Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Over the past few years, there has been an increasing amount of news on the topic of self-driving vehicles and the inevitable future of unmanned driving. On February 15th of this year, Amazon announced a $700 million investment in Rivian, a competitor to Tesla, and $530 million in Aurora, an independent automotive startup. This race among the various technology companies with be closely watched, and it should determine the winners in this rapidly growing industry.

According to research company Altimeter, the first fully self-driving cars are likely to appear in or around 2021. This is a realistic forecast based on an analysis of existing technologies and their prospects for immediate development, but not on consumer readiness in the market. Partially self-driving and fully self-driving cars will achieve mass market penetration closer to 2035.

Experts on the potential of driverless car sales and their market penetration have differing opinions. For example, according to an IHS report, in 2035, penetration will reach nearly 17% (of which 7% will be fully self-driving). At the same time, annual sales volumes of unmanned vehicles will reach 21 million vehicles by that time (by comparison, in 2025 this figure is expected to be around 600,000).

It is clear that between the present and 2035, there will be no magical leap forward, and self-driving vehicles will not become a mass-market product overnight.

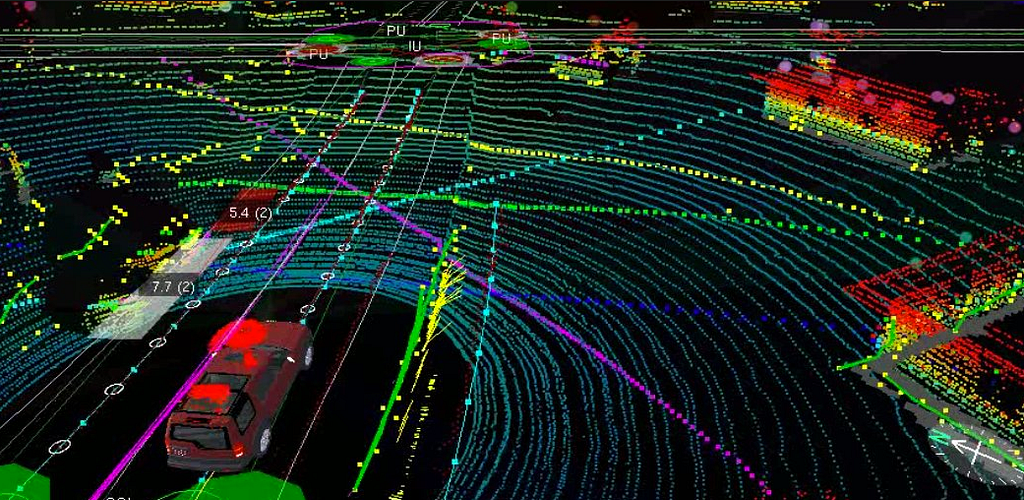

First of all, manufacturers have to accumulate a massive amount of data for the machine-learning technology associated with driverless systems to work. Only by accumulating millions of potential variations on potential real-world driving situations will the car be able to scale this knowledge and ensure a high level of traffic safety.

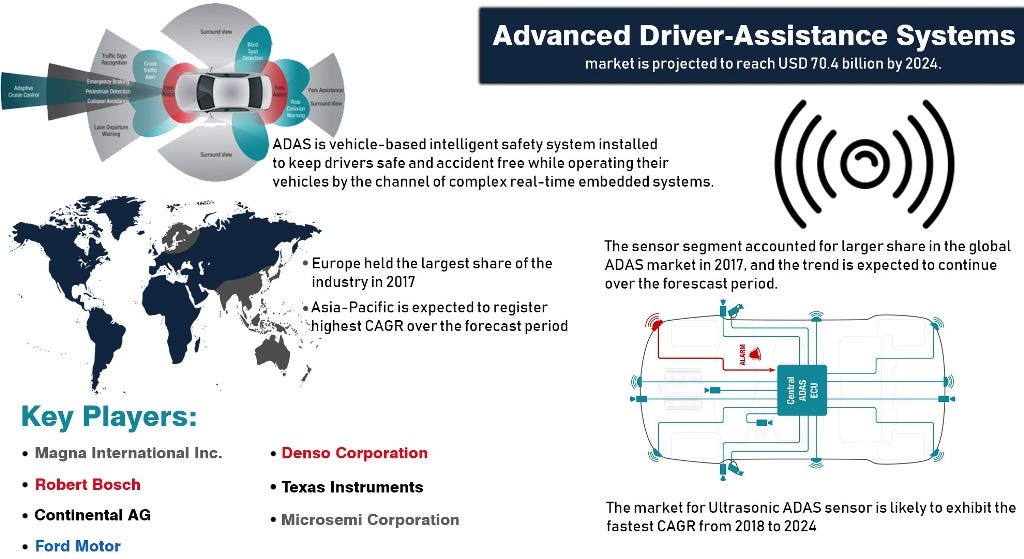

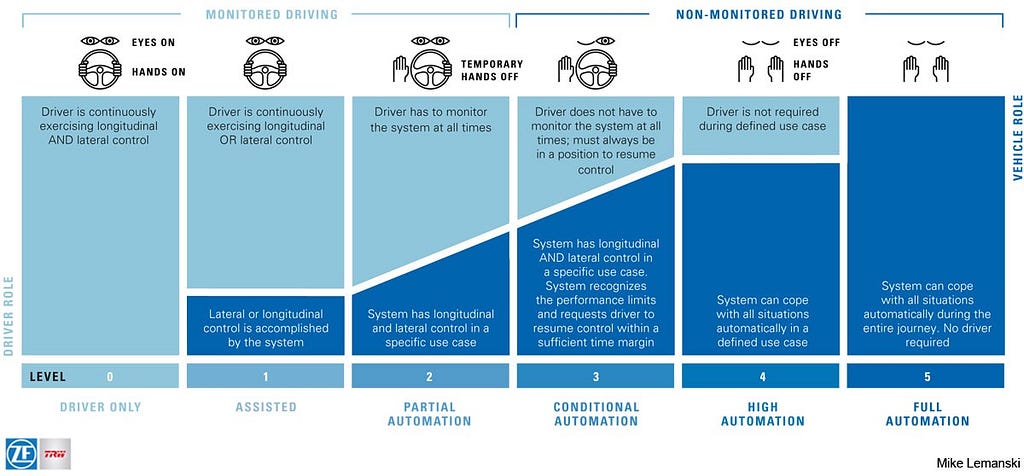

Secondly, market players will be engaged in the development of their own expertise, and this will occur in two areas simultaneously: the assistive driving segment (Advanced Driver Assistance Systems (ADAS)), that is, the basic technologies that allow for the automation of some of the driving processes without the driver relinquishing full control, and the segment of self-driving transport.

Companies will ramp up their software engineering competencies, especially in the area of merging raw data and machine-learning, building strategic partnerships, attracting talent, engaging in M&A activities, and looking for cheaper or more advanced solutions in the market.

And now there are start-ups coming into the space that are aimed specifically at assisting the large manufacturers of driverless vehicles. I had the opportunity to personally verify this during a conversation with Jay Dawani, Founder of Lemurian Labs, an AI startup who is in stealth preparing a new approach to data processing that will help achieve the fourth level of autonomy with an eye already fixed on the fifth.

It is his view that if we are to attain level four autonomy it will not be by trying to model how humans drive because that brings us full circle, and self-driving cars need to be better.

Jay Dawani highlights:

We need to approach the problem with these limitations in mind and view this not as a problem of robotics or multi-agent systems, but one of communication

Fifth-level autonomy is unconditional (that is, unlimited) automatic driving, without expectations that the driver will ever engage. In other words, a level-5 system must travel any place a qualified driver can drive, under any conditions that a driver would encounter, completely on its own.

It is possible that a level-5 system will result once a sufficient amount of level-4-connected vehicles have driven on the roads and been adequately taught. Systems deployed in thousands of cars in daily operation will collect huge amounts of data and encounter many new situations; they will quickly develop on their own, leading to their eventual evolution to level-5.

Among the issues that need to be resolved by technology suppliers to the automotive industry market, at least two are critical for the further development of ADAS and unmanned vehicles. The first is ensuring the compatibility of all systems and software inside a smart car that can think and communicate with other vehicles. Resolving this will make V2V (vehicle-to-vehicle) interaction possible, which will significantly increase the level of security during unmanned driving The second is to keep the final cost of a car with ADAS and unmanned cars at only a slight premium to the existing pricing for standard cars.

Thanks to new technologies, the cost of a smart car’s components will be reduced by at least an order of magnitude. According to a Boston Consulting Group report, during the first years of emergence of fully self-driving cars (2021–2025), the cost of systems for them will be approximately $10,000. Ten years later, similar equipment will cost $3,000 or less.

Even today, there are examples of dramatic price reductions due to new technologies. For example, a few years ago the cost of the LIDAR sensor (an optical sensor) was $80,000, which made it one of the most expensive parts of a self-driving vehicle.

Similar to sonar, LIDAR sensors create a 3D map of its surroundings using a collection of lasers — Source

Similar to sonar, LIDAR sensors create a 3D map of its surroundings using a collection of lasers — Source

Today, it costs around $8,000, and at the end of last year, Velodyne, the manufacturer of lidars, announced that it is working on a new design which could lead to the final product cost being as low as $50. In August 2016, the company received a $150 million investment from Baidu and Ford, who are obviously interested in bringing mass-market self-driving cars closer to reality. Today, along with other high-tech companies and automakers, Velodyne is working on nineteen distinct projects in the field of driverless vehicles. There also exists a great potential for making GPS systems, radars, ultrasonic sensors, video cameras and onboard computers more affordable.

Between 2020 and 2035, there will not only be improvements in technology and a significant reduction in production costs for driverless vehicles, but also expect a serious transformation in the mentality of drivers, and even broader society as a whole. Automakers first have to remove many issues from the agenda (not only the caution of consumers, but of regulating bodies as well, which will be aided by a large amount of statistical data confirming the safety of unmanned driving), as well as create new needs for their drivers, who at this point still prefer a car with semi-autonomous functions (and it will be ADAS that will allow drivers to become accustomed to a car that can drive itself).

I am of the opinion that that the first adherents to driverless technology will be companies whose business is directly connected with the management of large fleets — in logistics, commercial transport and agriculture. In these industries, the purchase of expensive unmanned vehicles will be justified and will pay for itself through a cheaper cost of doing business. This will come from a reduction in accident rates and other risks, headcount cost reduction, and a resulting smaller tax base. In this area, expect there to be a market for fully self-driving vehicles within 5 to 10 years.

The first passenger routes using unmanned vehicles will be limited in scope. For example, a dedicated public transport route on the territory of university or business campuses and in other parts of a city might be considered where infrastructure and traffic regulations are suitable for safe unmanned driving.

An important trend that will influence the development of a mass market for self-driving vehicles is that of shared mobility. On average, an urban car owner does not use his car 95% of the time, which makes car ownership and maintenance highly inefficient economically, and is a good reason to consider an alternative. The use of shared mobility services will also be stimulated by the transportation departments of large cities concerned with managing urban traffic and environmental issues.

Self-driving cars fit in well with this trend and can become a convenient personalized service for localized transport, which will be offered by leading providers on the ridesharing market. In a consumer’s behavior, the perception of what a car is will most likely shift from that of just the vehicle itself to vehicle-as-service. And, for certain, in several years’ time, some multi-billion dollar giant will appear, who will become the equivalent of a ClassPass service for transportation.

Nowadays, the auto industry is a market of unprecedented technological breakthroughs and huge investments. The industry is coming to understand that tomorrow’s profitability will depend on the monetization of the driving process itself, and not on the classic car sales model, and market players will have to create a service for which the consumer will be willing to pay in the long term. Companies with expertise in the field of ADAS and driverless systems are beginning to have a noticeable impact on automakers’ business agendas. This applies to purchasing for their businesses, their acquisitions, and strategic alliances. There are quite a few examples of this, and they include deals worth billions of dollars. Intel purchased Israeli ADAS systems manufacturer Mobileye for $15.3 billion.

Samsung announced plans to buy the American company Harman for $8 billion, which will allow the Korean company to gain a significant presence in the market of connected technologies. Toyota has invested in Uber, Volkswagen put $300 million into Gett, General Motors invested $500 million into a search service for private Lyft drivers, and the list goes on. The industry is on fire in all segments, and this is because everyone understands that the market is transforming itself dramatically. And it is also important to understand what not to do so that a superstar today avoids becoming an outsider tomorrow.

Driverless technology is still far from perfect, but it is being constantly and actively improved, and this will continue for the foreseeable future. According to Goldman Sachs estimates, robotaxis will increase shared travel service revenues from $5 billion to $285 billion over the next 12 years. Consequently, the stakes are quite high and it is not surprising that many companies are looking to bring their products to the market as soon as possible.

Competition in the Autonomous Vehicle Industry is Heating Up was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.