Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

trends.google.com

trends.google.com

Bitcoin is flat and going “to the moon” didn’t happen in January as it had been predicted by most analytics experts. Investors didn’t receive sky-high profits from the increasing price of Bitcoin when the ICO market crashed.. Following my #10kqachallenge (where I interview 10,000 experts in different niches) I asked founders and managers from crypto funds about how they view the market, and we’ve got their answers below.

But first, let’s examine some statistics and key metrics that affect the ICO and STO markets.

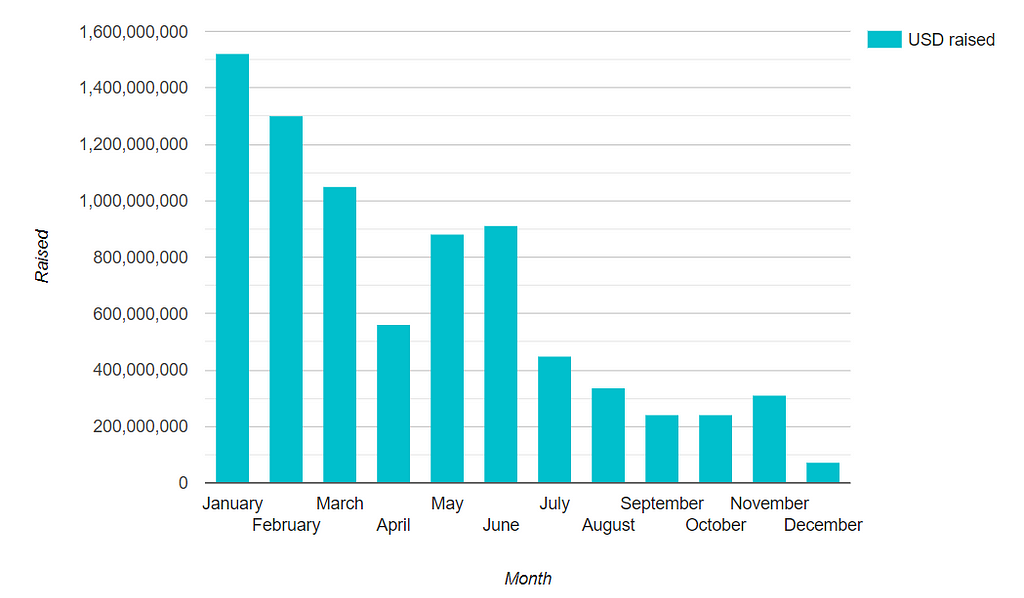

ICO funding continues to go down:

Total 2019 ICO funding: $20,400,000

January ICO funding: $20,400,00. It’s a 75x decrease compared to January 2018.

It’s too early to talk about STO statistics, but based on IcoBench there are more than 150 active STOs (source) Most of them are just rebranded ICOs.

Opinion are split, but there are some common opinions about ICO and STO:

- ICO is more dead than alive. And the factors that killed it are: poor projects and regulations

- STOs are in its early stage and the secondary market is key point of growth here. Also, most STO’s are rebranded ICO’s, and that’s not how STOs should work.

Tim Epskamp — Founding Partner at blockbaycapital.com

To answer the question, I will outline some general principles after touching upon the ICO and STO market and make a brief conclusion.

General

We divide our investments into three different segments that are derived from blockchain software layers (the protocol, network, and application layer). We see that most successful ICO’s can be attributed to the protocol layer (Ethereum, NEO, EOS, Tezos). We do expect that STO’s will fall (by nature) in the application layer as they attempt to build a (commercial) business on the blockchain.

In 2019 we expect (and there should be) ongoing development in the three layers that should ultimately lead to new money flowing into the ecosystem. The size and development pace of the ecosystem will decide investors’ interest and we expect that the distinction between an ICO and an STO will be more clear within the crypto community.

ICO

An ICO was the primary source of funding for the protocol layer. Successful ICOs and interesting blockchains share, in our opinion, that they do not depend on a single entity for development and funding. Most ICOs have failed (and are in trouble) partly because of this dependency. Ongoing blockchain development (scaling/privacy) on the major blockchains should increase entry barriers for new protocols, and new additional regulations lead to a situation where ICO opportunities in 2019 are therefore reduced. New projects and new protocol launches (GRIN, for example) do not require an ICO at all and can be successful without one because they are able to build a community (which is something that most ICO’s were not able to do, because they were centralized and focused on the application layer.

For 2019, we do not expect there to be significant ICOs as a result of 1) entry barriers for protocols (that are suited for an ICO as a funding method) despite the bear market continuously increasing; 2) dried-up liquidity (investors willingness is low); 3) alternative ways of funding as a result of increased regulation and low returns(and should emerge), such as VC, the GRIN approach, community funding, etc.

STO

It will be interesting to see if the first launched STOs can make significant returns going forward. Positive results might accelerate STOs as a funding method as these first ones should pave the way. STO as a funding method might be the solution for the application layer within the blockchain. We are all aware of certain limitations that currently prevent blockchain applications to successfully launch on a large scale. The STO’s that are launched can be classified overall as compliant ICOs rather than a real source of funding for a true blockchain application. We, therefore, do not expect positive results (and returns) from these initial STOs. We do not see significant investor demand from outside the crypto community as there are not enough success stories to tell yet.

For 2019, we have a negative outlook because 1) most STOs are rebranded ICOs; 2) successful STOs should require protocols that enable them to push the blockchain not the limits, ultimately allowing for a killer app.

Conclusion

There is a negative outlook for the ICO/STO market as we can see additional ways of launching protocols (which was the initial purpose of an ICO) and the STO market is not yet mature enough. We do see future opportunities in STOs once the application layer of the blockchain is ready to be built and once there are previous STOs launched. The risk/return ratio is just unfavorable at the moment.

Lewis Fellas — Co-Founder and Chief Investment Officer at www.bletchley.com

ICO — 99% dead. I never believed in the models that were put forward as they lacked any metric for valuation and those that suggested network effects have been proven wrong. We evaluated around 550 of them and only invested in two! In my view, the ICO mania was the biggest short i’ve seen in 19 years in finance, however, there was no way to short ICOs. I believe there will be no respite for these projects and many that raised money will face legal action in the year ahead.

STO — It’s early but from my perspective, the tokens, when issued to be regulatory compliant in quality legal jurisdictions with real consideration of the equity economics, appear to deliver many of the technological promises of the token economy. There are still significant hurdles to be overcome on issues, such as protection of retail investors, taxation on dividend payments, collection of stamp taxes for securities trading (jurisdiction dependent), and exchange listings.

The STO is closer to the vision of the digital asset class I had when I launched Bletchley Park. It’s still early, but we’re moving in the right direction to liberalize capital markets but also provide investors with a real value proposition. I should note that with regards to the ICO/utility tokens, I think a few (and I mean a handful out of the universe of thousands of tokens) do represent a new economic model as a utility token and we will continue to follow this group with interest.

Arianna Simpson — VC & MD @ Autonomous Partners

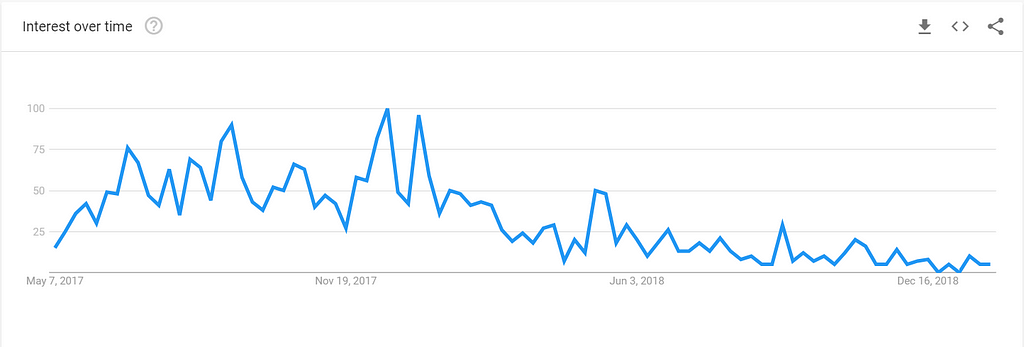

The ICO market has dropped dramatically since what we saw in 2017 and early 2018. Many investors (especially retail) were burned and have been slow to want to reinvest. Given the dramatic fall in prices that we’ve witnessed across the market, projects are avoiding doing ICOs and opting for equity rounds or private token sales (which have also been reduced, but to a lesser degree). I think the ICO market will remain weak in 2019.

As far as STOs are concerned, my sense is that prospects are slightly better than for ICOs, but interest has waned here as well. Institutional investors are still getting accustomed to the idea of tokenized ownership of assets, and my sense is that while we will eventually see this become a large market. However, it’s unlikely to happen this year.

David Siegel — Co-Founder and CEO at 2030.io

I don’t think we will use public ICOs to raise funds. Maybe to distribute tokens or sell tokens for existing systems at fixed prices, but ICOs as we knew them were effectively killed by regulators, and it’s too bad. A lot of good projects have gone under for no good reason. In trying to protect investors, the SEC in particular has done much more harm than good.

Equity offerings will continue as they always have, whether on paper or via tokens, using the same regulations as before. Tokenization is just a way to make the mechanics of the process cheaper and better. Ultimately, tokenization will increase liquidity, but we are 5–10 years away from realizing those benefits.

Bruce Fenton — CEO at Atlantic Financial and Founder of Chainstone Labs at brucefenton.com

We believe the the ICO model of 2017 and 2018 was flawed and won’t return. There was a lot of hype, which led to funding of projects without solid prospects or terms. Many were also questionable from a regulatory standpoint.

Digital securities/security tokens have a lot of potential. They can work within the large, existing, and regulated structure alongside crypto.

In 2019, there are dozens of major and funded initiatives in the area of digital securities. Many major crypto and traditional companies are building on this as well. It’s going to be interesting to watch.

Jan Brzezek — CEO of Crypto Fund AG and Co-Founder of the Crypto Finance Group

More and more professionalism is coming into the crypto market, which means only ICOs with a convincing business case and a compelling story will succeed in the future. We experienced a positive echo in anticipation of opportunities with STO investing recently, but this is not likely to happen at scale soon for two main reasons: the traditional players, such as banks, are not ready for tokenization, and new fintech players are not yet licensed to issue security tokens. Add to that the lack of returns materialized from recent ICOs and new investment products and services (either in funds or direct investments into crypto assets) becoming more attractive and eliminating some areas of risk.

Luka Gubo — CEO at blocktrade.com

I think the STO market will grow significantly in 2019. In 2018 we saw a couple of offerings, mostly small ones, while 2019 will bring us both a large increase in the number of STOs, where some of them will be quite large.Currently, the major bottleneck is the liquidity of security tokens as there are no secondary markets with enough institutional members, but that will also change over the next two years as institutional money starts investing more and more into STOs.

How do investors view the ICO/STO market in 2019? was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.