Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Crypto exchanges have played a pivotal role in the development of the blockchain industry. The ability to access these crypto assets, to trade them, and to keep them safe, is a responsibility set that goes well beyond the conventional expectations of an exchange. Some of these fintech pioneers have been rewarded for exploring the crypto world ahead of their peers, while others have ended in complete ruin, unprepared for the dangers of dealing with this new asset class. Now, 10 years after the creation of the first crypto asset, we are still evaluating the risk and rewards associated with exchanges, and particularly, the pros and cons of centralized and decentralized exchanges.

The key difference between centralized and decentralized exchanges (also known as a DEX) is ownership. In the case of centralized exchanges, they operate very similarly to banks and exchanges today:

- There is an owner

- There is a safe

- There are rules and regulations

Although this centralized model has existed for centuries, the idea of a decentralized exchange is new. The concept is only possible with the creation of crypto assets and a transparent, immutable ledger. Using the blockchain to keep track of ownership without a 3rd party, we can create a marketplace for exchanging these assets that operates without permission or oversight.

There are pros and cons to both models that will influence consumer choices. I personally believe that this can be broken down into 5 distinct areas:

FeesAnonymityOwnershipFiat-To-CryptoLiquidity

Fees

Trading fees is the area that most consumers pay attention to. In traditional, stock trading platforms like TD Ameritrade or E-Trade, customers pay a set “per-trade” fee, but that is different in crypto trading platforms. Centralized exchanges charge a % of every transaction, making the overall cost of trading crypto much higher than stocks. Decentralized exchanges on the other hand operate very similar to the “per-trade” fee structure we are used to, but in the form of gas.

When a transaction or trade is ready to be placed on a DEX, you have to pay a gas cost to have that trade confirmed on the blockchain. You get to choose how much gas you’ll pay; the higher the amount, the faster the confirmation. Today, this gas cost will be much lower than a fee you would pay on E-trade or the % transaction cost you’d pay on Gemini. Gas cost for a trade would range from as low as $0.05-$1.

The fees of a Centralized exchange are very high, but they provide more robust tools, and fast confirmation times. A decentralized exchange will be much cheaper in comparison, allowing trades that would potentially cost $1000s to be executed for pennies. The downside is that trades on DEX will not be confirmed immediately, and usually the service will not offer the same tool set that a centralized exchange would.

Individuals should have the choice, and more so the right, to partake in finance without any arbitrary restrictions if they so choose

Anonymity

Anonymity is one of the selling points that makes decentralized exchanges very appealing. Know-Your-Customer (KYC) regulations require users to provide a robust amount of personal information. This can lead to decreased sign-ups and friction in the onboarding process. A centralized exchange is required by law to make this information-gathering mandatory as a way to stay compliant with Anti-Money Laundering Laws (AML).

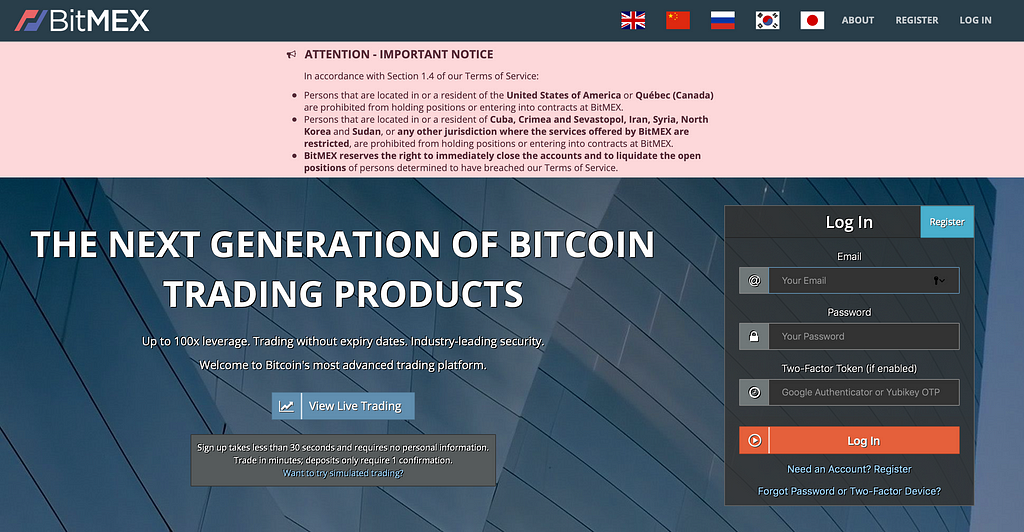

Country Restrictions on BitMEX

Country Restrictions on BitMEX

Decentralized exchanges have no central authority by definition, and thus do not have this requirement imposed on them. You can signup and start trading without any identification verification. Staying anonymous can be very appealing to certain crypto holders and it is in-line with some of the philosophies around self sovereign wealth.

Anonymity also provides access to tools that are not available otherwise. BitMEX for example provides trading with 100x leverage, but residents of the US can’t use the platform. A decentralized exchange like dYdX can offer these services. Shuvro Biswas, CEO of Cryzen, is focused on giving more access to these kinds of tools, building algorithmic trading bots that are currently only available to large Wall Street trading firms. “Decentralized marketplaces allow users to access financial instruments and tools that they otherwise would not have access to (such as shorting, leverage, and more. Such financial instruments are often out of the reach of the average person, restricted either by wealth and/or jurisdiction. Dapps level the playing field in regards to access to various financial instruments”

The benefit of knowing who you are is that you can prove you are the owner of an account in the event of losing access or some error that requires issue resolution. The benefit of not knowing who you are is that you can use your money without the loss of privacy and use systems that are not available in your jurisdiction.

body[data-twttr-rendered="true"] {background-color: transparent;}.twitter-tweet {margin: auto !important;}

Store coins yourself. You fight hackers yourself, and guard from losing wallet yourself. Computer breaks, USBs gets lost. Store on an exchange. Only use the most reputable, proven secure, exchanges. Or move to DEX, disrupt ourselves. https://t.co/Ci4ux9I3VD

Ownership

Another philosophy that decentralized exchanges reinforce is complete ownership of one’s assets. In centralized exchanges, the ownership of the coins (specifically the private keys) is held by the exchange itself. By holding on to the keys, trade execution is much faster (and can even be automated), because the user doesnt need to provide access to the funds on each trade. Although this can make trading easier, it is the #1 cause of crypto theft.

Someone has to be responsible for protecting your wealth, and this has traditionally been delegated to banks and exchanges

In 2018, $713 million worth of crypto was stolen, with most of it coming from the Coincheck exchange hack. A decentralized exchange can never have this risk, as the assets are always your responsibility.

During the frenzy that was the crypto boom of 2017, people were choosing exchanges not based on track record or security processes, but because of marketing gimmicks. Sometimes a relatively unknown exchange would see a spike in usage and deposits if they were the only providers of a newly issued coin. Raiblocks, (also known as NANO), was listed on only a handful of exchanges, one of which was Italian cryptoexchange BitGrail, which later was hacked. This chasing and FOMO reaction has led to multiple “exit scams”, where a coin or exchange would disappear overnight, along with all investor funding. This is a constant issue with centralized exchanges.

Bitcoin gave us 4 freedoms, but I only use 3

It’s this last fact that is poorly represented and commonly misunderstood. This new asset class creates new freedoms that weren’t previously possible, and also new risks. Someone has to be responsible for protecting your wealth, and this has traditionally been delegated to banks and exchanges. Major banks have more security than smaller ones and the same goes for crypto exchanges. The largest and most reputable exchanges like Binance and Coinbase are great examples of exchanges that have not suffered from these types of attacks.

$731 Million Stolen from Crypto Exchanges in 2018: Can Hacks be Prevented?

Fiat-to-Crypto On Ramps

A “fiat-to-crypto on ramp” is a process that facilitates the conversion of a government issued fiat currency into a crypto-based currency. Centralized exchanges have the advantage of being the first interaction most people have with cryptocurrencies; they are one of the only fiat-to-crypto on ramps.

We have yet to see this emerge as a function on a decentralized exchange, and it will take awhile, because fiat ultimately isnt the same as a crypto token. Someone has to provide the dollars or euros for the exchange, and those dollars and euros live in systems that are not blockchains. Stablecoins or Fiat coins could take the place of this eventually, but that first exchange from fiat-to-crypto will still need a central entity.

Higher liquidity would lead to faster transactions, more stable prices and therefore more market participants

Liquidity

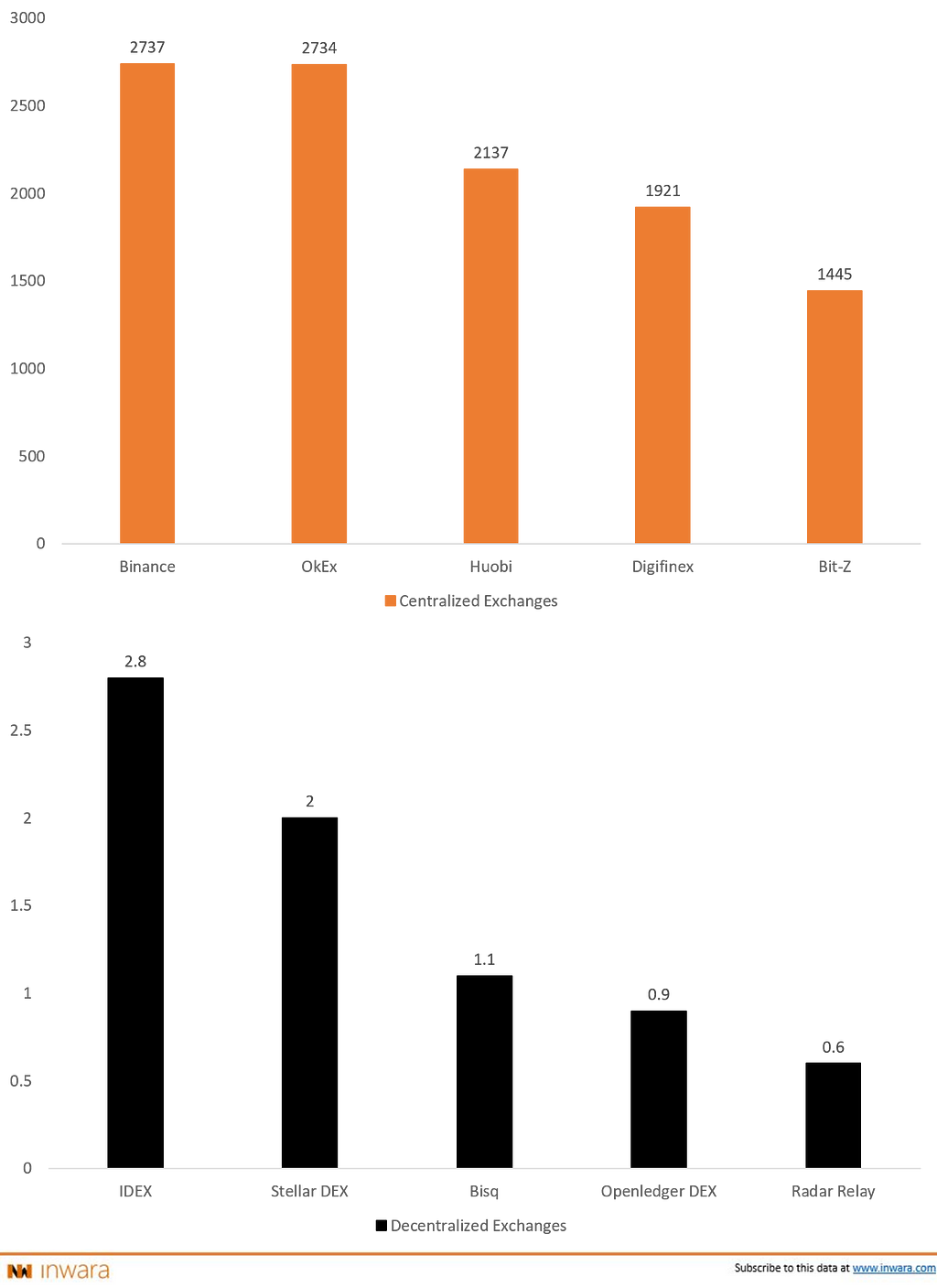

Liquidity is one of the major reasons why centralized exchanges have a large lead over decentralized ones. Without liquidity, price discovery is difficult to achieve and this leads to easy market-manipulation. A bad actor can influence an exchange with low liquidity by putting in fradulent orders that will not be detected. Although this isn’t a consequence of being decentralized, this might become an ongoing factor if the trust isnt established.

Catherine Yushina, COO at Zeus.Exchange, highlights the importance of liquidity not only in exchanges, but in the crypto ecosystem in general. “Liquidity in crypto can be provided by crypto assets backed by traditional assets, aka by bridging crypto and fiat markets. Higher liquidity would lead to faster transactions, more stable prices and therefore more market participants. This would boost general public adoption of blockchain technology and crypto instruments and lead to “maturity” of the industry. While there are discussions around Crypto VS. Fiat worlds, crypto is more of an extension, the next evolution step for financial market as a whole”

It is the combination of liquidity and custodianship that means faster execution. This creates a trading experience akin to trading stocks and equities, making centralized exchanges more appealing to current stock traders. However, the loss of anonymity and trusting a 3rd party with your keys is one of the reasons crypto assets were created in the first place. Deciding what you value and being disciplined with your security is a new option that was previously just not possible.

Choosing what’s best for you

As the world of crypto takes time to mature and develop into a rich ecosystem of applications, crypto exchanges will continue to take center stage. Currently, tokens and coins are primarily used for investment speculation, which means the platforms that give us access to trading them will have the biggest affect on shaping this industry.

It is not a clear cut decision of which exchange structure is the best to use. You could be extremely comfortable with managing your own crypto key security, but still want access to high frequency algorithmic trading decisions that are only available using centralized exchanges and tools like Cryzen’s smart bots. Another version could have you valuing your anonymity and keeping your wealth separate from your identity, but don’t want to worry about key security.

The best choice will be a combination of responsibility between you and your chosen exchange. You can always hold on to your own keys and then deposit into a centralized exchange only when you want to complete a trade, giving you the ownership security and the liquidity you want. You can also make a Fiat-to-Crypto conversion on a centralized exchange and then move your funds to a decentralized exchange after using a coin mixer to create a level of anonymity.

“As with all decentralized tools, a greater level of responsibility is required of individuals in terms of understanding the tool and safeguarding their assets; nonetheless individuals should have the choice, and more so the right, to partake in finance without any arbitrary restrictions if they so choose.” says Shuvro. Decentralization brings us a new world where trustlessness is possible, but you’ll still need to trust yourself to be responsible.

Want more discussion on the merits of Centralized and Decentralized Exchanges?

Ethereum Classic Labs is hosting a panel discussion with speakers from LATOKEN, CredoEx, and Zeus Exchange. If you are in the Bay Area, make sure to check out this must-attend event!

Buying Cryptocurrencies: Centralized and Decentralized Exchanges

Apply for the ETC Labs Accelerator Now!

ETC Labs is holding their second cohort accelerator in San Francisco this summer! Applications are open until May 1st. Learn more at https://etclabs.org

Thank you for reading and I hope you enjoyed this article

Feel free to add me on Linkedin here, follow my twitter there →@xldean, and send me a Telegram. New article ideas are always appreciated!

Trading Crypto: Centralized Vs. Decentralized was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.