Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Coinvest is an American startup that is developing a suite of products and tools for crypto investors and traders. Their aim is to automate and simplify the investing and trading experience for users at all levels.

In this guide we will cover the following:

- How Does Coinvest Work?

- The Purpose of the Coinvest Token

- Coinvest Team and Roadmap

- Coinvest Token Trading History

- Where to Buy COIN

- How to Store COIN

- Conclusion

- Additional Coinvest Token Resources

How Does Coinvest Work?

There are currently seven different products either publicly available or in development. We will take a brief look at each one.

CoinDNA

This is an interface that presents news, price data, and analytics to users. Right now it is free to use and is available for mobile. The main purpose behind the service is to educate users to make more informed investments and trades. Coinvest clearly sees this as a useful supplement to their trading and investment products.

Coinvest

This is Coinvest’s signature product, a wallet with a built-in trading market. The wallet itself is useful in that it means users can store their different crypto assets all in one place. However, it is the built-in market that offers the true value. The platform allows users to invest in multiple cryptocurrencies in one place. More impressive is the fact that users can create their own personalized index funds while only holding the COIN token. There is limited information right now on the exact mechanics of this.

Coinvest Plus

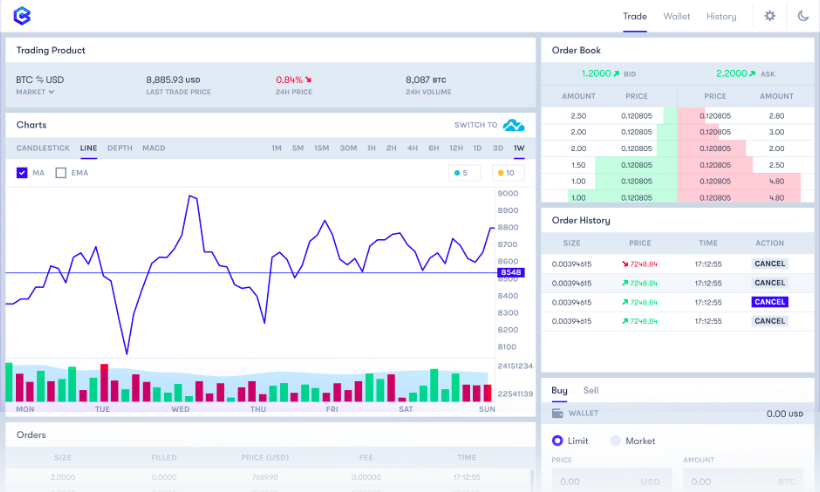

Coinvest Plus is an upgraded version of the Coinvest trading market. It offers an advanced trading platform for more sophisticated traders and investors. Currently, the exchange offers 14 different trading pairs and the ability to set limit and market orders. Instead of percentage-based fees like most other exchanges use, Coinvest Plus charges a flat $4.99 fee per trade. While this functionality currently offers little more than other exchanges, there are plans for several additional services, namely short selling, margin trading, futures contracts and options. There are still very few exchanges offering that level of functionality in the crypto industry so this certainly sets Coinvest Plus apart.

Coinvest Plus user interface

Both Coinvest and Coinvest Plus use a decentralized setup. Instead of the company having access to funds and storing them in a centralized location, the entire service is done via smart contracts, and funds are stored in escrow. For instance, whenever you close an investment or a trading position, the smart contract is deployed and allocates all appropriate funds to your wallet. This means that in theory, your funds should be safer from hackers and costs should fall as it does not require human oversight.

Coinvest Safe

This is a simplified, child-friendly software wallet. Unfortunately, it is not currently available. Given the often complex user-interface of many wallets, families should appreciate a child-friendly service as they look to encourage cryptocurrency saving with their children.

Coinvest Vault

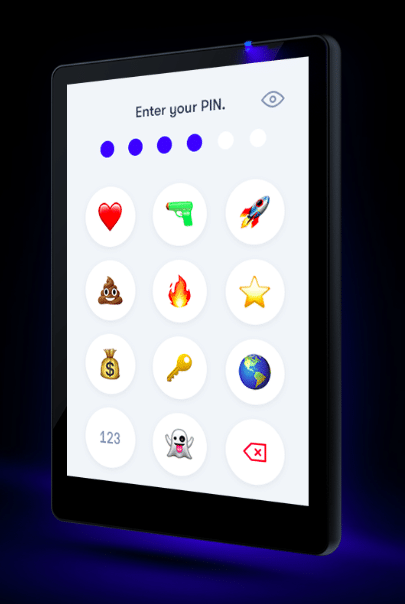

The Coinvest Vault is a simple hardware wallet for users who want stronger security for their crypto assets. Pre-orders are now available. It is very small, the same as a standard credit card and importantly is fully integrated with all the other Coinvest products and services. This means users can enjoy top-level security while taking advantage of the functionality of products like Coinvest Plus. We are not sure at this stage how it will compare in security to other hardware wallets.

Home screen of the Coinvest hardware wallet

Coinvest Debit

Although not currently available, this is a debit card that allows you to spend your COIN and other cryptocurrencies in any supporting store. The hope with Coinvest Debit is to add additional functionality to the COIN token as a means of payment.

Coinvest Commerce

This is a simple API that helps merchants accept COIN as payment for goods and services. Again, this is also not yet available, but just like Coinvest Debit it should increase the value and use case of the COIN token.

The Purpose of the Coinvest Token

The COIN token is essentially a utility token with which users can access the Coinvest services and use as payment via their merchant services. Furthermore, because you can use it to gain access to a range of crypto assets via index funds, COIN assists Coinvest’s aim of simplification.

Out of a total supply of 107,142,857 tokens, just 11,900,835 are currently in circulation, which at 11.1 percent is a very small amount compared to most other utility tokens on the market.

Coinvest Team and Roadmap

Coinvest’s team is relatively small, currently consisting of just four members. However, they do have two advisors as well as eight partners, including Quantstamp and Gemini.

In 2019, the team is aiming to acquire a banking license and a broker/dealer license, as well as going live with all seven products and adding additional functionality, especially for Coinvest and Coinvest Plus.

Coinvest Token Trading History

COIN has only been trading on public markets since 31st July 2018. It reached its all-time high of $0.6381 on 9th November 2018 and today trades at $0.1470.

Aside from its all-time high that it swiftly retraced from, COIN has been generally range bound since trading publicly and surprisingly has not shown a strong trend correlation with the rest of the cryptocurrency market. This could be as a result of its very low volume and extremely limited exchange support.

Investors may well be encouraged by the relative price resilience that COIN has shown this year.

Where to Buy COIN

Unfortunately, COIN is a fairly difficult token to acquire. It currently only trades on IDEX with any reasonable volume. Even then, according to data from CoinMarketCap, its 24-hour trading volume ranges between just $150 to $250.

Investors should be aware that, you will not be able to purchase large amounts of COIN without moving the market price. You would be wise to split your order up into smaller orders over a period of time so that you do not pay more than you need to.

How to Store COIN

COIN is an ERC20 token and so can be stored on any wallet that supports this Ethereum standard. Of course, you could simply store it on one of Coinvest’s own wallets, whether that be their hardware or software options.

If you wanted to take storage outside of any of Coinvest’s wallets, then we would recommend using MyEtherWallet, which can be used in conjunction with a secure hardware wallet like a Trezor or Ledger. This combination offers you premium level security and an easy to use interface.

Conclusion

Coinvest is trying to position themselves to be able to offer education and research tools, investment management, asset storage and trade execution all under one roof.

Whether they can offer products that can satisfy the entire spectrum of these ambitions is yet to be seen. However, they have managed with a very small team to already release initial versions of their most innovative products and have an exciting roadmap for 2019.

The COIN token itself is a standard utility token and makes sense for network access. This functionality is easy to see working. However, whether it can be used also as a payment token as Coinvest intends is less certain.

Additional Coinvest Token Resources

Fortunately, Coinvest has many channels where you can stay up to date with their latest developments:

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.