Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

I cringe every time I have to step into a bank. I dislike every aspect of the experience from the polluted lighting, long queues, lack of privacy, to their demeanor of probing why I want to access my money. It’s a nightmare, but that’s only a small part of the problem.

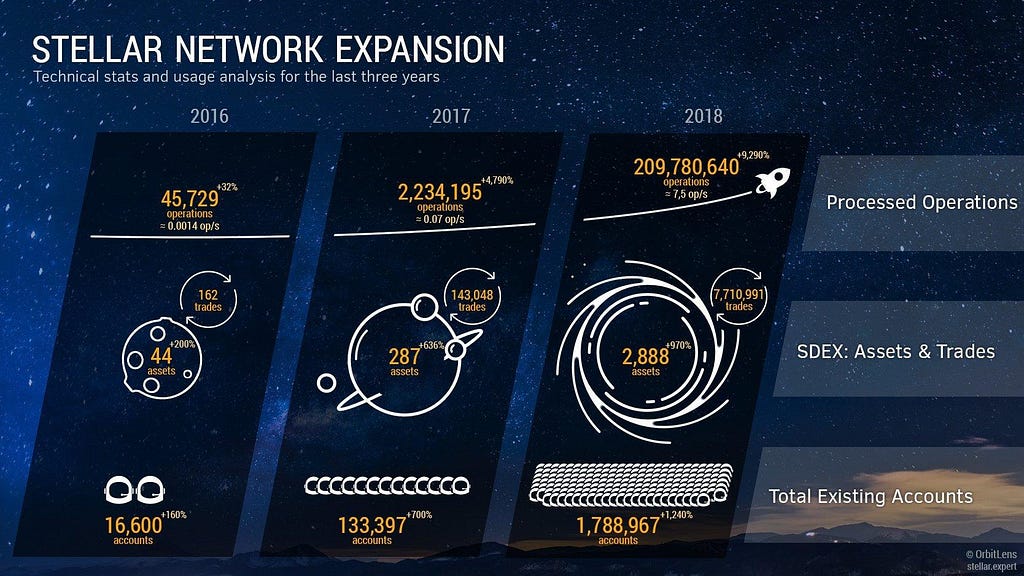

The world’s current financial infrastructure is littered with inefficiencies that contribute to high transaction costs, slow money velocity, and lack of global inclusion. These gaps have curtailed growth of communities and leaves billions of people financially underserved. One of my favorite projects that solving these problems is the Stellar Foundation. They realize that society needs a worldwide financial network that is open to anyone, internet like speed and cost for money transfers, and ensures integrity of transactions. I believe that they are offering new elements that can augment or enhance existing financial systems to modernize the global financial infrastructure.

Basics:

- The Stellar project started in July 2014 based out of San Francisco.

- The Stellar is an open-source, decentralized protocol for digital currency to fiat currency transfers which allows cross-border transactions between any pair of currencies.

- A unit of digital currency on their blockchain is referred to as Lumens.

- Ticker: XLMPrice: $.10Ranking by Market Cap: 7Market Capitalization: $2,026,558,238 Circulating Supply: 19,127,012,671 XLMMax Supply: 104,642,624,134 XLM24hr Trading Volume: $90,391,551

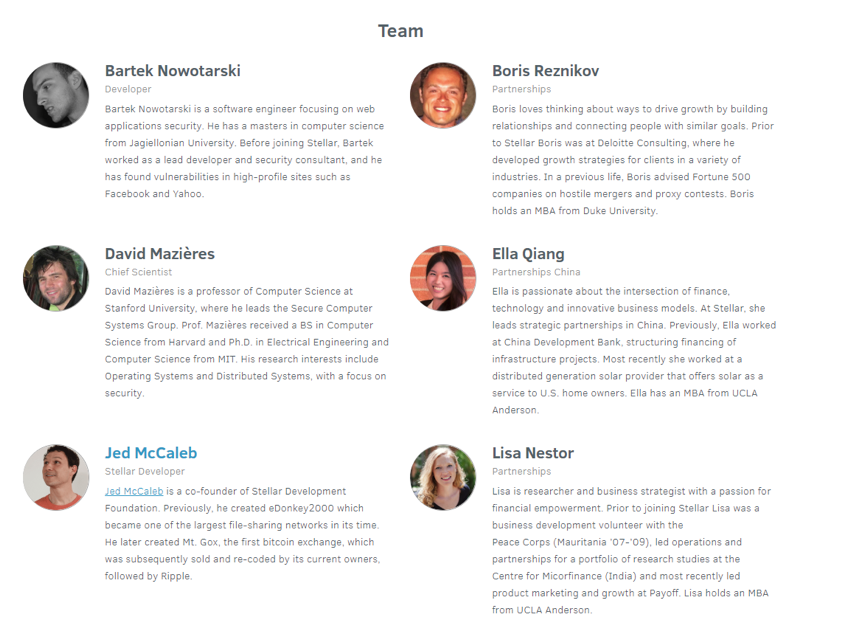

Team:

- The Stellar team is lead by legendary Jed McCaleb. His previous work includes creating the first bitcoin exchange, Mt. Gox, and cofounding Ripple.

- The Stellar’s CTO is Nicolas Barry. Previous to Stellar, he helped build large scale systems at Microsoft and Salesforce.

- The Stellar core team has an additional 7 blockchain developers and engineers.

- Rounding out the Stellar core team are 4 business developers, strategists, and marketers.

- Advisors to the Stellar project include:

- Patrick Collison: CEO of Stripe

- Naval Ravikant: Founder of AngelList

- Sam Altman: President of Y Combinator

Drivers of Growth:

- Stellar uses a new consensus model called Federated Byzantine Agreement (FBA). FBA is able to overcome adverse conditions through quorum slices, which means consensus can be reached if an adequate number of nodes conclude that a transaction is valid. Slices bind the system together, similar to the way individual networks’ peering and transit decisions now unify the Internet.

- FBA sets the stage for the Stellar Consensus Protocol (SCP) to confirm and validate transactions, which allows it to enjoy four key properties simultaneously:

— Decentralized control. Anyone is able to participate and no central authority dictates whose approval is required for consensus.

— Low latency. In practice, nodes can reach consensus at timescales humans expect for web or payment transactions — i.e., a few seconds at most.

— Flexible trust. Users have the freedom to trust any combination of parties they see fit. For example, a small non-profit may play a key role in keeping much larger institutions honest.

— Asymptotic security. Safety rests on digital signatures and hash families whose parameters can realistically be tuned to protect against adversaries with unimaginably vast computing power.

4. The Stellar network can handle more than 1,000 transactions per second compared to Ethereum’s 25 TPS.

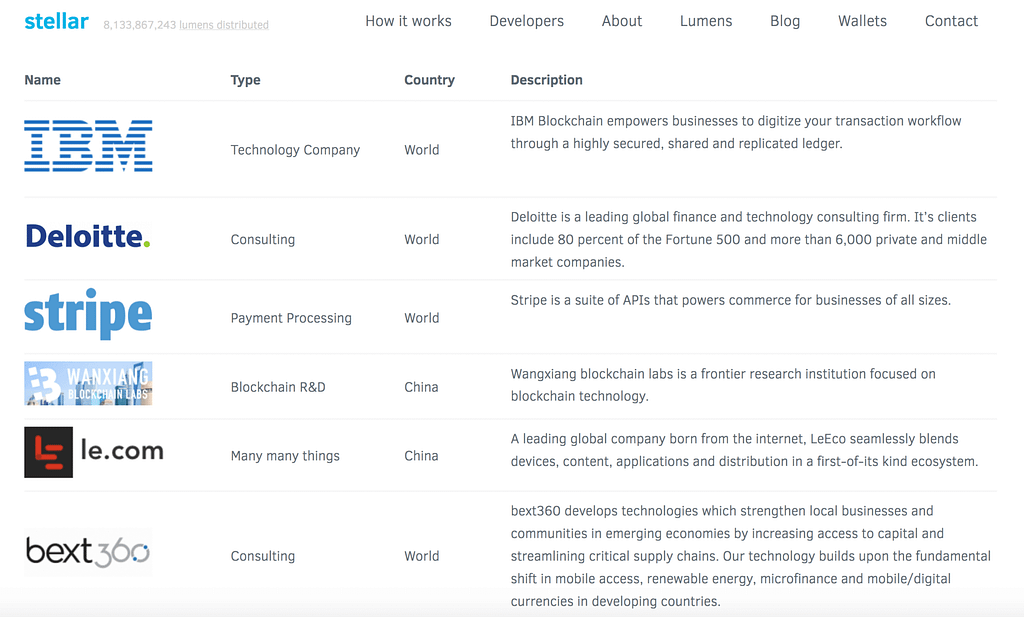

5. Stellar has established a strong partnership with IBM, that is helping them develop their Blockchain World Wire product or Universal Payment System. IBM’s blockchain division has also confirmed that they will be using the Stellar Lumens (XLM) as a unit of account for their payments infrastructure.

6. The Stellar foundation has recently had the New York Financial Regulators approve trading for Lumens, which means that Lumens is not considered a security.

7. StellarX, a Stellar-based zero-fee decentralized crypto exchange, has fully launched in September for public use. StellarX positions itself as a fiat onramp, which allows individuals to deposit U.S. dollars directly from a U.S. bank account. They are marketing themselves StellarX similar to Robinhood, as Stellar promises to refund all network fees for their users.

8. Through the Stellar/IBM collaboration, IBM has already partnered with dozens of private and central banks, especially in the Asia-Pacific region. IBM’s head of Blockchain Solutions, claims that they are very close to helping a central bank move fiat currency onto the Stellar blockchain. There is a fair chance that the IBM/Stellar partnership could replace the decrepit SWIFT/IBAN payments infrastructure.

9. A renewal energy startup, Veridium, is partnering with IBM and Stellar to tokenize the global carbon credits market. Veridium is working on integrating their native token, VERDE, with oil and gas trading platforms to automate the process of offsetting carbon emissions.

10. Stellar based project, Stronghold, is helping develop a USD stable coin for the network. Stronghold accepts deposits in the form of USD, and can issue tokens of any kind on the Stellar network, including Bitcoin, Ethereum, and USD. Stronghold is also partnering with PrimeTrust to secure the funds, which helps legitimize the project.

11. Tempo, a European money transfer company, successfully transitioned to the Stellar network. This means that anyone who owns XLM can send money throughout the Tempo network directly from a Stellar wallet. The service is being tested in the Philippines, which is one of the biggest remittance markets in the world.

Also, Tempo’s partnership with Stellar may mean that Stellar is now the cryptocurrency with the largest real-world network. Tempo has 300 locations across Europe where lumens are now for sale with their network currently active in 120 countries and utilized by 195,000 affiliates.

12. Other notable blockchain projects based on the Stellar Network: Open Garden, TillBilly, Slice, Sure Remit, Smartlands, Chynge, Modius. All doing cool things to expand the Stellar network.

13. Stellar executed a clever acquisition by purchasing Chain, now referred to as Interstellar. Chain allows the Stellar network to have payment channels that enable two parties to carry out transactions between themselves privately, instantly, and securely. These transfers are not charged a fee as they are not executed on the main chain.

15. Stellar has also entered into a formal collaboration with The Industrial Credit and Investment Corporation of India (ICICI), a top banking and financial service provider in India. India offers Stellar a very tactical advantage as they have one of the world’s largest populations, most of which are unbanked. Lumens could very well be the vital bridge currency for transactions involving banking the unbanked in India.

Headwinds:

- Stellar does face real competition from another blockchain based startup, Ripple. However, it’s still very early in the space so both of these project can coexist and thrive.

- The success of this project will not only be determined by how good Stellar’s product is but also whether it will be user friendly. In other words, will they be able to reduce the barriers to entry enough to bring in less technical people.

- Since regulation will always trail innovation, the digital currency space can be subject to new regulations in the future.

Conclusion:

The Stellar project is transforming the way cross border payments work, by modernizing the global financial rails. This allows financial institutions to send and settle payments in a matter of seconds, while eliminating the inefficiencies that have hampered the growth of so many global communities. By leveraging Lumens, Stellar is able to integrate payment instruction messages, settle proposed transactions, and exchange value in near real-time at a fraction of the cost of traditional banking.

For more insights be sure to check out my website:

15 Ways Stellar is Modernizing Global Financial Institutions was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.