Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

TaxBit is a cryptocurrency tax software company that helps cryptocurrency holders and investors calculate their profits, losses, and tax liabilities, and generate IRS-friendly tax forms.

Once a user connects their exchanges via TaxBit’s read-only API keys, TaxBit automatically pulls the user’s transaction history and cycles them through their tax engine. Users are then able to see the real-time tax impact of all their cryptocurrency transactions and download their yearly tax reporting forms.

Since TaxBit only collects read-only API keys, the platform only has access to view a user’s transactions and zero access to the actual assets. In the hypothetical event of a hack, the hacker would only have access to see a user’s transactions, with no access to the assets. A TaxBit representative also stated that the platform does not store personal information such as social security numbers or tax identification numbers on their servers.

TaxBit Founders and Company Information

TaxBit was founded by two brothers and is headquartered in Salt Lake City, Utah.

Austin Woodward (CEO) is a certified public accountant (“CPA”) with a master’s degree in accounting from BYU, a top ranking accounting program in the US. Prior to TaxBit, Austin was the controller and finance professional at Qualtrics.

Justin Woodward (Tax Compliance and Legal Officer) is a licensed tax attorney with a law degree from the University of Chicago, a top law program in the US.

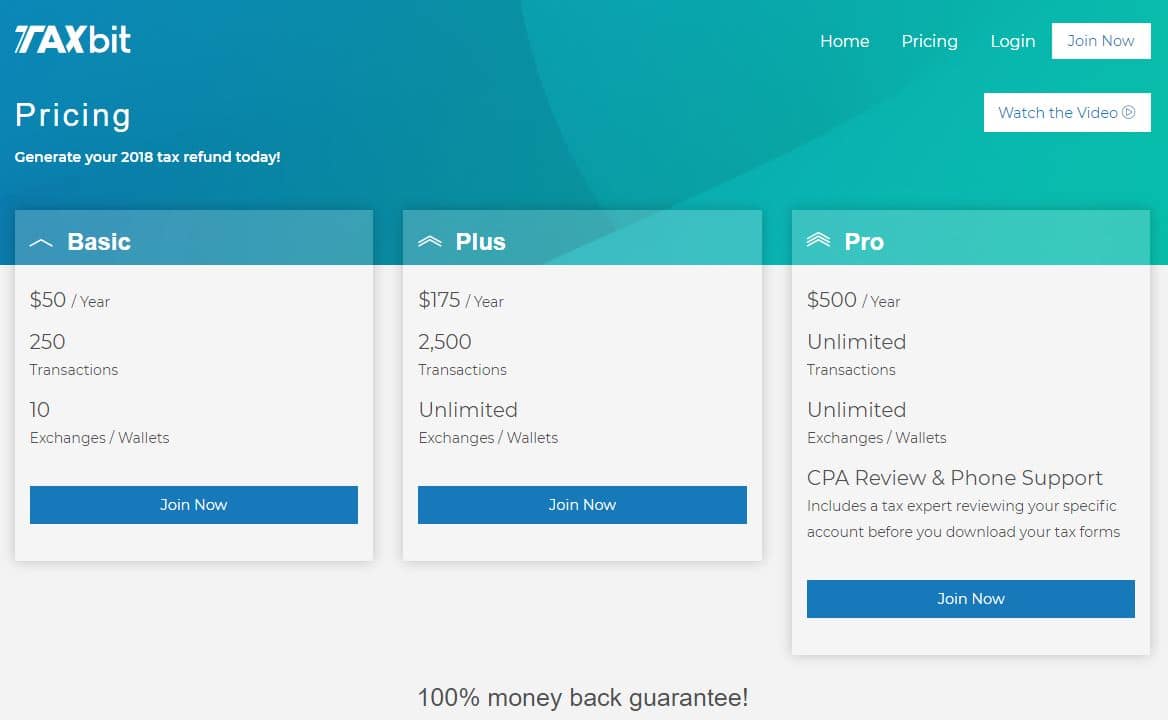

TaxBit Pricing

TaxBit’s pricing is separated into three tiers based on transaction volume. Every package includes API exchange integrations, real-time portfolio and tax tracking, transaction by transaction CPA and IRS audit trails, online customer support with certified tax experts, and automatic tax form generation.

TaxBit’s business model seems to leverage their in-house automated systems and processes to provide an affordable tax preparation price tag (relative to hiring a CPA) to attract cryptocurrency-savvy customers. Since most users generated losses in 2018, many of them are eligible to report those losses and increase their 2018 tax refund.

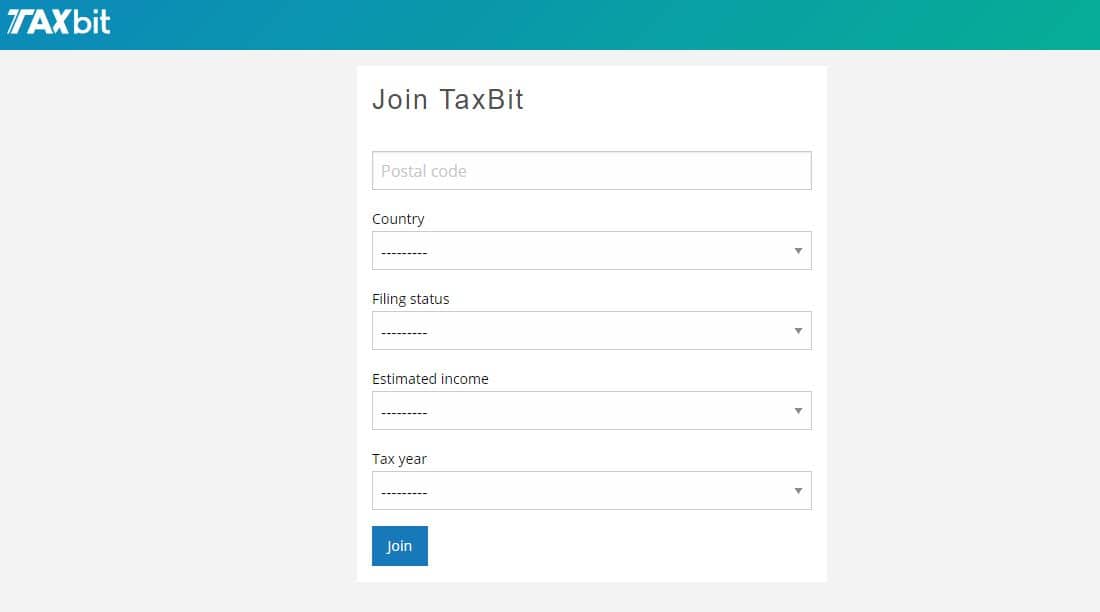

Onboarding Flow

Getting started on TaxBit is a fairly straightforward process. First, TaxBit asks some basic demographic questions that allow them to calculate a user’s individual tax rates. TaxBit displays a user’s taxable gains and losses and then applies their individual tax rates to those gains and losses to display what they owe in taxes.

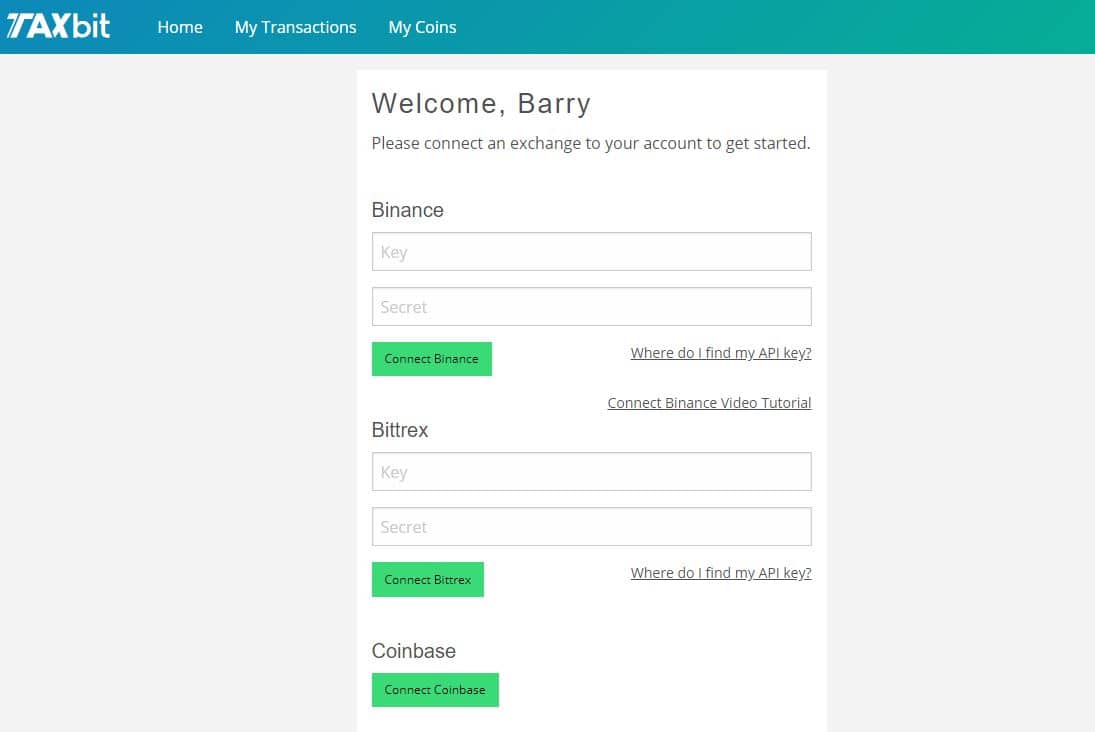

After calculating a user’s tax rates, TaxBit guides users to link their exchanges. Some exchanges, such as Coinbase and Uphold that have quick single sign-on integrations allow users to click connect to easily link their exchange. Other exchanges, such as Binance and Bittrex, provide API keys allowing users to paste the values into TaxBit to connect the exchange to their account. TaxBit provides documentation and video tutorials specific to each exchange guiding users on how to quickly link their exchanges.

Once a user connects their exchanges, TaxBit’s system starts pulling the user’s exchanges. This process can take several minutes. Once the syncing process is completed, a user can immediately dive into the interface and see the tax impact of all their cryptocurrency transactions, as well as download their tax forms.

Once a user connects their exchanges, TaxBit’s system starts pulling the user’s exchanges. This process can take several minutes. Once the syncing process is completed, a user can immediately dive into the interface and see the tax impact of all their cryptocurrency transactions, as well as download their tax forms.

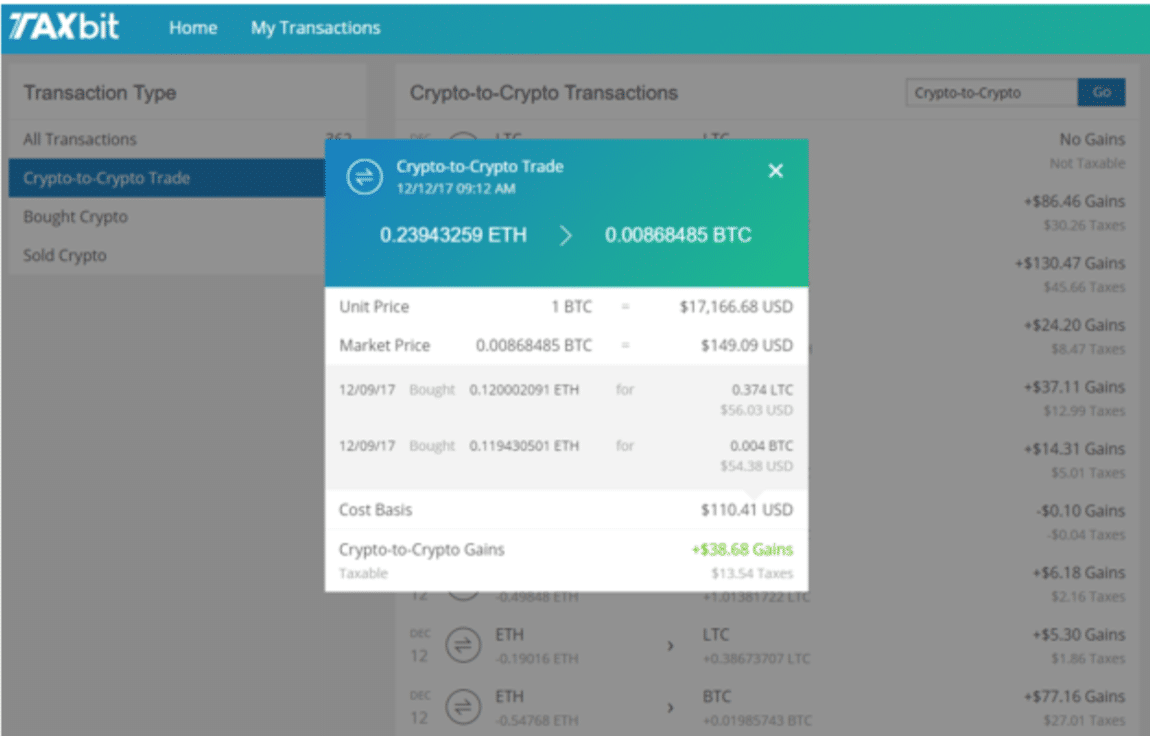

TaxBit’s User Interface

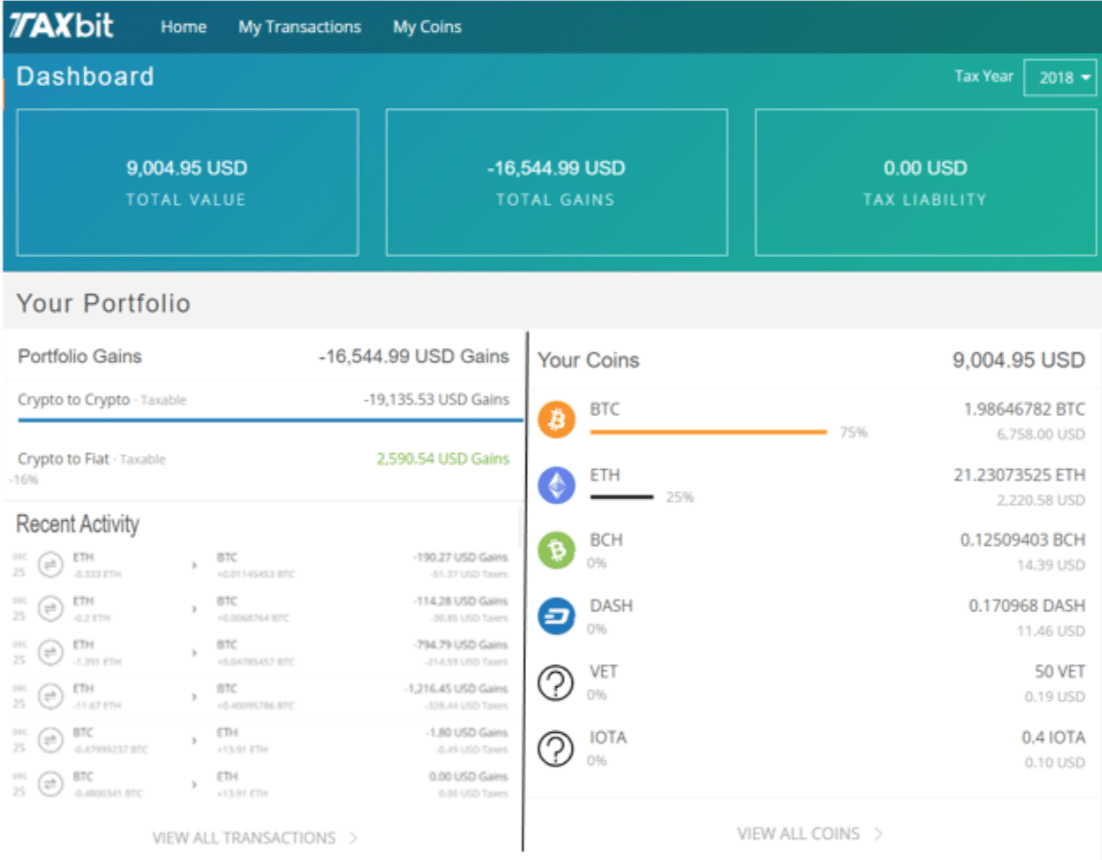

TaxBit’s user interface allows users to see a high-level overview of their account, as well as the ability to drill down on individual transactions. Users can see their total portfolio value, their gains or losses for the year, their coins, and their estimated tax liability. TaxBit tracks users cost basis on every transaction, and both short and long term gains and losses. By tracking and being able to drill down on every transaction, users can see the exact tax calculations on each of their trades. This provides users with a full audit trail in the event of an IRS audit or CPA investigation. Users can have peace of mind knowing that their taxes are being handled the correct way by certified tax experts in the cryptocurrency space.

By tracking and being able to drill down on every transaction, users can see the exact tax calculations on each of their trades. This provides users with a full audit trail in the event of an IRS audit or CPA investigation. Users can have peace of mind knowing that their taxes are being handled the correct way by certified tax experts in the cryptocurrency space.

Tax Form Generation

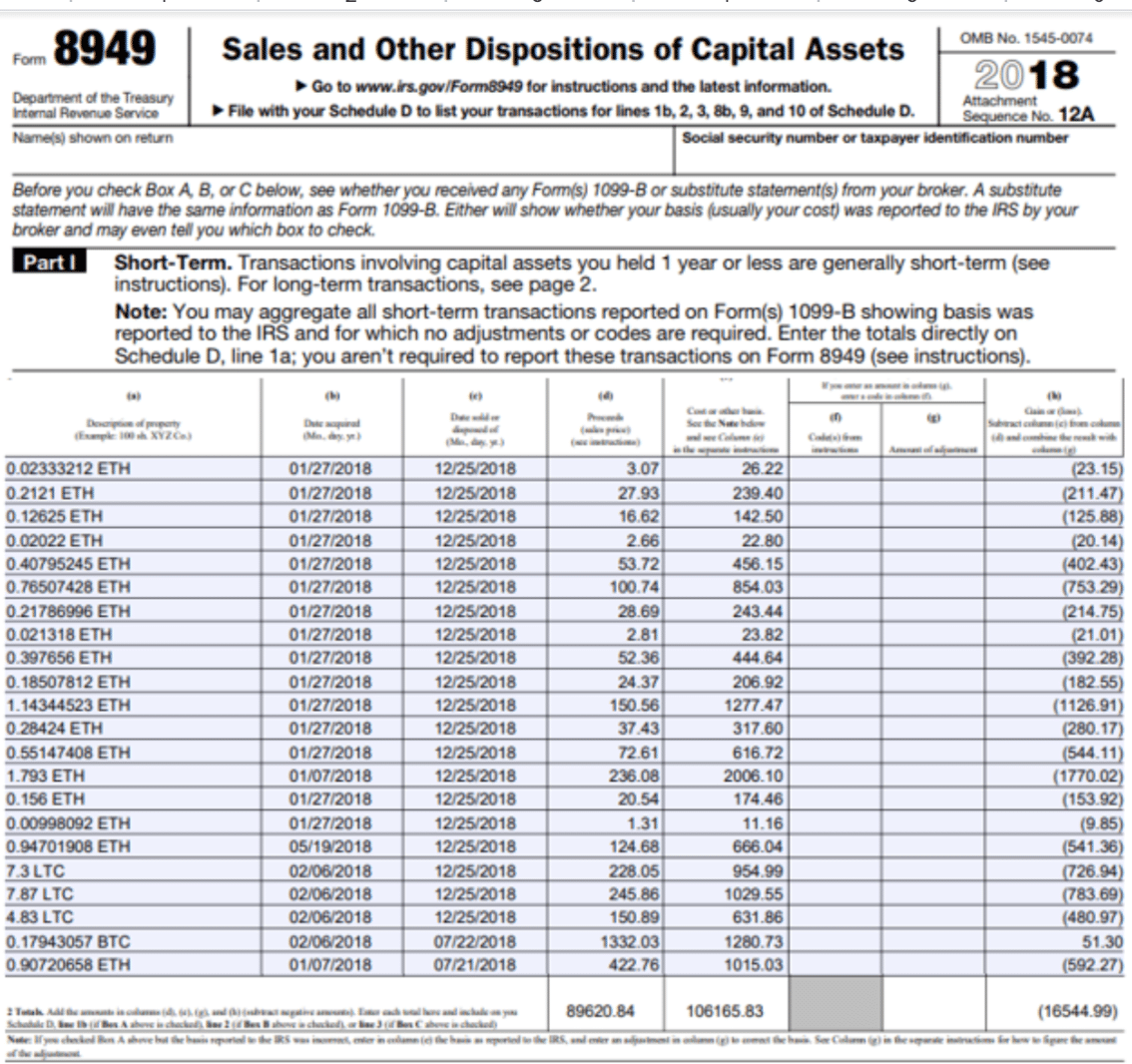

Once all of a user’s exchanges are connected they can export their completed IRS Form 8949 – the tax form that the IRS requires to report capital gains and losses. Users can generate their tax form within their TaxBit account in either PDF or CSV formats. PDF format is useful when a user uses a CPA to do their taxes, as they can simply hand this form to their accountant and not have to worry about the high fees for an accountant to manually prepare the form for them. CSV format is useful when a user files their taxes with popular tax filing software such as TurboTax, TaxAct, etc.

Summary

Summary

Taxation is going to play an enormous role in the maturation of the cryptocurrency industry. For the time being, however, navigating current tax laws in regards to digital assets can be a confusing and tedious process. As far as getting cryptocurrency tax help, TaxBit seems to be a good asset to utilize in order to accurately prepare your taxes and understand your tax liability.

You can snag a 10% discount for your tax filing with CoinCentral: www.taxbit.com/invite/CoinCentral

Editor’s’ Note: The above article is a piece of sponsored content. All sponsored content on CoinCentral must adhere to our sponsored content editorial guidelines.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.