Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

I spent the past four days at Shoptalk, a retail and e-commerce conference that welcomed nearly 8,500 attendees from around the world. As a venture investor who thinks a lot about the future of retail and how startups can make an impact, I was excited to hear from an amazing roster of industry experts, from CEOs of public companies to data scientists at global retailers.

Shoptalk 2019 photo from Daisuke Iizuka on Twitter.

Shoptalk 2019 photo from Daisuke Iizuka on Twitter.

As a newcomer to Shoptalk, I thought it would be fun to share some of the things I learned, with a focus on the topics and questions that are top-of-mind for retailers of all sizes today. Here are five of the key initiatives that many retailers seem to be thinking about:

- Meeting the consumer where they are — outside of a mall!

In the age of Amazon, many consumers are no longer willing to make the trek to their local mall. Art Peck, CEO of Gap (which recently announced plans to close 230 stores in the next two years), said that it’s incumbent on retailers to find locations that better “fit into customers’ lives.”

What do these new locations look like? Retailers are testing a variety of options, from stand-alone stores in unconventional locations (Peck noted that Gap recently opened a location next to a Trader Joe’s in Encinitas) to pop-ups and even kiosks in other retailers’ stores.

Build-A-Bear is a great example of a retailer testing new models. According to CEO Sharon Price, the company’s business model was built on 3,000 sq ft stores in malls. Over the past few years, they’ve had to adapt, closing mall stores and opening kiosks in a variety of locations, from cruise ships to Great Wolf Lodge and even Walmart. Build-A-Bear is still investing in full stores, but in more heavily-trafficked locations like Pier 39 in SF and 34th Street in NYC.

Build a Bear’s new stores (pictured left in Walmart and right on 34th St) don’t look like the mall workshops you remember, but they’re a crucial part of the retailer’s strategy to meet consumers in more convenient locations.

Build a Bear’s new stores (pictured left in Walmart and right on 34th St) don’t look like the mall workshops you remember, but they’re a crucial part of the retailer’s strategy to meet consumers in more convenient locations.

2. Re-imagining physical locations to fulfill specific service needs.

In addition to finding new locations, many retailers are starting to re-think brick-and-mortar. Think of a typical store for a major retailer — it’s several thousand square feet, with tons of inventory. Ten years ago, you might have spent hours wandering the aisles and trying on clothes, and this store would have served you well. But does this store fit the needs of today’s consumers, many of whom shop online and use stores mostly to return or exchange items?

Erik Nordstrom cited Nordstrom’s three “local” stores in Los Angeles as one example of their efforts to provide better service to customers. He noted that the most popular service at these stores is processing returns, followed by picking up e-commerce orders and then getting items tailored. The purpose of these stores is not to display merchandise, but to provide a more convenient experience, and Nordstrom has seen a “significant uplift” in spend and high engagement from customers who visit these locations.

Inside Nordstrom Local (credit to Business Journal) — these stores carry no inventory, instead serving as a hub for customers to pick up and return items, get alterations, and consult with personal stylists.

Inside Nordstrom Local (credit to Business Journal) — these stores carry no inventory, instead serving as a hub for customers to pick up and return items, get alterations, and consult with personal stylists.

A number of other execs at top retailers mentioned plans to test new physical locations with smaller footprints. Paula Price, CFO of Macy’s, floated several ideas — stores focused on “special occasion” items that are harder to purchase online, “replenishment hubs” for consumables that customers may need on short notice, and even locations with the sole purpose of processing returns.

3. Merging brick-and-mortar and e-commerce data in customer profiles.

Imagine you’re a frequent customer of a major shoe company with hundreds of retail locations and, of course, an e-commerce business — let’s call it Shoe Emporium. In a given year, say you visit two different Shoe Emporium locations and make purchases, and you also place an online order (all with the same credit card). Do you think Shoe Emporium knows who you are and how many total purchases you made that year?

Shockingly, if Shoe Emporium is like many large retailers, the answer is no. One of the biggest themes of Shoptalk was the importance of having a “single view” of the customer — a customer data platform (CDP) that aggregates, cleans, and merges data from multiple sources. Without this, it’s hard to effectively segment and market to customers, understand how your physical stores are lifting e-commerce traffic (or vice versa), and even calculate your customer acquisition cost and lifetime value.

Steve Miller, SVP of Marketing and Ecommerce at JOANN Stores, said that JOANN has invested in creating and maintaining a database of 60M customers, tracking all of their touchpoints with the retailer across email, website, SMS, direct mail, and physical stores. As 70% of customers use JOANN’s website to research an in-store purchase, it’s crucial for the company to unify data across all channels — otherwise, how would they know who actually made a purchase (and should no longer be retargeted with ads)?

4. Shift in marketing focus towards the value of a unique brand.

As retailers think about how to compete against Amazon’s prices, convenience, and selection, many are banking on the value of their brand. However, making consumers feel an affinity for a brand often requires much more than just selling a quality product — you need to be present in their daily lives, and reflect their values in a way that doesn’t feel contrived.

Richard Dickson, president and COO of Mattel (which owns Barbie, HotWheels, and American Girl), said his team is making a significant effort to make these brands more relevant to consumers. Barbie, for example, just released a line of “sheroes” honoring female role models worldwide, and launched a “Closing the Dream Gap” campaign to encourage girls to dream big. Mattel also recently announced a new slate of 22 TV shows centered around its brands as part of an effort to monetize IP beyond selling toys.

Dollar Shave Club is taking a similar approach with MEL, the company’s magazine and online publication that tackles tough topics like mental health, relationships, and the changing nature of masculinity. Michael Dubin, CEO of Dollar Shave Club, called MEL “an independent lifestyle brand that’s really important to the Dollar Shave Club mission,” noting that while it doesn’t directly drive revenue, it plays a key role in engaging DSC members.

A few examples of recent articles from Dollar Shave Club’s MEL Magazine.

A few examples of recent articles from Dollar Shave Club’s MEL Magazine.

5. Investing heavily in key influencers who truly align with a brand.

There’s been a lot of talk recently that influencer marketing is overrated, but many retailers are seeing exceptionally strong results from well-executed influencer campaigns. If an influencer is aligned with your brand mission and truly loves your product, their posts can be more “authentic” and engaging than any ad campaign your brand can make.

One of Nickelodeon’s star influencer is JoJo Siwa, a 15-year-old YouTuber known for her sunny personality and love of bows. According to Andrea Fasulo, who leads Consumer Products Marketing, Nick doubled down on JoJo by featuring her on their shows, giving her awards gigs, and producing a line of toys and apparel. The strategy paid off, as JoJo’s global franchise is now worth nearly $1B — she has the top selling doll at Walmart, has sold 50M bows, and gets millions of views on videos featuring her Target clothing.

JoJo Siwa has become a major star for Nickelodeon. With nearly 8M Instagram followers and 9.2M YouTube subscribers, JoJo regularly sells out concert venues around the country in minutes.

JoJo Siwa has become a major star for Nickelodeon. With nearly 8M Instagram followers and 9.2M YouTube subscribers, JoJo regularly sells out concert venues around the country in minutes.

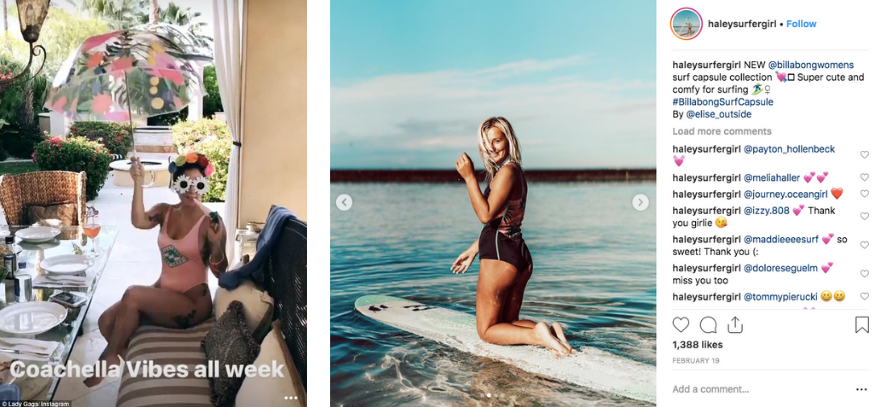

The influencer strategy has also paid off for brands who don’t recruit mega-stars. According to Cathey Curtis, VP of Global Marketing, Billabong’s Instagram posts that feature athletes and micro-influencers get 3x the engagement of those with traditional models. Billabong has successfully used influencers to promote new products, using their posts to stoke interest in a retro one-piece that was unavailable to the general public for months. The swimsuit generated so much buzz that Lady Gaga even wore it an Instagram post right before headlining Coachella, an incredible piece of free press!

Lady Gaga wearing your swimsuit for free may be the ultimate advertisement, but Billabong has also found success with “smaller” influencers like Haley Otto, a professional surfer with 16k followers on Instagram who regularly posts photos competing and practicing in her Billabong gear.

Lady Gaga wearing your swimsuit for free may be the ultimate advertisement, but Billabong has also found success with “smaller” influencers like Haley Otto, a professional surfer with 16k followers on Instagram who regularly posts photos competing and practicing in her Billabong gear.

There’s no question that we’re living through a time of immense change in the retail landscape. The rise of e-commerce and social shopping platforms is forcing incumbent retailers to more clearly define the meaning of their brand, articulate it to consumers, and assert their value proposition in an increasingly crowded market. Meanwhile, the decline of traditional malls is encouraging brands to be creative about designing new types of physical locations that better serve consumers.

I’m excited to see how startups find ways to add value in this new ecosystem, whether it’s by building DNVBs that speak to the needs of today’s consumer or creating technology that other retailers can leverage in the battle against Amazon. With so many facets of retail that can be improved, the opportunity is massive — check out my piece on D2C infrastructure for more detail on a few spaces I’m particularly excited about.

If you were at Shoptalk and/or are building a company in the e-commerce, retail, or DNVB space, I’d love to hear your thoughts — feel free to email me at justine@crv.com or tweet me @venturetwins!

Like this post? Clap for it to help more people see our story, and share it with your friends!

Interested in reading more content from us? You can subscribe to our weekly newsletter, Accelerated, for more insights on millennial and Gen Z trends: https://accelerated.carrd.co/

The Future of Retail: Lessons Learned from Shoptalk 2019 was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.