Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

It’s easy to believe that you understand something just because you’ve heard the term a bunch of times. At the surface level, this is true. You know what a stethoscope is, because you’ve seen a stethoscope and have seen it being used.

At a deeper level, however, there’s a knowledge of what a stethoscope is for. That is, a stethoscope allows you to listen to the sounds made by the body and get clues as to how it’s functioning. A kid may have seen stethoscopes and can maybe even identify one, but not understand what it’s for.

Most people know Bitcoin at the surface level; they know that it’s a form of money and maybe have even bought some. This article is for the people that understand Bitcoin at the surface level but want to understand it at a deeper level.

Scarcity

Resources that are scarce tend to be valuable. Money, in particular, needs to be scarce as an abundance of money would cause everything else to rise in price and make it impractical for use in trade.

There is a dichotomy between two very different kinds of scarcity. On the one hand, you have centralized, artificial and controlled scarcity. On the other hand you have decentralized, natural and uncontrolled scarcity.

Centralized scarcity is the result of a central authority producing or issuing the item. Everything from numbered prints to taxi cab medallions fall under this category as some central authority makes the item. Counterfeiting can be a big danger to this category of scarcity as it’s generally cheaper to counterfeit the item than to buy the item on the market.

Decentralized scarcity is something that occurs in nature. Diverse things such as salt, glass beads, seashells and gold have been scarce in this second sense. These are things that take a lot of effort to procure and generally cost a lot to produce. These are not things that are easy to counterfeit. It’s not a coincidence that all of those things listed above have been used at some point as money. Only when the cost of production of these goods go down or get outcompeted by something else do scarce things of the second type stop being money.

The distinction here is crucial. Centralized scarcity is qualitatively different than decentralized scarcity. Controlled scarce things can lose value through the will of the controlling authority. Uncontrolled scarce things cannot easily lose value and usually requires some significant technological breakthrough or forced confiscation to do so.

Digital

Until Bitcoin, there was only one kind of scarcity in the digital realm: centralized/artificial/controlled. In a sense, this is to be expected since the entire digital realm is created by human beings and there’s little reason to believe anything decentralized or natural or uncontrollable exists within it.

Because digital things are made of 1’s and 0’s, they are generally easy to copy. We can categorize digital items into two classes: infinitely copyable items and scarce, but centralized items. You have stuff like mp3s which can be replicated over and over again an infinite number of times and you have stuff like World of Warcraft gold which is controlled by a central authority.

Enter Bitcoin

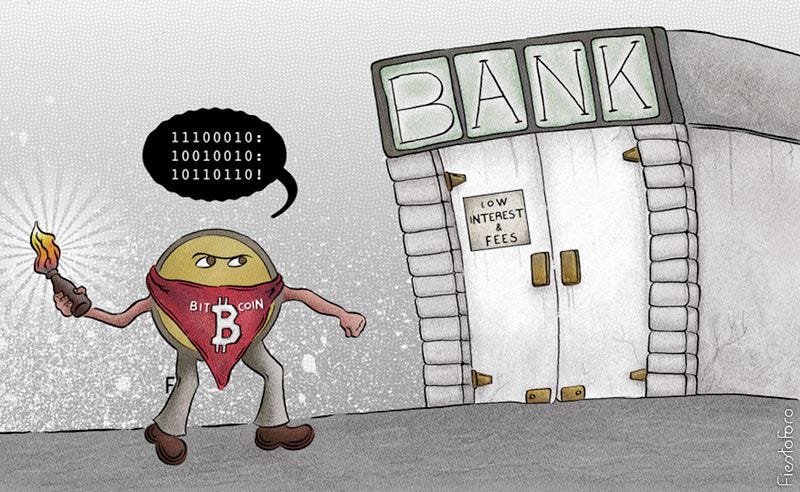

The innovation of Bitcoin was that it brought decentralized scarcity to the digital realm. Nobody knew that was even possible before Satoshi Nakamoto’s invention in 2008. So how can this possibly be? What natural, decentralized and uncontrollable things exist in the digital realm?

The answer is proof-of-work. Proof-of-work is often talked about as a “difficult math problem” or “consensus algorithm”, but the best description is what most Bitcoiners call the proof-of-work finding process: mining.

In gold mining, dirt and rock are processed to find gold. Generally, around 45 tons of dirt and rock are crushed, treated and sifted to obtain 1 ounce of gold. The overall cost of doing this generally is just a little bit under the price of 1 ounce of gold. Yet the cost to verify that the ounce of gold is really gold (via touchstones, chemical tests, etc) is minute compared to producing it. In other words, the cost to produce gold is high, but the cost to verify that it is gold is fairly low.

Proof-of-Work is much like that in the digital realm. There’s something called a nonce (aka number-used-only-once) that is provably hard to find which satisfies a particular equation. The overall cost of doing this, like gold mining, is just a little bit under the price of Bitcoin’s block reward and fees. However, verification is insanely easy and cheap. Like gold, proof-of-work is expensive to produce, but cheap to verify.

In a sense, Bitcoin uses mathematics as the decentralized, natural and uncontrolled scarcity that allows for good money.

Conclusion

Bitcoin is something that is natural, decentralized, uncontrolled and digital. This is something that didn’t exist before Satoshi invented it in 2008 and I would argue, doesn’t exist with any other cryptocurrency. This is the key to Bitcoin’s usefulness as money. Scarcity is the first thing that’s required without which its proposition as money crumbles.

In the next part of this series, we’ll cover Bitcoin’s properties as money and how it’s superior to its competitors.

What is Bitcoin? (Part 1) was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.