Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

No one wants to buy into faltering products that are here today and gone tomorrow and the same is true of businesses with regard to their IT infrastructure. Given the productivity dependencies, a traditionally slow rate of return, and steep financial burden of IT infrastructure, CTOs and the like around the world often look to key performance indicators (KPI) including revenue, profitability, customer counts, and so forth, much like a prospective shareholder, in order to anticipate the viability of infrastructure as a service (IaaS) platforms such as AWS and Azure prior to making long-term investments in them.

For example, if a service provider is breaking close to even or operating at a loss after 8 years, this could be indicative of operational inefficiencies, architectural oversights, and looming changes which increase the likelihood of costly outages. All of which may also highlight the possibility of rate hikes down the road or that the platform in question may not be standing up to the test of time. But if revenue and profit are on point, this is indicative of long-term stability and much less risk. Comparatively, it is like being given the choice of paddle boarding on a calm summer morning or in the middle of a winter snow storm.

Needless to say, you can tell a lot about a solution by measuring its profitability. This is why common frontrunners such as Amazon, Apple, and Google are not bashful about disclosing individual revenue, profit, and user counts of their products. But this is also why the competition behind them tends to get creative rather than simply reporting on the same metrics. And when considering the lengths that Microsoft goes though in order to suppress the individual merits of Azure, I am forced to question just how profitable Azure truly is.

Before anything else though, it’s worth highlighting that any refresher course focused on lying with statistics would remind you that omission is by far the easiest way to lie with them. Along with shying away from helpful metrics while promenading with misleading and less valuable metrics instead, essentially leveraging data like an octopus jetting its ink, their application in unison is a formidable and proven recipe for statistical gaslighting that companies behind the frontrunner of their industry love to resort to. Put simply, some businesses choose to plea ignorant and resort to diversionary tactics rather than throwing it on the table so to speak and shining themselves in a negative light with the truth; Microsoft is no exception to this. Apple is also guilty of this as of late.

As mentioned before and as the #1 cloud infrastructure provider, Amazon happily reports on the individual merits of AWS by posting revenue, profit, and user counts. Why hide being the best? As the #2 cloud infrastructure provider though, Microsoft opts to bundle Azure’s earnings into a container called Intelligent Cloud which averages Azure’s revenue, profits, and losses with legacy server software such as Windows and SQL Server, Active Directory, Hyper-V and so on, making it impossible to compare the two platforms on equal ground.

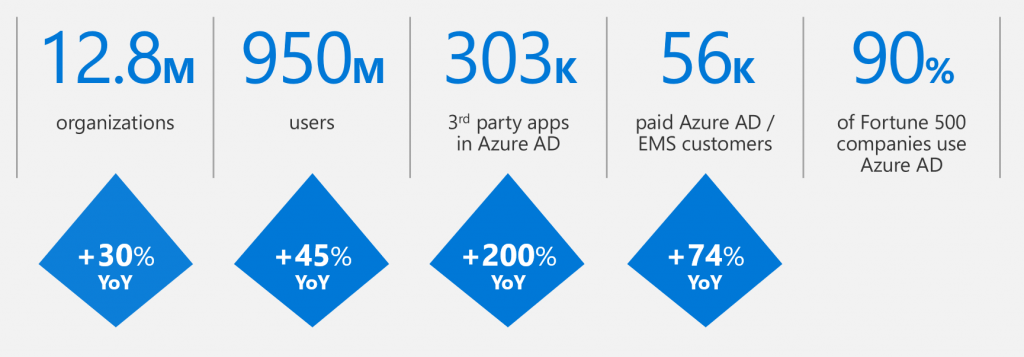

Azure reports total users but not revenue or profit outside of the Intelligent cloud (crutch?). Meanwhile, LinkedIn reports revenue, profit, and total users while omitting monthly usership statistics such as monthly active users (MAU). Although it’s Microsoft policy not to report on helpful metrics such as MAU, hence why LinkedIn no longer reports it, they seem to have no problem reporting it for Azure AD, Office 365, Windows, Edge, Cortana, Bing, Skype (ooops now they don’t), XBox, Minecraft, and other services that perpetuate the narrative of having a strong foothold in their market. With the above in mind, you can see how Microsoft seems to flop their policies tactically, but you can also see a clear trend of omissions being a tell just the same while seemingly trying to mask them with arbitrary policies.

Sometimes not to speak is to speak with statistics and omitting data along with creative bundling tactics which Microsoft is leveraging at present are not exceptions to this, but the billion-dollar standard. Although they claim to be changed now, they still have the same general council, Brad Smith, that they’ve had since their laughable antitrust days, and we can also see Microsoft putting in extra effort into muddying the waters so to speak with run rates, obscure metrics, massive marketing overspending rather than simply presenting their data; as they have done historically.

However, we can still speculate by giving Azure the benefit of the doubt and simply assume that it is solely responsible for all of the Intelligent Cloud’s revenue in FY18 Q4, which was $9,606,000,000, so that we can have a look at Azure’s average revenue per account (ARPA) on its best hypothetical day and compare it to AWS. While we’re at it, let’s also assume that Azure has 13 million accounts rather than their 12.8 million just to account for growth since this data is over a year old. So let’s take $9,606,000,000/13 million accounts = $738.92 average revenue per account for their latest quarter. Not bad. Good job Hypothetical Azure.

AWS, on the other hand, has reported a paltry 1 million accounts subscribing to it at the moment while only generating 6.68 billion in revenue, 2.1 billion of which was profit, in FY18 Q3. So we can take $6,680,000,000/1 million accounts = $6,680 average revenue per account for their latest quarter. For the sake of comparison, we can then divide AWS’s ARPA by Azure’s ARPA ($6,680/$738.92) which shows us that AWS is monetizing its accounts 9.04x more effectively than Azure is. Also and if AWS could maintain this ARPA with Azure’s account-base (6,680*13,000,000), then it would be generating $86,840,000,000 in revenue per quarter. 😳

AWS being 31.4% efficient (profit/revenue) while being more 9.04x more efficient than Azure when measured by its ARPA also indicates that Azure efficiency could be as low as 3.5% or $359,320,000 in Q4 which in itself would easily rationalize bundling it into a container such as the intelligent cloud comprised of more efficient products. This would also mean that Azure could be generating could be generating as little as $27.64 average profit per account compared to the $2,100 average profit per account that AWS is seeing at present which is still 76x more than Azure; when it is given a significant benefit of the doubt.

These differences only become greater if Azure represented half of the intelligent cloud’s revenue at $4.8 billion though. If that were the case, then they would be making averaging $369.23 in revenue per account and netting anywhere in between $163 million on the low end to $1.5 billion in profit if they’re as efficient as Amazon this quarter. If accurate, this would also show AWS to be as much as 18x more efficient than Azure from the perspective of ARPA. But I digress.

In summary, when a data-driven technology company as equipped as Microsoft turns their pockets inside out instead of posting basic KPIs such as itemized profits or MAU while reporting on metrics that no one asked for instead with regard to a service that’s been in production for 8 years now, it is usually a consequence of these KPIs being contradictory of the narrative that they’re selling, not because they are not readily available. In lieu of these metrics and even when giving Azure the benefit of the doubt and compared to AWS as done above, there appears to be more disparity between AWS and Azure than Microsoft would like us to believe after being in production for 8 years. Azure may indeed be profitable, but when considering the disparity in operational efficiency between AWS and Azure and the exhaustive effort that Microsoft makes towards suppressing its individual performance metrics, I am given no option but to ask how profitable Azure is or whether it is profitable at all.

Is Azure Profitable? was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.