Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Contributed by Dennis_Z

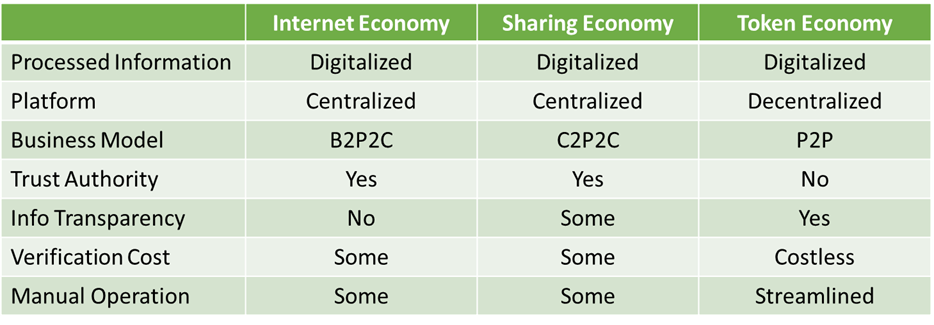

1. Comparison: Internet Economy vs. Sharing Economy vs. Token Economy

Internet Economy (aka Digital Economy) refers to refers to an economy that is based on digital computing technologies, which conducts business through markets based on the internet, such as Amazon.

Major Features:

- Digitized info/workflows: The transactions can be fully managed by online processes given that the transaction related information is already digitized, including product/service info and payment method, etc.

- Logistics: Internet Economy relies on streamlined logistic processes to deliver the product/service to complete the transaction.

- Light-asset based: Since Internet Economy does require an offline location to interact with customers, the Internet Economy is light-asset based and more cost-effective in pricing for competition.

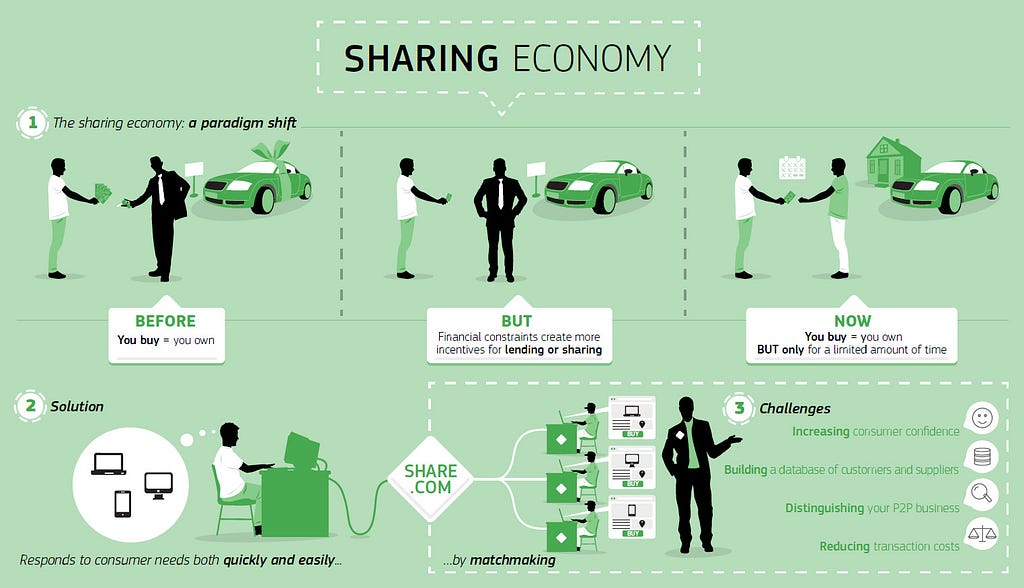

Sharing Economy (aka Collaborative Consumption) refers to peer-to-peer (P2P) transactions based on the Internet. Such transactions are often facilitated via community-based online services. It differs from Internet Economy in the sense that the platform only facilitates online connection of product/service provider and consumers. The platform does not sell the product or provide the service directly.

Major Features:

- Peer-to-Peer Transactions: Transactions in Sharing Economy are peer-2-peer, which can be B2C, C2C or B2B.

- Trust Authority: The platform serves as a trust authority to endorse both the consumer and product/service provider.

- Unused Value to Share: Sharing Economy is largely dependent on the willingness to share unused value, which can be recycled or reused. For example, cars are not used for 92% of the time and the unused value can be a significant resource/opportunity for sharing economy car solutions, such as Uber and Lyft.

Token Economy refers to the system of incentives based on cryptocurrencies that reinforce and build desirable behaviors the in blockchain ecosystem. To form the consensus in the blockchain, it requires miners to provide validation service for transactions. Token Economics is the mechanism to incentivize miners to provide better service on the network.

For example:

- Blockchain Mechanisms, which create and verify the transaction using cryptography algorithms without centralized authority;

- Token Economics, which incentivizes the service (e.g., mining and validation) provided on the blockchain network.

In analogy, blockchain mechanism is the skeleton and the token economics is the nerve, muscle, and veins to bring life to the blockchain technology. In Summary, Token Economics is the core to keep the system sustainable in the long term.

Major Features:

- Blockchain-based: Token works naturally with blockchain technology as an intermediary of value measure and exchange. It does not require trust authority to validate the P2P transactions on the network.

- Multiple-purpose: Token is classified as utility token and security token. For utility tokens, it can be used for transaction, vote, and staking.

- Multi-Factor Driven: Depending on application scenarios, the token economics mechanism can be customized to address the unique characteristics of the application scenario.

The following comparison summarizes the common and different features of Internet Economy, Sharing Economy and Token Economy.

As Token Economics is mainly based on mechanism designs, inappropriate token economics may lead to death spiral if there is a perceived loss of value in the token economy.

Appropriate Token Economics should not only incentivize desirable behavior but also be able to stabilize the network operation. Therefore, the Token Economics should be designed at an absolute level (incentivization) as well as relative level (stabilization). The following examples demonstrate some good and failing examples of Token Economics

Token Functions:

- Security Token for investment in cryptocurrency

- Utility Token: 1) payment; 2) voting; 3) transaction fee; 4) unit measure; 5) staking governance

- Bitcoin: Bitcoin Token Economics determines the reward mechanism between Bitcoins and blocks. The reward started at 50 Bitcoins per block and is cut in half every four years. Currently, the reward per block is 12.5 Bitcoins. Bitcoin was also designed to create a new block approximately every 10 minutes. As the number of block miners increases the average time to create a new block would decrease. Keeping other factors constant, increases in computational power would also make it faster to generate new blocks.

- To keep block generation time consistent, Bitcoin uses a ‘difficulty algorithm’ to adjust the difficulty of the puzzle that needs to be solved to generate a new block successfully. These two features — the token reward mechanism and the difficulty algorithm — form Bitcoin’s Token Economics.

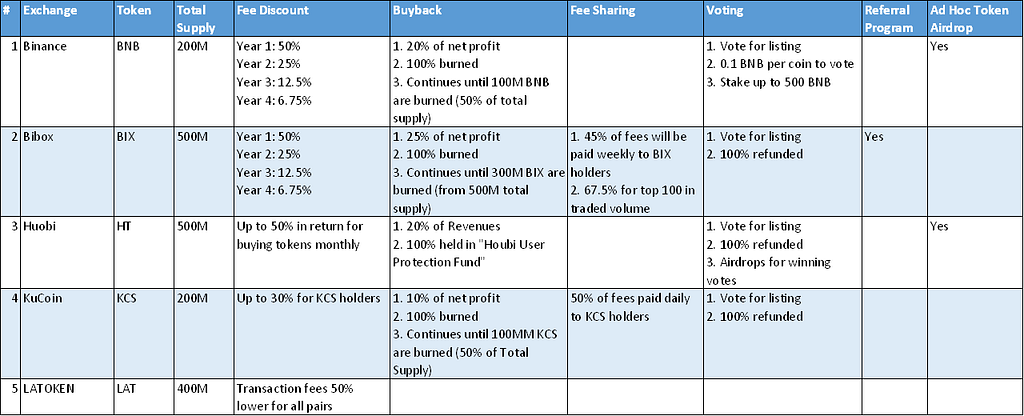

- Exchange Tokens: Several exchange cryptocurrencies have used their own token to pay for the transaction fee. Plans of constant buy-back help stabilizing token value.

- FCoin: FCoin comes up with the PoT (Proof of Trading), which incentivizes the trading as mining. As seen in the chart, when volume increases sharply, the coin price explode. As there is no stabilization mechanism, when coin price drops, the trading volume also decreases. The reinforcement of trading volume further drives down the coin price.

Token Economics is a system of mechanism designs to grow the ecosystem, and it is crucial to growing the blockchain ecosystem and applications while navigating various regulatory requirements.

Reference:

- https://en.wikipedia.org/wiki/Digital_economy

- https://maxkanaskar.wordpress.com/2018/08/05/token-economics-101/

- https://www.iedcevents.org/Downloads/Conferences/annual_16/telles.pdf

- https://www.digitalistmag.com/digital-economy/2016/06/07/5-characteristics-of-digital-economy-and-what-they-mean-for-oil-gas-04247790

Token Economics #2: Comparison Review of Token Economy was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.