Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Mr. Crypto’s Wild Ride

Looking at the starting and ending market caps of this week, you may think that it was a relatively uneventful seven days. The market shed less than two percent of value, placing the total market cap at around $122B. However, the middle of the week saw the market plummet nearly five percent in six hours before regaining that loss nearly as quick about a day later.

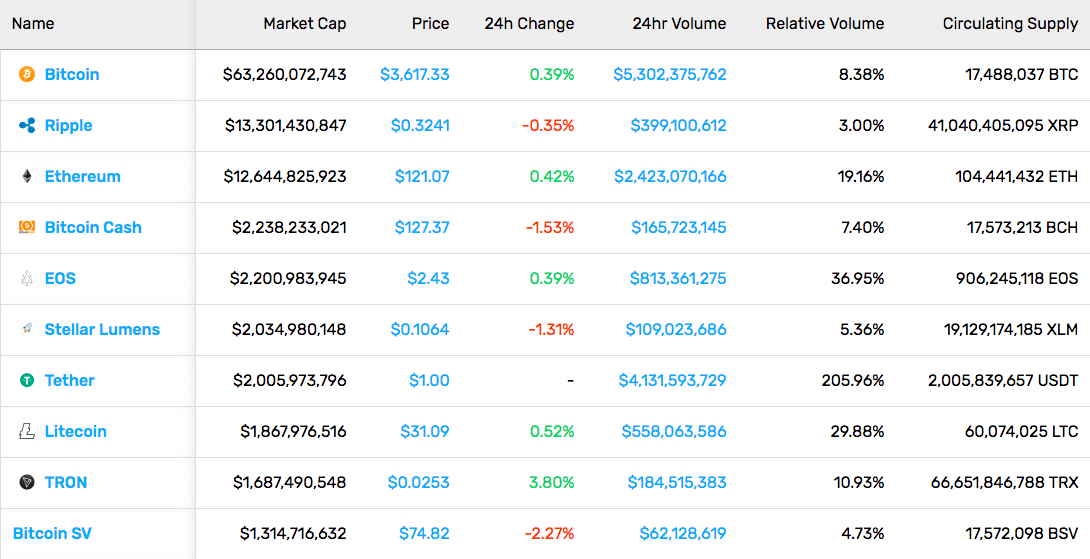

Cryptocurrency Market Stats (1/18/19)

Most individual cryptocurrencies stayed within single-digit gains and losses. A few exceptions were Augur (56.85%), Chainlink (20.45%), and TenX (78.94%). As for our top three:

Bitcoin continued its price stability with a price drop of just 0.96%.

XRP dropped 2.54% during the week.

And, Ethereum came up short with a 3.86% loss over the past seven days.

Wyoming to Potentially Tokenize Stocks: The Equality State is once again on the forefront of positive cryptocurrency legislation. This week, members from the House created Bill 0185, which would legalize the tokenization of stock certificates for corporations. Beyond stock issuance, the bill would make voting via blockchain legally binding as well.

This bill isn’t Wyoming’s first piece of crypto legislation. As we’ve reported previously, the state has proposed bills loosening the regulations for ICOs, classifying tokens as their own asset class, and creating a technology sandbox to test blockchain technology without overwhelming regulatory oversight.

Blockchain companies are beginning to notice too. IOHK, the development company behind Cardano, has announced plans to relocate from Hong Kong to Wyoming.

College Nerds Challenge Bitcoin: And when we say nerds, it’s in the best possible way. Professors from MIT, Stanford, and Berkeley are attempting to create a new cryptocurrency that blows Bitcoin’s transaction speeds out of the water without sacrificing the core decentralization principles of crypto. The new crypto, Unit-e, will allegedly process up to 10,000 transactions per second utilizing a new form of sharding.

Unit-e is the first project under Distributed Technology Research, a non-profit for creating decentralized tech and backed by investors such as Pantera Capital.

Same song, different chorus. This attempt isn’t the first (and won’t be the last) try to dethrone king Bitcoin. We’ll have to wait until the coin’s launch later this year to see if it lives up to the hype.

People Saying Things

Soto vs. SEC: Darren Soto, blockchain’s biggest fan on Capitol Hill, told Cheddar this week that the SEC shouldn’t have jurisdiction over most cryptocurrencies. He believes that “securities laws can be very intense” which inhibits the growth of blockchain technology. The Congressman has also put his money where his mouth is, introducing two bills that would help to place the U.S. at the top of the blockchain food chain. Your rebuttal, SEC.

JP vs CZ: Exchange owners had quite a lot to see in response to Cryptopia’s recent hack (see below). Binance CEO Changpeng Zhao (CZ) outlined the risks of storing funds yourself, encouraging users to only store coins on reputable exchanges or, even better, decentralized exchanges (DEXs).

Store coins yourself. You fight hackers yourself, and guard from losing wallet yourself. Computer breaks, USBs gets lost.

Store on an exchange. Only use the most reputable, proven secure, exchanges.

Or move to DEX, disrupt ourselves. https://t.co/Ci4ux9I3VD

— CZ Binance (@cz_binance) January 15, 2019

Kraken’s CEO, Jesse Powell, doesn’t agree. Following CZ’s tweet, Powell pleaded with followers to “not store more coins on an exchange (including [Kraken]) than you need to actively trade.”

PLEASE do not store more coins on an exchange (including @krakenfx) than you need to actively trade. Use @LedgerHQ or @Trezor. DEXes are not a panacea — look at The DAO. Open source just means exploits will be discovered sooner (probably not by good guys). 🙏 https://t.co/LmzhtCjpM0

— Jesse Powell (@jespow) January 16, 2019

Always remember: Not your keys, not your crypto.

Mexican Narcos Are Using Chinese Crypto Money Laundering Syndicates: It’s a story so good, it should have its own Netflix series.

What Is Nimiq (NIM)? The Browser-Based Blockchain: Hard to spell but easy to access. Check out our guide on the browser-based cryptocurrency.

Blockchain Land Registry: The New Kid on the Block: From Vermont to Dubai, recording your land ownership on blockchain is on the rise.

What Is Theta Token (THETA)?: Share your bandwidth and your videos with this soon-to-launch blockchain.

Ethereum Classic, Consensys, Bitmain, and More: Crypto Startups Are Feeling the Price Dip: If you thought you were hit hard by this bear market, wait until you hear about these heavyweights.

Ethereum Constantinople Fork | What You Need to Know: Everything you should know about the upcoming delayed Ethereum hard fork.

CryptoCompare | An Overview of the Cryptocurrency Market Data Provider: Learn about the one-stop shop for all of your cryptocurrency data needs.

Interview: Zilliqa Team on Sharding, Scalability, and Secure Smart Contracts: The Zilliqa team gives there opinion on the three big S’s of blockchain today.

Blockchain Uses | Where Can Crypto Make a Real Difference?: People commonly tout some ridiculous uses for blockchain. These are the ones where it can make a real difference, though.

Unbundling CryptoNight and the Enigmatic CryptoNote: A guide to the technology powering some of your favorite privacy coins.

Crypto Tax Havens: A Beginner’s Guide to Lenient Crypto Tax Locations: Don’t want to pay taxes on your crypto? It may be worth fleeing the country. (Just kidding, of course)

The First Hack of 2019 Goes to…: *cue drumroll* Cryptopia! On Tuesday, the Cryptopia team notified users via Twitter that they had “suffered a security breach which resulted in significant losses.” The exchange has since paused operations, putting the site on maintenance mode until they figure out exactly what happened.

— Cryptopia Exchange (@Cryptopia_NZ) January 15, 2019

Although the exchange and law enforcement haven’t disclosed the total amount of stolen funds, estimates range anywhere between $3 million and $13 million. The thief apparently tried to move a portion of the stolen goods to Binance, in which they were promptly frozen, according to Binance CEO Changpeng Zhao (CZ).

Need Representation, Eh?: Our great neighbor to the north now houses its first ever all-crypto law firm. Based in Toronto, the firm was started by Addison Cameron-Huff, a prominent cryptocurrency lawyer. Before starting the firm, Cameron-Huff served as a lawyer for numerous crypto startups and token-based companies.

The firm implements a fixed fee for a suite of services from “deal-specific advice” to “assistance with DMCA takedowns.” Because cryptocurrency is still within a legal gray-area in Canada, the firm should stay plenty busy over the next year.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.