Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Over the last two years, the Kenyan government and central bank have been discussing how to regulate bitcoin and other digital currencies. In March 2018, the Central Bank of Kenya warned the general public about cryptocurrency investments. After those warnings, the region’s Capital Markets Authority (CMA) cautioned the public again after investigating a project called kenicoin. Even though financial regulators are dressing down digital currencies, Kenyan merchants and traders in the region are still flocking toward the crypto asset economy.

Also read: SEC Chair Explains Key Upgrades Needed for Bitcoin ETF Approval

Kenyan Crypto Trade Volumes Show Increased Demand for Digital Assets

The government in Kenya and the financial regulators have been leery toward regulating bitcoin and other digital currencies. The central bank mulled over regulatory guidelines in the summer of 2018, while last month Kenya’s Capital Markets Authority (CMA) warned the public about trading digital currencies because of an initial coin offering (ICO) called kenicoin. The project allegedly sold 10 million tokens and promised 10 percent monthly returns after the initial purchase. However, even though Kenya’s financial watchdogs are cautioning against investing and trading cryptocurrencies, they have been powerless to stop the steady trend of cryptocurrency acceptance and rising trade volumes within the country.

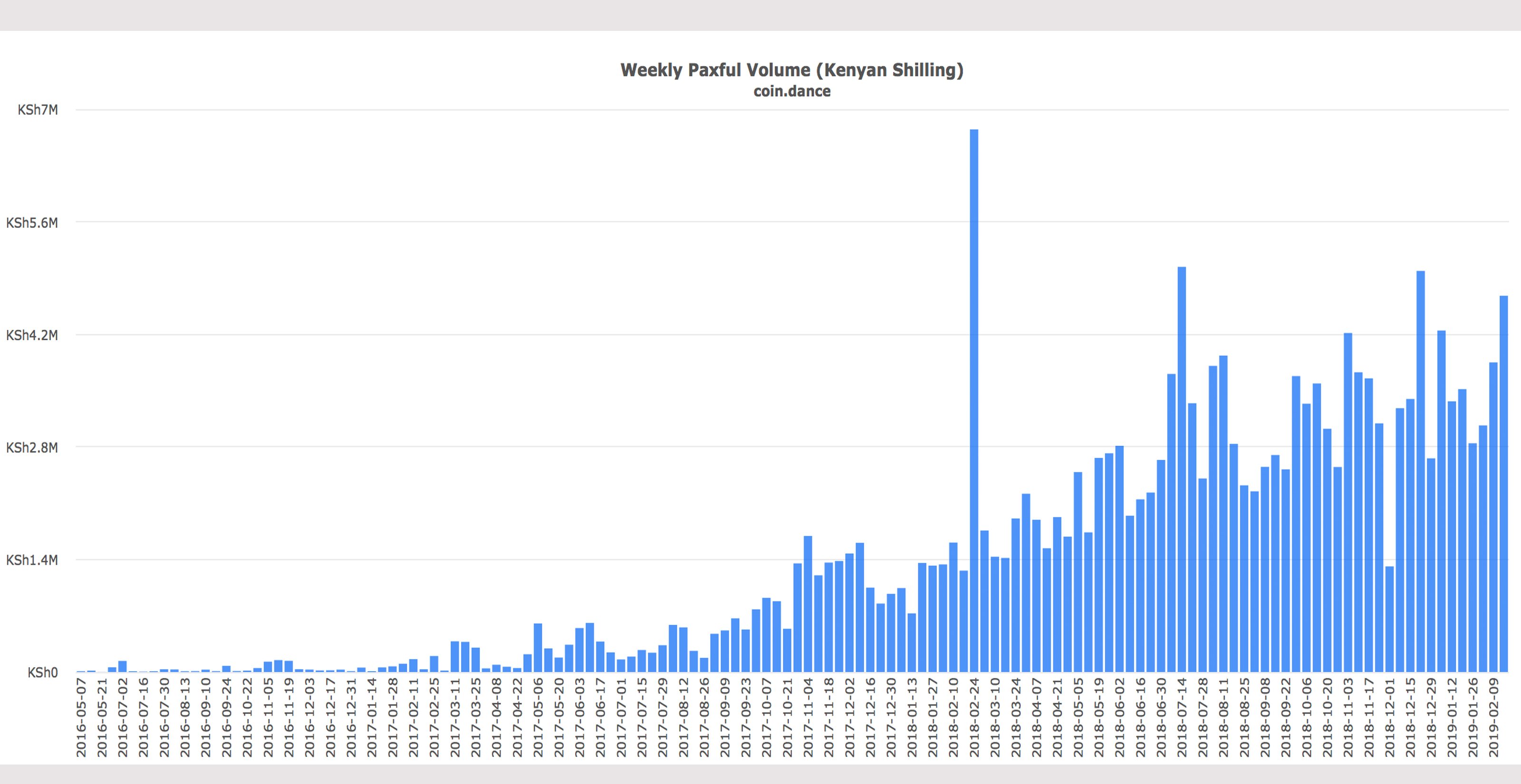

KES volumes on Paxful have increased a great deal.

KES volumes on Paxful have increased a great deal.

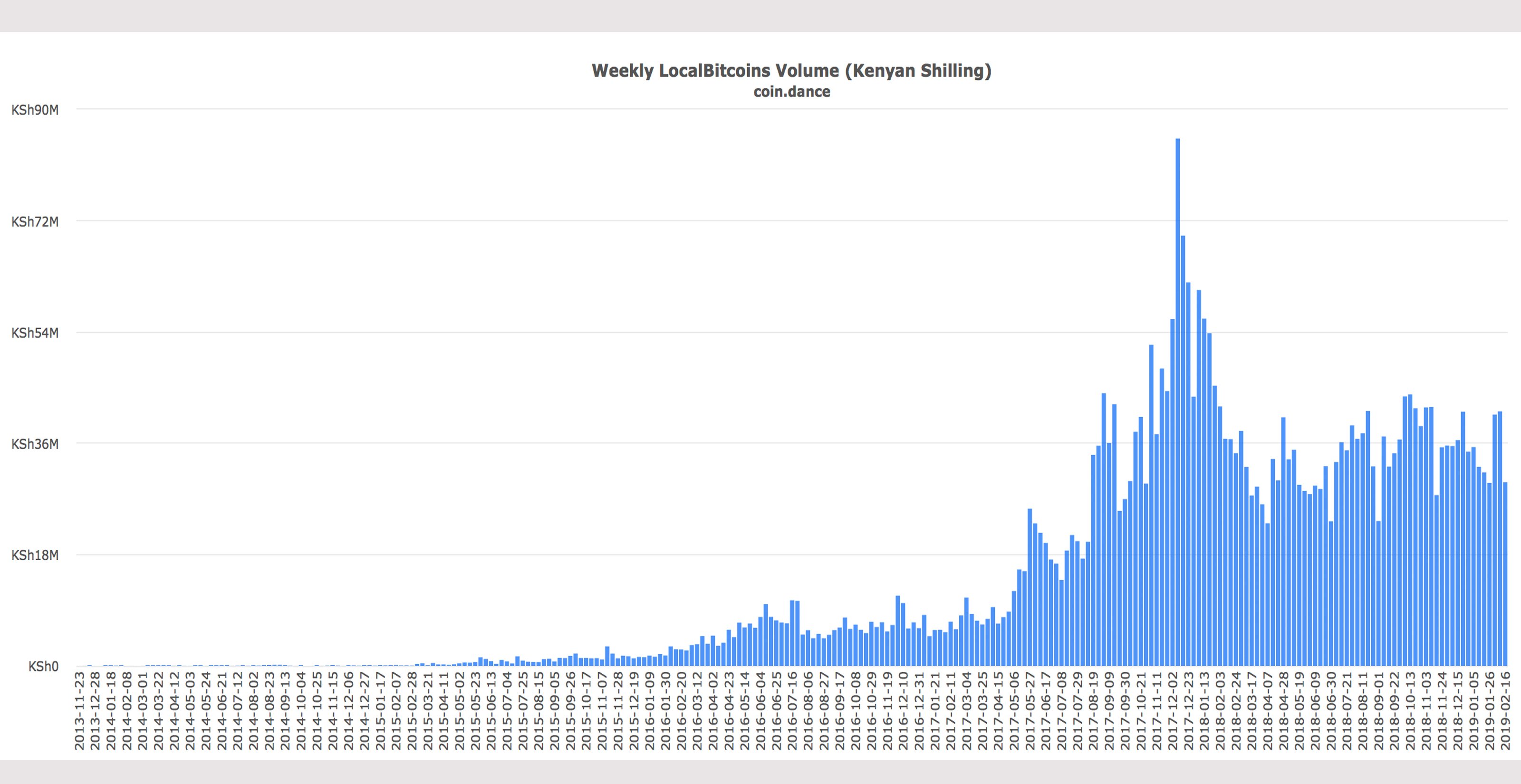

Kenyans have a wide variety of exchange avenues to choose from if they want to purchase cryptocurrencies like bitcoin. This includes popular trading platforms like Remitano, Bitpesa, Coindirect, Paxful, Localbitcoins, and Belfrics. Localbitcoins volumes in Kenya have been consistently strong. At the time of writing, BTC trade volumes for Feb. 16, 2019 indicate 29,701,339 Kenya shillings ($297,000) traded on Localbitcoins in Kenya over the last two weeks. Paxful trade volumes in Kenya shillings (KES) are also significantly higher than usual with 4,679,664 KES ($48,000) traded over the last two weeks on the peer-to-peer exchange. According to Crypto Compare’s BTC pairs analysis, bitcoin core (BTC) purchases account for $3,418 (KES 341,876) in daily trades stemming from Stocksexchange.

Localbitcoins trade volumes have remained steady despite the financial authority’s warnings.

Localbitcoins trade volumes have remained steady despite the financial authority’s warnings.

Merchant acceptance is still growing in Kenya as well according to a report from the BBC news outlet published on Feb. 22. The Blockchain Association of Kenya (BAK) explained in an interview that digital currency awareness has increased, despite regulators in the region warning about trading them. BAK details that Kenyans are using bitcoin and other digital assets to pay for education in Kenya and Nigeria and to purchase products in China and bitcoin is also empowering many Kenyan freelancers. The nonprofit organization believes blockchain-based currencies can reduce transaction costs and boost local remittances.

Last December, news.Bitcoin.com reported on the Healthland Spa in Nairobi which started accepting BTC for payments for goods and services. This year Tony Mwongera, Healthland Spa’s chief executive, explained he uses the virtual currency mainly to avoid theft but the business also enjoys the convenience.

”I decided to adopt the use of cryptocurrencies because there was so much theft in my business,” Mwongera told reporters on Friday. The spa owner continued:

So I said, let me use a way that can be safe, secure and I can also embrace technology.

The Blockchain Association of Kenya believes blockchain-based currencies can boost local remittances. The organization is hosting a summit this March in Nairobi.

The Blockchain Association of Kenya believes blockchain-based currencies can boost local remittances. The organization is hosting a summit this March in Nairobi.

Kenya’s Capital Markets Authority Thinks Blockchain Firms Are Okay as Long as ‘They Don’t Deal With Cryptocurrencies’

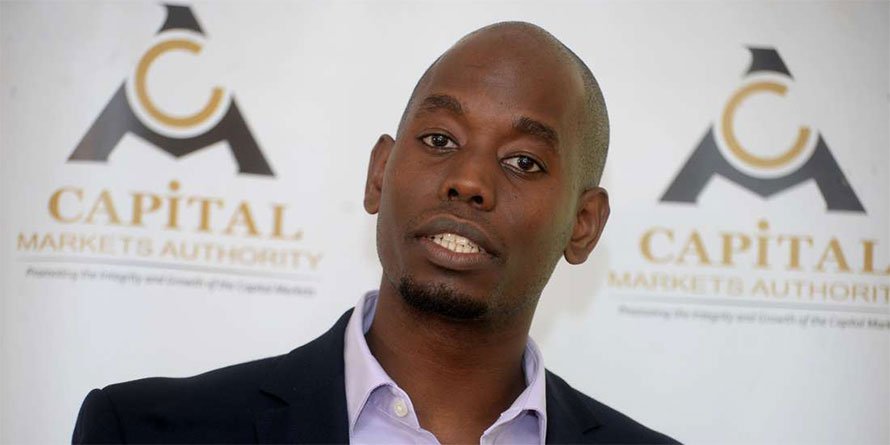

Kenya’s BAK is also hosting a World Blockchain Summit in Nairobi on March 20 in order to bolster cryptocurrency solutions and blockchain technology in the country. However, Kenya’s CMA is also organizing a financial technology incubation platform set to launch this May, but cryptocurrency projects and developers are barred from attending the sandbox. The CMA chief executive officer Paul Muthaura stated last Thursday that the agency would evaluate distributed ledger projects under certain conditions.

“In the validation, we have 70 companies, some from outside Kenya. Blockchain firms will be considered so long as they are not dealing with cryptocurrencies since the CMA’s mandate does not extend to currency,” Muthaura said.

CMA chief executive officer Paul Muthaura.

CMA chief executive officer Paul Muthaura.

Muthaura further reiterated what the CMA and Kenyan central bank underscored in the past: that cryptocurrencies have zero oversight and regulators could not help retail investors with financial losses. On Thursday the CME executive said he believes digital assets bring new risks to the world of finance that can destabilize traditional markets and possibly hurt retail investors a great deal. Despite the warnings, statistics and tales of merchant adoption indicate that Kenyan crypto traders and bitcoin volumes continue to thrive in 2019.

What do you think about cryptocurrency trade volumes in Kenya rising despite the warnings from the central bank and CMA? Let us know what you think about this subject in the comments section below.

Image credits: Shutterstock, Pixabay, Twitter, and Coin Dance.

Need to calculate your bitcoin holdings? Check our tools section.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.