Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Disclaimer: This is not financial advice. Article inspired from InWara. For more details visit terms and conditions.

This study is dedicated to explain the following trends during January 2019

•ICO Landscape

•STO Landscape

•Private Funding Activity

•Mergers and Acquisitions

ICO Landscape

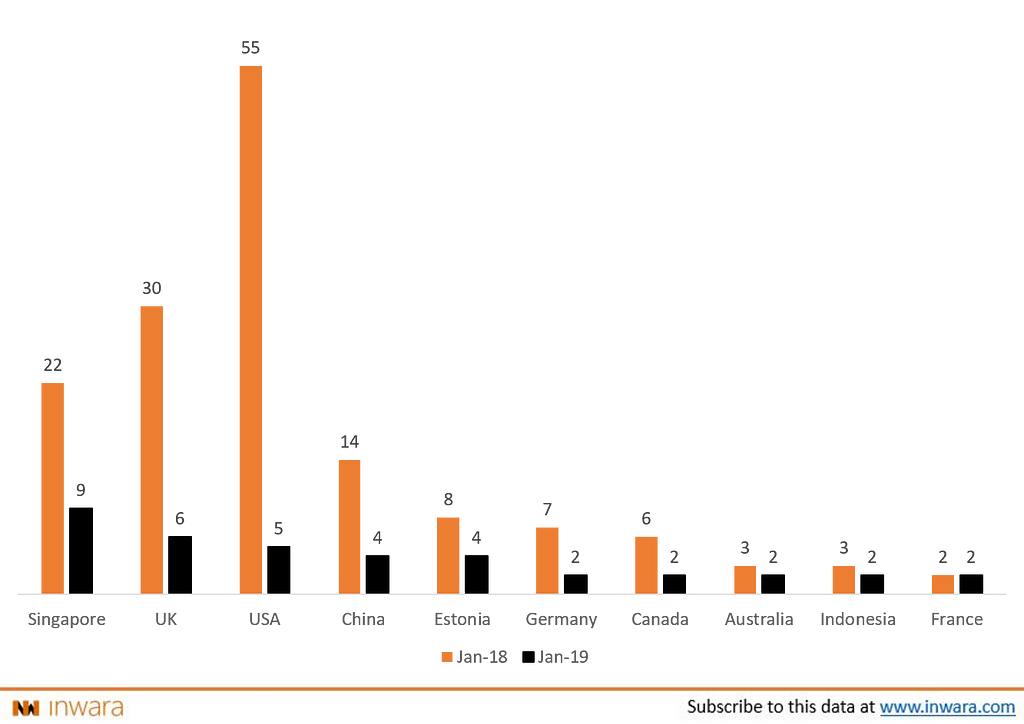

USA dethroned as ICO sales taper

The market observed a depreciating trend in ICO sales when compared to January of 2018, with just over 50 ICO sales observed. This pales in comparison to the 150 ICO sales observed last year. The lingering ‘crypto winter’ has Blockchain enterprises looking to raise funds through ICOs.

# of ICOs according to country in 2019

Interestingly Singapore and UK have overtook USA in ICO sales numbers in the month of January. Increased regulation on ICO sales by the SEC could be the reason for the depreciating trend observed.

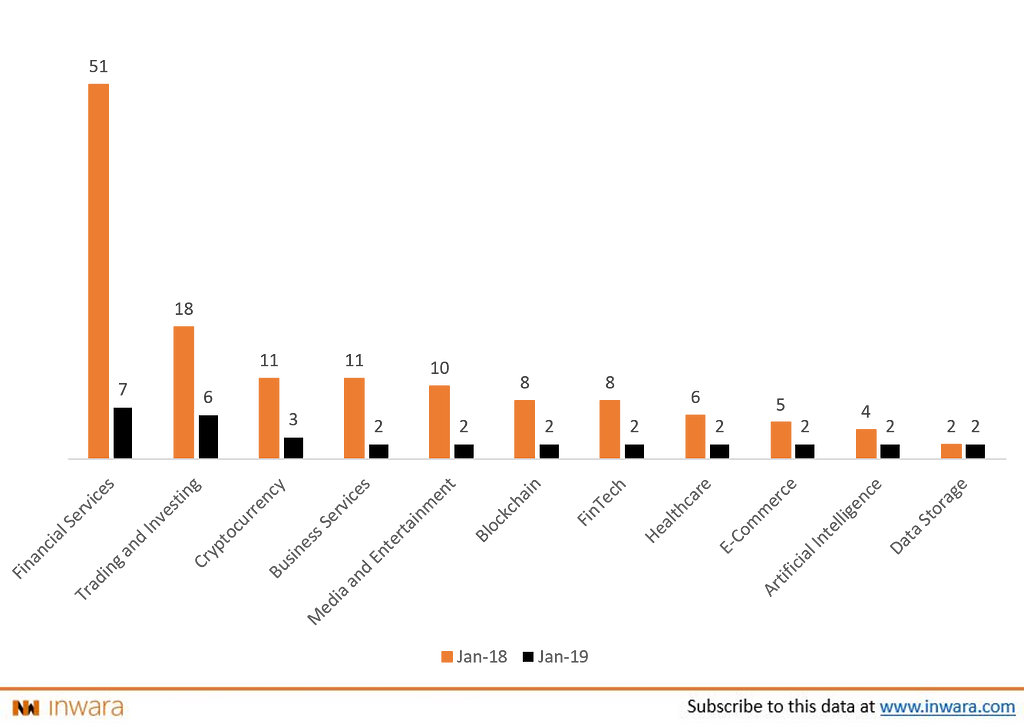

Industry sector outlook

Blockchain enterprises in financial services industry along with allied sectors such as trading and investing, continues its dominance over the market despite unfavourable market conditions.

ICOs in Blockchain, Media and Entertainment and Fintech have suffered major contraction but this perfectly reflects the overall market as all sectors observed negative growth in comparison to 2018.

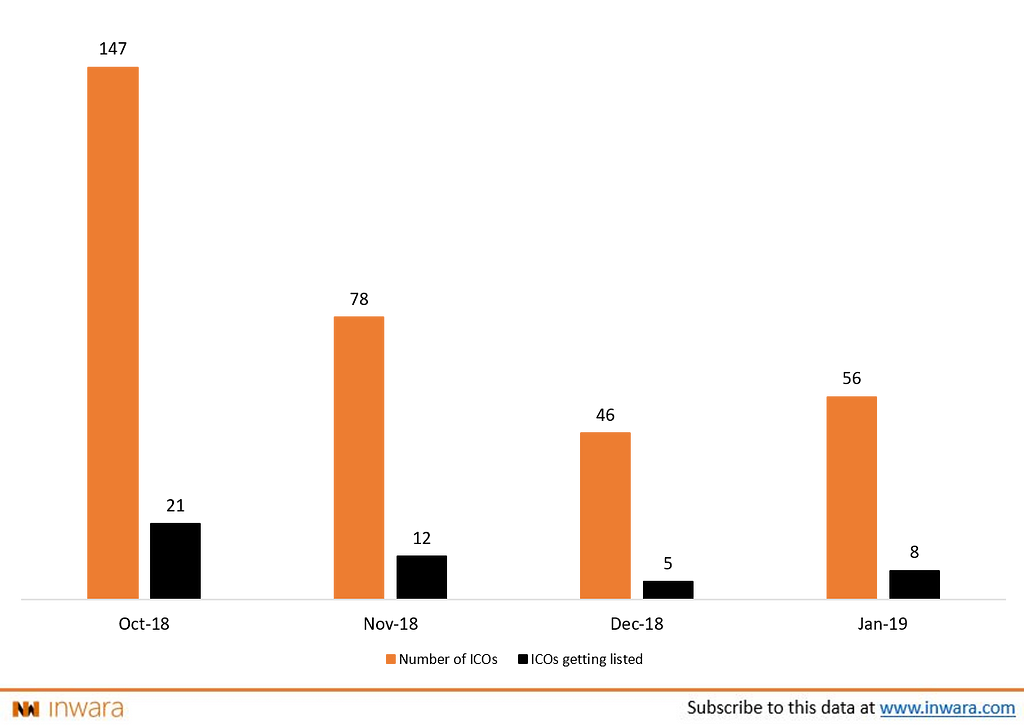

# of ICOs compared to ICOs listed

The number of ICOs getting listed on exchanges, still remain at a low 15%. In Q3 2018, less than 20% of ICOs listed themselves in exchanges, this year observed a similar trend.

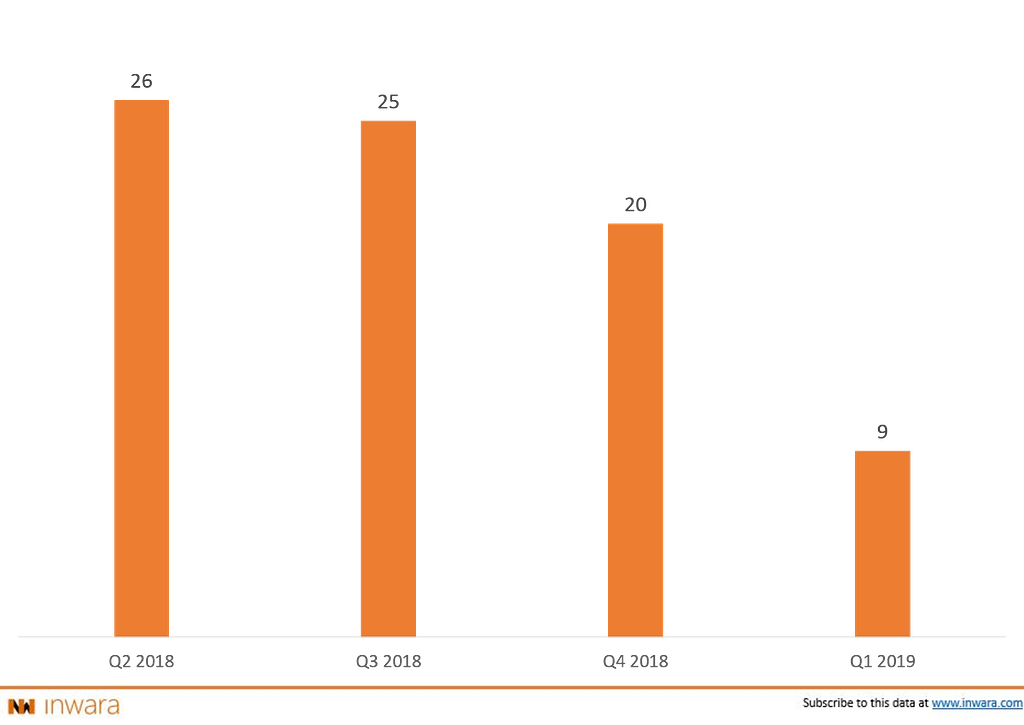

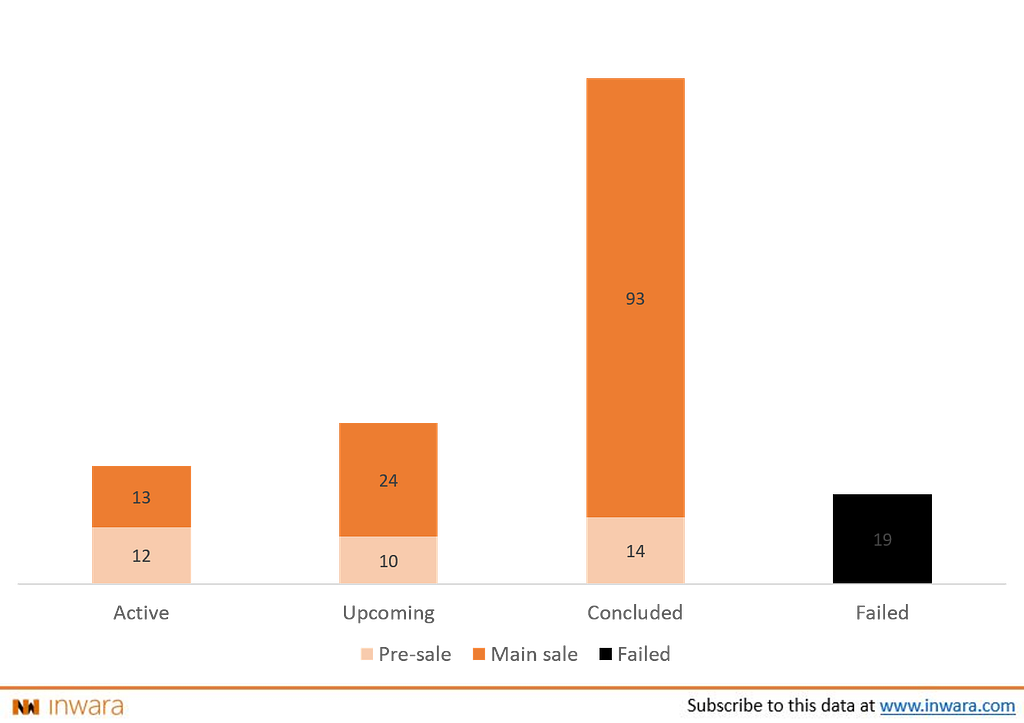

STO landscape

STOs spring continues despite the crypto crash

STOs seemed all the rage in the crypto market space last year, with the number of STOs steadily picking up pace in 2018. STOs are moving forward with the same pace in 2019 with 9 STOs coming up in just one month of Q1 2019.

# of STOs according to financial quarter Source: InWara’s ICO+STO databaseSTOs withstanding the crypto winter

Source: InWara’s ICO+STO databaseSTOs withstanding the crypto winter

Despite the market conditions being unfavourable, the failure rate among STOs is a low ~10%, with the largest STO being Petro’s $735 million raise.

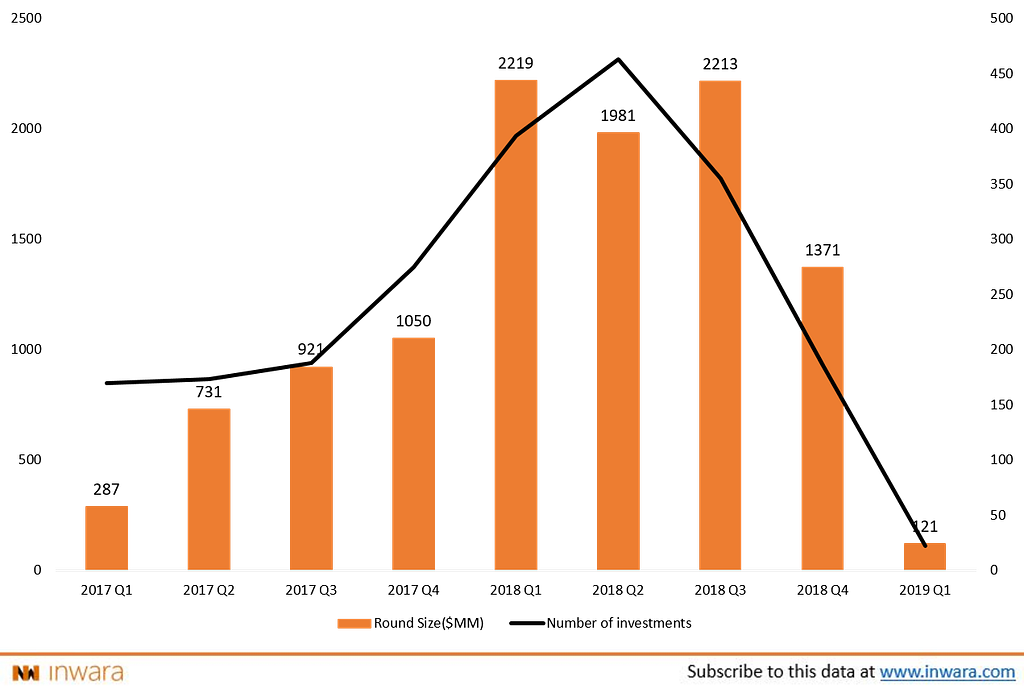

Private funding activity

Bearish market trends prevail

Private funding observed a severe plunge this year as the market still tries to recuperate after its decline.

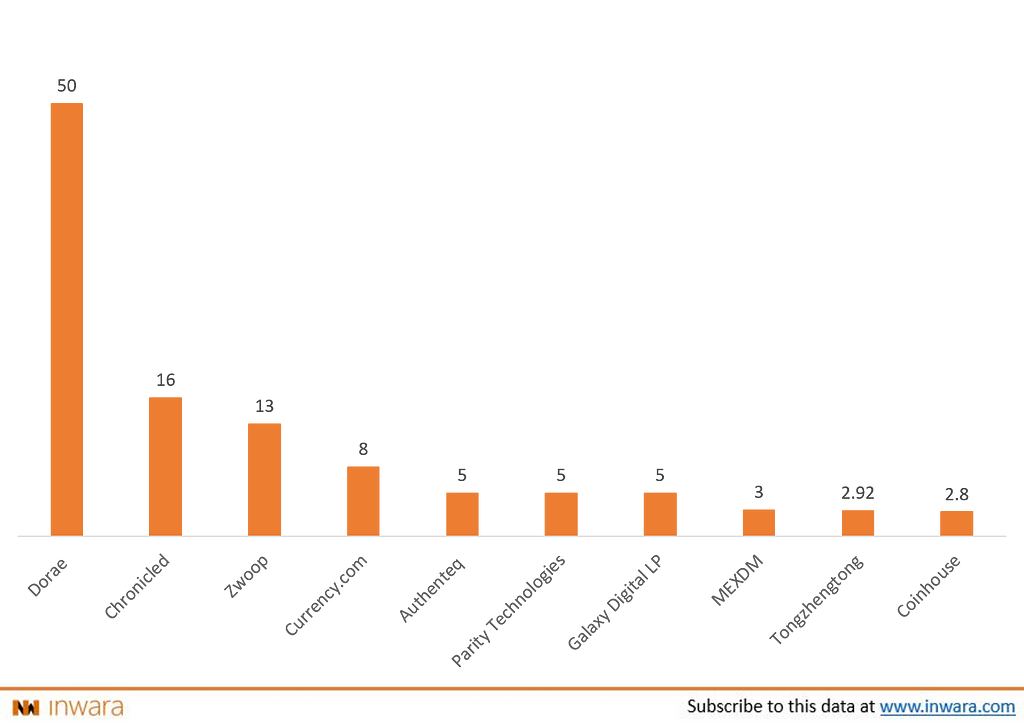

In terms of funds raised, Blockchain sector emerged dominant with the top five Blockchain ICOs taking their place in top ten funding rounds in January 2019. UK based Dorae ICO takes the cake in private funding with over $50 million being raised in a series B funding round from the investor Aethel Partners.

Top 10 Private Funding Rounds in Jan 2019

Download Full January 2019 Report

Mergers and acquisitions

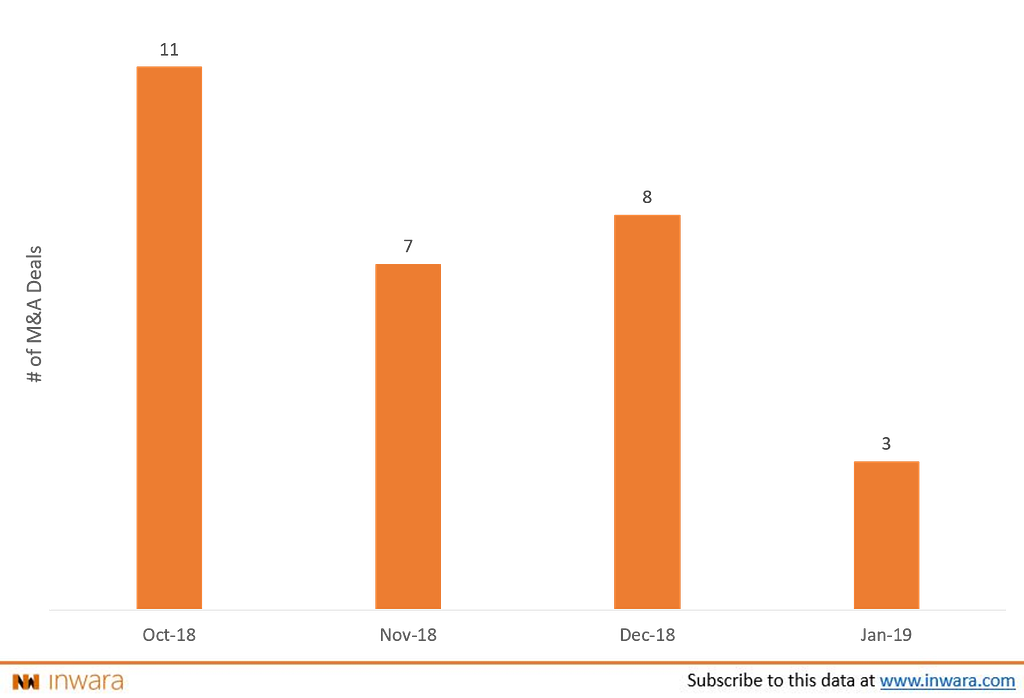

The prolonged ‘crypto winter’ has forced many ICOs to either close up shop or move forward with strategic partnerships that could help both parties survive in the long run.

# of M&A deals in Blockchain and crypto market

Some of the marquee M&A deals this year includes, fiat-to-crypto exchange Coinbase, acquiring data handling startup Blockspring. Bakkt’s acquisition of certain assets of Chicago-based futures commission merchant Rosenthal Collins Group (RCG). EZ Advance acquiring Indian digital payment start-up Alconomy to expand their business into digital banking.

January 2019 Outlook for ICOs, STOs and Blockchain Companies! was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.