Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

One of the biggest dilemmas that I see traders run into is the issue of setting an appropriate stop loss.

We’ve all heard the story before — “Ah man, my stop loss got hit!” because of a ‘shake-out’ or some other market event that’s going on.

Source: https://www.investopedia.com/terms/s/shakeout.asp

So, Who Cares?

You do. Because more often than not an inappropriately set stop loss can prevent you from accruing massive profits.

How?

I’ll show you in this article. Then, I’ll help you to create a better one through some techniques that you can use on TradingView (very simple/I’ll try to make it as simple as possible).

First, let’s use an example that I’ve created with $ZRX (0xcoin)

Example

So, you’ve decided to finally make an investment and you’ve picked $ZRX. Great job.

This circle above is where you placed your hypothetical investment

So, you’ve invested at 16.8k sats. Not a bad point, right? Your TA led you to believe that this was a good decision.

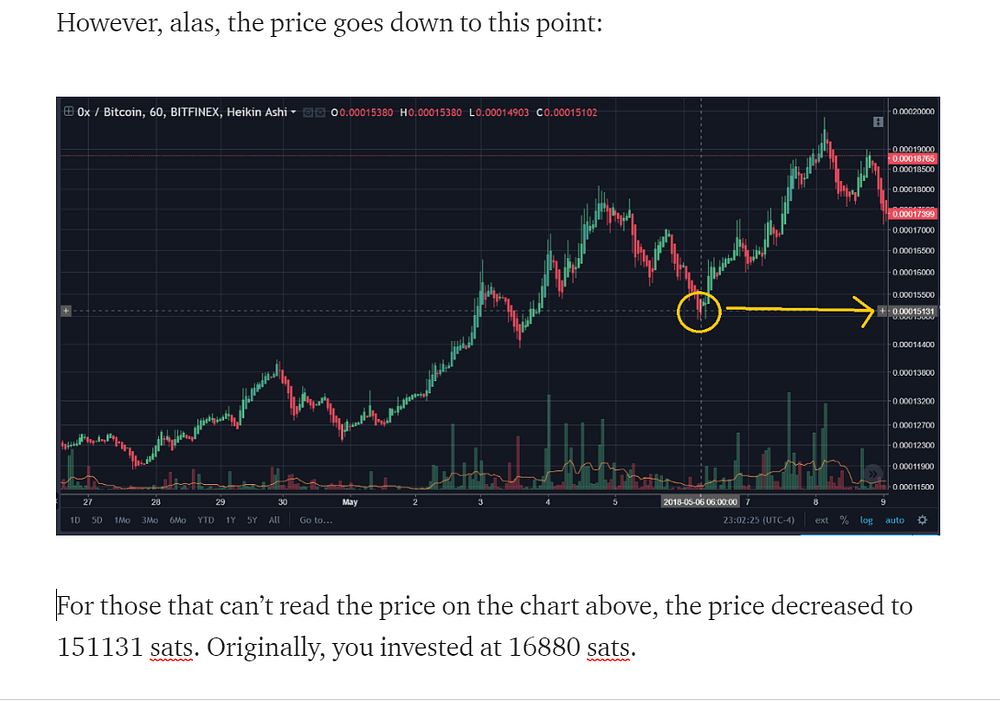

However, alas, the price goes down to this point:

For those that can’t read the price on the chart above, the price decreased to 151131 sats. Originally, you invested at 16880 sats.

That’s a total loss of approximately 10%.

Now, you might be thinking “Great! My stop loss did what it was supposed to do.”

However, when you look at the remaining price action, you might think to yourself “Damn it! I should have stayed in. I wish I didn’t set that stop loss.”

But then again, 10% is a pretty sizable stop loss, right? Anything greater than that, and you risk taking a serious loss on your investment.

But then again, there was a 16%+ gain that you missed out on!

So, the question that you’re probably wondering is:

How Would I Have Known in Advance That My Stop Loss Should’ve Been 12% (possibly) and not 10%?

From our friend, Average True Range

What is Average True Range?

Average True Range (ATR) Indicator – This is one of those indicators that you don’t see too many traders using, but one that has a lot of use in the…medium.com

The article above tells you what Average True Range is.

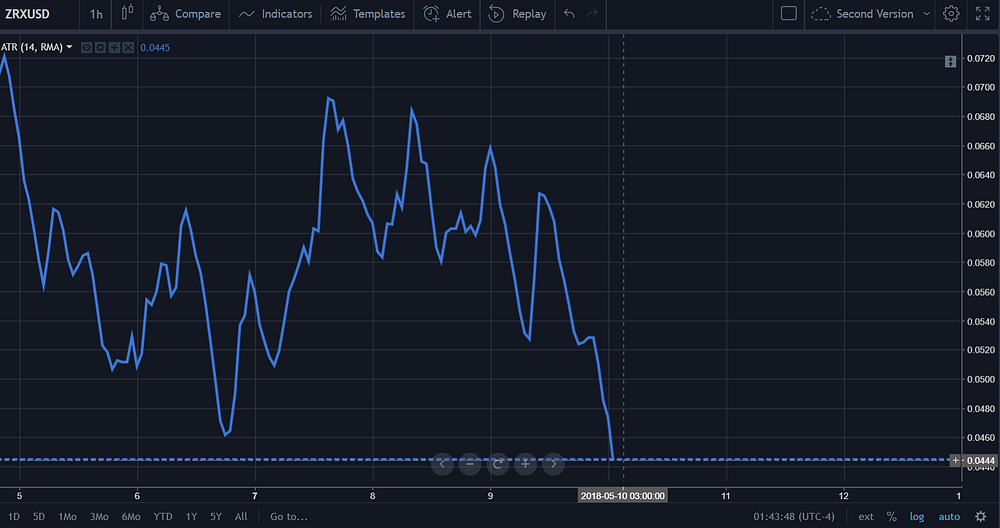

To summarize, it basically tells you the average rate of volatility. So, if you’re looking at the 4H chart and you see this:

That dotted-dash line is the value that the ATR is currently at.

The direction of the line here has nothing to do with the actual price action, to be clear. This indicator strictly measures volatility.

So, what you’re seeing above means that the volatility has been plummeting.

Now, Here’s the Catch

You can only use the Average True Range on the USD charts, not for BTC.

Here’s what will happen if you try to use it with a BTC pairing (i.e., ZRX/BTC like what we have above):

As you can see in the golden rectangle on the right side of this picture, all the values are at 0.00000 for the BTC pairing, which is of NO assistance to us at all.

Never fear, though. This issue is neither here nor there.

If you don’t understand, relax — I’ll tie everything together at the end.

Let’s switch back to the USD pairing (ZRX/USD).

This is where we first placed our investment — May 5th, 2018; 18:00:00

So, the average volatility (daily) was $0.1996

What was the price of $ZRX/USD at the time that we invested?

So, the price was $1.6596

Let’s do the math here — .1996/1.6596 = .1202 = 12.02%

That 12.02% is all we need.

Wait, Let’s Go Through a Time Machine

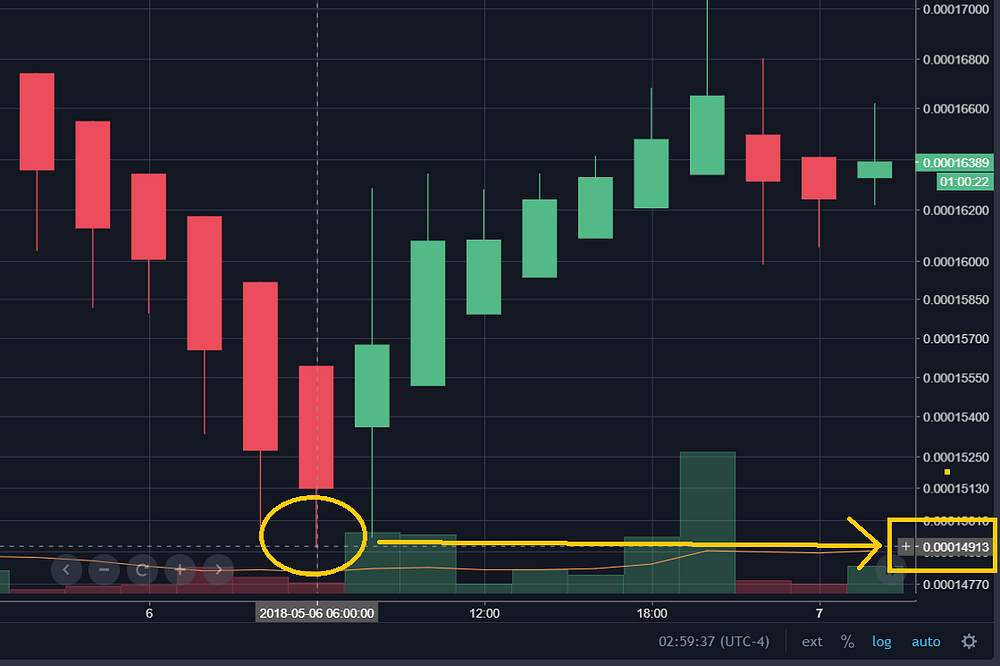

So, we know that our original investment was at 16880 sats.

So, let’s do some simple math.

16880*.1202=2028.976 sats = 12.02% below where we were.

So our stop loss should be at 16880–2028.976=14851.024 sats

Let’s go back to the precise bottom again here:

The absolute low for the price was .00014913 sats

So, our stop loss would NOT have been hit and instead of losing 10%, we would have gained 15%!

That’s a Solid Increase

Is this bulletproof?

Hell no. But, it’s at least a guide that you can use to help ensure that when you get stop lossed, you get saved and not screwed.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.