Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

What You Didn’t Know About Crypto Index Funds— Part 2

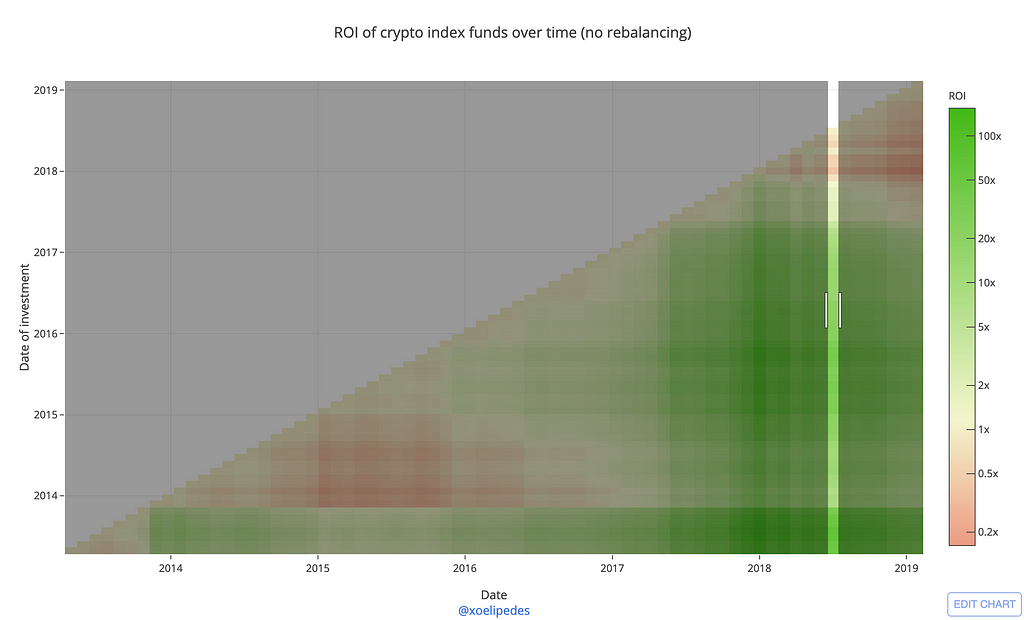

Introducing a new way to look at crypto index funds and visualize and compare asset performance.

This is part 2 to this other post. Enjoy!

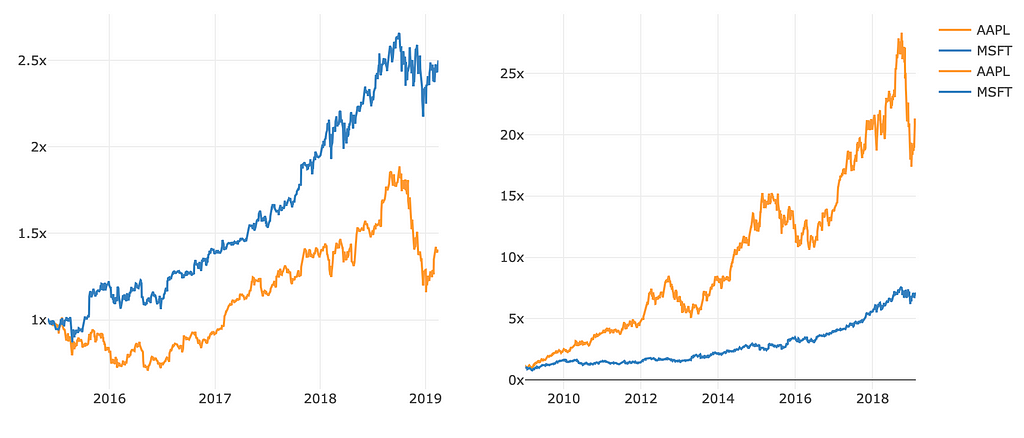

When comparing the performance of two assets, it’s common to plot their cumulative returns between a certain date X and another date Y to see which one performed better. But this only tells us about a small part of the story, and maybe a biased one. See the following two plots, comparing Apple to Microsoft.

We could write two completely different stories depending on which plot we choose. That’s because they are totally dependent on the start and the ending dates we choose, and it’d be very easy to cherrypick them to make the data fit our narrative.

Even if we’re not trying to deceive anyone, if we do something similar we’ll show only an incomplete view of reality, and this is a problem that the first post of this series may have. I’ll show you why in a little while.

Is there a better way?

Yes, there is.

We could include all the dates in a plot, and that way we would eliminate the bias we induce when all of the data refers to a single start or end date.

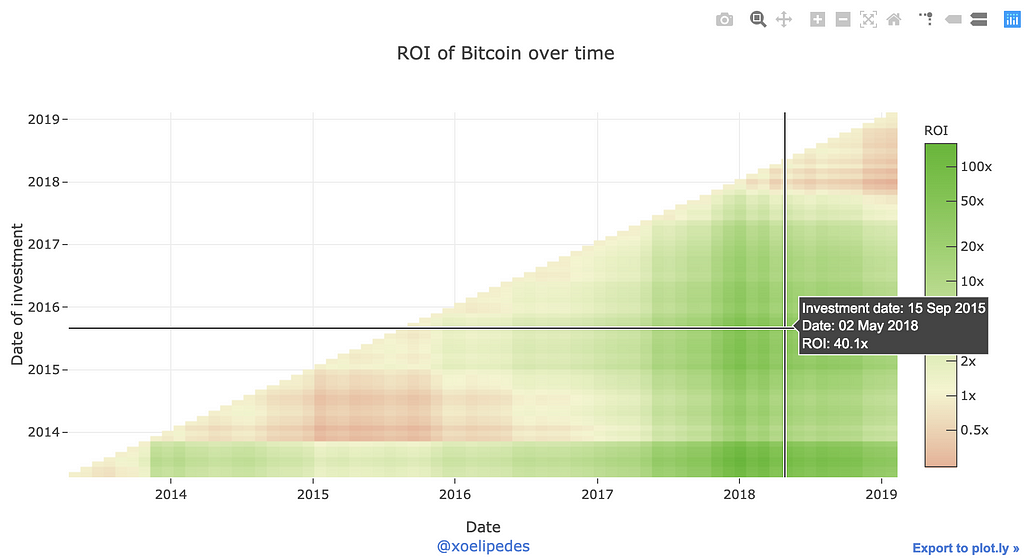

How? Heatmap plots. With them we can visualize the start and end dates, and a 3rd variable.

Better on a computer. On the phone: use landscape mode, tap to see the info of every point, drag inside to zoom, double tap to reset zoom. Hovering, it’ll show info for each point about when the investment would have been made, the date at which the ROI is calculated, and the ROI itself, relative to the initial investment.

Having data for the price of Bitcoin along the past 6 years we can compute, for example, the ROI (return on investment) of buying on May 4, 2014, by June 9, 2018. Or the ROI of buying on Nov 15, 2015, by Dec 3, 2017. This is exactly what’s shown in the next plot: The ROI of buying on any possible day, calculated at all of the possible days, and taking one sample every month.

Constructing the index funds

To do this, for each date I calculated how big each coin’s market cap is compared to the total market cap. That gives us a weight for each asset. With this, knowing also how much the price of each coin changed across time we can know the ROI of the fund.

Note that the weight of each coin in each fund is constant. Normally we want the weights of the assets in an index fund to change in time(so that the fund actually tracks the index). This is called rebalancing and I’ll explore it in the last post of this series.

Below there’s the same plot but calculating the ROIs of crypto index funds created with the top 500 coins in Coinmarketcap by February 2019. To create them

What was wrong with the first post?

In the previous post, I would look at the performance of investing in funds along several periods of time. Those periods started at different dates, all of them ended on the same date (~July 2018). It’s not wrong, but it’s like just looking at what’s highlighted in the right chart (color in the right plot would correspond to the height of the black (or green) markers in the left plot).

In this post, I’m looking at funds’ performance through periods starting at all of the possible dates, and ending at all of the possible dates from that (and not only ending at the latest date, like before). This approach tells us much more information.

Finally…

These new charts are OK, but they don’t tell us much more than what we already knew: that the ROI of anything bought before the peaks of late 2013 and late 2017 was good after the price surges in those times; that anything bought after the 2013 peak was underwater for a couple of years… And it’s hard to compare them to each other, they look quite the same.

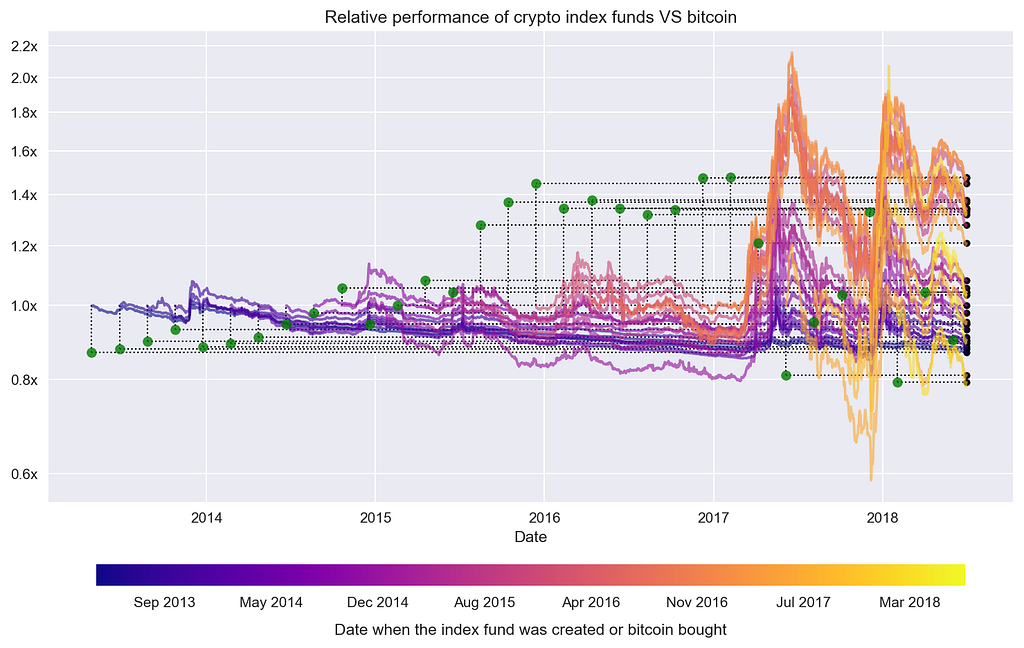

If we divide the ROI of index funds by the ROI of Bitcoin we get a much more interesting visualization, that tells us what would have been better, whether to just buy bitcoin or to buy a basket of coins weighted by market cap. Here it is, with weekly resolution:

This is much more interesting and tells us various things, some less obvious than others, about three main parts of the plot:

ROI before mid-2017 (yellow area at the left): before mid-2017, the ROI of investing in an index fund VS in Bitcoin would have been almost the same (because the weight of Bitcoin in such indexes would have been very high)

ROI after mid-2017, having invested before mid-2017 (green area, bottom right corner): The ROI of investing in an index fund before mid-2017 would have been almost 2x Bitcoin’s. This is because even though Bitcoin went up a lot in that time, the rest of the coins went up more.

ROI after mid-2017, having invested after mid-2017 (red area, top right corner): Almost all investments in crypto index funds that were made after mid-2017 have been worse than just buying Bitcoin. Interestingly, this is when most of the money entered the crypto space and when most funds were created. SFYL. Let’s zoom in

There was only a small window of green when the funds created between July 2017 and January 2018 did better than Bitcoin, but you can clearly see the exact moment around mid-2018 when this graceful animal ran out of sugar and Cardano couldn’t be pumped anymore.

In the 3rd (and last) post I’ll extend this analysis to explore if rebalancing the portfolios helps in crypto index funds and whether it would have been a good idea to put money in the Coinbase Bundle. I’ll tweet when it’s ready.

One more thing…

Last month I left my job as a Data Scientist at Zara and started working remotely as a software developer for Narrativa, part-time. I’m also doing some data consultancy, so if you need some short-term help in some project with…

- Machine Learning,

- Data Visualization,

- Or, in general, use the data you have to take better decisions at your company and make more money,

Reach me out and let’s talk, I can probably help you.

Nope, not me. Source

Nope, not me. Source

BTW, I’m living here 👆(Revelstoke, BC, 🇨🇦) since January and will stay for some months. If you’re around, hit me up and let’s get some 🍻 or go share some turns 🏂 ⛷

(Part 2) What You Didn’t Know About Crypto Index Funds was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.