Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Photo by Cristian Newman on Unsplash

Photo by Cristian Newman on Unsplash

2018 was an interesting year for crypto. The year started on a high with bitcoin valued close to $20k. Then, the rollback began. When the drop started in January, only very few actually believed it would last the whole year.

Hodlers made money in 2017, but 2018 appeared to be the heaven of the short sellers. The most interesting part of the year was the disbelief of the market downtrend among many within the ecosystem. When bitcoin seemed to stabilize above $11k, the chants began;

“buy the f***ing dip!!”

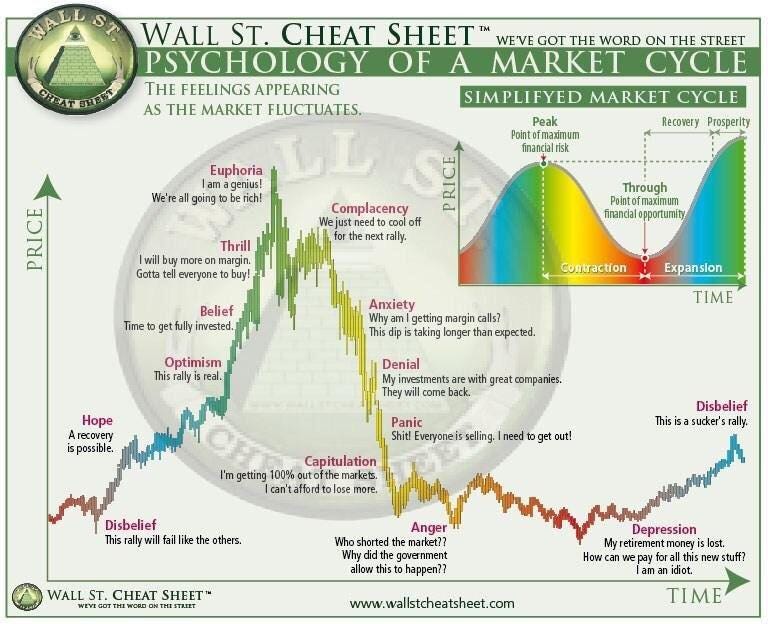

Now, the event looks so ridiculous today but it is just as true. It reminds me of the chart below, although I do not agree with everything on the chart.

Well, the year progressed and the $10k barrier was broken. There was a long idling at that level before it sank significantly lower to $6k. At $6k, there was quite the calm. Almost nobody was chanting, “buy the f***ing deep”. People began salvaging their losses. The evangelists of “bitcoin will go to zero” began to gain an audience. Most started questioning their choices. And you know the rest of the story; the market went below $4K and very close to $3K.

Here is the interesting part, most people would have lost much less than they did if they had not been hopeful. The whole idea of buying the dip is to sell the top. Now, many were required to sell the bottom because of taxes. I’m not saying they should have sold earlier, I am saying that if they had a sound strategy and stuck to it, the results would have been different.

The crypto market is not a place for hope; hope in the technology, but you have to be smart about what you do with your money

I did make some “not-so-smart” decisions also. I hinged my strategy solely on a bullish case. When the year was bearish, I had to readjust my expectation to a much longer term and had to do something different in the short term. One of the wrong decisions I observed was keeping my gains in bitcoin and not in one of the USD stablecoins. This is a decision that should be avoided if you are in for the short term.

Buying the dip is overrated. This is because the dip often times get deeper. Instead, having a portfolio strategy is important. A strategy tells you what to do at every turn of the market. You can create a chart and list all possible turn of the market, and then think of what you will do in every one of those cases. Also, you can pick a date of each month to take an action.

The number one rule of investing is not to lose money. Investing is not primarily a way to make money, but a way to preserve the value of the money you have.

You are an investor whether you like it or not. The question is, are you a good investor or a bad one?

There several forms of a proper investment portfolio can take. I consider this structure to be a good form. Make up your mind not to catch the falling knife. You can lose your money by investing it in “the next big thing”. But if you properly structure your investing, you might not be all-in on the massive bull runs, but the bear runs will have little or no effect on your money.

It’s 2019; although we are not expecting the bear to linger much longer, we ought to step up the game.

The 2018 Crypto Market Investing Review was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.