Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

There is much talk about the benefits of tokenisation, primarily in application to capital markets (so-called “security tokens”). But how much benefit are we talking about? Let’s draw a quick outline, roughly.

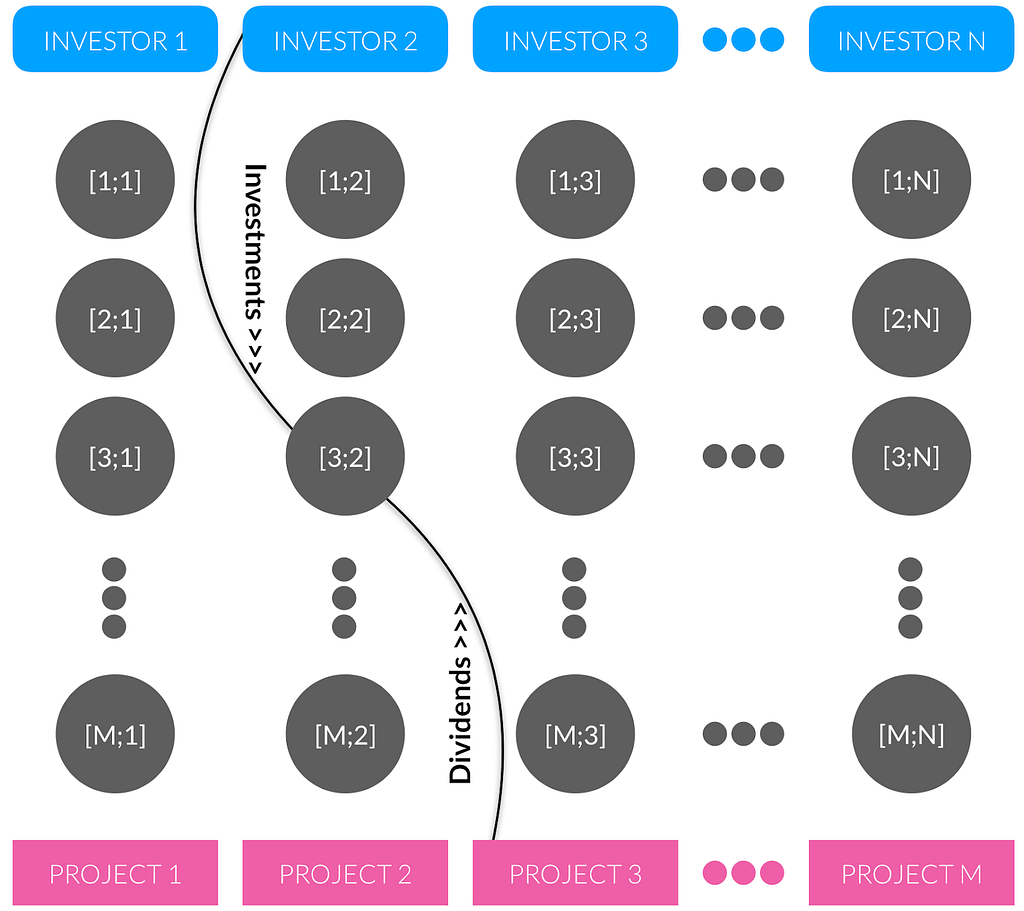

In the diagram above, you can see the typical equity crowdfunding operator’s task. Grey circles are “sub-accounts”; the money goes through a sub-account from the particular investor to the particular project and back (as interest or dividends). Each horizontal line of sub-accounts represents a “project bank” where the money accumulates to reach the cap, to prepare for the quarterly distribution, etc.

This function allows operators to easily manipulate money amongst separate “wallets” and it comes at a cost. But how much? Before we calculate, let’s note one thing: it seems pretty obvious, but we need to emphasize that for the economy, these costs add up with each new operator. In other words, if there are 1,000 operators and each pays $10k annually, the yearly impact for the economy is $10M. Operators pay different providers; there are no standards within countries, less so globally.

There are a bunch of SaaS providers that sell subscriptions to crowdfunding operators. They work on a market mature enough so the supply and demand forces have already made the needed measurements for us. Some providers offer full services, whereas the above task is included as a set of APIs so an operator simply uses a specific accounting system in the cloud and pays regular fees. Some providers offer only basic services such as KYC, payment channels integration, and user UI so that the job described in the diagram needs to be done semi-manually or outsourced elsewhere.

To derive the figure for the cost of the function on the diagram, we should look at the pricing schemes of the two types of providers (full and basic) and deduct one from another. This gives us a ~$10k setup fee plus ~$50k annual fee. Those operators who don’t pay full-service providers still do the job internally; it naturally costs them some similar dollars, otherwise the market for the service wouldn’t be mature and stable. The cost doesn’t depend on investment volumes. It varies slightly based on the number of investors, but the average would stay in the same order of magnitude. It is not $5k annually and it is not $500k.

There are roughly 5,000 operators in the world. So we have global annual cost of $2.5*10⁸ (quarter of a billion dollars each year).

Now for the fun part. How much would the same task cost in a tokenised form? Eventually, zero! And to stay zero, it doesn’t even need to be standardized, in an ordinary sense. Tokens are tokens. They are interoperable by their nature. Remember that “obvious notion” we made above? That’s where the core difference lies. In normal centralised operations, the fees are forced repeatedly in time, onto each actor. In decentralised form, it is some few pioneers who bear the costs; the followers will pay less and less until the entire business function becomes a commodity.

Why does it cost zero and how does it work?

Imagine yourself a grandmaster in the simul.

How much does it cost you to walk from one board to another, pick a chess piece and move it? Nothing. Now imagine a super fancy chess show where figures are projected holograms and you make your move by speaking to an operator through the intercom. What are the costs in this case? This depends on how fancy the setup is, how greedy the organizers of the show are, and can be anything.

Today’s online operations have turned into a mega-complicated “hologram”, in each field owned by a bunch of global quasi-monopolies. In contrast, tokens are digital/physical objects that can be moved by the bearer alone! In a tokenised crowdfunding setup, for example, both investors and projects simply watch their “chess figures” by themselves. Each person is responsible for what is at stake for them. Investors use crypto wallets and go from “board” to “board” (projects) and move their pawns, knights, bishops, and queens.

Quarter of a billion might seem not a dramatic saving, but don’t forget that equity crowdfunding represent a tiny-tiny share of the entire equity issuance market — probably way below a thousandth of a percent. It is just that at this segment we can make a quick and fairly reliable estimation without leaving home. The real costs of the serious big issuance are hardly discoverable at all, at least it’d take not research but an investigation: we wouldn’t be too far from the truth saying those costs are being intentionally distorted.

____________

P.S. Tokenisation of securities is in its infancy, so whoever is considering the practical implementation today needs to be very careful. There are a lot of scammers who simply exploit the ruins of the ICO hype and mislead issuers.

How Much Money Does Tokenisation Actually Save? was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.