Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Many people haven’t heard of the decentralized web yet, but it brings with it a huge shift in how internet companies will be built, and one day, we’ll all be using it. But even among the decentralized web’s most ardent supporters, many people don’t understand why we’ll all be using it. Supporters will tout “censorship resistance”, “controlling your data” or “freedom” as the big advantages. As I’ll explain, the real reason decentralization will win is simply economics. It changes who owns the “inventory” of a marketplace from any particular company to all companies (ie. a common data backbone), which will lead to more competition, and naturally create better products and lower prices that consumers will love. A “decentralized Airbnb” might only be able to take 1% instead of 15%. A “decentralized Craigslist” might be forced to have a pleasant design.

This will happen because the decentralized web solves the natural tension between marketplace industries that tend toward monopoly, and the problems of monopoly companies. This will affect a huge swath of industries from taxis (Uber), to vacation rentals (Airbnb), loans (LendingClub), auctions (eBay), and more. Basically all marketplaces.

A house for rent on a real decentralized P2P marketplace, just like Airbnb, except 25% less expensive than normal.Primer

A house for rent on a real decentralized P2P marketplace, just like Airbnb, except 25% less expensive than normal.Primer

When I say “decentralized web”, I, and others, are referring to the web of “decentralized applications” and protocols that are built on top of any blockchain, such as Ethereum, or Cardano. The term “decentralized application” (‘dapp’) doesn’t have a rock solid definition yet, but for our purposes, it means an app that primarily uses data stored on the blockchain. It might otherwise look and feel just like a regular app.

Blockchains are a way to save data and do computations on that data through a distributed network of computers that aren’t fully controlled by any one central authority. In today’s world, if Facebook updates their app, and you don’t like the update, your options are to accept the update or stop using the app. Those are drastic choices. But in a decentralized world, if the Ethereum foundation puts out an update that people don’t like, then participants of the network have a third option. They can keep running the existing version, just like they did before. Ethereum can’t force anyone to upgrade. This effectively gives participants in the network a “vote” on every upgrade. Thus the control of the network is much closer to a democracy. Everyone can trust the network, without having to trust any particular central entity, and hence you get the term “decentralized”. As we’ll see, this change of power dynamics is critical.

Start screen of a decentralized browser which can block ads and automatically give micro payments (through crypto currency) to content creators

Start screen of a decentralized browser which can block ads and automatically give micro payments (through crypto currency) to content creators

Decentralized apps and browsers exist today. They’re clunky and no one is really using them yet, but a substantial community of developers and investors are actively working to change that.

If you’re curious for more blockchain background, I encourage you to Google around after reading this article. The internet provides.

What people are getting wrong about the decentralized web

The hype around the “decentralized web” is pretty lofty. It has been described by Wired as a “digital Garden of Eden that can restore freedom”. An MIT report on the topic touts “censorship-resistance as a major benefit”, and Tim Berners-Lee, the man credited with inventing the internet, “envisions [a new web where] users control where their data is stored and how it’s accessed”.

These are laudable goals, but all evidence suggests that consumers don’t care about these ideals nearly as much as the technologists who tout them. You can achieve most of those goals right now if you really wanted to. DuckDuckGo provides a great search experience without taking your data. FastMail provides excellent email service without your data. Millions of teens use Jott to text over a mesh network (no central server) for free. But they use it because they can’t afford data plans and they don’t have access to wi-fi in school, not because they need to evade government censorship. If consumers really cared about these things then those products would be the mainstream, not the alternative.

Fixating on freedom and censorship is a classic example of what Paul Graham has called “the mistake you [startup founders] will make”, which is getting caught up in the “vision” — privacy and freedom in this case — , while forgetting what your customers really want. Not everyone is getting caught up though. Chris Dixon gets it. He talks about it from a developer perspective. He says decentralized systems will win because they’ll win the “hearts and minds” of developers. He’s right, but let’s take this further, to what I would say is the even more powerful force — consumers. One thing Internet Explorer taught us is that, despite being hated by developers, those same developers still spent countless hours making sure their app worked on Internet Explorer 9, because consumers used it. Apple’s 30% tax in the App Store quantifies just how much power is wielded when you own the consumer. So until we’ve articulated why consumers will want the decentralized web, we won’t have the full picture.

The truth is that for most consumers, the technological “garden of eden” isn’t one that’s free from censorship. It’s one that’s easy to use. It’s one that has all the shows you want, has every apartment to rent, has all of your friends. And ideally, it’s free or cheap. This last part is exactly why the decentralized web will eventually win. Let me explain.

Shifting The Network Effect

When you want to buy and sell local things, you kinda have to use Craigslist. It doesn’t matter that their design sucks or that support is non-existent. Such is the power of the “network effect”, which can be defined as a product getting more valuable as more people use it. And so it is with Facebook, eBay, Airbnb, Uber, AdWords, and the list goes on. It’s not that someone can’t compete with them, it just wouldn’t make sense to. Two-sided marketplaces like these are actually better when there’s only one, or a few, places to go. Because then all the “inventory” of a given market (cars, homes, your friends, etc.) are in one place. Searching is expensive and the consolidation reduces that overhead. It’s inefficient to post your couch for sale in 25 different places. Having the industry agree on one place saves you that cost. It also allows for an “ecosystem” to develop around the center, like 3rd party apps, integrations with partners, etc. These all add value.

But if we all agree on one place, or company, then we effectively crown that company a monopoly, and monopolies are bad, right? Yes, without question.

Well damn. What we have here is a natural tension. On the one hand, consumers want the inventory for these industries in one place because it reduces search cost, and lets ecosystems add value. But on the other hand, consumers do not want monopolies because monopolies will, in the long run, over charge you or underserve you. So why not break up the monopolies? Well you could, but recall that doing so is actually worse for consumers, because you add search cost or reduce ecosystem value. How much worse are these added costs compared to monopoly? It’s hard to quantify, but as an upper bound, we can say Uber charges about 20%, Apple 30%, and Airbnb roughly 15% (of entire multi billion dollar markets) [1].

When I hear “why is the decentralized web going to win?”, I’m reminded of the famous James Carville quote, “it’s the economy, stupid!”

The blockchain, however, resolves this natural tension. The decentralized computing and storage offers a way for the inventory to cheaply be shared by all, while being controlled by no one. We get all the inventory in one place, without the monopoly. Said another way, the blockchain shifts the network effect away from any one company, and onto the decentralized web, allowing any company to be built on top of the same data.

What would happen to vacation rentals if any site had full access to every home on Airbnb? No one can say for sure, but it could cut costs, eliminate them, or even entirely shift business models. While there aren’t great examples today of industries built on truly public data, we do have a couple industries where some large subset of data is at least commonly shared by all competitors, and looking at those industries is super interesting in this light. Online home sales is one example (eg. Trulia, Zillow, Redfin). Each have partial access to the MLS database of homes, plus public data (eg. crime and school info). Zillow and Trulia, perhaps surprisingly, consider themselves “media” companies. They make money from ads, not commission. Redfin has their own agents, but they’re paid salary, and Redfin’s sale commission is 1%, about 1/3rd of typical agent rates. So there we have 2 with entirely different business models from traditional agents, and 1 with cheap rates.

Texting apps may be another example. In this industry, the “inventory” is your contacts. But unlike normal social networking, all the inventory is just stored on your phones sim card, accessible by any app. And this industry sees a plethora of apps, without any monopoly controlling the market. There are numerous players including Signal, Messenger, Telegram, Textra, WhatsApp, and I regularly use all of them. I don’t use 5 versions of Facebook.

It’s fascinating to consider the implications, but I don’t want to speculate too much. The key point is we’re talking about many multi billion dollar companies who’s fees may go down 10x (30% -> 3%), or potentially be eliminated. When I hear “why is the decentralized web going to win?”, I’m reminded of the famous James Carville quote, “it’s the economy, stupid!”

Example: The Lending Industry

For fun at a recent work hackathon, I built a demo app on top of a decentralized lending protocol called Dharma (I have no financial connection). It helped spur many of my thoughts here, so I’ll use it as an example to make the above concepts more concrete.

First, a primer on Dharma. Think of Dharma Protocol as a program that runs on the Ethereum blockchain just like Garage Band is a program that runs on Mac. Dharma’s purpose is to model the lending industry in such a way that others could build run-of-the-mill, centralized, profit-maximizing businesses on top of it. Imagine if eBay or LendingClub didn’t take any fees, and instead gave full, realtime access to their database, and then allowed others to build their own versions of eBay or LendingClub on top of that same database. This is something like what Dharma and other blockchain protocols enable with data that sits on the blockchain.

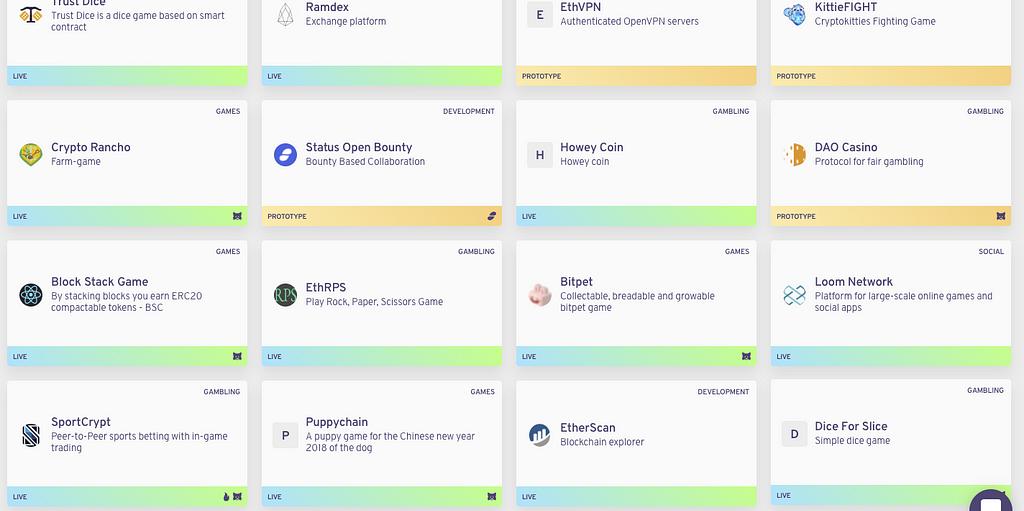

Screenshot showing a handful of the dapps and protocols currently available that are built on the Ethereum blockchain.

Screenshot showing a handful of the dapps and protocols currently available that are built on the Ethereum blockchain.

Dharma is actually one of thousands of protocols already built on top of blockchains. The term “protocol” here just means a set of agreements and concepts enforceable through code. Dharma contains concepts that other businesses can plug into. Concepts like “debtor” and “lender”. It contains concepts like a “marketplace” (which they call a “relayer”), and “underwriters” (who determine the risk level for a given loan request). It also automatically handles things like enforcing loan repayment contracts, and collecting collateral. Built into these concepts is the ability for each player to specify a fee. As in, the relayer can say they’ll take 0.5% of loan request value, and Dharma will handle it for them and deposit the money automatically. And all the data it receives, and computations it performs are available on the blockchain, for all [2].

If you’re asking how Dharma makes money, that’s a fair question. I asked them that too, and they told me they’re going for an “open core” model, which means the “core” product is open source and free, while they would eventually try to sell services to large enterprise clients. This model actually has strong precedent in the tech world, including RedHat (just sold to IBM for $34Bn), and Docker ($1.3Bn valuation). The dust hasn’t settled yet on protocol business models, but others are trying “bonding” (sort of like membership fees), ICO’s, transaction fees, and more.

Today, P2P lending has, unsurprisingly, only two key players. Unless you’re an accredited investor (which is basically no one), you’re probably going to Lending Club or Prosper, who together control ~60% of the market [3]. The same goes if you’re the debtor (i.e. you want a loan). As stated above, monopolies or oligopolies are exactly what you expect from these kinds of markets, because they’re better for consumers.

But as we discussed, when companies have that much market power, it typically makes things worse for consumers in one of two ways: abuse of power, or uncompetitive behavior. While the blockchain could certainly solve some of the first problem (see my footnote on the May 2016 LendingClub scandal where they doctored loan info, and their CEO and several other high level officials were forced to resign [4]), I don’t want to focus on that. I want to focus on what I think is the more pervasive “uncompetitive behavior”, which I think will have a much larger impact.

To illustrate that difference, let’s talk about prices. If you’re an investor, LendingClub charges 1% of your loan amount, and if your debtor defaults, they’ll take 30–40% of any amounts they collect for you (known as “collections fees”). If you’re a borrower, it will be 1–6%, probably averaging 3% “origination” fee.

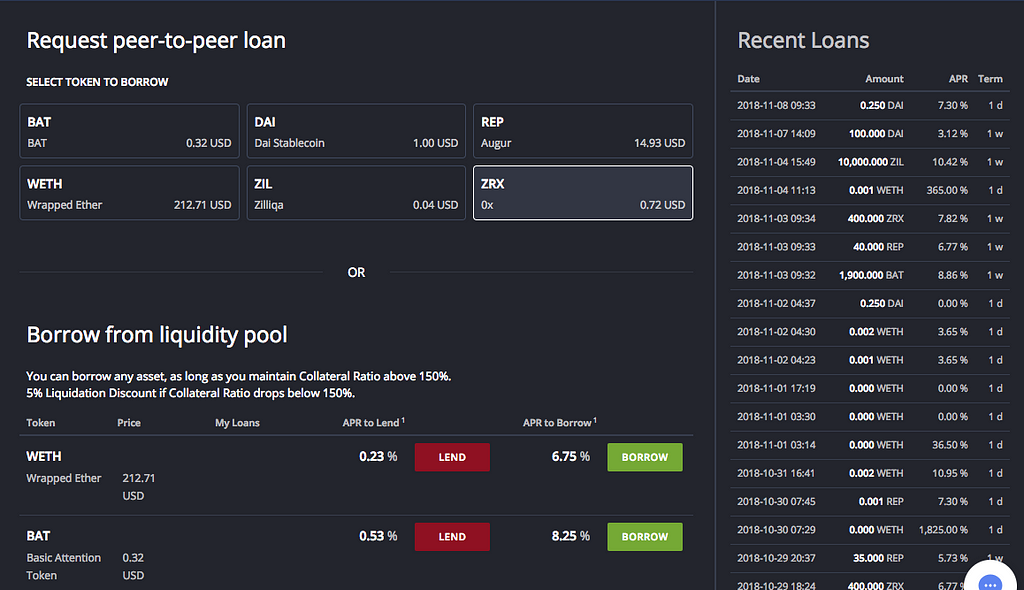

Screenshot of a real decentralized P2P lending platform, using Dharma’s protocol.

Screenshot of a real decentralized P2P lending platform, using Dharma’s protocol.

Now imagine that you want a personal loan, and instead of going to LendingClub to post your request, you go to Bloqboard — a real decentralized relayer, but again, I have no financial affiliation — and your request wasn’t just posted to Bloqboard, but also, if you want, automatically picked up by 20 other sites [5]. In such a world, all 20 of those sites are competing to fulfill your loan the fastest. Bloqboard doesn’t “own” your loan, or anything about it, so they’ll have to keep fees low to attract investors to come and fill your loan, which is when Bloqboard would take their cut. Now back to fees: As an investor, Bloqboard will currently charge you zero (that may change later, but still likely an order of magnitude less than LendingClub, see footnote [6] for more), and their “collection fee” is also nothing, because there’s actually no collection to do. The loans start out being collateralized, and the Dharma smart contract automatically allows the investor to pull the collateral from a (blockchain) escrow account if the loan is past due on it’s payments.

What’s interesting is that different marketplaces might compete on different dimensions (both for debtors and creditors). Some might have rock bottom prices, some might have incredible support, others might have impressive matching algorithms between debtors and creditors. But everyone would have to compete on something that matters to the users, because holding the data ransom would no longer work.

Let’s take that a little further. By bringing the true source of power for marketplace companies — the inventory — onto what is essentially a publicly available database — the blockchain — the decentralized web allows us to ask “what if we took that power away from any one particular company? Even better, what if we gave it to every company?”

This forces companies to abandon “owning the inventory” as a strategy, and instead to compete on other dimensions that consumers appreciate (price, support, tech, etc.). Thus the decentralized web wins because that competition will naturally produce better products, and consumers will naturally flock to them.

Yeah OK, But Why Do You Need the Blockchain?

Great question. Technically, none of what I mentioned really “requires” the blockchain. As stated above, eBay, LendingClub, Airbnb, or whoever could easily give full, realtime access to their database, and then let others build their own products on top of that data. This would be a “marketplace as a service” product, if you will, essentially saying “we’ve got the inventory, you build the business”. So if nothing from a technical standpoint stops them, and consumers would want it, why don’t we already see it?

This is a really interesting question. I think the answer comes to down to two main things, incentives, and power dynamics.

Incentives — The profit opportunities of data monopoly are so immense that it’s nearly impossible for companies to ignore them. Even if companies allowed others to build on their data, there’s no way that investors or shareholders (or founders for that matter) would let that happen for free. So if eBay became a data platform, they would likely start charging a company instead of the end consumer, but they’d probably end up effectively charging the same amount.

Power dynamics — This is perhaps the more interesting answer. As I mentioned earlier, when a company in today’s web updates their policies or app, the users must either accept the update, or stop using the product. The blockchain allows for a new dynamic, more closely resembling democracy. Users can simply ignore updates and continue running an old version of the software, much like you can ignore requested operating system updates from your laptop. This has the effect of “voting” on which version gets used, and gives true power back to the users. It means that if Dharma or the Ethereum foundation wants people to upgrade, they need to create compelling reasons for everyone to do so, aligning incentives and constraining their power [7]. The reason this is important is it allows developers (and by extension, end users) to have a voice. That voice will naturally demand that data be common to all, and before the blockchain, this kind of power dynamic simply wasn’t technically possible. Theoretically, you could try to enforce such an arrangement through legal means (eg. Airbnb hosts unionized), but that’s quite a logistical headache, and costly.

How Do We Get There From Here?

Existing monopoly players, like Uber for example, are clearly not just going to put their data to the blockchain. That might be literally illegal, given the fiduciary duty they have to shareholders. So the change will have to come from consumers, and like any large bottom-up change, this will likely happen over many years, from different angles. One angle is just getting people used to owning and using crypto. In the same way that Uber only came along after enough people had a smart phone, many crypto marketplaces will only be possible once enough have a crypto wallet. Different (non marketplace) use cases will help with this over time. Speculation already did that for tens of millions of people. Stablecoins, decentralized browsers and file storage, and others may help do that for even more people.

Another angle is “fringe use cases” that aren’t served well by the current system. Examples include cannabis companies who can’t interact with traditional banks or get loans, or international student loans, who can’t get U.S. financial aid. Another examples is high priced marketplace transactions, like, say, renting an Airbnb mansion for 15 friends for a bachelorette party. If that costs you $1,000/night, then Airbnb will charge you 11.5%. That means you’re paying $115 per night to Airbnb as a finders fee, which is crazy. You could instead rent that house on Origin (a different decentralized marketplace) for zero fees, or pretty close to that. Or sending very large ($10k+) or very small (< $1) amounts of money. These are niche use cases, but this is how these things start. It’s what drives work on making the tools and experience better, which brings more people, which brings the network effect, meaning more use cases open up, and the cycle continues.

The Implications

While it may take many years, it’s staggering to consider the scale of potential impact. Think of how many industries are controlled by these same network-effect forces. Google, Airbnb, Uber, Lyft, Facebook, Ebay, Craigslist, Instagram, Google, WhatsApp, Pinterest, OpenTable, Waze, WeChat. Should I keep going? [8]. Each of these industries may have to deal with a huge number of new entrants, which could mean significantly reducing prices, different features, or even entirely different business models. It’s anyone’s guess how it will play out, but it won’t be like it is today.

Many people are already excited about how the decentralized web can bring back user control of their data, and allow for censorship resistance. Armed with our new understanding though, it turns out the economics could make it way more exciting than before. I also hope this helps us get past black and white discussions of blockchains being scams or creating utopia. Let’s start asking why the blockchain is actually better for customers, because that, ultimately, will be why it lives or dies.

Footnotes:

[1] — You might say, “well, actually they can charge that much because they have incredible technology.” Which seems reasonable, but I would argue that in fact nearly all of their ability to charge this amount comes from their monopoly on the inventory of the market, and surprisingly little comes from their technology. And I say that as a practicing backend software engineer. Even for big famous companies like Airbnb, Lyft, etc, the technology that powers them is mostly commoditized at this point. It’s a bit like jet planes for airlines. Impressive, yes, and they certainly require highly skilled, highly paid professionals to build and maintain, but jets (ie. large scale web tech in this analogy) have been built many times before and many people know how to build them now. Safely operating the jet is “table stakes” for airlines. You choose your airline for their routes, their prices, and their support. You expect the jet part to “just work”. Similarly, I think for a lot of these marketplace services, like loans, vacation rentals, cars, etc., we should be choosing based on prices, options, and support, and not because they happen to own the inventory.

[2] — If “all your data on the blockchain” sounds scary, realize that it’s not like Joe Shmo can just google for Jane Shmanes blockchain history. The data is linked to anonymous addresses. The details of whether or not others, and in what circumstances someone could link blockchain data to your real identity are quite complicated. I’ll just say privacy was in fact the entire reason blockchains were invented, and many companies are working on making blockchains even more secure and more private than it already is.

[3] — Forbes on P2P Industry Analysis Also, if 60% sounds low, you should realize that Google controls about ~70% of search.

[4] — From LendingClub’s own SEC filing detailing the problem: “In one case, involving $3.0 million in loans, an application date was changed in a live Company database in an attempt to appear to meet the investor’s requirement, and the balance of the loans were sold in direct contravention of the investor’s direction.” That scandal would not be possible on the blockchain, because you can’t alter existing entries. In fact, I can hardly think of a better advertisement for the benefits of using a non-alterable, publicly trusted ledger than that.

[5] — I want to note that technically, posting on Dharma does not immediately go “on-chain” (saved to the blockchain). However, this is more of a design choice. The fact that loan requests don’t immediately go on-chain could be a feature and not a bug. It puts the user in ultimate control. They can skip the relayers and underwriters if they want a more private loan where perhaps they already know who the creditor will be. And all that it takes for someone to put the loan request on chain is to pay the gas fee (the network fee required to save it to the blockchain), which is very small (pennies, give or take), and likely getting cheaper over time. One could imagine businesses popping up to deal with this too, potentially fronting gas fees to users in exchange for a larger fee later on.

[6] — Bloqboard is in beta, which is why it’s free, but they will eventually start charging fees, and they know what their competition is (1–6%), so given blockchain’s other hurdles, you’d expect them to come in well below that, or have some other business model. I briefly chatted with folks at Bloqboard, and while they certainly aren’t saying anything definite, they hinted that they might come in around what other decentralized exchanges (not for loans), charge, which is around 0.3–0.5%. That’s still roughly an order of magnitude less LendingClub’s average which is around 3%. Also, Bloqboard users must pay the “gas” fees (to the blockchain), but these are cheap, like $1.50 total all said and done. Even $1.50 is actually kind of high, but that’s because during the lifetime of a loan, you need to do many transactions, each of which incurs a small fee. The gas fees are subject to change over time.

[7] — There are many nuances to “governance” on the blockchain, as it’s called. For example, see Dharma’s rules; “smart contracts” can technically be updated without User consent, but there’s an enforced 7-day “timelock”, in which the new code would be known, and users could make a decision about what they want to do. If the changes are truly bad, users can “fork” the smart contracts, and still run the old version. Also, the power of what the smart contracts can do is limited. They cannot run off with your funds, for example.

[8] — Ok I’ll keep going: Slack, Betfair, LinkedIn, Salesforce, Twitter. But seriously, it’s been estimated that a full 70% of value creation in tech since 1994 has derived from network effects. See https://medium.com/@nfx/70-of-value-in-tech-is-driven-by-network-effects-8c4788528e35 . Also worth noting that some companies won’t be affected. Apple for one would be shielded. While the AppStore has network effects, Apple makes way more money from their incredible hardware and software which would be just as incredible if only you owned it. Another nuance here is that it’s important not to confuse “economies of scale” with network effects. Amazon’s logistics are an example of this. Because they ship so many packages, they can spread out their fixed costs (like trucks, and warehouses, etc.) and make shipping very cheap. But that’s not really network effects. If Amazon only delivered to you, it wouldn’t be profitable for them, but it would be just as valuable to you. If Facebook only served you, it’s worthless.

Why Consumers Will Love the Decentralized Web was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.