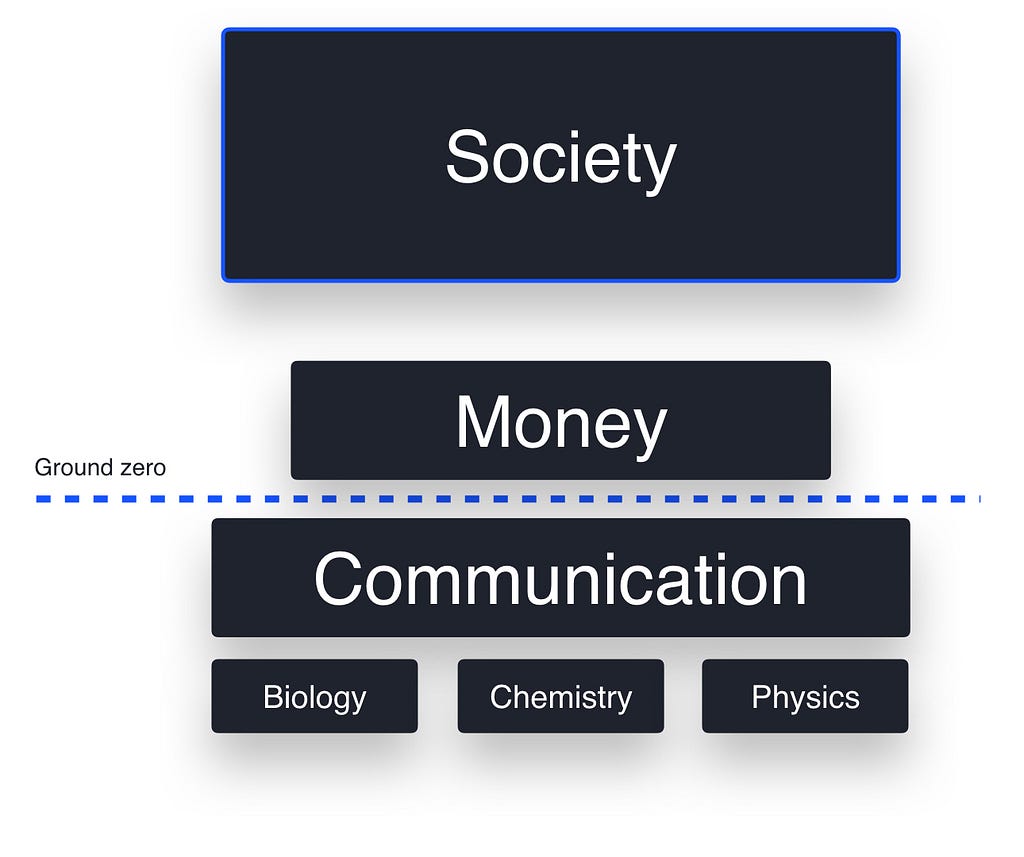

Notice how the further down the stack of society/humanity you go, the more robust it has to be?

Let’s take a moment to explore language as a function of communication.

Language

Communication / Language is but a set of rules, that govern how we use our physiology & sounds to convey a message (however complex).

Language is a PROTOCOL (or set of protocols).

We have specific rules for language. Basic ones such as vowels & consonants, through to higher order rules such as grammar, register, punctuation, etc.

You’ll note, these rules don’t bend & they don’t change, yet we are able to create however much complexity in our communication with those fundamental ingredients.

If you screw around with the base layer rules, you’re not going to get a “cool variation” on your message, you’re going to get a jumbled up line of shit nobody understands!

The more basic & fundamental the rule, the more rigid it must be, and it’s this rigidity of ingredients & fundamental rules that gives language its power.

Its strength of foundation has allowed us to build a level of complexity in the world that far exceeds any other species.

Two more things to note:

a) If you go lower than communication, the rules get even stricter. You get into math & the sciences:

- Biology

- Chemistry

- Physics

b) One might say: “well, language does change”. And whilst that’s true, think about how it happens. Language evolves generationally and involves a form of social consensus driven by people’s need to be understood & the adoption of similar language patters for the sake of better communication & exchange.

So yes — Language and it’s rules change; but that change is not abrupt. The change is more like an evolution over time, involving broad based consensus amongst the participants involved in using that language.

Sound familiar??

Anyway. Back to Money…

Money

Money is very similar to communication in many ways. Being so fundamental to the stack, it must be sound. It must be rigid. It must be robust.

You can’t build monuments on poor foundations.

To truly appreciate this, we’ll need to go back to the beginning and explore money’s journey & evolution through time.

So where where did Money start?

Money, ledgers & promises.

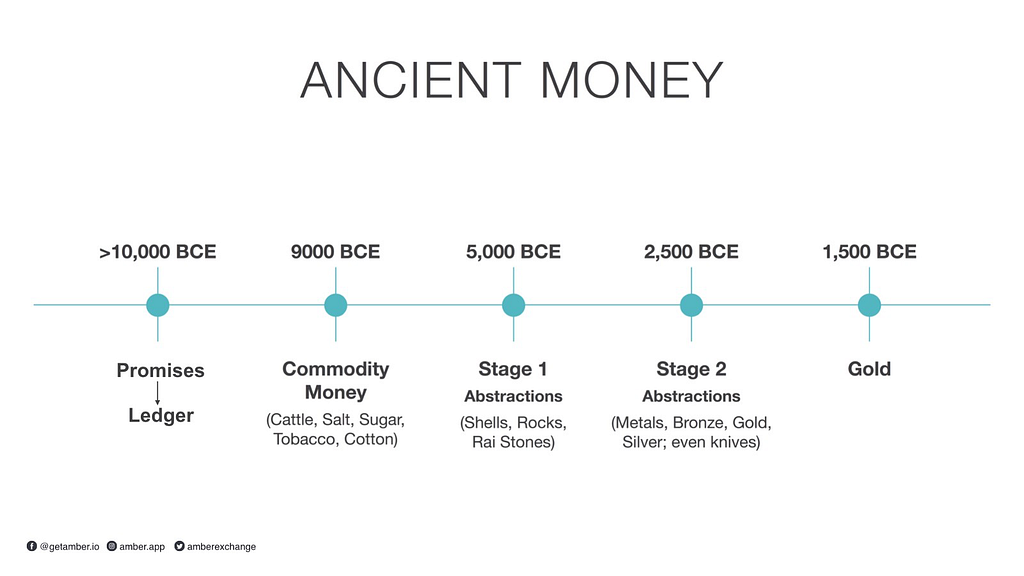

I also used to believe the earliest form of ‘money’ was something like Barter — but I’m now convinced I was wrong.

I don’t believe barter was ever a functional form of money or value exchange, primarily because it has a combinatorial problem (also known as the lack of coincidence of wants — Saifedean Ammous).

What this means is that if Bob has an apple, and Jim has a shoe, they will be able to trade (albeit the amounts may be difficult to agree on), but what if Jim doesn’t want an apple? What if he wants a banana?

Then Bob needs to go find Zoe who has a banana, that wants an apple, swap with Jim so he gets his shoe.

That’s just 3 people, and I’m already confused. This gets exponentially more difficult, particularly with increased specialisation and a larger number of participants.

So if it wasn’t barter, what did money start as?

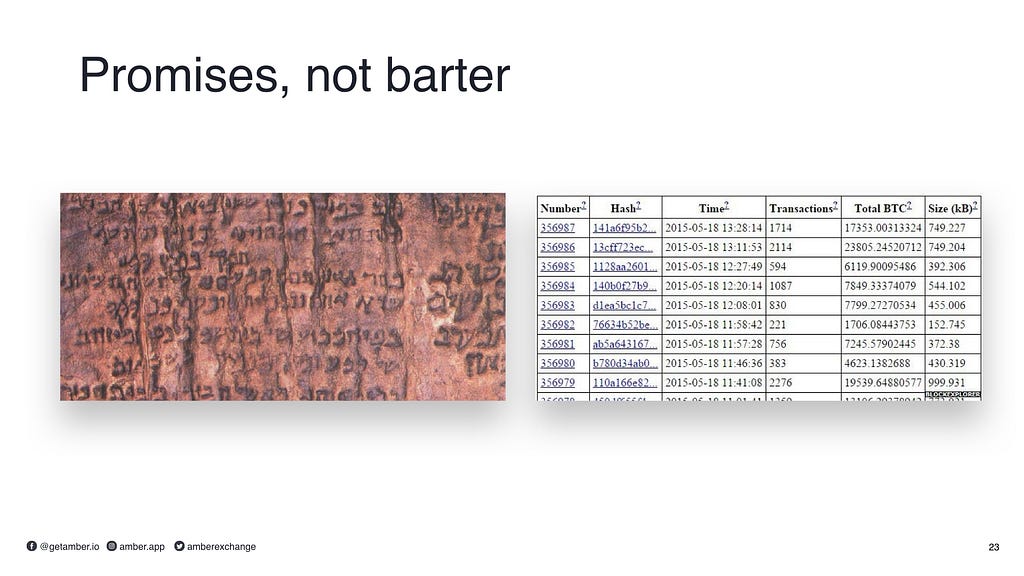

Well, believe it or not; the concept of money has its root in “promises”. Promises related to some form of labour, work, debt, item (product) or service that participants of a community would keep track to know who did what & who owed what.

And where were these promises kept? On a ledger.

This ledger was viewable, or able to be viewed by everyone, and the people who helped manage it were the first form of book-keepers.

Digging deeper here is outside of the scope of this article, but what’s interesting to note is that here we are, tens of thousands of years later, with a digital version of a ledger, made up of ‘promises’ (txns), that’s viewable by anyone, ie; Bitcoin.

LHS image is Satoshi’s first iteration ;)

LHS image is Satoshi’s first iteration ;)

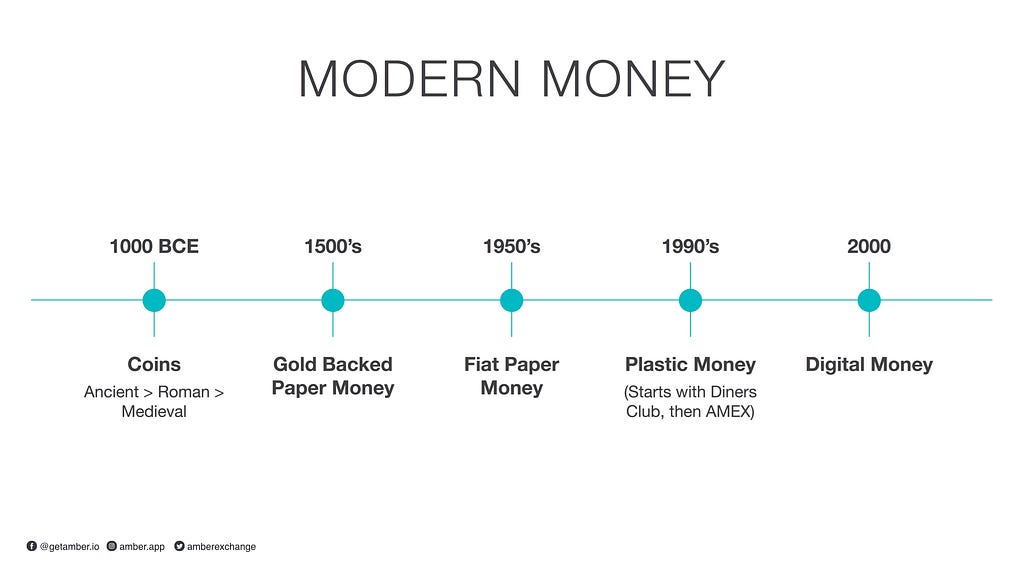

So back to early Money.

Promises & some writing on the wall were great, but we realised that we needed some form of more tangible, transportable, objective representation of money, so we could use it outside of our immediate community.

So naturally, we proceeded to use things of value such as cattle, salt, cotton, etc to represent money — this was commodity money.

As we got smarter, we started to abstract Money further, with objects that had better attributes, had a greater degree of scarcity & that more people could agree on / recognise as Money.

This right here is what fueled the acceleration of the development of society.

Money was the first & still is the most important collaborative technology homo sapiens have created.

Whilst the Ancient forms of money changed everything, they were clunky and difficult to build broad consensus with. So as the ingenious creatures we are, we found ways to abstract it further and thereby create more complexity and specialisation with less friction, all via the creation of “Modern money”.

Modern Money = The introduction of “trust” in an intermediary

Modern Money = The introduction of “trust” in an intermediary

In broad terms, the element of trust in a third party became an important feature of making Money more physically useful — but somewhere along the line, the core tenets of Money were either forgotten or conveniently swept under the rug — and it’s this that we need to get back to.

So let’s define it.

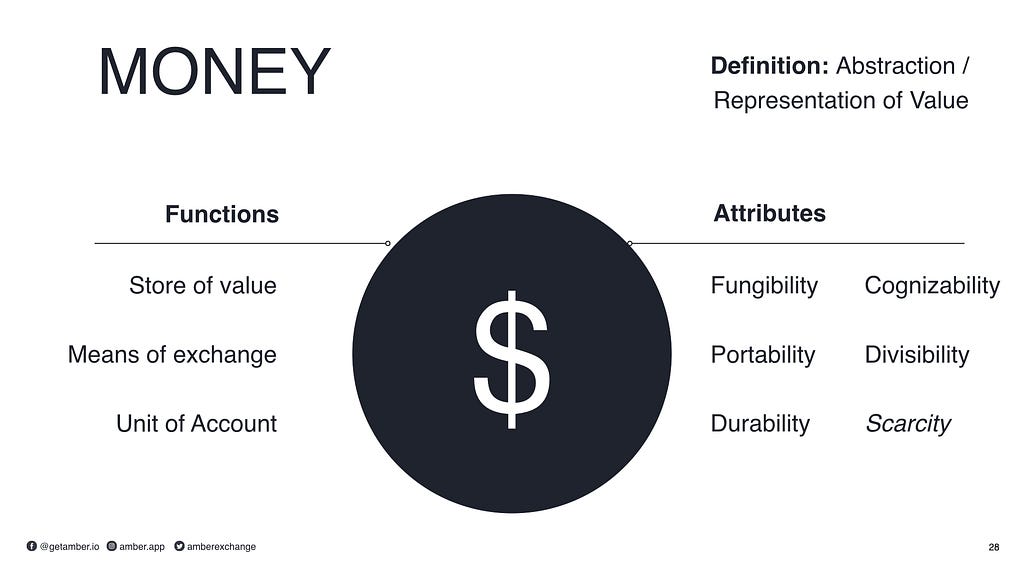

What is Money

A friend (Sven) calls it “crystallised energy” or “crystallised life force”. And without wanting to sound woo-woo about it; that’s exactly what it is!

Money is your labor in a measurable form.

When people tell me something like “Money is the root of all evil”, it just shows how little they understand about it. In fact, if you think about it; they’re saying that their work, their labour & their effort is evil. Seriously?

It’s madness.

I have a saying:

Money is not the root of all evil.

Money is the root of all complex cooperation.

So it’s time we stop shitting on it & start realising that money as a concept is fundamental to humanity & critical for us as a whole.

We must recognise that the fiat form of money we’ve been sold for the last century is the steaming pile of shiat that needs to be transformed.

Defining Money

A definition of Money I like to use is:

Money = A representation/abstraction of “Value”

If we take this definition, we can then extend the functions it should perform, and the attributes a form of Money must have in order to best perform those functions. See below:

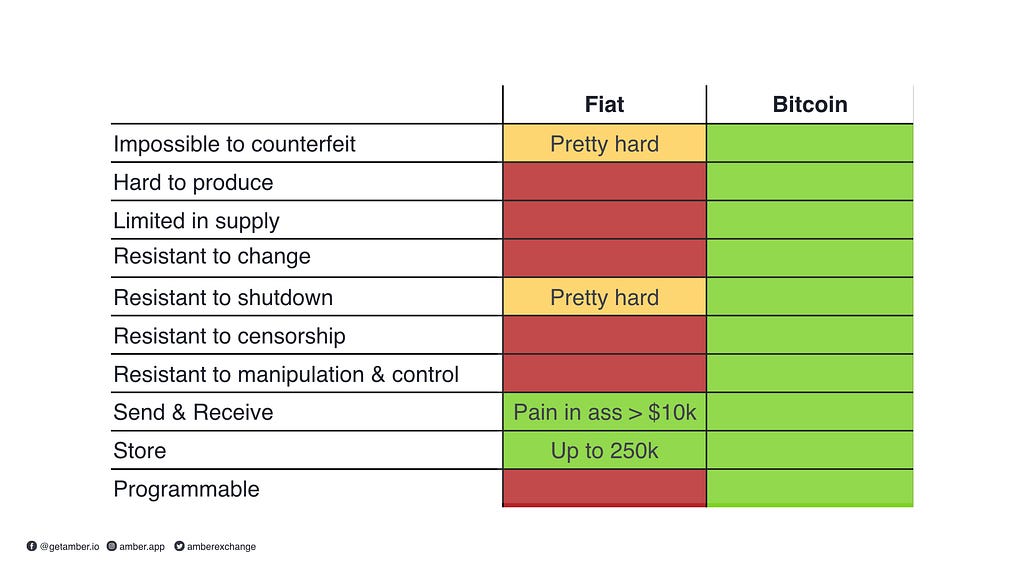

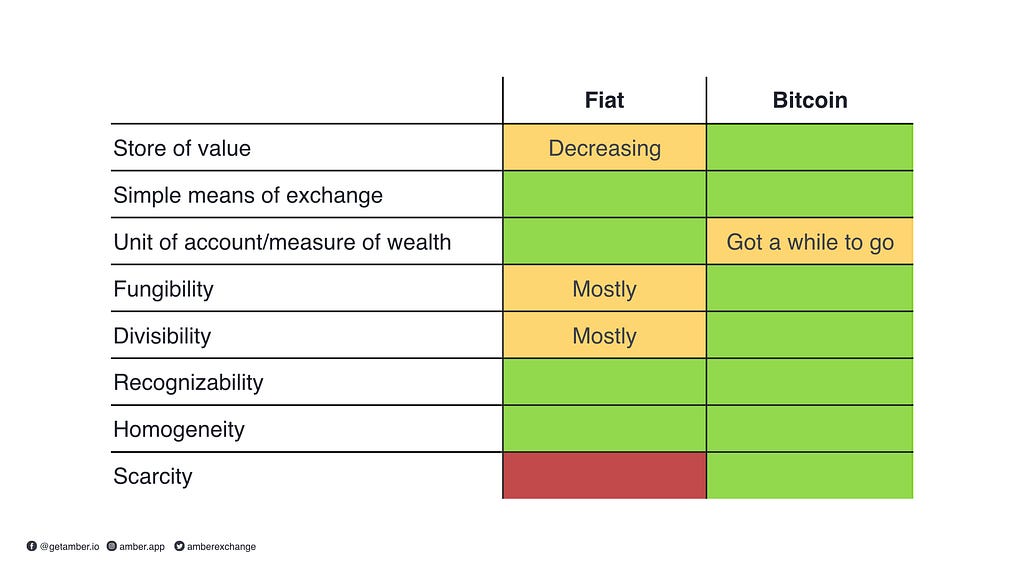

You’ve probably seen the above in one form or another, but what you may not have seen on the list is the term “Scarcity”.

It’s the attribute that not enough people talk about, because they don’t understand the fundamental predicates for value.

We’ll explore scarcity below, but the important take away here is that these are the core tenets of Money.

This is what Money must be & do in order to allow us to best collaborate & build complexity without having the entire shared fiction / story fall apart (as it has every time we’ve strayed away from it).

Scarcity

Why is Scarcity important? In short:

Scarcity is inherently tied to our notion of value.

Furthermore, something that remains scarce, will ensure value is maintained, across time.

A few examples will help:

Why does one care about (value) their friends & family so much?

Have you ever heard of the saying: “You only have one mother / father / brother / sister” ?

Your family members & friends are verifiably scarce, or in other words unique to you. If something happens to one of them and they’re gone; you can’t get them back and you can’t create a duplicate.

We value our loved ones because they’re truly unique, and inherently scarce.

The same goes for a special trinket handed down to you by your great grandmother. It’s rare / scarce / unique.

Now for those of you who are little more sociopathic in nature & don’t value your friends / family, then perhaps you get the same feeling with some other item that you can never get another one of.

The same goes for art. We all inherently know why a piece of art goes up in value once the artist dies.

It all comes back to scarcity.

And the most scarce (fungible) resource we know of?

Time.

Time is a little different than the above because those items / people / etc are not fungible. Time is the “gold standard” of a unit or resource that is scarce and fungible, and that we (at least the more intelligent of us) value highly.

As you read this, you may ask how much would you pay, to have more time?

(probably ask yourself the same re: Bitcoin)

So if scarcity is at the core of the idea of “value”.

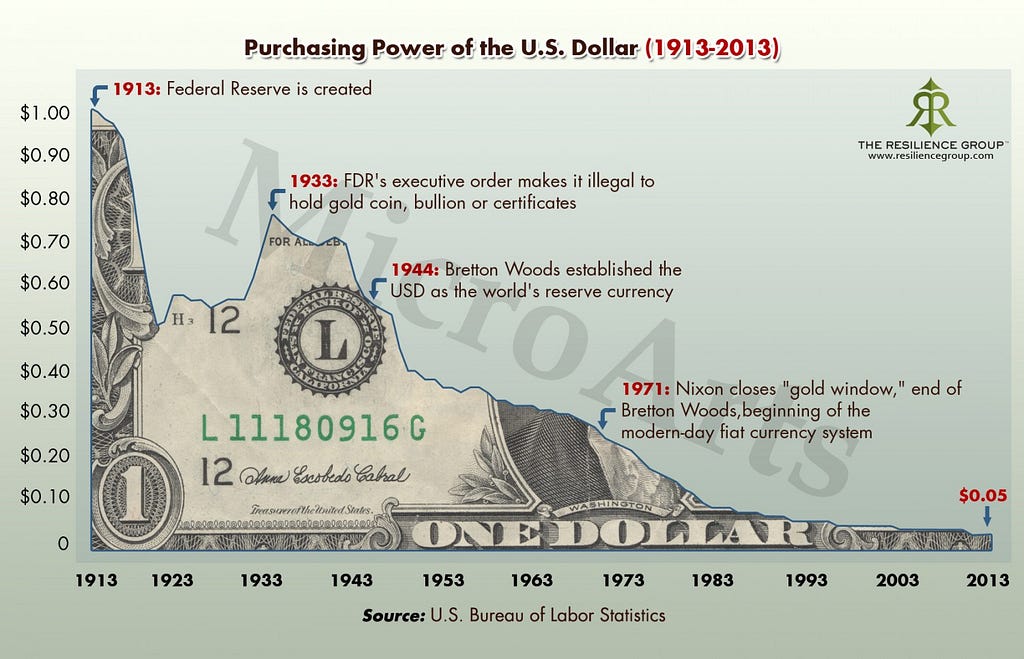

Then for something to maintain “value” (for example a means of exchange, like money), than it must be scarce — else, it does this:

You’ve all probably seen this chart, and although it’s become a bit of a cliche, it’s important to be reminded.

Bitcoin, as far as I can ascertain, is the only fungible unit (other than time) that we can say is truly scarce — which follows that as a “money”, it is more sound & will maintain its “store of value” over time.

This is the core of ‘store of value’, (not the day to day market price in USD as some mathematically inept individuals might tell you).

One final note on scarcity.

Bitcoin is the first time we’ve had a digital good, that functions like something physical.

And because it’s bound my math, it’s able to be made truly scarce & verifiably so, whilst maintaining the scalability that only comes with something that is natively digitally.

Digital Scarcity is the innovation. Not: “The Blockchain”.

(Thanks Jimmy Song)

Next:

The unit & the Network

Before we can appreciate what it takes for a modern form of money to perform the functions defined above, and truly embody all those attributes, there are two important factors we need to understand better.

- The Unit

- The Network

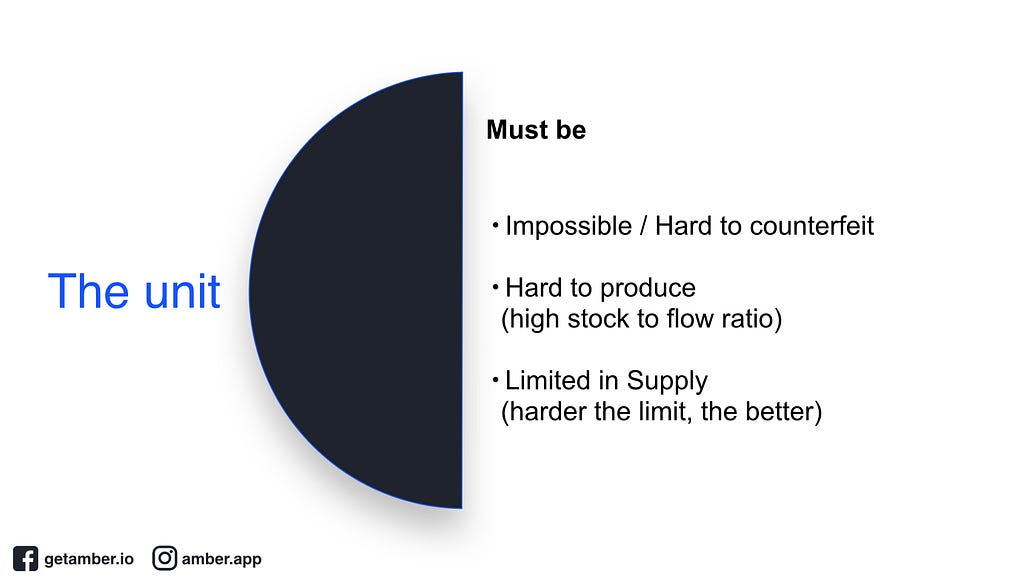

Must be

- Impossible / Hard to counterfeit

- Hard to produce (high stock to flow)

- Limited in Supply (harder the limit, the better)

These attributes make money sound, and it’s the last one which to date, we as a species have not delivered on.

Why?

Because we’re human, and our nature is one that desires more — which is also why the attributes of the unit are best codified & governed by math (not the whim of people).

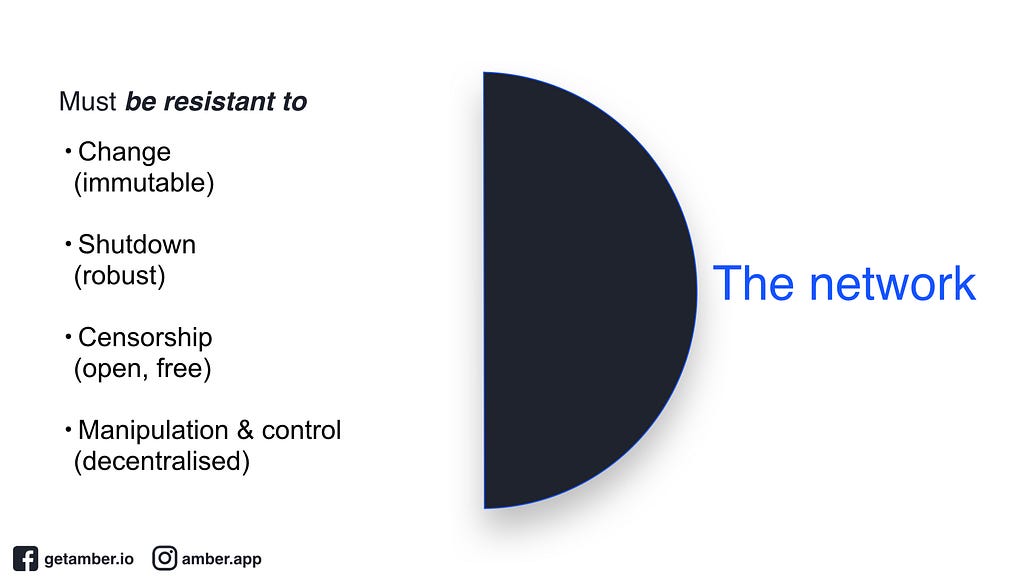

2a. The Network

The unit must be part of a larger monetary network, and this network must BE:

- Resistant to change because it Money is fundamental, and you cannot build anything on an ever-changing foundation.

- Resistant to shutdown because if a monetary network is not on, or can easily be shut down; then everything stops. This is a big reason why natively digital money has been a challenge.

- Resistant to censorship because similar to language / speech / communication; it’s only truly functional when it’s free & inclusive. If you try control it, it degrades.

- Resistant to manipulation & control, because it undermines all other attributes.

These are all critical, and non-negotiable for a broadly used monetary network.

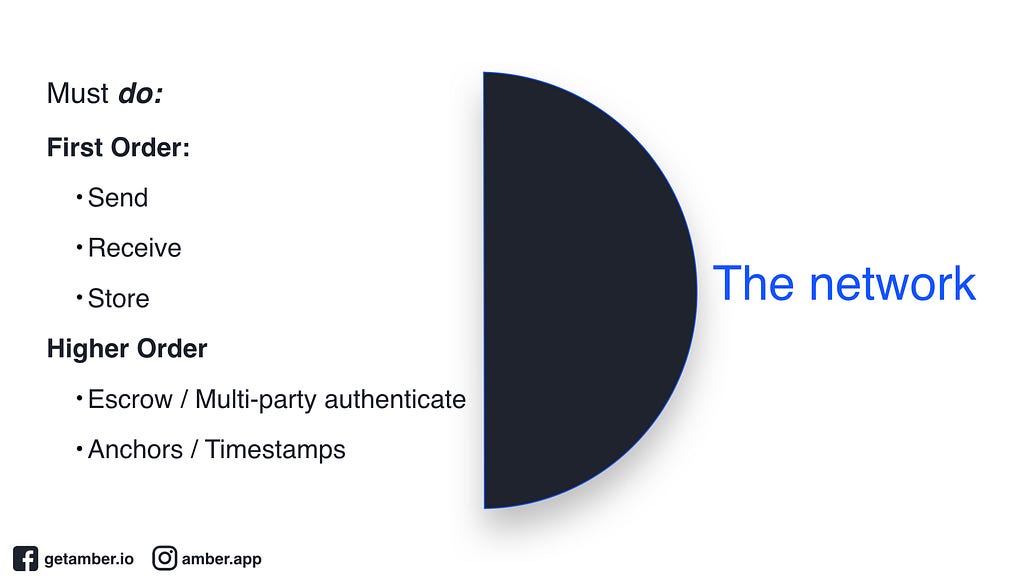

2b. Network Functions

The above is what the network must be. The below is what it must do.

A monetary network must perform these key functions VERY well, without compromising on them. Never. Ever. Ever.

Money is about confidence.

It’s a story / social contract that we broadly agree on and in order for it to function well (particularly when it’s digital & ephemeral), it cannot risk failing at it’s delivery of the first order functions.

A broadly functional monetary network must optimise for Send, Store, Receive above all else.

It can then also perform higher order functions like:

- Escrow / Multi-party authentication (eg; multisig)

- Anchors / Timestamps (smart contracts like HTLC)

But note that these higher-order functions are a combination or derivative of the first order.

That’s it. That’s all you need.

Not like these idiots out there trying to build all this complexity into the base layer of their networks, at the expense of the security & robustness of the first order principles!

(Yes Ethereum & every other shitcoin — I’m talking to you)

So to conclude this section:

It’s the above attributes of both unit & network that the most fundamental layer of society (money) should have in order to function properly.

So why does Bitcoin Matter?

Well, if you haven’t figured it out by now; I’ll spell it out to you:

- Money is the foundational layer for everything in society.

- Bitcoin is the most organic, stable, powerful form of money the world has ever seen.

Bitcoin is both the only unit & network that executes on everything I’ve outlined as fundamentally important about money.

SoV is green because it’s green. I’ll write something on this in another article

SoV is green because it’s green. I’ll write something on this in another article

But more importantly than the above, Bitcoin is an opportunity for a new beginning, in a new age.

Here we are today; with an incredible opportunity to not only learn from the mistakes of those who did not adhere to those core tenets, but with a technology that can both embody everything that money should be, and also evolve with society and the market into what it could be.

This is why Bitcoin matters..

Now one might say; what about some other clepto-currency?

My answer: They don’t matter.

I’ll show you why.

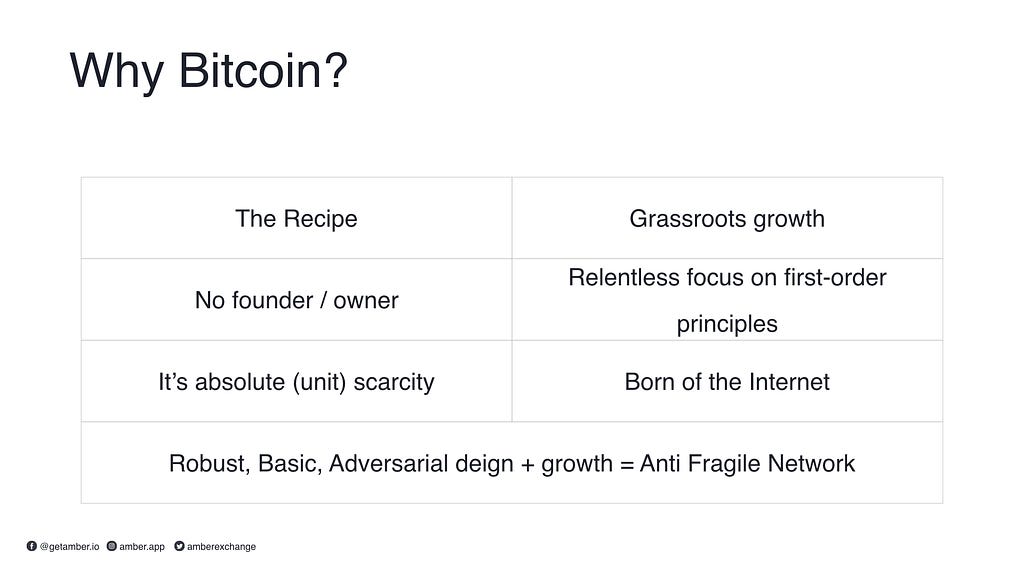

Why Bitcoin?

What makes it different?

First of all; it’s a monetary phenomenon. Not a technological one. This is where most people get it wrong at the outset.

Most people new to the space, or who just don’t understand money, or it’s role in society think that Bitcoin is some “payments mechanism” designed to move internet money around the world.

So with that thesis, they set out to do it faster, or perhaps give it more features.

The problem with this approach is that they miss the entire point of what gives Bitcoin its “money-ness” !!

I’ve put together the following table to hit the key points (although there are many more) with respect to Bitcoin:

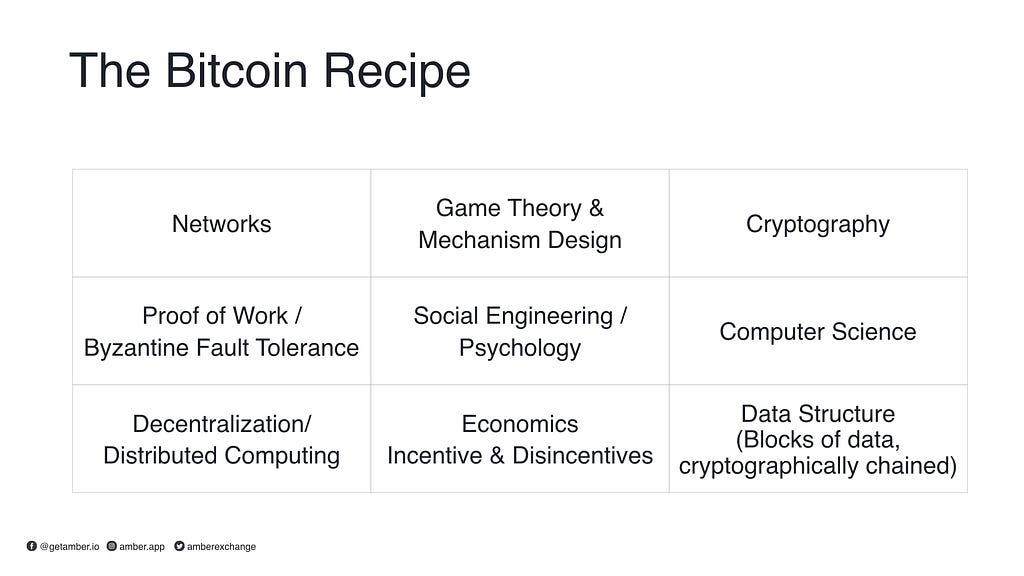

1. The Recipe

I call Bitcoin’s entire formula, “The Recipe”, because the fact that it works is because it combines so many previously disparate disciplines into one, cohesive, robust & functional whole.

Taking one ingredient out of context, does NOT yield the same result.

Taking one ingredient out of context, does NOT yield the same result.

I’ve discussed this recipe at length, at a number of talks, and primiarly when I’m explaining why “blockchain” is such a stupidity on its own; or as an entire recipe applied to anything other that something as foundational as Money (as in the case of BTC). You can find me presenting “Blockchain’s AOL moment” here:

2. The Grassroots Growth

Bitcoin was never sold to anyone via an ICO, nor via some VC funded start up, nor for any one person or institution’s direct gain.

Bitcoin was adopted by people with a desire to be a part of it, because of what it was & what it represented. An idea. And all support of it in the beginning had a collective impact.

These early supporters and borderline crazy people formed the ever growing “stubborn minority” who form the base of support that Bitcoin has, which no other network in the world has. As Trace Mayer would call them: “the Hodlers of last resort”.

You can’t replicate this, and no amount of ICO money raised can compete.

This is missionary VS mercenary. They don’t stand a chance.

In fact; just as a funny example, we saw EOS (Extremes Of Stupidity) raise $4 BN USD, and they’re not only nowhere, but they’re now using that money to buy property & land 🤣🤣🤣🤣

3. No founder

This is extremely hard (nigh on impossible) to replicate, and is one of the primary strengths that Bitcoin has.

The fact that it’s something which has grown beyond its original founder, has grown as a function of the market, and can now not have the “head of the snake” cut off makes it incredibly hard to stop.

There’s nobody to throw in jail, no corporation to shut down, and nobody to point to as the saviour or messiah (Sorry Roger, we don’t need you).

Furthermore, the idea that it could be anyone, is not only functional; but also adds to the myth. The myth adds to the allure, and reinforces Bitcoin as an incredible, once in a lifetime creation.

When I say “anyone”, I mean anyone but this douche bag..

When I say “anyone”, I mean anyone but this douche bag.. Even Jap Satoshi was more shocked at Faketoshi’s claims than the reporter’s claim it was him..

Even Jap Satoshi was more shocked at Faketoshi’s claims than the reporter’s claim it was him..

Moving along..

4. Its relentless focus on first order properties

Bitcoin is THE ONLY network of it’s kind that has displayed such a stubborn, relentless focus on the primary drivers that count (ie; the elements I described above in Unit & Network).

Everything else comes second to maintaining the integrity of the network.

Furthermore, because of the way it’s grown & the broad mixture of participants (miners / validators, nodes, holders, speculators, etc) that are now involved, that desire to retain the first order principles has basically turned into a core mandate.

That’s something that’s very hard to replicate — and something you can’t do with software tweaks alone, and especially hard with pumped up ICOs & shitcoins with no stubborn minority & flakey speculators.

5. It’s absolute (unit) scarcity

Something else that’s ossifying, if not yet already ossified (thanks Andreas M. Antonopoulos for the terminology) is the absolute unit scarcity of Bitcoin.

The fact that more capital is flowing onto the Bitcoin Network, ie; dollars in exchange for an amount of units on the network that can never be inflated, is further reinforcing this attribute as a guarantee.

When you exchange anything else (dollars, work, shitcoin, etc) for Bitcoin, it’s like owning a portion of land somewhere. It’s territory on this finite network (or landscape), and you’re not only given the guarantee of, but you further reinforce the guarantee that your attribution with respect to whole will remain that way.

Again — no other digital network (nor anything else that I know of really) can give you this guarantee, let alone make that guarantee stronger with each day that passes (Lindy compatible).

6. It’s digitally native, & born of the internet

I loved when Jack Dorsey said: “Bitcoin is born of the internet” on the Joe Rogan show.

It’s absolutely correct.

If the internet is this new world of bits & software, then it follows that a medium of exchange and value transfer that should be used & proliferate on this network is one that should also emerge from it.

Just like Gold & physical money has emerged from the physical world, over the millennia.

Bitcoin is the first time we’ve had a digital object, function like a physical one, (where time moves in one direction), that can be used as a monetary medium and give the same hard money guarantees we have in the ‘real’ world (assuming we’re not already in a simulation…more on that next time).

Gold was the first hard money we found in the real world, and was the basis for everything we built thereafter. Show me another money that’s lasted as long. I don’t think you can. It’s still the standard for the real world. **

Bitcoin is the standard for the digital world; and because it’s digitally native; it’s truly scalable — and we’ll build everything on top of it.

**The Keynesian experiment we’re running in the world now is a disaster waiting to happen, and has been conveniently masked as “functional” because technology (and bullshit monetary narratives) have managed to carry productivity forward despite the facade.

7. Overall.

Bitcoin’s robust, basic, adversarial design the closest thing to an anti-fragile network we’ve ever seen.

Bitcoin’s unit and its network perfectly embody everything that money should be.

It’s unstoppable, it gets better with time (Lindy compatible) & there is nothing quite like it.

There is no other money, network or copy-cat klepto-currency that exists which can replicate that.

Bitcoin is not its code, or its community, or its miners, or it’ block size, or its history — it’s all of these things, all mixed together — and that’s why it’s the only one that matters.

So to conclude this now essay, I’ll leave you with three over-arching reasons as to why Bitcoin matters:

Bitcoin Matters because:

- It’s a Hard Money

- It’s a stable, secure, scalable financial network

- It has the best chance of success

1. Hard Money

As I mentioned earlier, Bitcoin is a monetary phenomenon. These phenomena only come around once every epoch.

There are multiple reasons why you’d want to take note of a hard money:

a) Dis-Inflationary, ie; It will not lose value/purchasing power (you can give it to your children & your children’s children). There is no other monetary medium other than gold that can give you this. Except with Bitcoin you can store billions in your head, and there’s a greater guarantee of scarcity.

b) Hedge against corruption / stupidity / malevolence / incompetence. Whether you think the world is run by Lizards, or complete buffoons, or somewhere in between; chances are mistakes will happen (ie; 2008), and holding a hedge is a very, very intelligent idea.

c) Self-sovereign Unit. This one is not appreciated enough by non-bitcoiners. There is no other monetary unit in the world that is yours & only yours when you hold the key to it. It’s Unconfiscatable (as Tone Vays has termed). People underestimate how powerful a concept like this is; until of course they lose their money somehow, or are censored.

d) Truly Scarce. I’ve discussed this on ad-nauseam throughout, and I’ll say it again: Bitcoin is the only resource, other than time, that’s truly scarce. This alone makes it an extremely intelligent asset to hold, whether you believe in that Bitcoin will take over the world (hyper-bitcoinization) or not.

2. As a stable, secure financial network

If we’re going to build a ROBUST global financial (read: cooperative) system, it should be built on something secure, stable, game-theoretically sound and digitally native. You wouldn’t build cars to run on horse tracks, and neither should you build the next generation of human cooperation (ie; money, finance & capital), on old shit with a digital veneer.

It’s like putting lipstick on a Pig.

I scratch my head a little when I see these “Neo Banks” building on top of the legacy financial system, although I should probably be grateful because they’re giving projects like what I’m working on @ Amber an opportunity to reinvent the idea of banking, by using Bitcoin and for the first time in history being truly open & transparent.

What gets me excited the most about having an incorruptible foundation, is the ability to build & anchor a layer above, such as Lighting.

A layer of Abstraction, Complexity & Interoperability.

- Bitcoin’s basic, robust, digital, nature allows for abstraction & complexity to be built on top via layers of trust & transparency (not for wanks sake; but for the inclusion of skin in the game & management of tail risk [fragility])

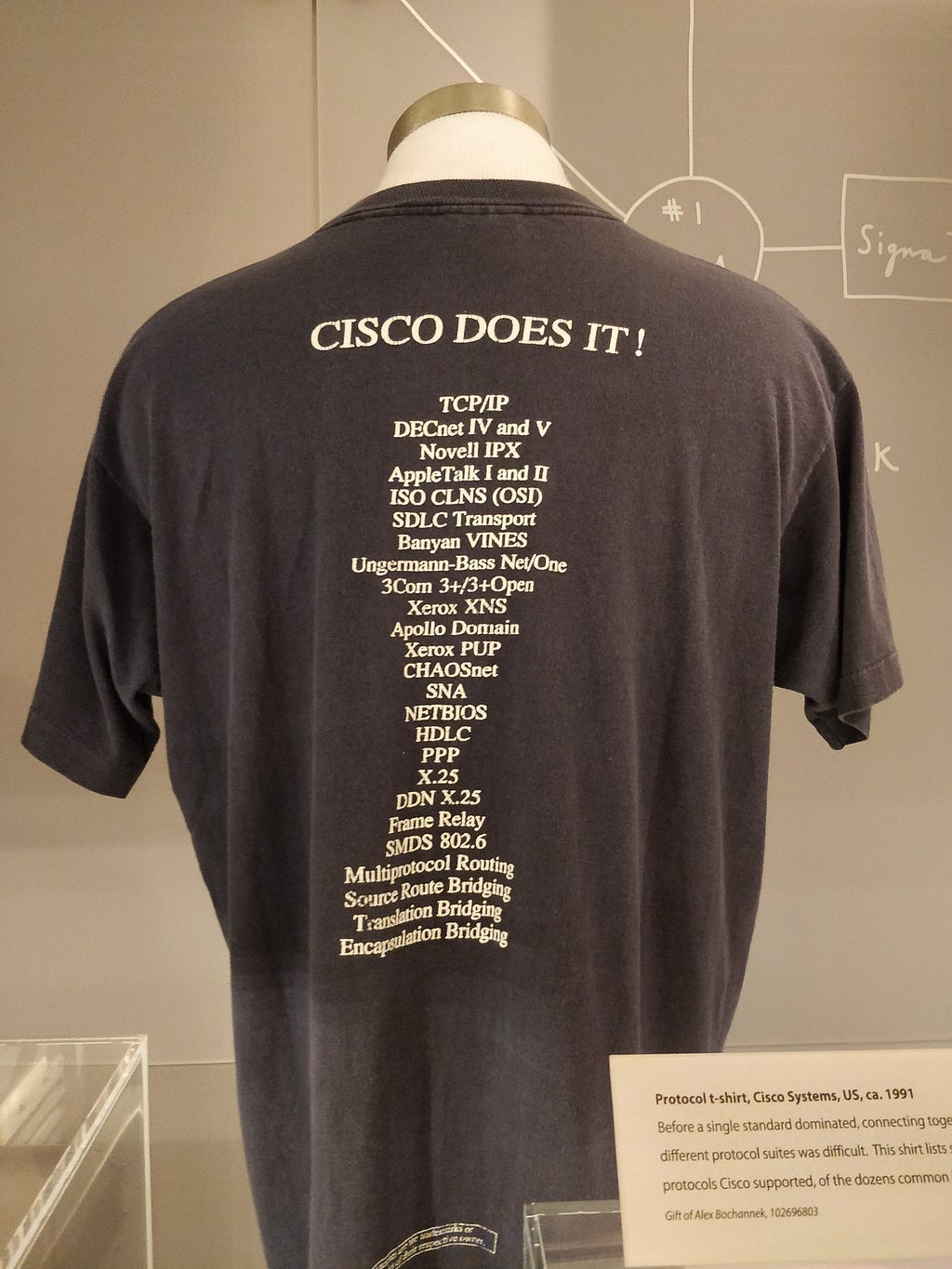

- It will be just like the Internet, where the majority of the economic activity these past 20 years has occurred. All built on top of a set of core, basic, secure protocols (information & packet routing).

Remember the points Jeff Bezos made in his 2003 TED Talk.

And for those of you who subscribe to the multi-fat-protocols-are-eating-the-world thesis, these few images might help give you context :)

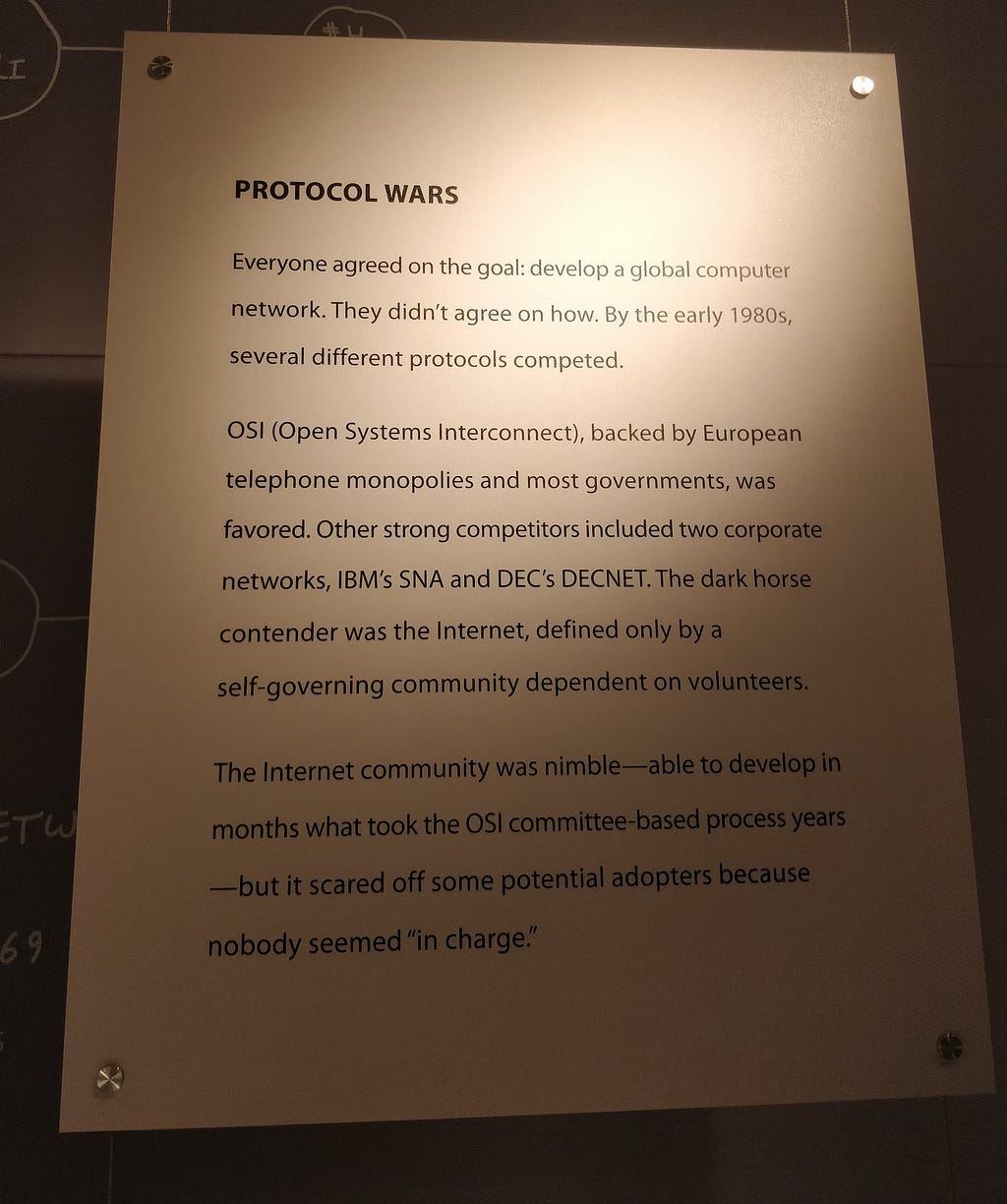

In the beginning, there were many…

In the beginning, there were many… And it took a while for them to fade away

And it took a while for them to fade away But one, won out. Does the above sound familiar at all???

But one, won out. Does the above sound familiar at all???

This last plaque is so very telling.

3. Bitcoin has the best chance of success

And last but not least:

If we’re going to have a chance at creating a more open society, that resists censorship & the moronic attempts by the state (or the bureaucrats that run them) to centrally govern society via “theoretic” models that don’t work in practice, then Bitcoin Matters.

Wasting time looking for the next ‘variation’ of Bitcoin or pump & dump opportunity, created by the get rich quick schemers (scammers) and chased by the sheeple is a dangerous gig — because you don’t know when the fools will run out & you’re the last one holding the can.

This is why I’m often called a maximalist, but I don’t care — because I’m adamant that we as a society have ONE chance at this, and if we dilute our impact by fucking around on other crap, we lose time & energy (at best), and at worst; we lose.

In saying that I don’t think failure is likely — because Bitcoin has already won (we just can’t see it yet, similar to the internet in the early 90s) —but I still believe we should save our other precious resource, ie; time, and FOCUS on what Matters. Bitcoin

Conclusion

So to wrap this up:

Bitcoin matters.

- Just like the internet before it did.

- And electricity before that.

Bitcoin matters.

- Because it’s the new monetary operating system (OS).

- It’s the OS of the fair, skin in the game, robust form of capitalism that we all yearn for, that can drive humanity forward.

Bitcoin matters.

- Because it’s the zeitgeist of our time.

- It’s probably the biggest opportunity of mine and your life.

You don’t want be the guy who missed out on this one — you’ll feel like the biggest moron of all, probably worse than Ronald Wayne:

Sold his stake in Apple for $800. May have been worth > $50bn today.

Sold his stake in Apple for $800. May have been worth > $50bn today.

So…take note & perhaps:

- Buy some Bitcoin.

- Hold some Bitcoin.

- Stop reading what the mainstream says.

- Support the industry.

- Work in it if you can.

- If you can’t, buy some, use an app like what we’re working on at Amber, and come back in a few years once things have matured further — you’ll be glad you did.

I hope you got some value out of this. It’s a message myself & all the team @ Amber strongly believe in, and it drives everything we’re doing.

Wishing you all an amazing, prosperous new chapter ahead in 2019.

If you enjoyed this post, please show it some love, give it a clap (or a few) and pass it around to anyone you think should have a read.

Aleks Svetski

CEO & Co-Founder @ Amber Labs

You can find some more more of my work here:

And you can reach out & connect with me here:

- Aleksandar Svetski - Brisbane, Queensland, Australia | Professional Profile | LinkedIn

- Aleksandar Svetski (@AleksSvetski) | Twitter

If you’re interested, you can follow Amber on:

Why Bitcoin Matters was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.