Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

“Past performance is not a reliable indicator of future performance”

Crypto hedge funds are part of a larger group of crypto funds, including those based on venture capital and private equity. Grouped together, there are currently 622 crypto funds across all categories, 303 of those being crypto hedge funds, which represent assets of less than $4 billion, according to the research. Half of the funds are based in the U.S., multiple launches have been seen in Australia, China, Malta, Switzerland, The Netherlands and the U.K. this 2018. 2017 was a great year to start a crypto hedge fund. Great returns.

Is it hard to perform in bull markets?

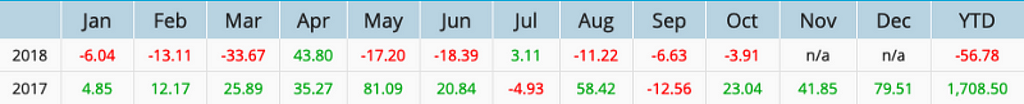

2018, on the other hand, has seen a significant downturn in many of the cryptocurrencies. Many of these coins make up a strong percentage of most of the crypto hedge funds. So-called ‘diversified portfolios’, or ‘risk mediation in coin-bundles’ underperformed greatly. Investors money is still tight up unless sold at loss. With YTD 2018 Returns of -56.78%, investors consider alternative option within this disruptive, high growth technology space.

Average Crypto Hedge Fund returns

Average Crypto Hedge Fund returns Historical Monthly Performance (%)

Historical Monthly Performance (%)

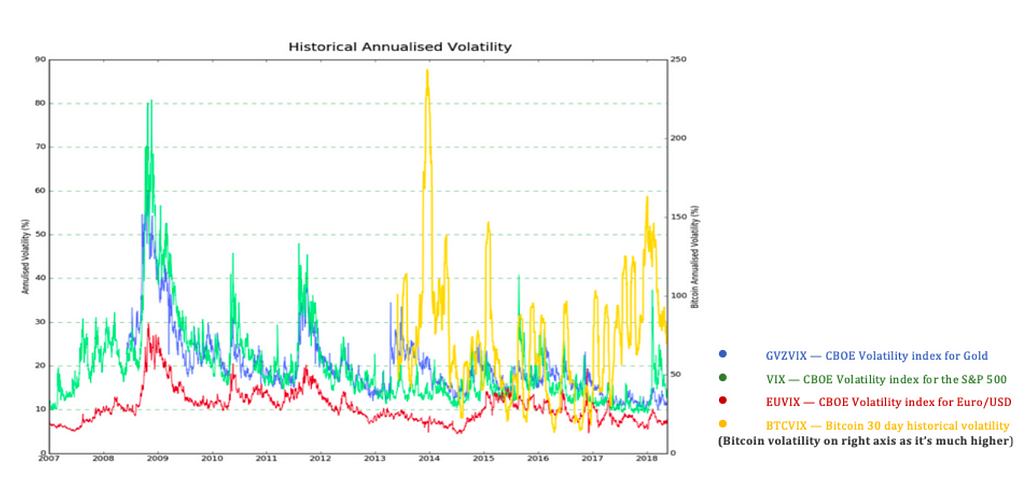

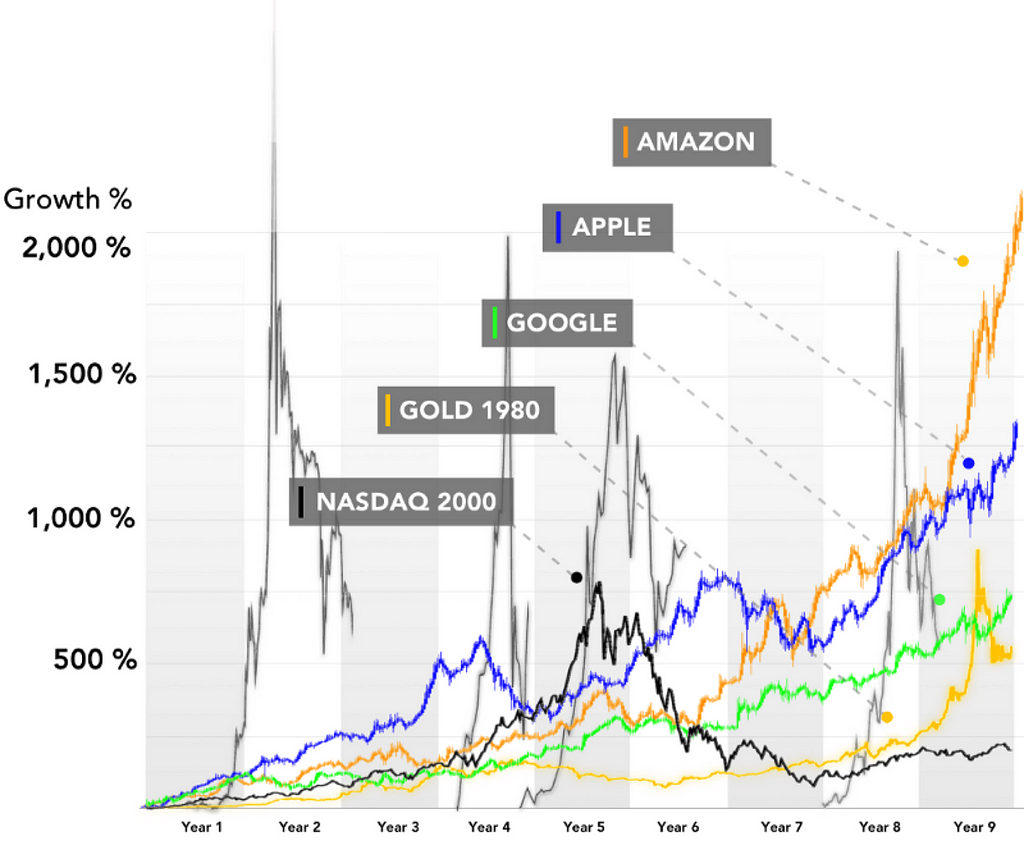

Cryptocurrencies are speculative in value.

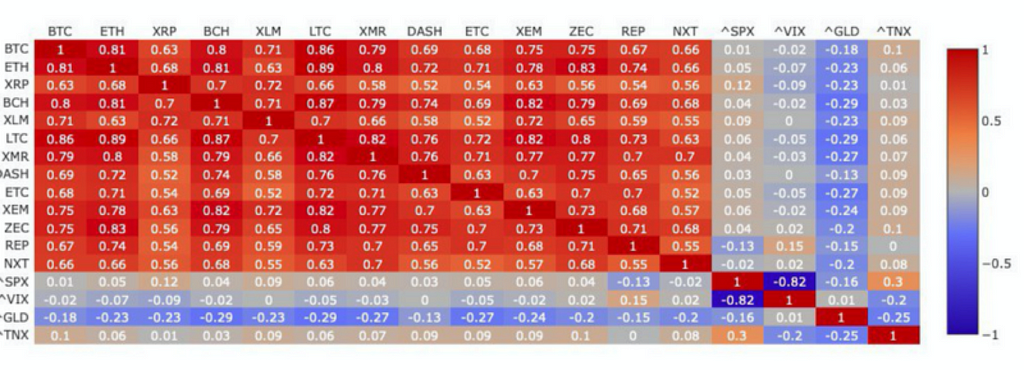

By now, most should know that the majority of token and coins stand and fall with Bitcoin performance due to strong correlations. Additionally, with an average of 50% of the total crypto market share, Bitcoin is certainly the dominant driver in overall behavior. Furthermore, crypto is a young asset class and will likely continue to be volatile as it matures. Even the volatility of equities, currently at 13.4% from the VIX, is completely dwarfed by that of Bitcoin, coming in at 70% (down from 150% earlier in the year).

Total market capitalization rose from $18.3B at the start of 2017 to $613B by the start of 2018 — over 3000% growth. The market for cryptocurrencies is rapidly changing, presenting huge opportunities for investors, and in turn, investment managers. But, individuals looking to capitalize on the inefficiencies of the market by offering interests in actively managed hedge funds need to be wary of and disclose the associated risk.

Crypto Correlation Matrix

Crypto Correlation Matrix Bitcoin Dominance

Bitcoin Dominance Volatility: 12th Apr 2018 — A move of $1200 within an hour

Volatility: 12th Apr 2018 — A move of $1200 within an hour Bitcoin Crashes (or bubble bursts or correction)

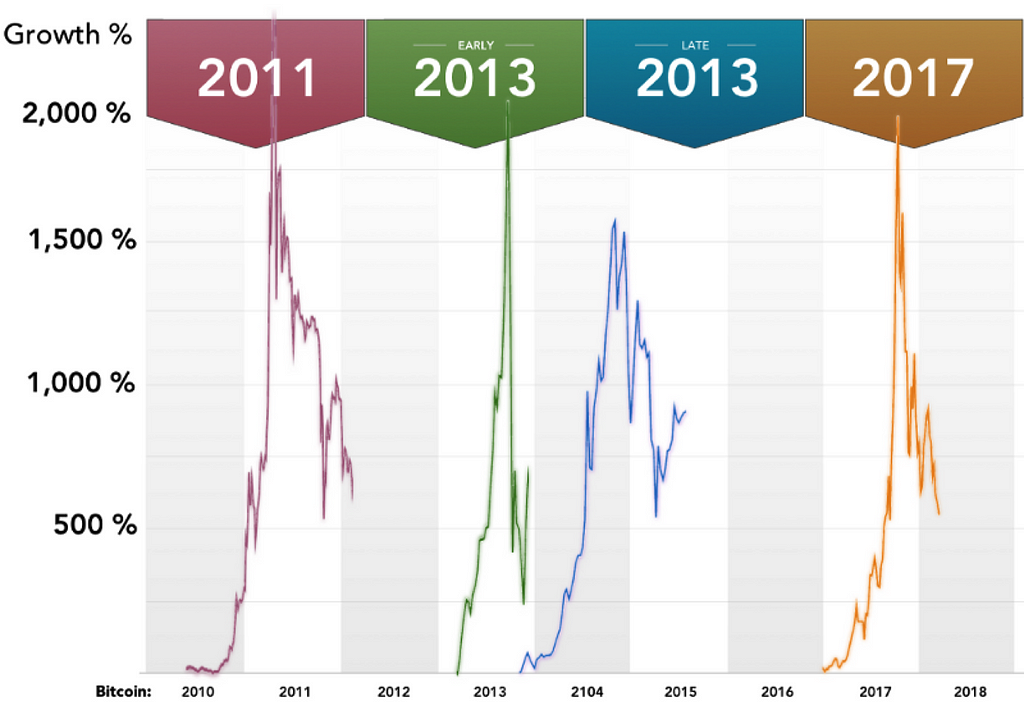

Bitcoin Crashes (or bubble bursts or correction) Some context for the know-it-all

Some context for the know-it-all

Damage Limitation

Due to the 70–90% corrections from all-time highs in 2017, a majority of crypto funds will most likely not make any performance fee last year, despite their “complex hedging strategies” or automatically re-balanced functions.

This means they had three (no, 4) options for the rest of the 2018 fiscal year:

1) Raise New Capital,

2) Ride the market out and hope 2018 is better,

3) Close the fund

4) or change strategy.

“Cryptocurrency cannot be analyzed in the same manner as traditional assets.”

There is no physical item or stake in the startup or company to which the price is tied. The valuation of your token is based on the expectation of future demand and is thus very susceptible to changes in sentiment.

Hedge funds are the most common type of digital asset fund, but venture capital crypto funds are launching quickly, and existing tech/FinTech VC firms are expanding investments into blockchain startups and launching their own blockchain funds. Investing in technology startups — instead of solely relying on price appreciation of existing crypto-assets — serving investors the most disruptive, high growth market, worth trillions in the future.

2019: The year of ?

We are approaching the end of January and there have been plenty of predictions of what this year could mean for cryptocurrencies. Some claimed that this could be the year for security token offerings (STO), some say it could be the year mass adoption will finally take place.

My thoughts on the matter are, 2019 could be the year when regulations finally build an infrastructure for cryptocurrencies or blockchain-based projects to thrive. The road is long but nothing can stop innovation. It is the single most consistent growth humanity has offered since maybe the dawn of time.

Source: Crypto Fund Research, Eurekahedge, Sifr Data, Alpaca Securities

I hope you enjoy this article! Please leave any feedback below. Let’s wish for a better 2019. :)

Iliya Zaki is the Business Development and Marketing Officer forMoonwhale Ventures.

Moonwhale Ventures is a Blockchain Technology Consultancy and Investment Platform, helping three types of businesses on Blockchain implementation, expansion/ new venture building, fundraising, go-to-market strategies:

- Tech Startups (ICOs, STOs) — full life-cycle from business setup to technology/ token development to fundraising

- SME, MNC, Listed Companies to finance expansion by Tokenization (STO) of assets

- SME, MNC, Listed Companies to improve security/ value chain through blockchain technology application

Moonwhale then delivers/ showcases these vetted projects as investment opportunities on the Moonwhale Investment Platform, where VC, LP, other Funds or high net worth individuals can securely invest, individually or managed through our fund.

For more information on how we can help you explore blockchain technology for your business: Blockchain Consulting

iliya.zaki@moonwhale.io

Follow us on our various social media platform. — TwitterInstagramLinkedIn

Press Release #2 — Moonwhale Secures Important Corporate Client — Odyssey Financial Group

2018: The Downfall of Crypto Funds was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.