Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

In this edition of The Daily we cover the beta launch of a new platform from Shapeshift, an acquisition by one of the largest cryptocurrency exchanges in Canada – Coinsquare – and the latest Grayscale digital asset investment report.

Also Read: Startups-Focused Law Firm Now Accepts Bitcoin Cash Payments

Shapeshift Unveils Beta

Noncustodial crypto changing service Shapeshift is opening signups for a beta trial of its new combined user interface which incorporates a number of services. CEO Erik Voorhees tweeted: “The new ShapeShift is at beta.shapeshift.com. We built it to give the world a true non-custodial crypto platform in an easy and beautiful package. This is the foundation for financial self-sovereignty.”

The new platform is part of an overall update to Shapeshift’s brand and user interface. The company updated its logo, typeface, color palette and imagery earlier this month. Its new visual style is said to be influenced by the art deco, futurism and constructivist art movements. In a blog post the team explained that “These 20th Century art movements also had a significant influence on literature. In particular, futurists such as George Orwell, Ayn Rand, and Aldous Huxley (all of which believed in a decentralized future). We feel this is a nice subconscious tie to Shapeshift.”

Coinsquare Acquisition

One of the leading digital asset exchanges in Canada, Coinsquare, recently announced it has acquired Stellarx, a trading app and decentralized exchange. The move comes on the heels of Coinsquare’s December 2018 acquisition of Blockeq, which will be rebranded to become the anchor wallet for the decentralized platform. Stellarx will be a wholly owned subsidiary of Coinsquare, based in Bermuda, and will look to apply with regulators there to become licensed to operate and scale its offering under Coinsquare’s compliance guidance.

Megha Bambra, Blockeq cofounder, will now lead Stellarx and her new team of Toronto-based developers will continue to build the service according to the product roadmap announced last fall. It is said that in time they will also add features that weren’t possible under Stellarx’s previous leadership such as new fiat tethers and securities tokens.

In their last blog post, the Stellarx team commented that: “Coinsquare is the perfect fit. They are already the leading Canadian cryptocurrency platform. They have very close relationships with regulators in the U.S., Europe, and Canada. The Bank of Montreal is their banking partner.”

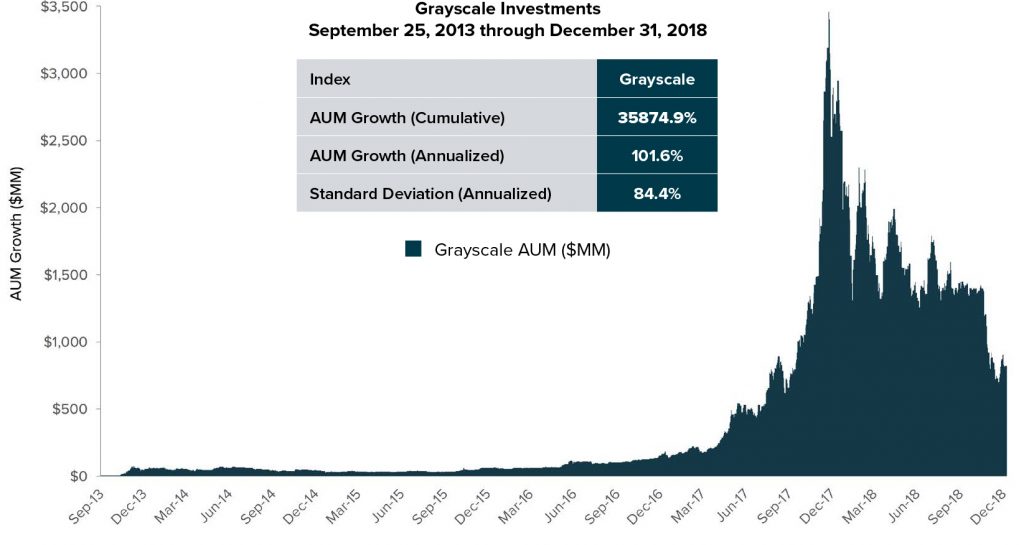

Grayscale Investment Report

Grayscale Investments, the wholly-owned subsidiary of Digital Currency Group which offers trusts for BTC, BCH, ETH, ETS, XRP, ZEC, and LTC, recently released its 2018 Grayscale Digital Asset Investment Report, detailing activity across its line of products for last year. The report shows that in spite of the ongoing crypto winter, Grayscale raised almost $360 million of investment into its products in 2018, marking its strongest fundraising year yet with nearly triple the total capital that was raised in 2017.

The team wrote: “Despite a deceleration of investment into digital assets in the fourth quarter, Grayscale raised $30.1 million over the last three months, bringing our full year 2018 inflows to $359.5 million. This marks the strongest calendar year inflows since the inception of our business. The full year inflows of $359.5 million were nearly 3X those recorded during the 2017 digital asset bull market and nearly 2X the inflows from previous four years combined (2014-2017), demonstrating that long-term investors remain bullish independent of the recent price action.”

What do you think about today’s news tidbits? Share your thoughts in the comments section below.

Images courtesy of Shutterstock.

Verify and track bitcoin cash transactions on our BCH Block Explorer, the best of its kind anywhere in the world. Also, keep up with your holdings, BCH and other coins, on our market charts at Satoshi’s Pulse, another original and free service from Bitcoin.com.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.