Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

I’ll let you in on what I have learned the hard way, in Indian Crypto world after RBI cutout banks to deal with cryptocurrencies. Will talk about P2P and at the end how to trade cryptocurrency in India.

Earlier on Feb 2018, RBI (Reserve Bank of India) declared cryptocurrencies as not a legal tender. They cut-out bank accounts who are dealing with any cryptocurrency trading. People started withdrawing all of their money from the cryptos assuming the end of the crypto in India. I also did the same.

But I knew, what will happen. The exchanges will find a way as they know people are addicted to it. Addicted to instant profits.

As per India Today article released on Jan 19, 2018

Its survey revealed 0.6 million active cryptocurrency traders in the country (unofficial figures put this at several times more) in nine cryptocurrency exchanges. Up to Rs 17,800 crore has been traded on these exchanges. Reports quoting the survey said a 25-year-old, who had invested Rs 25 lakh in bitcoins, has seen the valuations of the currency he held multiplying to Rs 760 crore.

17,800 crores. Interesting isn’t it, which is definitely not a small amount.

So, what has changed after RBI declaring it as not a legal tender?

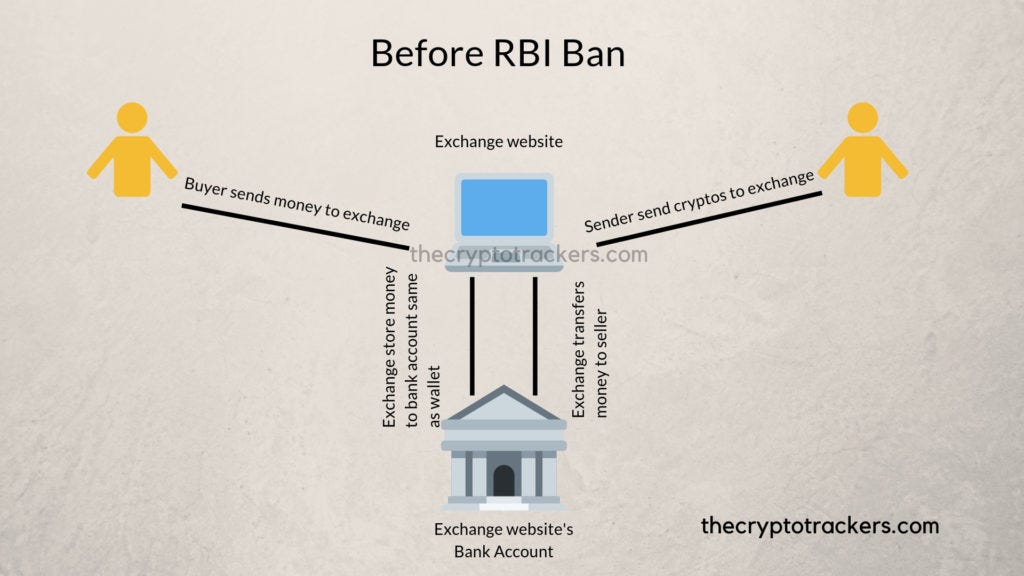

Previously, the cryptocurrency exchange websites like Koinex, Bitbns, WazirX deal directly with banks. And hence the banks knew that the money is used to buy cryptocurrencies.

Buyers — They pay money to the exchange websites. Exchange websites take it to their banks and once the buyer purchase coins they transfer that money to the seller’s account.Sellers — To sell their coins, they transfer their coins to exchange websites. When a seller sells the coins the money is credited to seller’s account by the exchange itself.

The diagram below describes the how trading is done before:

So, previously, all the money went through the exchange website’s bank account. After RBI ban, what bank did is, stopped all the bank accounts transactions which are dealing with cryptocurrencies.

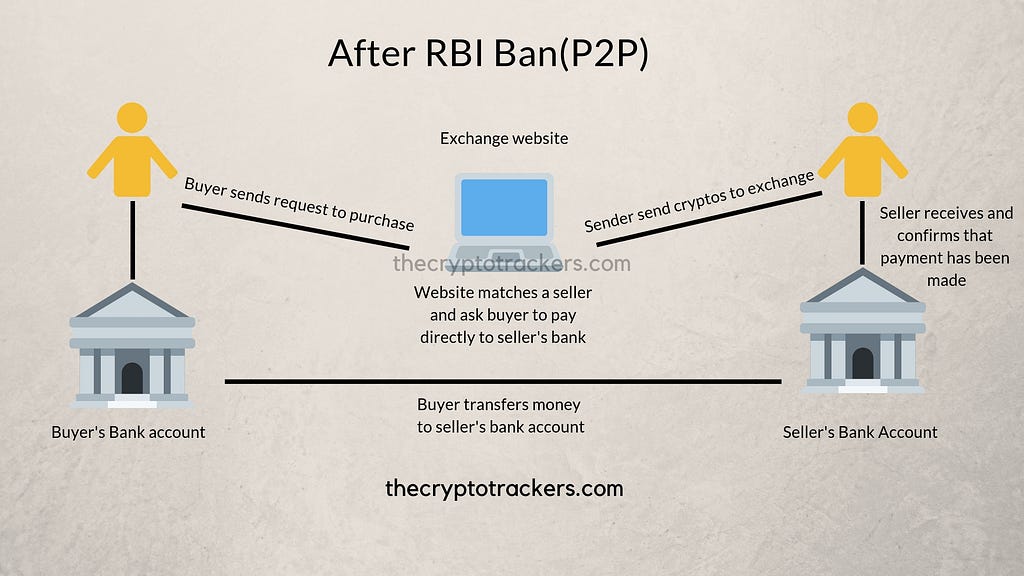

P2P(Peer to Peer) explained:

P2P or Peer to Peer is a way in which the buyer directly pay to the seller’s bank accounts. As these transactions amount are small, the banks can’t find out what this transaction is for. Hence, a win-win situation.

This diagram will show how trading is done now using P2P:

Seller — Seller sends all his crypto, to the exchange that he/she wants to sell. Now seller will request to sell his/her cryptocurrencies. Anyone interested will directly transfer the money to seller’s bank account. Once both seller and buyer confirm that a payment has made. The exchange will send the cryptocurrency to the buyer’s wallet.

Exchanges from where you can buy cryptocurrencies in India:

WazirX — Best platform for P2P. Everything is well-automated and easy makes it very reliable. The support team is very good.

Fees 0.25%

Koinex(Get Rs 50 on first trade with this link) — Early bird, great features, P2P service is same as LocalBitcoin. But you can still trade without P2P using Koinex. That’s the greatest thing of all. The support team is very good.

Fees 0.15%.

LocalBitcoin — A worldwide jaw-dropping awesome platform. There are several options to send/receive the payments. You can even buy/sell crypto with cash, in-person. Still not automated, you have to request for buys and sells, you have to deal with people with chats and all. Time-consuming and sometimes irritating. Mentioning in this list as it does what it needs to do. Hard for beginners.

Free trading, LocalBitcoins users who create advertisements are charged a 1% fee for every completed trade.

It doesn’t end there. If you want to trade more coins you should sign up for other exchanges such as Binance.

I have used all these exchanges, filled KYC, traded with them, killed myself several times and hence found best of them. I prefer WazirX, Koinex and then LocalBitcoin. While Binance has no match.

References:

How P2P works and India‘s best cryptocurrency exchanges was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.