Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Fundamentals of Money !!

By definition Money is nothing but “Medium of exchange”. If money is just the Medium of exchange why some people can print it as much as they want and can inflate the value of it.

What's going on flocks! Let's get into more details. If we print more money, prices will rise such that we’re no better off than we were before. To see why, we’ll suppose this isn’t true, and that prices will not increase much when we drastically increase the money supply. Consider the case of the United States. Let’s suppose the United States decides to increase the money supply by mailing every man, woman, and child an envelope full of money. What would people do with that money? Some of that money will be saved, some might go toward paying off debt like mortgages and credit cards, but most of it will be spent.

Why Will Prices Go Up After printing money continuously?

In short, prices will go up after a dynamic increase in the supply of money because:

- Let's say people have more money they will spend more on purchasing the products. Which in turn leads to the decrease in the products in the market thereby creating more demand. This will lead to an increase in product pricing.

- Retailers who run out of product will try to increase the demand for the products. Producers face the same dilemma of retailers that they will either have to raise prices, in order to justify the newly created demand for goods or increase price of the products.

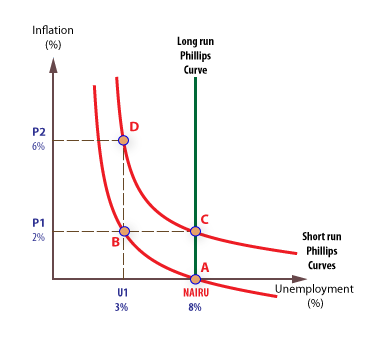

When there is a new demand for more goods the unemployment decreases as the producers need to find more labor to meet the upcoming demands. The newly recruited labor might be having inexperience in meeting the demand goals thereby creating the quality uncertainty. Unemployment can be met by inflating the price. Resources plays major role as resources can back the value of money.

“The problem is if we all have more money doesn’t mean we will be richer. Increasing the amount of money does mean anything if we have nothing to back the wealth.”

As the same amount of population is using the same amount of resources. Even if we increase the supply of money, we cannot on average be wealthier than we were before.

How do we create money..?

Had you ever thought how we used to create money.

- When we created modern day money for the first time in the past. It’s in the forms of silver and gold coins. Money was introduced in order to make transactions efficient and simple.

- Money is a consistent unit of value, because balances and prices are reported in terms of money in order to avoid confusion & promote efficiency.

In simple words when we have money backed by a value it makes life more feasible for others to look at. Initially when we create money we have a standards which is how the value of the money is created. One of the renounced standard is the Gold Standard. But we found out that we cannot checkmate the raising unemployment rates, So we decided to move a bit away from the standard and create a new standard to fix it. Well We achieved the obvious results in increasing the number of jobs. Like everything else you need to lose something to win something else. So, We ended up having more inflation.

Well, Now the question is about “Trust”. Whom to trust?

“When exposing a crime is treated as committing crime, whom are we being rules by. Here the problem is about a group of people who can keep on inflating the prices by creating more money. But you or me wont know where all this money is going.”

So, Here we are looking at some cryptographically secure and trust less ecosystem named #Blockchain which we can use inorder to create more digital currencies which actually hold certain value.

“Value is created once someone believe in something.”

If people believe in some digitally secure and trust less cash with limited supply. It will create value to such a digital peer 2 peer cash. One such classic example is #Bitcoin.

To be continued…

Fundamentals of Money !! was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.