Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Market Reaction To Apple’s Announcement Hard to Swallow — Or Is it?

APPL Stocks plunge, making tech stock ownership hard to swallow.

APPL Stocks plunge, making tech stock ownership hard to swallow.

This week Apple told us (AAPL stockholders) that their expectations for performance in the China market is performing less than optimal.

Lower than anticipated iPhone revenue, primarily in Greater China, accounts for all of our revenue shortfall to our guidance and for much more than our entire year-over-year revenue decline. — Tim Cook, Apple CEO

Investors responded with a cold and hard b*tch slapping of Apple and dozens of other tech stocks. As usual, the market was reactive at the first signal of trouble.

As a software developer focused on building great experiences, we’ve come to believe that responsive and reactive websites are a good thing. At Cloudinary, the last company I worked at, we were absolutely obsessed with delivering images and video in the most timely and responsive manner. The Cloudinary SDK made it simple as adding a single line of code in your application to deliver the right sized image in a responsive manner.

Then why is reactivity so bad for investors in tech?

In my opinion, POTUS, and frankly most investors just don’t understand how tech works, they don’t understand global supply chains, globally distributed workforces and just how complex things are. They want to think that smartphones are manufactured like baking a loaf of bread; get a few basic ingredients, mix it up, bake and then sell the loaf at the grocery store. They invest like a herd of cattle and stampede the moment there’s a signal of change.

The market’s general perception of tech stocks as high risk investments is really out-of-date. It fuels the idea, that a very small change in growth or profit is a signal of doom for a company. Apple fell short for sure, but they are NOT imploding.

I personally believe following the herd this way is risky. It’s a perfect way to loose your money. Every technology company today is global in nature, whether it’s a manufacturing a product like the iPhone, or a cloud-based service with a globally distributed workforce, the core business and customers comes from that global POV.

Apple’s investment in global markets is huge, and their growth in China went from zero to nearly 20% of total rev or about 84 billion last quarter is quite impressive. The signal — “We didn’t make our projected 93 Billion” hit the market with an 8% drop in AAPL stock, and then plunged the rest of the market and the DOW down 650 points. Was that really warranted?

“Buy stock to own the company, not to own the stock”

Seems simple enough, taking ownership in the companies you invest in. I selected and treat all my investments with ownership and pride. I don’t waiver with that commitment, unless the company significantly changes.

That ownership investment strategy seems to work.

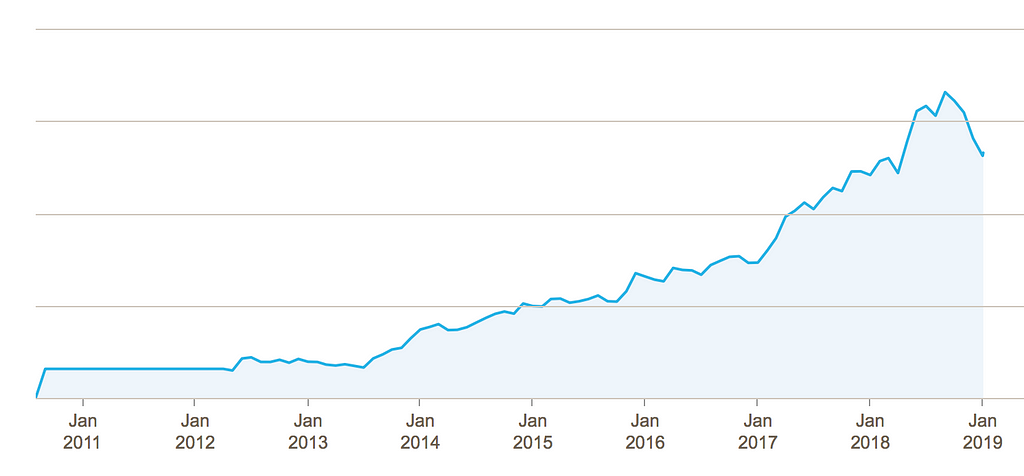

Take one look at this chart of my tech investments; This charts the overall growth of my personal portfolio since 2011.

Actual chart of my tech investments since 2011

Actual chart of my tech investments since 2011

Over the past 8 years I’ve taken my annual SEP IRA contributions and invested in a handful of tech stocks. My portfolio consists of AAPL, FB, EB, TWTR and a few others. As the chart suggests, my selection criteria was pretty solid.

Growth of my portfolio has been consistently between 50% and 500% over the years. It’s that crazy range of potential return that illustrates how reactive the market has become with tech stocks. It’s very easy to be distracted by the herd.

It’s important not become reactive to the ebb and flow of the what the rest of the investor pool was doing and stay the course with the companies I truly believe in.

The tech stocks that I have handpicked for this portfolio were selected based on simple intuition, percieved value, knowledge of the company and their business domains, and personal experience with people who work at these companies.

Todays record drop in AAPL simply presented a new opportunity to purchase many more shares of a company I love, at a lower price. As an iOS developer and devoted fan of their products, I see the drop as a just a small correction in price, and an opportunity to own just a little bit more of the company I love.

So what’s really going on?

The signals surrounding the Apple drop suggest:

- Uncertainty. Behind the headline is the market acknowledging the real impact of POTUS’ weak understanding of the nature of global trade business, and the market is overreacting to his ever-changing position on trade… everyone seems to be freaked out — essentially because he’s out-of-depth for his role and reactive investors don’t have the resolve to sit still long enough to allow the tech business to recover or improve beyond the current quarter.

- Greed. $84 Billion isn’t enough.

- Impostor Syndrome. The market doesn’t believe tech success is sustainable.

As we exit a challenging quarter, we are as confident as ever in the fundamental strength of our business. We manage Apple for the long term, and Apple has always used periods of adversity to re-examine our approach, to take advantage of our culture of flexibility, adaptability and creativity, and to emerge better as a result. — Tim Cook, Apple CEO

Paying attention to market signals is important, but in the age of instant communications, the market’s over reaction to a single signal from one company is a sign that the herd mentality behind that reaction is faulty.

For myself, staying the course, by identifying companies and domains in tech that provide value to their customers, their employees, and the rest of us, actually end up providing their shareholders the most value.

Disclaimer: This is my personal opinion about the current market and the stocks selections mentioned here are for illustrative purpose only, and NOT to be considered investment advise. Use your brain, Invest wisely, and don’t be so darn reactive.

Market Reaction To Apple’s Announcement Hard to Swallow — Or Is it? was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.