Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

On March 4, cryptocurrency-backed USD lending platform Blockfi announced the launch of a new savings program called the Blockfi Interest Account (BIA). Having started as a private beta service, BIAs are now available to the public who can store bitcoin core (BTC) and ethereum (ETH) and receive 6 percent annual interest, paid monthly in cryptocurrency.

Also read: An In-Depth Look at Ethereum’s Maker and Dai Stablecoin

Blockfi Introduces Savings Account That Earns a Return on BTC and ETH Holdings

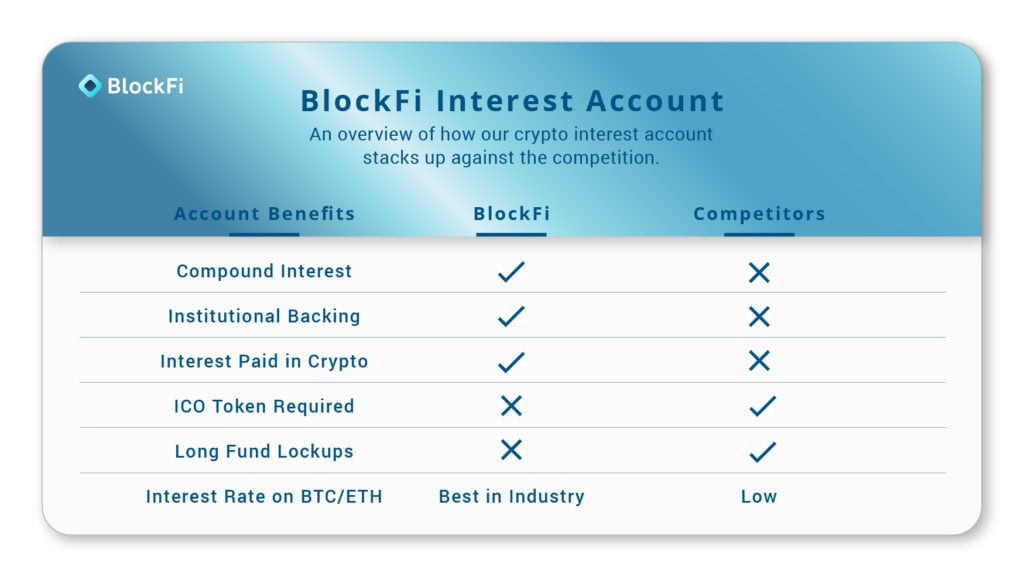

Cryptocurrency lending company Blockfi has initiated a new service that provides investors with annual interest on stored cryptocurrencies. The Blockfi Interest Account (BIA) enables customers to earn 6.2 percent a year compounded monthly by simply storing BTC or ETH in an account. Last July, Blockfi raised $52.5 million to get the company rolling with a funding round led by Michael Novogratz’ company Galaxy Digital. In August, the lending firm was approved to operate its services in California. According to Blockfi, the newly created BIA savings program was initially launched in private beta and managed to attract $10 million worth of ETH and BTC from retail, corporate, and institutional investors.

“The launch of BIA is another significant step in Blockfi’s goal of becoming the go-to provider of financial services for crypto investors,” said Blockfi CEO Zac Prince on March 4. “Lending and borrowing are readily available at the institutional level, and we’re excited to leverage our relationships and capital markets expertise to provide utility and yield on digital assets for all crypto investors.”

Blockfi details that the BIA service is available to customers worldwide and the digital assets are held by the Gemini Trust Company in New York. Gemini recently announced its custodial services and completed a SOC 2 Type 1 security compliance review. Blockfi says customers accrue the 6.2 percent on a monthly basis and are able to initiate withdrawals at any time.

“As crypto markets mature, greater liquidity will be constantly required to keep markets orderly,” Rene van Kesteren, Blockfi’s chief risk officer stated. “By providing a transparent yield on BTC and ETH, Blockfi will be a key part of the trading and market making ecosystem.”

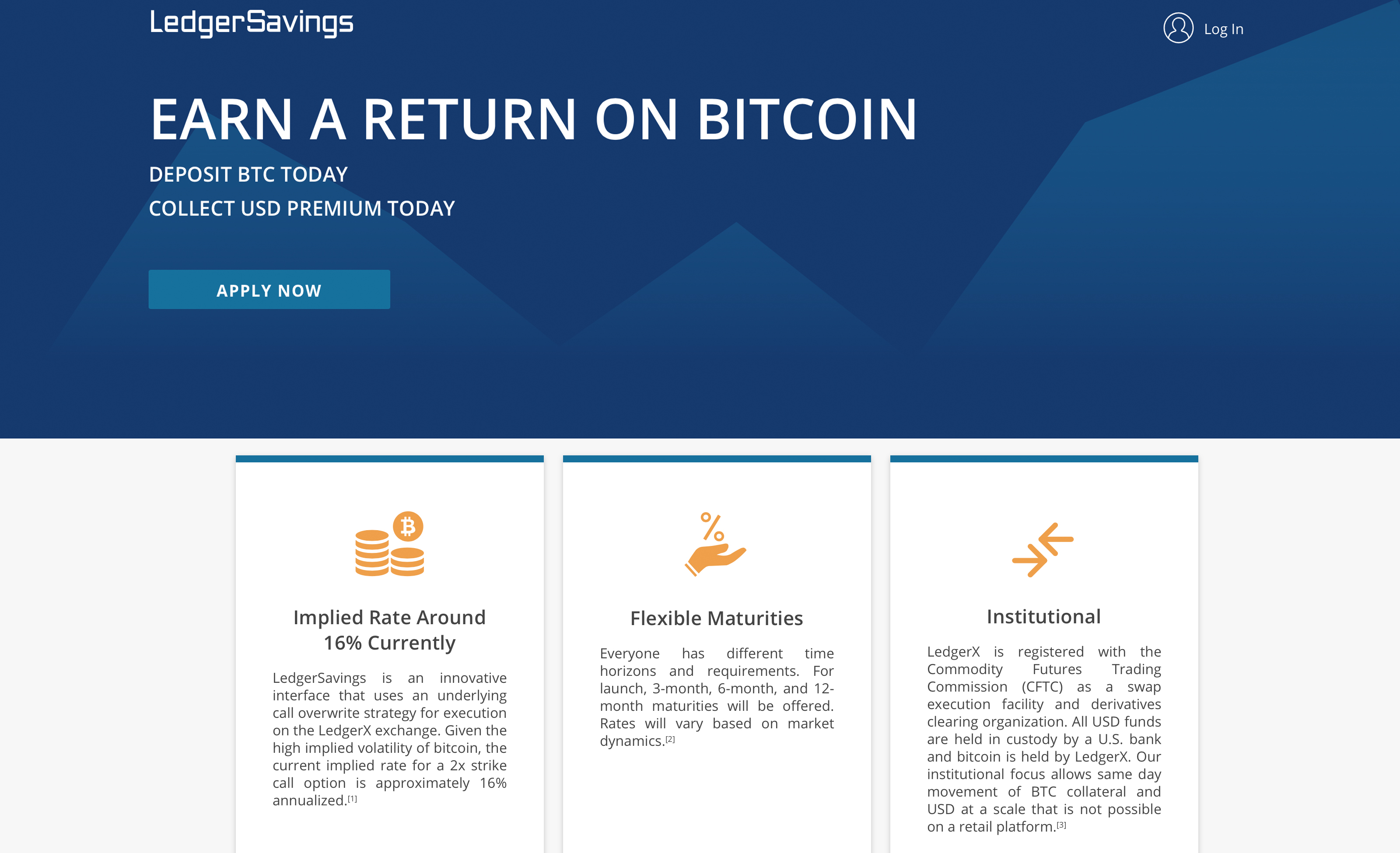

Blockfi Joins a Few Other Startups Offering Compounded Crypto Yields

Blockfi is not the only firm offering cryptocurrency investors a yield on BTC and ETH. Last August, the U.S. Commodity Futures Trading Commission (CFTC) regulated exchange Ledgerx launched an interest-bearing BTC savings platform. According to Ledgerx, the program allows clients to gain an annualized return of roughly 16 percent, even when crypto markets are not appreciating. Unlike Blockfi, Ledgerx holds the digital assets and a U.S. bank holds the accrued USD interest.

Another company headquartered in San Francisco called Compound has developed a platform that creates a decentralized interest rate market for cryptocurrencies. The Compound application uses BAT, ETH, and REP within its protocol that runs on the Ethereum network. The startup received $8.2 million in seed funding from venture capital firms like Andreessen Horowitz, Polychain Capital, and Bain Capital Ventures.

Flori Marquez, cofounder and VP of Blockfi operations, believes the startup’s compliance programs set it apart from the competition. The yield earned by BIA customers is generated by Blockfi’s institutional borrowers and from participants from the company’s last fundraiser. Since Blockfi launched, it has also added litecoin and GUSD for crypto-backed loans. “Blockfi’s proprietary risk management system, which automatically initiates margin calls and liquidations to protect our customers’ assets, has a perfect zero-loss performance record since launching in 2017,” concluded the company’s announcement.

What do you think about Blockfi’s BTC and ETH savings program with its 6.2 percent annual interest? Let us know your thoughts on this subject in the comments section below.

Image credits: Shutterstock, Blockfi, and Ledgerx

Verify and track bitcoin cash transactions on our BCH Block Explorer, the best of its kind anywhere in the world. Also, keep up with your holdings, BCH and other coins, on our market charts at Satoshi’s Pulse, another original and free service from Bitcoin.com.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.