Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

People buy bitcoin because it is a system of money that corresponds to how humanity has exchanged value for most of our history. Technologically, this system is based on mathematical formulae and a straight-forward verification and record system. The implications are spectacular: you can now trust exchanging value with another person or institution directly, even if you don’t know them.

In terms of values, the crypto system is profoundly natural, a very human invention, based on the concepts of freedom and fairness. It is the most authentic form of money humanity has had since value was based on memory. It is characterised as set out below.

- Based only on PV money (i.e. value that exists today, not tied to any required future value creation).

- Allows value to be exchanged directly between two parties without any bank middlemen, almost instantaneously and at extremely low cost.

A better description than the term crypto currencies is honest money. This money system is about more than just exchanging value; it is also about our values. The crypto system is digital technology to banking and paper money’s analogue technology. The potential, the combination of value and values, that this new (old really) system unlocks for humanity is hard to overstate.

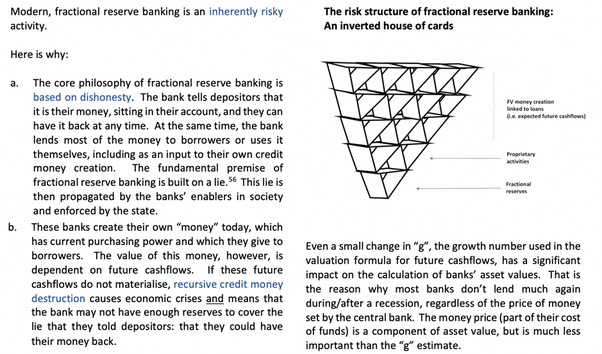

The fractional reserve banking system is intrinsically dishonest: bankers will tell you that your money is both safely in the bank and, at the same time, they are lending it out to others. They will tell you that it is your money while, legally, it belongs to the bank and they can do what they want with it.

Why is bitcoin superior to other currencies?

Bitcoin is a superior product to nation state currency and the fractional reserve banking system, for these reasons:

- lower cost (transaction costs much lower than bank transfers)

- more convenient (you transact directly, cuts out the bank/credit card company middlemen).

- fixed supply.

- Greater alignment with our better human values.

The crypto system is digital technology. Traditional banking/payments is analogue technology, that cannot be upgraded; the entire architecture is antiquated 1970s technology cobbled together in a fit of absent-mindedness.

Why is limited supply important for a currency?

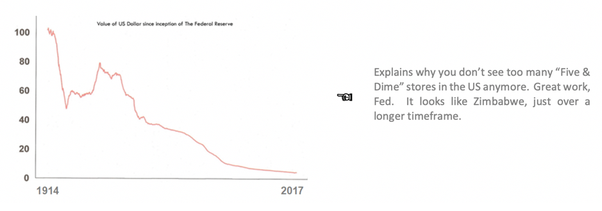

A currency that does not have limited supply is subject to inflation. Inflation is simply a way of measuring a reduction in your purchasing power. It is better called a Theft Index and is essentially a transfer of value from holders of nation state currencies to debtors. Usually, this happens just a little bit at a time, so you don’t notice the missing money and don’t freak out. Debtors benefit from inflation because it means that they have to repay less value, in real terms.

Here is a chart of the purchasing power of the US dollar since the inception of the Federal Reserve to the end of 2017.

If you hold any nation state currency that doesn’t have a fixed supply, it is guaranteed that you will lose value. The US dollar has lost 95% of its value since the establishment of the Federal Reserve System in the US (which happened regardless of whether the country was on the gold standard or not).

What can bitcoin do for society?

Crypto currencies allow low income people to access a financial system.

In the future, low income people everywhere will do their banking using the crypto system.

The fractional reserve banking system has completely failed low income people. Of course, most poor people are not even accepted by these banks. The crypto system has significantly lower fixed costs than the traditional banking system and, consequently, allows everyone to benefit from financial inclusion. The poor will be able to make transfers at extremely low cost. Emerging crypto banks will allow them the benefits of the savings function, giving them the first opportunity ever to climb out of poverty. The effects for poor communities globally will be transformational.

Here is a typical example of how banks treat those poor people who are fortunate enough even to have bank accounts.

Bank of America will charge low-income customers $12 per month for their checking accounts unless they have a $1,500 account balance. @laura_nelson, Twitter, 2018

Finally, a bank with some fresh ideas on how to make poor people poorer. @kashanacauley, Twitter, 2018

Here is how blockchain is helping refugees.

The UN’s World Food Programme uses blockchain technology to provide identity and has distributed millions of dollars in food vouchers to tens of thousands of Syrian refugees in Jordan since May 2017. “The major benefit to the food program so far is a large drop in payments to financial services firms, the usual middlemen for transactions. Such fees have dropped ‘significantly,’ according to Houman Haddad”, the WFP executive leading the project. Quartz 3 Nov 2017.

Note the major benefit: “the major benefit to the food program so far is a large drop in payments to financial services firms.” And what do banks think about bitcoin? A scam, used for buying drugs, money laundering.

Imagine them telling the truth: Well, people use it to make the lives of refugees better. Worse, it reduces the profits we make getting money to these refugee camps. So, it is really terrible.

Asking a banker or central banker or their enablers what they think of bitcoin is like asking a taxi driver what he thinks about Uber.

People like Jamie Dimon or Warren Buffett — one of the largest shareholders in Bank of America mentioned above.

Maybe some people don’t like the show of greed and all of the dodgy characters who tried to use crypto currencies to raise money, mostly for ill-considered projects, in 2018. No one does. But, you need to look beyond them to what bitcoin and blockchain can do for society.

In the future, you will have to decide: do I stand with a community of people who want to make a better world, or do I stand with the 1% and their system of money and banking?

Twitter: res_crescofin

Why do people really buy bitcoin? was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.