Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

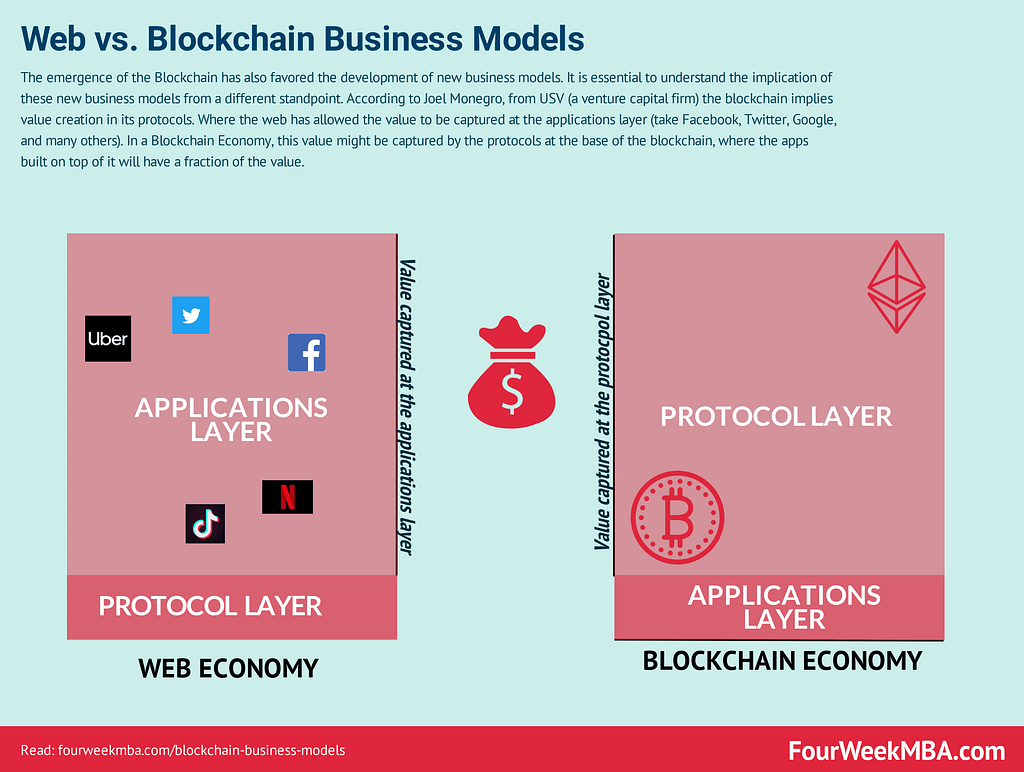

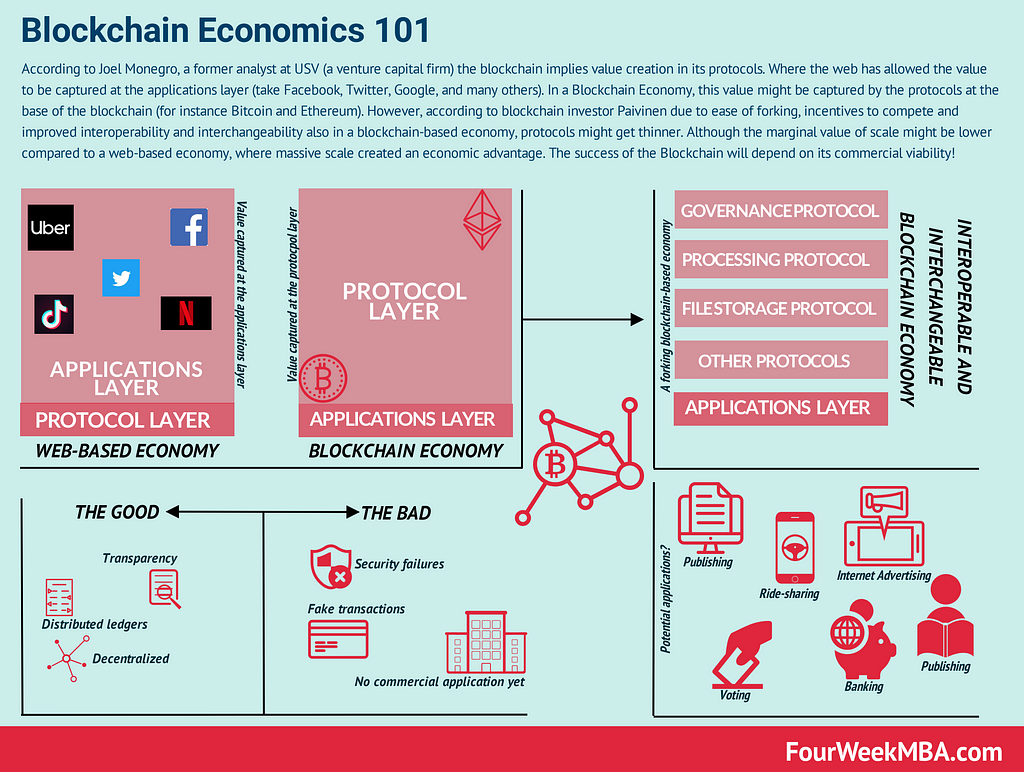

According to Joel Monegro, a former analyst at USV (a venture capital firm) the blockchain implies value creation in its protocols. Where the web has allowed the value to be captured at the applications layer (take Facebook, Twitter, Google, and many others).

In a Blockchain Economy, this value might be captured by the protocols at the base of the blockchain (for instance Bitcoin and Ethereum).

However, according to blockchain investor Paivinen due to ease of forking, incentives to compete and improved interoperability and interchangeability also in a blockchain-based economy, protocols might get thinner.

Although the marginal value of scale might be lower compared to a web-based economy, where massive scale created an economic advantage. The success of the Blockchain will depend on its commercial viability!

Blockchain: the beginnings

On January 10th, 2009, a man named Satoshi Nakamoto sent an email to Hal Finney, another man from Santa Barbara. Reported by online.wsj.com, the email said:

Normally I would keep the symbols in, but they increased the size of the EXE from 6.5MB to 50MB so I just couldn’t justify not stripping them. I guess I made the wrong decision, at least for this early version.

I’m kind of surprised there was a crash, I’ve tested heavily and haven’t had an outright exception for a while. Come to think of it; there isn’t even an exception print at the end of debug.log. I’ve been testing on XP SP2, maybe SP3 is something.

I’ve attached bitcoin.exe with symbols. (gcc symbols for gdb, if you’re using MSVC I can send you an MSVC build with symbols)

Thanks for your help!

The subject of that email said “Crash in bitcoin 0.1.0.”

Satoshi Nakamoto (none would eventually figure out whether he was a real person, a pseudonym or a group of people) was explaining to Hal Finney how to make the bitcoin work!

The Bitcoin would be the first application of The Blockchain, a decentralized way to handle exchanges of this cryptocurrency, which didn’t require a central authority or an intermediary.

As a business person, you might want to understand how the Blockchain value-capturing mechanism works. In a world powered by web apps, most of the business value so far got captured at the applications layer level.

To understand this mechanism look at the infographic below:

In the so-called theory of “fat protocols, and thin apps” of the blockchain, compared to the “fat apps, and thin protocols” of a more traditional economy is a good starting point to understand at what level, business value is captured in these two forms of economic systems.

However, this theory also minimizes two significant effects:

- The power of forking in a blockchain-based economy

- And the power of open business models in a web-based economy

Understanding both — I argue — is critical to understand how a blockchain-based economic system might evolve.

What is forking and why it matters in a Blockchain Economy?

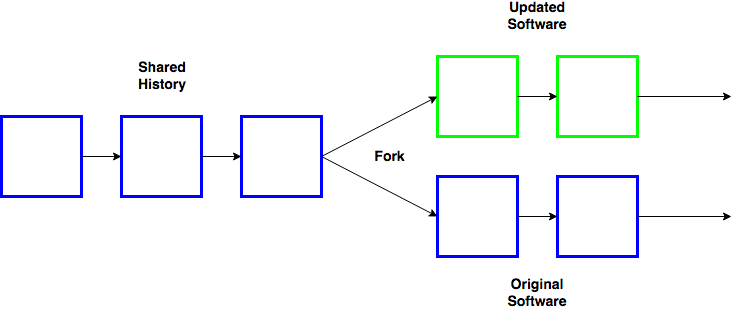

In simple words, a fork is a mechanism where a blockchain path splits toward two separate paths that imply different outcomes. However, this is the hardest form of forking.

As explained by coindesk.com, “a byproduct of distributed consensus, forks happen anytime two miners find a block at nearly the same time. The ambiguity is resolved when subsequent blocks are added to one, making it the longest chain, while the other block gets “orphaned” (or abandoned) by the network.”

Therefore, at its most basic level, a fork is a way to resolve ambiguity within a blockchain. On the other hand, there are two different forms of forks that have a more radical impact:

- hard-fork

- and a soft-fork

In a hard fork is similar to a software update, where the previous version won’t be valid anymore, thus a device to work will have to update to the newest version of that software. A fork is a “collectively agreed upon update” to a blockchain protocol.

Source: Digital Asset Research

When this update happens, the new version of the software will not be compatible with the old one. This implies a “hard fork” or a mechanism that makes the old version incompatible.Thus, if there is a lack of consensus on “convincing” old forks to join the updated blockchain, this brings a split of the blockchain.That happens when the majority of a blockchain can’t agree on a fork. Splits happen and a blockchain that once was united splits up in competing versions, that will run with different consensus rules, features and “cultures.” In other cases, however, when a new version of the blockchain is still compatible with the old version, this is called “soft-fork.”Understanding the implication of forking in a blockchain-based economy is a fundamental issue. Teemu Paivinen, blockchain entrepreneur and investor referring to fat protocols theory, pointed out:

I’d like to propose that while these protocols in aggregate will continue to capture most of the value, individual protocols will in fact be quite thin and tend towards capturing minimal value, due to the combined effects of forking and competitive market forces.

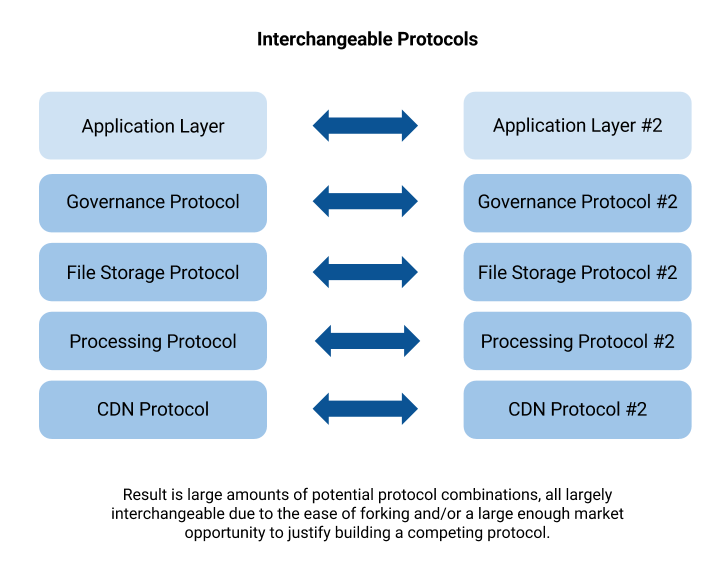

In short, Paivinen introduces three important variables that might apply to a token economy or blockchain-based economy:

- Ease of forking

- Incentives to compete

- Improved interoperability and interchangeability of protocols

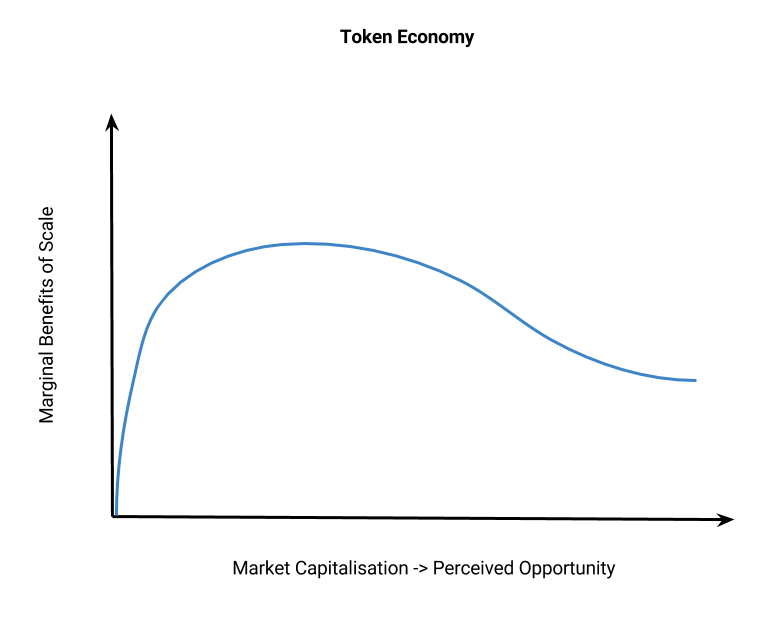

He defines this phenomenon as “the great thinning” a phenomenon in which the marginal benefits of scaling up a protocol becomes smaller and smaller the bigger the protocol it gets. In a web-based economy tech giants have used “scale” to dominate the market. Therefore, this concept might sound counterintuitive.

When a larger protocol gets thinner, smaller protocols form. These smaller protocols might become useful and more efficient in performing specific tasks. And as most of the forks on a blockchain are soft-forks, those are “backward-compatible” which makes several protocols spring up.

Once these protocols become interoperable, that is how new ecosystems get created. As Paivinen points out:

As these forces push the industry towards more specialisation and forking allows almost unlimited competition, less the anti-competitive information and data advantages of the traditional technology industry, it would seem that protocols can only get thinner.

When these protocols get thinner, and they get interoperable, this kind of phenomenon might arise:

Source: blog.zeppelin.solutions

Once again this concept isn’t simple to grasp initially. In a traditional economy, as companies get bigger, they scale up but also become more centralized. These companies tend to unlock value by creating a closed system.

The marginal benefits of scalability in a blockchain-based economy

In a traditional, web-based economy, competitors can’t access data. The primary argument is actually that data ownership is what makes those companies worth billions. A traditional example is Facebook and Google. As the web has grown more and more centralized (even though the world is connected it is so via a few apps and websites).

Those tech giants also set the rules of the game. When Google “imposes” AMP (accelerated mobile pages) as the prevailing format for mobile searches publishers follow. When Google uses the Open Handset Alliance — the developer of Android — Google does that so it can get featured on as many mobile devices as possible.

When Android (owned by Google) is on those devices, Google can exchange data at a higher rate. That data is turned into an asset and locked into the company’s algorithms to generate more advertising revenues.

Thus, a closed centralized company uses open systems to increase its scale. In a blockchain-based economy, in theory, data should be shared, and this would create a way more competitive ecosystem where the advantage of scale decreases at a certain threshold.

This is how Teemu Paivinen represents it:

Source: blog.zeppelin.solutions

It is important to notice that those expressed so far are theories. And whether they will prove sound, only time will tell.

Before we conclude this analysis, we need to look at another couple of points that matter to us to understand a blockchain-based economy.

When the web was supposed to be open

The web might have turned the way it did, with applications capturing most of its business value, but one might wonder whether this was the only path possible.

The answer to this dilemma is of course not. When protocols that made the web possible were made freely available, or they didn’t have necessarily a monetization strategy, those allowed other private companies to take advantage of them.

Those open protocols were such not necessarily because it was an intrinsic characteristic. Rather it was a choice. The first people that developed the web wanted it to be open, decentralized, and transparent.

Then tech giants leveraged on the open model to squeeze in profits and centralize data in the process. Thus, the web has become more closed, centralized and less transparent. This, of course, is a simplification. The main point here though is that the web was supposed to have certain characteristics.

But the “commercial web” flipped them. This is neither good or bad. But in my view is what made a web-based economy be configured as “thin protocols and fat applications.”

The battle from closed to open web isn’t over yet. And as open business models might be coming back, the Blockchain might help this process, unless existing tech giants will be able to leverage on it.

For instance, Facebook has launched a Blockchain team to find out possible applications and integrations of it within the platform (presumably for a payment infrastructure, even though we can’t know for sure):

Is the Blockchain killer app trust decentralization?

If you ask me what is that is special about the Blockchain which can radically change the way our economic system works, I’d say trust decentralization.

This concept is completely new to our society. Indeed, even though we’ve now been used for centuries to deal with impersonal entities, which we call governments those are still run by people, at a central level. And while the bureaucrat we all hate is a person, we all imagine that person with certain features.

However, we also know that power is centralized and our way to decentralize it is to express our vote. With a blockchain-based economy, things change. In short, you don’t have to trust a middleman, a corporation or anyone else ensuring a transaction among two parties.

You just have to trust the mathematical system behind it. It’s math, science, all proved, and it can all work without trust! So far so good. But is it really as good as it seems? We often forget that a blockchain is a technology.

Just like AI and machine learning can help you finally process massive amount of data. Still, if you give garbage to the AI, it not only will give you garbage back, it will give you even more.

Take the case of Amazon who had to stop its sexist AI from wanting to hire all males candidates. Therefore, it all goes back to data! A technology that allows to audit data at a decentralized level doesn’t make that data good in the first place.

Kai Stinchcombe points out that a Blockchain which works by removing trust from the equation won’t make things better. It would actually make them worst. For instance, he points out that “The key feature of a new payment system — think of PayPal in its early days — is the confidence that if the goods aren’t as described you’ll get your money back.”

In other words, in a financial system, trust is what makes it thick. In a system where trust is removed, and people are left on their devices, things won’t work.

For instance, Kai Stinchcombe also points out the case of “The government-backed banking system” which “provides FDIC guarantees, reversibility of ACH, identity verification, audit standards, and an investigation system when things go wrong.”

In short, a system that works, in the long run, is not a system where things work out more efficiently. It’s instead a system that survives when it all goes wrong.

And when you are a Bitcoin trader or Bitcoin holder, and you lose your key, or due to security failures of the system, you lose all your cryptocurrency, and there’s no one that can help you with that, this feels like more of a hell than a world where we all would like to live in.

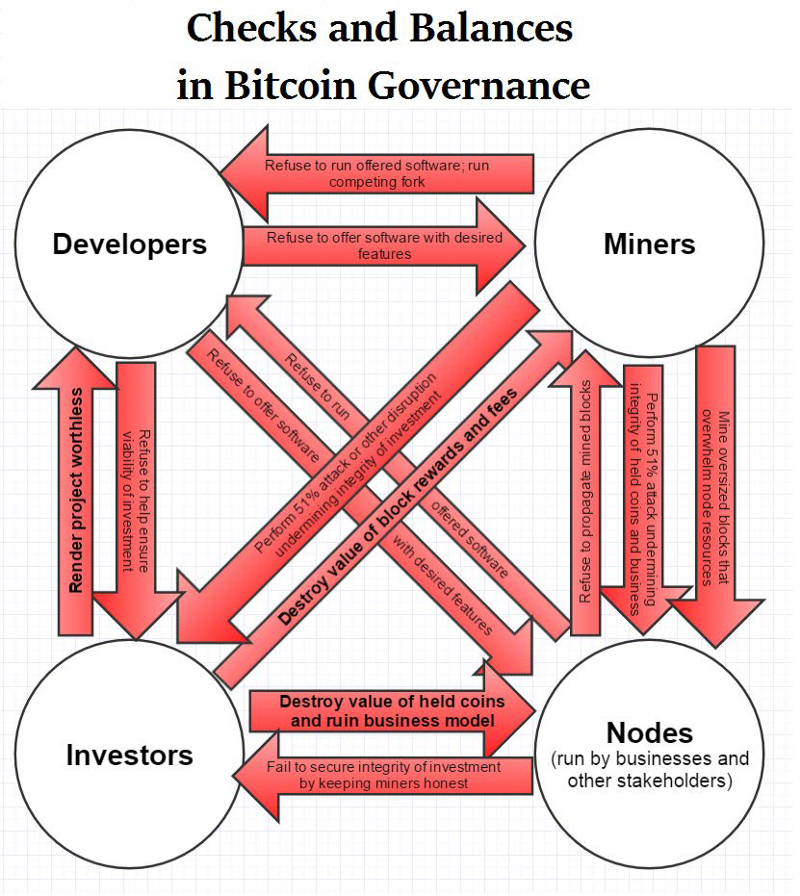

Therefore, a system of checks and balances will be critical to the blockchain success and this system seems comprised by four key players that all act in their own interest, but together might form a solid ecosystem:

- developers

- miners

- investors

- and nodes

Source: hackernoon.com

For the system to keep its integrity it becomes crucial that each of these stakeholders doesn’t amass too much power. A risk of a blockchain-based economy of course, is that a few key nodes might control the whole system.

Thus, while we all like to have utopian views about the Blockchain and what it can do. We have to realize it is a powerful technology, but it also evolves according to the prevailing culture.

Beside the utopian side though, whether or not a blockchain-based economy will be successful will depend on whether people will find it useful and better suited compared to other existing solutions and technologies.

When tech giants like Google and Amazon finally proved commercially viable, and actually extremely successful, it was finally a proof that the web wasn’t just something built on thin air.

Therefore, for the blockchain to prove successful it will need its first commercial breakthrough.

What is going to be the Blockchain breakthrough?

CB Insights lists among fifty potential sectors where the Blockchain might have a strong impact. From Banking to Waste Management. The top ten list comprises:

- Bankings

- Messaging apps

- Hedge funds

- Voting

- Internet identify and DNS

- Critical infrastructure security

- Ride-sharing

- Internet advertising

- Crypto exchanges

- Education and academia

What of these will actually be commercially successful it’s hard to say. Yet when that commercial success will be proved, we can finally say we live in a blockchain-based economy!

Originally published at fourweekmba.com on January 15, 2019.

How A World Driven By The Blockchain Might Look Like was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.