Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

It’s tax time and everyone will be busy consolidating their tax documents and filing taxes for the year 2018. Apart from consulting CPAs for complicated situations, almost everyone in the USA uses TurboTax. It has simplified accounting and tax returns so much that it’s almost a household for many Americans.

TL;DR: Export your itemized capital gains or losses information in TXF format and import it on your TurboTax software. This works with TurboTax software and not the online version.

Photo by Joanna Kosinska on Unsplash

Photo by Joanna Kosinska on Unsplash

On the other hand, trading of cryptocurrencies is a taxable transaction and one should report the gains or losses in their tax filing. Consolidating trades from various exchanges manually and reporting them as capital gains or losses on your TurboTax would be a tedious task.

Calculating Capital Gains or Losses

To alleviate this, most of this part has been automated by cryptocurrency tax software like BearTax. You can connect to most of the popular exchanges via their API or File Upload. If the exchange is not supported, their staff can get your transactions processed if you can email them on support@bear.tax.

BearTax - Cryptocurrency Tax Software for CPAs & Accounting Firms

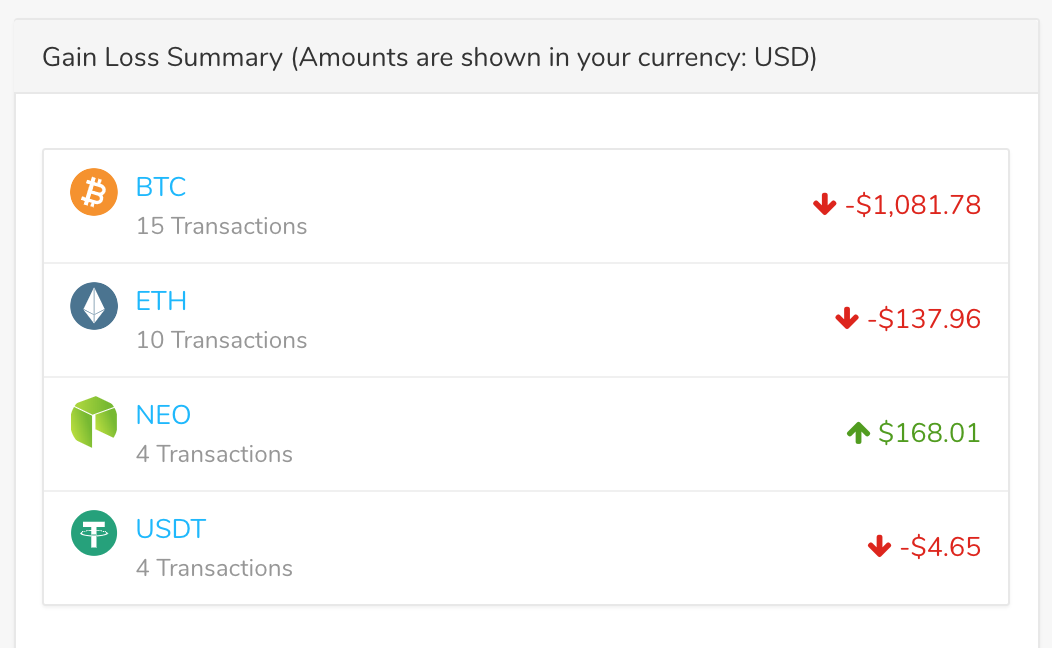

Once the transactions from various exchanges are imported to BearTax, calculation of tax liability aka capital gains or losses will be triggered. This could take a couple of minutes and then provides you with a gain-loss summary as shown below.

Everything until this step is FREE of cost and you won’t have to pay a penny to view your gain-loss summary information. However, if you would like to get your tax documents — you can pay for the recommended plan starting $0.99 (depending on the number of transactions) and get your tax documents.

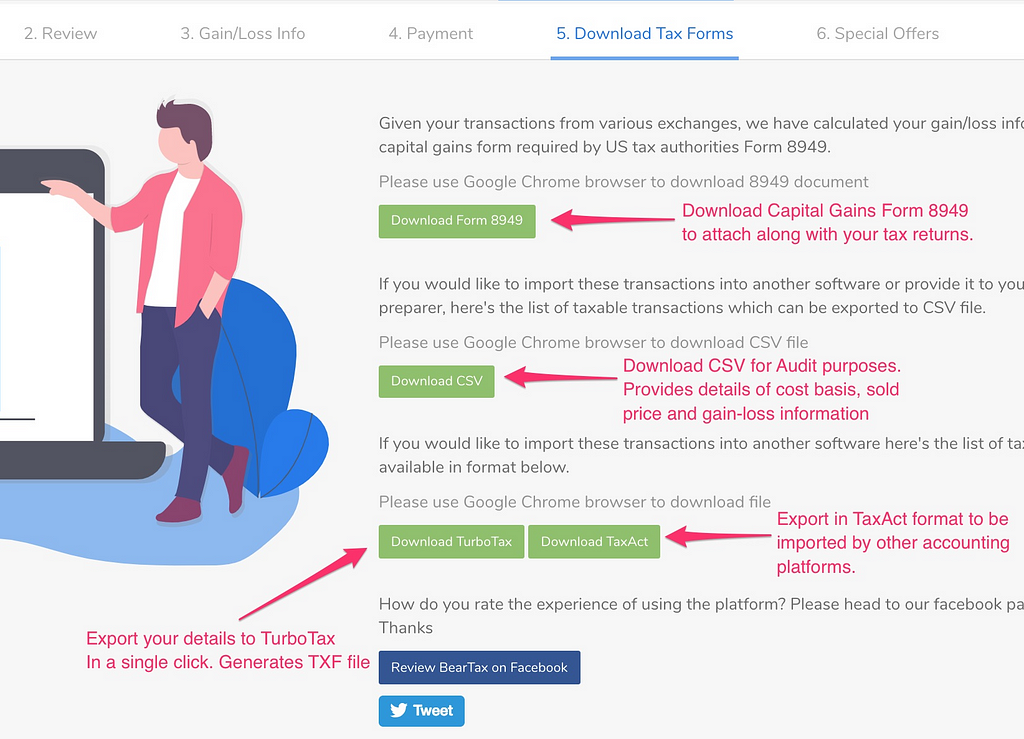

“Download TurboTax” button third row will take your gain-loss information i.e. Form 8949 data to a TXF (*.txf) file which will allow you to import into TurboTax® and many popular tax software programs that accept the TXF file format.

Exporting Capital Gains/Losses Data to TurboTax

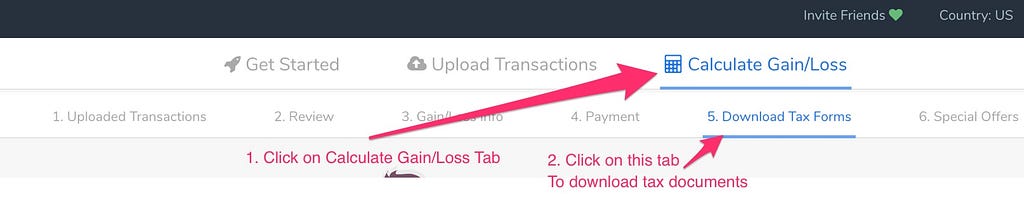

To create a TurboTax® TXF export file follow these steps:

1. After your gain-loss summary is generated in BearTax, click on “5. Download Tax Forms” tab under Calculate Gain/Loss

2. This will have a bunch of buttons to export or download your capital gains document in various formats. Use the button “Download TurboTax” to download a file with extension TXF

3. This file can be imported into TurboTax software or other applications that accepts TXF format.

Warning: TurboTax® online versions do NOT allow you to import TXF data. Desktop versions limit importing records for Form 8949 to 2,000–2,500 records. If you exceed this limit or are using the online version, you will have to enter them manually along with stocks and bonds investments (We will cover in detail on this in future).

Signup now for the inexpensive and the best software to calculate your cryptocurrency tax liability and export it to file using your favorite tax tool TurboTax®!

How to Calculate and File your Cryptocurrency Taxes using TurboTax was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.