Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

DLT M&A Weekly : March 2nd 2019

Distributed ledger technology mergers and acquisitions

DLT M&A news with week was dominated by reactions to the acquisition of Neutrino (chain analytics for exchange risk management) by Coinbase which was well covered by The Block. The only notable newly announced M&A transaction this week was the acquisition of Ethos (private) by newly public Voyager Digital(Public TSX.V: VYGR), described in detail below.

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

Voyager | Ethos | $3.9mm | February 28, 2019

Small but strategically important and illustrative acquisition

Target Description: Ethos offers a mobile phone-based multi-asset cryptocurrency wallet (the Ethos Universal Wallet).

There are a long list of wallet competitors include Coinbase (Toshi), Blockchain, GreenAddress, Bread, Jaxx, Mycelium, Electrum, MyEtherWallet, Samourai, and hardware based-wallets including Ledger, Trezor and KeepKey.

Ethos raised $2.3mm in capital in July 2017 through a token issuance (whitepaper). The token (ETHOS) currently trades on Binance and Bithumb and according to OnChainFX, has a current market capitalization of $14mm. 56% of the total token supply remains in the Ethos treasury.

Ethos.io PTE LTD (“Ethos”) was founded by Shingo Lavine in May 2017 as Bitquence. Mr. Lavine will assume the role of Chief Innovation Officer and join the board of directors a Voyager upon close of the transaction.

Buyer Description: Voyager Digital (Canada) Ltd (TSX.V: VYGR) is a crypto asset brokerage firm, offering retail and institutional clients commission-free trading services. Via their Smart Order Router, Voyager access multiple crypto exchanges and other trading venues to ensure efficient execution of desired trades. Voyager currently operates in the select U.S. states and plans expansion within the U.S. and internationally this year. Voyager competes with companies such as Coinbase, Circle and Robinhood.

Voyager, led by Steve Ehrlich and based in New York, NY, was created via the reverse merger of Voyager into a public shell company which closed on December 31, 2018. Voyager is pre-revenue and has a current fully diluted market capitalization of $45mm U.S. (79.6mm fully diluted shares at $.5625 per share U.S.).

Transaction Parameters:

Voyager is acquiring certain assets of Ethos for 7 million common shares of Voyager, today valued at approximately $3.9mm U.S.

Comparable acquisitions include: Binance’s acquisition of Trust Wallet (July 2018), nChain’s acquisition of HandCash (May 2018), Coinbase’s acquisition of Cipher Browser (April 2018), ShapeShift’s acquisition of KeepKey (August 2017) and Bitmain’s acquisition of BlockTrail (July 2016).

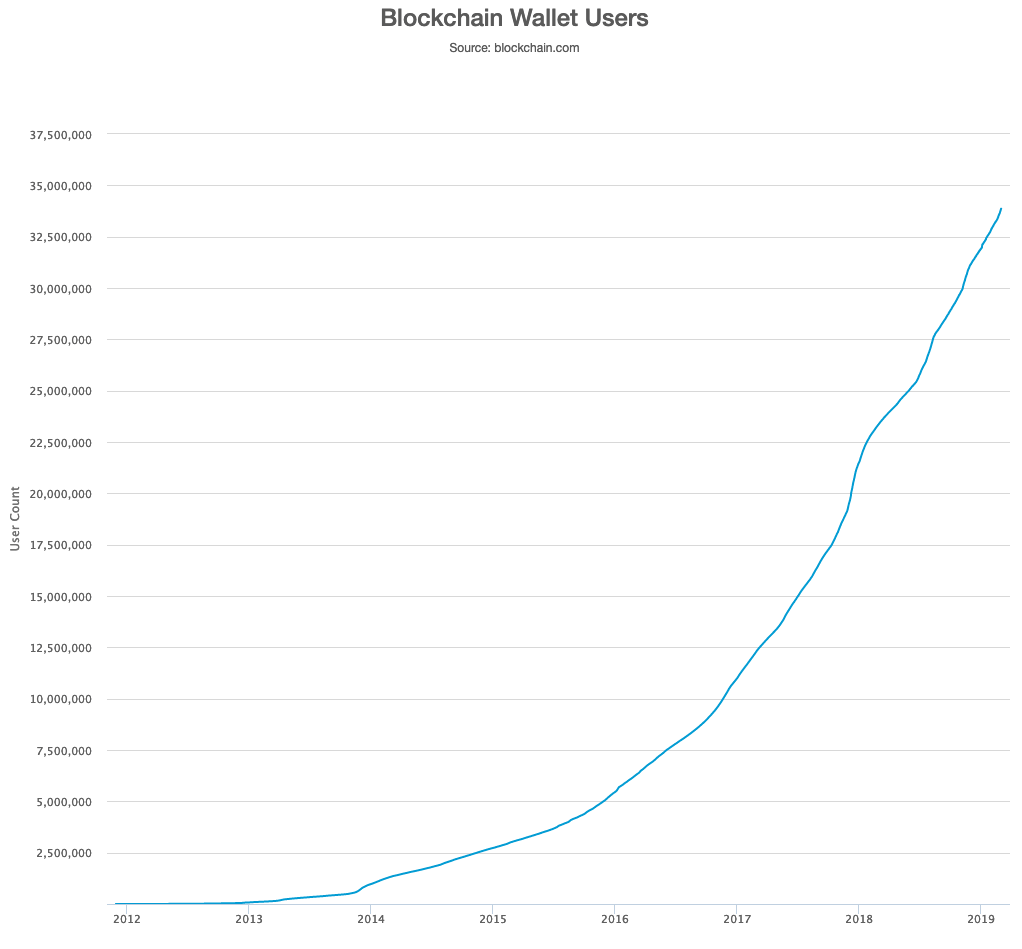

Strategic Rationale: A cryptocurrency wallet is essential to allow an individual to access, store and transact with cryptocurrencies and tokens. In essence, the wallet is a critical user interface. Companies who control the wallet, have direct access to the consumer, making it highly strategic to control. Today, there are 35 mm cryptocurrency wallet users according to Blockchain.com

Vision, and other crypto exchanges, require wallet integration (their own or third-party wallets) and are also seeking strategic advantage by controlling the wallet as cryptocurrencies and tokens are more widely utilized as payment or access.

Other competing user interfaces include cryto-enabled mobile and desktop browser (Brave or Metamask), use case specific apps (including crypto exchanges like Voyager, Coinbase, …) where the wallet is linked but in the background.

Voyager and Ethos had an existing business relationship.

Architect Partners Observations: We’ve only begun to see the emergence of the competition to control the cryptocurrency wallet given its immense strategic value. Those who control access to the consumer, have the opportunity to extract value from that relationship. No different than the web and mobile browser, search or social media.

Also of note, this is an acquisition of a company which had previously issued tokens in an ICO. The circulating supply of these tokens are currently ascribed a market value of $14mm and 56% of the token supply remains held in the Ethos treasury. As we’ve observed before, while issued tokens may make M&A more complicated, it’s certainly not impossible as theorized by Kyle Samani in his October 2017 Crypto Acquisitions post.

One way to think of this transaction is that Voyager paid $3.9mm for the assets of Ethos which theoretically include tokens valued by the market today at $18mm. Interesting …

DLT M&A Weekly : March 2nd 2019 was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.