Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Market cap is often used as a metric of importance in the crypto industry. Communities will react jubilantly as their preferred coin moves up the rankings. People will often invest in the top X coins based solely on their market cap as they think it is representative of a diversified portfolio. However, is market cap the right metric to focus on?

Also read: Coinbase Acquires Cryptocurrency Surveillance Company Neutrino

In this post I will explore the fallacy of market capitalization. I will look at the methods with which market cap is often determined and why it could be considered flawed for a number of reasons. I will also touch on other potential metrics which could be more representative of “value.”

But first, let’s start with some basics…

Recap on Market Cap

Market capitalization is a concept that has been borrowed from the traditional equity markets. In the context of a publicly traded company, it is supposed to give a measure of how much the outstanding free float of shares are worth on the market. It is merely calculated by taking the price of the shares and multiplying it by the outstanding free float of shares.

Capitalization is often used as a metric of size, value and importance in the equity markets because all the shareholder information can be publicly verified and the shares are often traded on one exchange.

There is no disagreement as to the market cap of Coca Cola because analysts can easily replicate it themselves. They can pull the shareholder records from their databases and grab the latest price from the NYSE ticker information. However, the same cannot really be said for the cryptocurrency markets.

Market Cap in Crypto

When cryptocurrencies first started gaining the public’s attention a few years ago, numerous websites wanted to find a quick and easy way to compare all of the different coins on the market. They needed a simple ranking number that people could use as a rough benchmark.

Market cap was one of the most applicable metrics that they could use. It was also relatively easy to understand for those who were new to the cryptocurrency markets. It was understood to imply the total value of all coins in circulation.

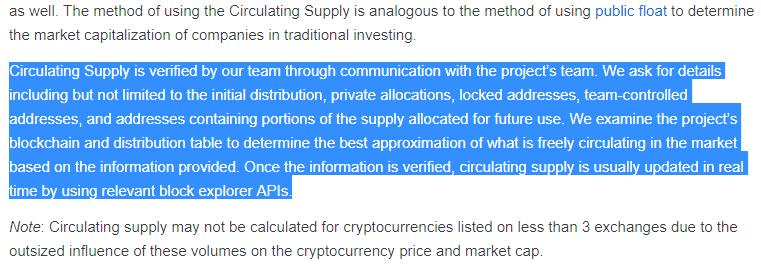

A problem that is unique to cryptocurrencies though is the fact that this “circulating supply” is often defined subjectively by the coin ranking websites. For example, if we were to take a look at the definition of “circulating supply” on Coinmarketcap (CMC) it states the following.

How circulating supply is calculated on CMC. Image via Coinmarketcap.

How circulating supply is calculated on CMC. Image via Coinmarketcap.

While this seems like a pretty thorough examination of the circulating supply of a project, a great deal of it will come down to the judgement of the folks at CMC. You will have to trust their assessment of what is freely circulating based on information that is provided to them by project teams.

As many Bitcoin proponents know, “Don’t trust, verify.”

Potential Manipulation of Numbers

Something specific that CMC does is exclude the pre-mined coins from the circulating supply of a particular project. While the intentions behind this may be right, there are some negative externalities that come with this.

For example, when a project has pre-mined a large proportion of their coins, every time they release these funds, their circulating supply will go up. If these coins are not sold immediately (which impacts price) then the market cap of the coins is also likely to increase.

There have been many projects that have been accused of this tactic. While some of them may not have been intentionally seeking to impact price, it is disconcerting that such an important metric can move at the whim of the developers.

This is of course only the circulating supply number that we are talking about. We are well aware of how crypto whales are able to impact price in relatively illiquid markets. Through wash trading and limited external demand, nefarious actors can pump the price and hence impact market cap.

What Can Be Done?

In a sense, the coin ranking websites are in a bind when it comes to market capitalization. They are using it precisely because it is well known, easy to understand, comparable and seemingly applicable. They are trying to provide an objective view of the coin’s total value and the more they try to tweak the formula, the more they can be accused of being subjective.

Another coin ranking site, Coingecko, has taken a slightly more transparent and innovative approach to their rankings. For example, when it comes to listing their circulating supply they do not exclude pre-mined coins. They do this more for consistency because technically tokens issued on smart contract platforms are all pre-mined. Similarly, pre-mined coins could potentially already be traded on exchanges because they are not locked.

They also give the user more information on how circulated supply is calculated for each coin that they have listed. For example, in the below image you can see the supply numbers for the 0x (ZRX) project.

Circulating supply breakdown for ZRX. Image via Coingecko.

Circulating supply breakdown for ZRX. Image via Coingecko.

Indeed, determining the “value” of a cryptocurrency project is itself such an involved discipline. If someone really wanted to analyze this then they would need to look at factors such as on-chain metrics, developer activity, community interest and so forth.

In fact, exchanges such as Binance have even started to roll out their “gold standard” metric which awards projects based on their “communication.” Although this is not an endorsement by Binance, projects that regularly communicate with their community could be a valuable metric.

Of course, one can’t really look at these other metrics in isolation and compare them to another coin. They have to be broken down and analyzed piece by piece and adjusted for particular technicalities of the coins in question.

None of these metrics can be viewed as a potential replacement for the quick-and-dirty measure that comes with a coin’s market cap. They can only be used as a complement to it by the analyst should they decide to delve deeper into the relative “value” of a project.

Don’t Get Bitconnect Rekt

Market capitalization is a useful metric. It allows us to get a rough sense of the general market value of particular coins that are on the market. However, that is where its usefulness should stop.

It should not be used as some sort of a metric of importance, value or market support for the project in question. It is a simple metric which, although useful, can and has been manipulated.

While circulating supply numbers can be tweaked to better reflect market dynamics, market cap should be a singular factor in a much more thorough due diligence process. Development, user numbers, scaling and communication should all be thrown into the “DYOR” soup.

Let us not forget that Bitconnect was at one time in the top 10 of CMC. If you had invested solely based on this fact, you would have been utterly Bitconnect rekt.

Do you think crypto market capitalization is inherently flawed? How useful is market capitalization for determining the crypto market’s total valuation?

Images courtesy of Shutterstock, Coinmarketcap, and Coingecko.

OP-ed disclaimer: This is an Op-ed article. The opinions expressed in this article are the author’s own. Bitcoin.com does not endorse nor support views, opinions or conclusions drawn in this post. Bitcoin.com is not responsible for or liable for any content, accuracy or quality within the Op-ed article. Readers should do their own due diligence before taking any actions related to the content. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any information in this Op-ed article.

This article was written by Nic Puckrin. He is an ex Investment Banker and blockchain enthusiast. He has founded several online businesses and fell down the crypto rabbit hole in 2016. When he’s not sitting behind six screens trading Bitcoin, Nic is maintaining his numerous mining rigs.Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.