Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

In the aftermath of the 2001 internet bubble, Carlota Perez published her influential book Technological Revolutions and Financial Capital. This seminal work provides a framework for how new technologies create both opportunity and turmoil in society. I originally learned about Perez’s work through venture capitalist Fred Wilson, who credits it as a key intellectual underpinning of his investment theses.

In the wake of the 2018 ICO bubble and with the purported potential of blockchain, many people have drawn parallels to the 2001 bubble. I recently reread Perez’s work to think through if there are any lessons for the world of blockchain, and to understand the parallels and differences between then and now. As Mark Twain may or may not have said, “History doesn’t repeat itself, but it does rhyme.”

Framework Overview

In Technological Revolutions and Financial Capital, Carlota Perez analyzes five “surges of development” that have occurred over the last 250 years, each through the diffusion of a new technology and associated way of doing business. These surges are still household names hundreds of years later: the Industrial Revolution, the railway boom, the age of steel, the age of mass production and, of course, the information age. Each one created a burst of development, new ways of doing business, and generated a new class of successful entrepreneurs (from Carnegie to Ford to Jobs). Each one created an economic common sense and set of business models that supported the new technology, which Perez calls a ‘techno-economic paradigm’. Each surge also displaced old industries, drove bubbles to burst, and led to significant social turmoil.

Technology Life cycles

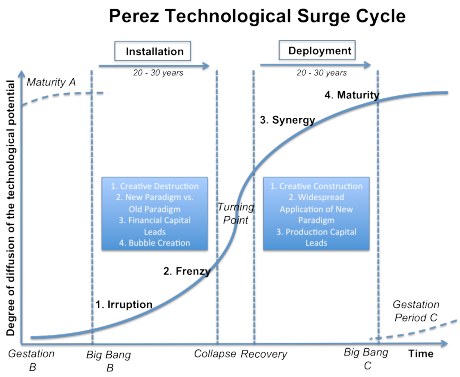

Perez provides a framework for how new technologies first take hold in society and then transform society. She calls the initial phase of this phenomenon “installation.” During installation, technologies demonstrate new ways of doing business and achieving financial gains. This usually creates a frenzy of investment in the new technology which drives a bubble and also intense experimentation in the technology. When the bubble bursts, the subsequent recession (or depression) is a turning point to implement social and regulatory changes to take advantage of the infrastructure created during the frenzy. If changes are made, a “golden age” typically follows as the new technology is productively deployed. If not, a “gilded age” follows where only the rich benefit. In either case, the technology eventually reaches maturity and additional avenues for investment and returns in the new technology dwindle. At this point, the opportunity for a new technology to irrupt onto the scene emerges.

Image from Technology Revolutions and Financial CapitalInclusion-Exclusion

Image from Technology Revolutions and Financial CapitalInclusion-Exclusion

Within Perez’s framework, new techno-economic paradigms both encourage and discourage innovation, through an inclusion-exclusion process. This means that as new techno-economic paradigms are being deployed, they provide opportunities for entrepreneurs to mobilize and new modes of business to create growth, and at the same time, they exclude alternative technologies because entrepreneurs and capital are following the newly proven path provided by the techno-economic paradigm. When an existing technology reaches maturity and investment opportunities diminish, capital and talent go in search of new technologies and techno-economic paradigms.

Technologies Combine

One new technology isn’t enough for a new techno-economic paradigm. The age of mass production was created by combining oil and the combustion engine. Railways required the steam engine. The information age required the microprocessor, the internet, and much more. Often, a technology will, as Perez says, “gestate” as a small improvement to the existing techno-paradigm, until complementary technologies are created and the exclusion process of the old paradigm ends. Technologies can exist in this gestation period for quite sometime until the technologies and opportunities are aligned for the installation period to begin.

Frenzies and Bubbles

In many ways, the bubbles created by the frenzy in the installation phase makes it possible for the new technology to succeed. The bubble creates a burst of (over-)investment in the infrastructure of the new technology (railways, canals, fiber optic cables, etc.). This infrastructure makes it possible for the technology to successfully deploy after the bubble bursts. The bubbles also encourage a spate of experimentation with new business models and new approaches to the technologies, enabling future entrepreneurs to follow proven paths and avoid common pitfalls. While the bubble creates a lot of financial losses and economic pain, it can be crucial in the adoption of new technologies.

Connecting the Dots

A quick look at Perez’s framework would leave one to assume that 2018 was the blockchain frenzy and bubble, so we must be entering blockchain’s “turning point.” This would be a mistake.

My analysis of Perez’s framework suggests that blockchain is actually still in the gestation period, in the early days of a technology life cycle before the installation period. 2018 was not a Perez-style frenzy and bubble because it did not include key outcomes that are necessary to reach a turning point: significant infrastructure improvements and replicable business models that can serve as a roadmap during the deployment period. The bubble came early because blockchain technology enabled liquidity earlier in its life cycle.

There are three main implications of remaining in the gestation period. First, another blockchain-based frenzy and bubble is likely to come before the technology matures. In fact, multiple bubbles may be ahead of us. Second, the best path to success is to work through, rather than against, the existing technology paradigm. Third, the ecosystem needs to heavily invest in infrastructure for a new blockchain-based paradigm to emerge.

The ICO Bubble Doesn’t Match Up

2018 did show many of the signs of a Perez-style ‘frenzy period’ entering into a turning point. The best way (and ultimately the worst way) to make money was speculation. ‘Fundamentals’ of projects rarely mattered in their valuations or growth. Wealth was celebrated and individual prophets gained recognition. Expectations went through the roof. Scams and fraud were prevalent. Retail investors piled in for fear of missing out. The frenzy had all the tell-tale signs of a classic bubble.

Although there are no “good bubbles,” bubbles can have good side effects. During Canal Mania and Railway Mania, canals and railways were built that had little hope of ever being profitable. Investors lost money, but after the bubble, these canals and railways were still there. This new infrastructure made future endeavors cheaper and easier. After the internet bubble burst in 2001, fiber optic cables were selling for pennies on the dollar. Investors did terribly, but the fiber optics infrastructure created value for consumers and made it possible for the next generation of companies to be built. This over-investment in infrastructure is often necessary for the successful deployment of new technologies.

The ICO bubble, however, did not have the good side effects of a Perez-style bubble. It didn’t produce nearly enough infrastructure to help the blockchain ecosystem move forward.

Compared to previous bubbles, the cryptosphere’s investment in infrastructure was minimal and likely to be obsolete very soon. The physical infrastructure — in mining operations, for example — is unlikely to be useful. Additional mining power on a blockchain has significantly decreasing marginal returns and different characteristics to traditional infrastructure. Unlike a city getting a new fiber optic cable or a new canal, new people do not gain access to blockchain because of additional miners. Additionally, proof of work mining is unlikely to be the path blockchain takes moving forward.

The non-physical infrastructure was also minimal. The tools that can be best described as “core blockchain infrastructure” did not have easy access to the ICO market. Dev tools, wallets, software clients, user-friendly smart contract languages, and cloud services (to name a few) are the infrastructure that will drive blockchain technology toward maturity and full deployment. The cheap capital provided through ICOs primarily flowed to the application layer (even though the whole house has been built on an immature foundation). This created incentives for people to focus on what was easily fundable rather than most needed. These perverse incentives may have actually hurt the development of key infrastructure and splintered the ecosystem.

I don’t want to despair about the state of the ecosystem. Some good things came out of the ICO bubble. Talent has flooded the field. Startups have been experimenting with different use cases to see what sticks. New blockchains were launched incorporating a wide range of new technologies and approaches. New technologies have come to market. Many core infrastructure projects raised capital and made significant technical progress. Enterprises have created their blockchain strategies. Some very successful companies were born, which will continue to fund innovation in the space.The ecosystem as a whole continues to evolve at breakneck speed. As a whole, however, the bubble did not leave in its wake the infrastructure one would expect after a Perez-style bubble.

Liquidity Came Early

The 2018 ICO bubble happened early in blockchain technology’s life-cycle, during its gestation period, which is much earlier than Perez’s framework would predict. This is because the technology itself enabled liquidity earlier in the life-cycle. The financial assets became liquid before the underlying technology matured.

In the internet bubble, it took companies many years to go public, and as such there was some quality threshold and some reporting required. This process enabled the technology to iterate and improve before the liquidity arrived. Because blockchain enabled liquid tokens that were virtually free to issue, the rush was on to create valuable tokens rather than valuable companies or technologies. You could create a liquid asset without any work on the underlying technology. The financial layer jumped straight into a liquid state while the technology was left behind. The resulting tokens existed in very thin markets that were highly driven by momentum.

Because of the early liquidity, the dynamics of a bubble were able to start early for the space in relationship to the technology. After all, this was not the first blockchain bubble (bitcoin already has a rich history of bubbles and crashes). The thin markets in which these assets existed likely accelerated the dynamics of the bubble.

What the Blockchain Space Needs to Focus on now

In the fallout of a bubble, Perez outlines two necessary components to successfully deploy new and lasting technologies: proven, replicable business models and easy-to-use infrastructure. Blockchain hasn’t hit these targets yet, and so it’s a pretty obvious conclusion that blockchain is not yet at a “turning point.”

While protocol development is happening at a rapid clip, blockchain is not yet ready for mass deployment into a new techno-economic paradigm. We don’t have the proven, replicable business models that can expand industry to industry. Exchanges and mining companies, the main success stories of blockchain, are not replicable business models and do not cross industries. We don’t yet have the infrastructure for mass adoption. Moreover, the use cases that are gaining traction are mostly in support of the existing economic system. Komgo is using blockchain to improve an incredibly antiquated industry (trade finance) but it is still operating within the legacy economic paradigm.

Blockchain, therefore, is still in the “gestation period.” Before most technologies could enter the irruption phase and transform the economy, they were used to augment the existing economy. In blockchain, this looks like private and consortium chain solutions.

Some people in blockchain see this as a bad result. I see it as absolutely crucial. Without these experiments, blockchain risks fading out as a technological movement before its given the chance to mature and develop. In fact, one area where ConsenSys is not given the credit I believe it deserves is in bringing enterprises into the Ethereum blockchain space. This enterprise interest brings in more talent, lays the seeds for additional infrastructure, and adds credibility to the space. I am more excited by enterprise usage of blockchain today than any other short-term developments.

The Future of Blockchain Frenzy

This was not the first blockchain bubble. I don’t expect it to be the last (though hopefully some lessons will be learned from the last 12 months). Perez’s framework predicts that when the replicable business model is found in blockchain, another period of frenzied investment will occur, likely leading to a bubble. As Fred Wilson writes, “Carlota Perez [shows] ‘nothing important happens without crashes.’ ” Given the amount of capital available, I think this is a highly likely outcome. Given the massive potential of blockchain technology, the bubble is likely to involve more capital at risk than the 2018 one.

This next frenzy will have the same telltale signs of the previous one. Fundamentals will decrease in importance; retail investors will enter the market for fear of missing out; fraud will increase; and so on.

Lessons for Blockchain Businesses

Perez’s framework offers two direct strategic lessons for PegaSys and for any serious protocol development project in the blockchain space. First, we should continue to work with traditional enterprises. Working with enterprises will enable the technology to evolve and will power some experimentation of business models. This is a key component of the technology life-cycle and the best bet to help the ecosystem iterate.

Second, we must continue investing in infrastructure and diverse technologies for the ecosystem to succeed. This might sound obvious at first, but the point is that we will miss out on the new techno-economic paradigm if we only focus on the opportunities that are commercially viable today. Our efforts in Ethereum 1.x and 2.0 are directly born from our goal of helping the ecosystem mature and evolve. The work other groups in Ethereum and across blockchain are doing also drives towards this goal. We are deeply committed to the Ethereum roadmap and at the same time recognize the value that innovations outside Ethereum bring to the space. Ethereum’s roadmap has learned lessons from other blockchains, just as those chains have been inspired by Ethereum. This is how technologies evolve and improve.

Why Blockchain Differs from Traditional Technology Life Cycles was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.