Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Funding Strategies decoded: ICOs turn the tables in 2019!

Flippenning has always been associated with altcoins like Ethereum & Ripple, both trying to assert their dominance in terms of total market cap. A similar story is expected with Bitcoin, despite being the first cryptocurrency and dominating the market ever since its inception, the crypto community now believes that with just the payment solution, the future may not be so bright for BTC and it will lose its current market dominance to alternates.

Could this be Flippenning 2.0?

Flippening 2.0 appears to be a market trend that could witness Initial Coin Offerings becoming less accessible to the public and more exclusive towards high-net-worth individuals and institutions. Originally created to favor decentralization and thus a semblance of normalcy to the traded price on exchanges, ICOs have now made up with traditional investors for capital raising. The idea of the Token Generation Event to raise capital seems to be losing favor with the market continuing to be soft & major regulatory bodies seeking to arrest scammers.

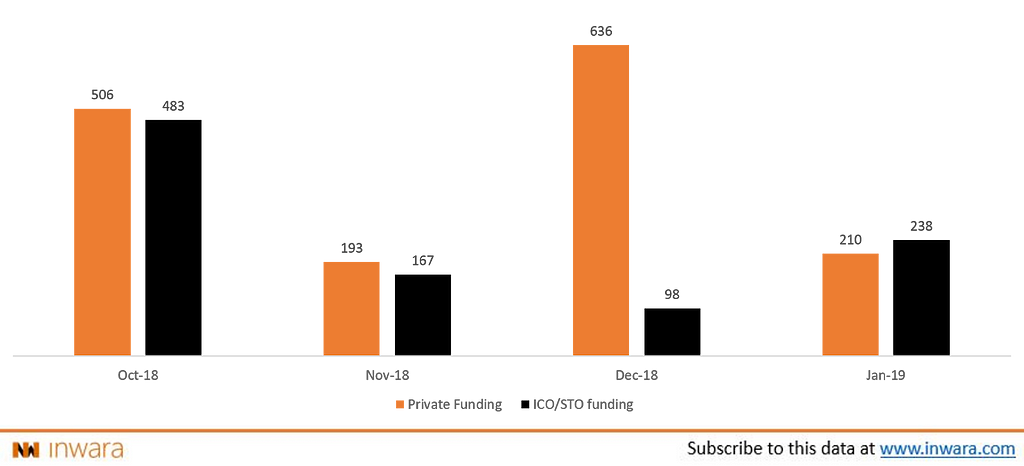

Funds raised ($MM) through private funding and ICO sales

Capital raised by Blockchain enterprises through accredited investors and private institutions in the past four months alone were considerably higher, at a whopping $0.9 billion (source) compared to ICO/STOs sales at $1.5 billion. Interestingly, however, the gap has closed over Q3 and flipped in Jan 2019 with Private funding outdoing main sale raises!

Regulatory authorities fueling this transformation?

Growing regulatory scrutiny in Token Generation Events, especially in the USA, is forcing entrepreneurs to look towards traditional sources of capital raising like institutional investors.

Earlier, entrepreneurs with “ground-breaking” ideas could easily raise capital for their project, simply by building a website and uploading a whitepaper pertaining to the details of the project. This changed when innumerable ICO scams began to pop up. According to a study by Statis group almost 80% of all ICOs conducted in 2017 were scams, forcing regulators to become more vigilant. Now entrepreneurs find it easier to raise funds through traditional means instead of navigating the regulatory minefield of conducting a public sale.

.

Benefits of raising private capital

On top of being “easier”, raising private capital has a host of other benefits like creating a conducive environment for company management to focus on long term goals, most often retail investors are motivated by short term goals and earning quick returns. Retail investors most often have very little to offer other than their capital but onboarding private investors, on the other hand, opens up the option to leverage their network of professional connections. This could help a company scale faster and achieve their long-term goals.

Further, this allows the company to worry about core development as opposed to deploy resources on ensuring PR around the development. After all, not every project has a Justin Sun!

Does the crypto market need institutional investors?

Blockchain has been making waves in many industries, in the short time since its inception. In spite of this, for mainstream adoption of Blockchain technology, it needs to scale to reach a global platform. Bulge bracket banks and private institutions with deep pockets can propel blockchain by providing both the financial muscle as well as an understanding of business to allow for pursuing relevant use cases and filtering out the noise. Institutional investment could also help fuel wide-scale adoption by boosting credibility in the eyes of the public.

In November 2018, KPMG, one of the ‘big four’ auditing firms in the world, published a report which strongly advocating the growth in the crypto market and pushing institutional investors to enter the market instead of staying on the sidelines. “Institutionalization is the necessary next step for crypto and is required to build trust, facilitate scale, increase accessibility, and drive growth.” KPMG was quoted saying in their report.

For now, only a fraction of the world directly interacts with crypto and blockchain and they are largely retail investors, entrepreneurs, and crypto enthusiasts. However, the growing number of VCs and VC funds solely specializing in Blockchain and akin technologies could be indications of institutional investors inching towards this still-nascent market.

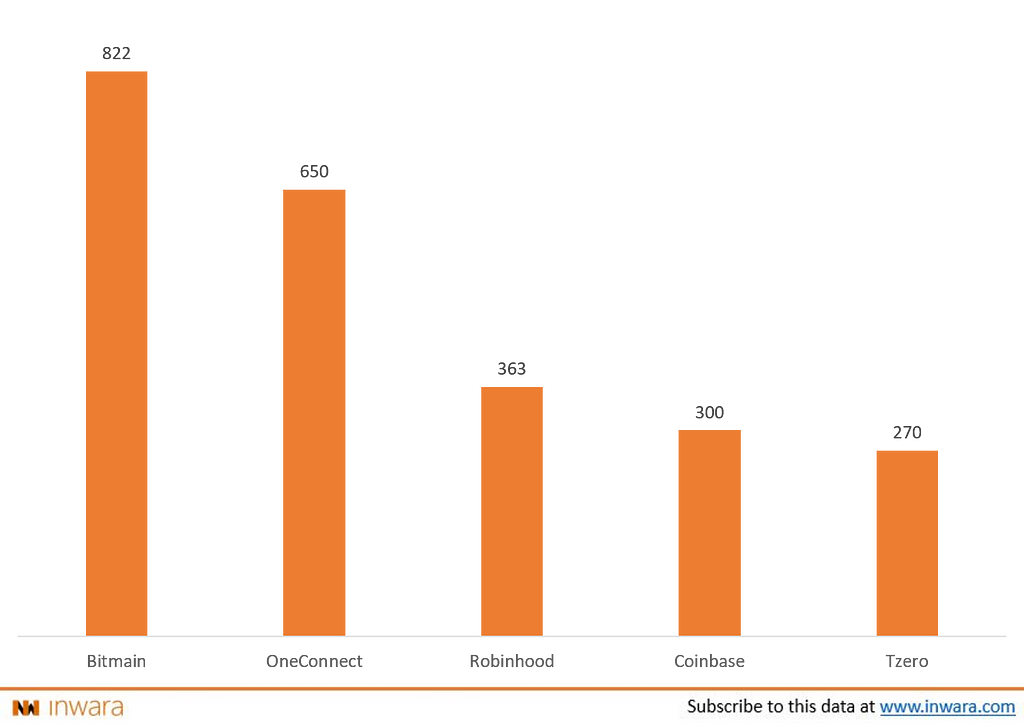

Marquee private funding deals of 2018

Bitmain, a privately owned Chinese company, operates of one of the largest Bitcoin mining pools, Antpool. Bitmain known in the crypto space as the manufacturer of high-tech crypto mining hardware raised a total of $822 million dollars in two separate rounds, backed by well-known VC firms such as Sequoia Capital.

OneConnect

OneConnectm a Chinese company, provides financial services and Fintech solutions to larger public institutions such as banks. They raised $650 million as part of a series A private funding round. OneConnect has previously been part of high-profile deals such as partnering with the Hong Kong Monetary Authority to launch a Blockchain powered financial system for trading.

Robinhood

Robinhood, a popular stock trading app, is considered to be one of the top Fintech startups from the US, according to a report by Fortune. The app was valued at a whopping $5.6 billion and raised $363 million as part of a series D funding round from well known VC’s such as Sequoia Capital and Kleiner Perkins among others. Although the company started out as a trading platform for stocks, it later launched a platform for trading crypto assets.

Coinbase

Coinbase is a San Francisco based digital currency exchange that distinguished itself by allowing its users to directly buy crypto using fiat currency. Coinbase is known to be flush with capital and is often at the forefront in acquisitions. The exchange managed to raise a whopping $300 million as part of a series E funding round in 2019 from VC’s in the crypto space such as Andreessen Horowitz among others.

Is this the end of the road for retail investments?

Not exactly. An ICO is not exclusively for raising funds, it also doubles as a mechanism to distribute tokens among retail investors, developers, and crypto-enthusiasts.

Consider a messaging platform or a payments platform powered by Blockchain, an ICO can give the platform the initial nudge of users it requires to get off the ground and proliferate. In light of this, even though startups seem to be swaying towards professional investors to raise funds, the probability that retail investors will be utterly cut off are slim.

ICO Funding Strategies decoded: ICOs turn the tables in 2019! was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.