Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Types of Stablecoins:

A few popular stablecoin tracking sites have their own unique approaches to categorizing the various types of stablecoins, but for this article I’m going to use my own approach to classifying stablecoins.

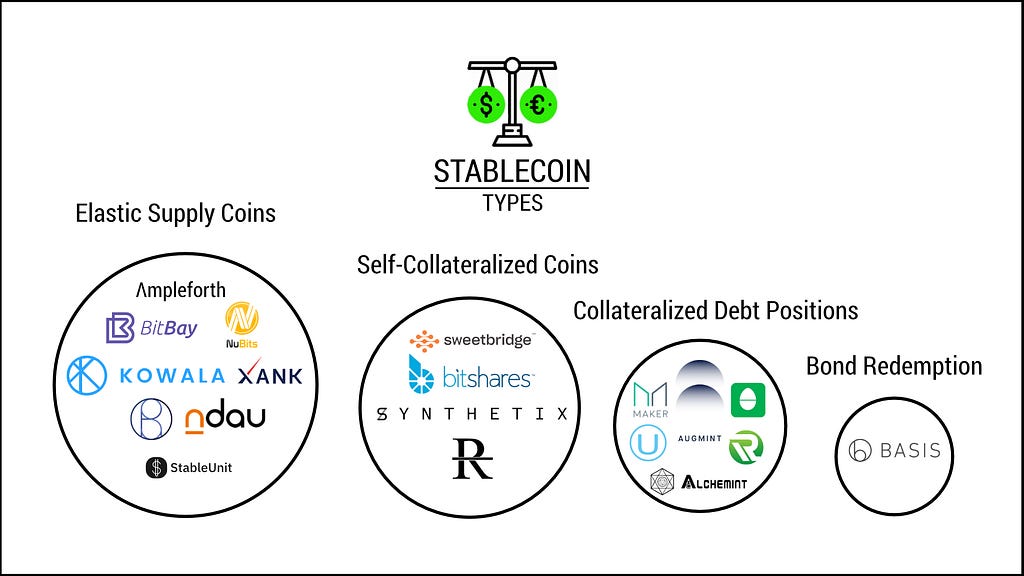

Most decentralized stablecoin monetary systems fall into one of two design categories: collateralized and non-collateralized economies. But if we want to gain a better understanding of how these non-fiat backed stablecoins actually work we can divide them into 4 primary sub-types: elastic supply, bond-redemption, collateralized debt position and self-collateralized stablecoins. The following diagram is a non-exhaustive list of decentralized stablecoin projects based on the types of stabilization mechanisms they have adopted:

Elastic Supply Coins:

The majority of stablecoin projects use an elastic supply monetary policy in which a high interest rate is offered to users to incentivize them to hold the stablecoin in question when its value dips below its currency peg. A stablecoin monetary system that uses an elastic supply stabilization mechanism contracts the supply of its stablecoins when low demand causes the value of its stablecoin to fall below its peg and expands its stablecoins’ supply when the value of its stablecoin rises above its peg due to a sudden increase in demand.

When, for example, a stablecoin whose value is pegged to the US dollar at a rate of 1 stablecoin to $1 falls below its peg, its annual interest rate would rise from 0% to 5% in order to increase its market demand. To obtain the promised interest rate, users must have all the stablecoins they purchase locked in their accounts until the stablecoin’s value reaches the target value of its peg. The interest rates offered on locked stablecoins is similar in nature to the annual interest rates that traditional banks offer on saving accounts and certificates of deposit.

Nu’s Elastic Supply Economy

The first stablecoin to use the elastic supply model was Nu: a hybrid proof-of-stake and proof-of-work blockchain that was created as a fork (modified copy) of Peercoin. Nu’s economy utilizes two native cryptocurrencies: Nubits, a stablecoin pegged to the US dollar, and NuShares, which have a fixed supply.

The holders of NuShares mint new blocks with their coin stake through Nu’s proof-of-stake protocol and are responsible for making governance decisions e.g. setting the interest rates for parking (locking in) Nubits whenever the price of Nubit falls below $1, and deciding how many new Nubits must be minted and given to a custodian (a non-shareholding market participant), who has the responsibility of creating large sell walls (sell pressure) when the price of Nubits rises above $1.

Weaknesses of Elastic Supply Monetary Systems

Nubit’s peg broke twice: once in December 2017 when Bitcoin’s price rose to $20,000 and again in April 2018. Nubit holders may have decided to sell off their Nubits for Bitcoins in December of 2017 to cash in on Bitcoin’s sudden end of year price rise.

Nubits was unable to recover from its second depegging and has lost most of its value and all its credibility among its former users, some of whom called it a scam and threatened to sue its creators. Nubits may have ultimately lost its peg because the selling pressure of Nubit holders wishing to purchase volatile cryptocurrencies like Bitcoin was higher than the buying pressure of users who wanted to cash in on the interest rates offered for “parked” Nubits and the buying pressure created by Nubit custodians chosen by NuShare holders.

Elastic supply stablecoin economies use parked stablecoins and newly minted stablecoins provided to elected custodians as the “collateral” for their buy and sell walls on exchanges. Parking interest rates and newly minted coins may not generate enough capital at a fast enough rate to maintain a stablecoin’s peg in an elastic supply monetary system and the rate at which such “collateral” is generated during depegging events is very difficult to quantify.

The dynamic supply rate and the complete absence of crypto-collateral assets in elastic supply monetary systems makes them more cost-effective for stablecoin users than monetary systems that rely heavily or entirely on collateral assets to maintain the price of their stablecoins. This fact may explain why elastic supply monetary systems remain the most popular choice for an economic system among stablecoin startups even though Nubits, a stablecoin with an elastic supply monetary system, was the first stablecoin to permanently lose its peg.

Most national monetary systems have no financial assets reserves whatsoever and rely almost entirely on a flexible interest rate and an elastic supply policy to maintain the value of their currencies while promoting economic growth. In the short-run most if not all stablecoins may not have high enough demand and supply rates to maintain a relatively stable price and may have to rely on a fully or overcollateralized pool of collateral assets to achieve price stability.

Collateralized Debt Positions (CDPs)

In Collateralized-Debt-Position (CDP) based monetary systems users deposit collateral into a smart contract and then receive a certain number of stablecoins equal to the value of the collateral deposited. CDP-based stablecoin economies effectively loan their respective stable currencies into existence with the collateral they receive from their users in a fashion that similar to how commercial banks loan national fiat money into existence through fractional reserve banking.

Unlike traditional bank loans, the majority of CDP loans are backed by full-reserve or overcollateralized reserves of volatile crypto-assets, because speculative cryptocurrencies such as Ether and Bitcoin can rapidly depreciate in value at any point in time. Cryptocurrency exchange hacks, government bans on cryptocurrencies, and other unexpected or unexplained events can dramatically reduce the value of the collateral assets that back up a crypto-trader’s collateralized debt position.

The users of CDP loans are charged a daily and sometimes hourly interest rate that is calculated at and presented as a per annum rate. The interest that CDP holders pay is often referred to as the “stability fee”.

Most CDP monetary systems are built on the Ethereum blockchain and even though users can deposit a variety of assets including standard Ethereum tokens such as ERC-20 and ERC-721 (non-fungible tokens), the primary asset deposited into the smart contracts of each CDP-based stablecoin is Ether. CDP monetary systems are multi-collateral smart contracts that accept any token or tokenized asset created on the blockchains on which they were built.

MakerDAO’s CDP-based Economy

MakerDAO, the most prominent example of a CDP-based monetary system, uses two native cryptocurrencies: Maker (MKR), a volatile currency that represents ownership shares and governance power, and Dai — a stablecoin pegged to the US Dollar at 1:1 ratio. Like most CDP-based monetary systems, MakerDAO requires its users to overcollateralize their debt-positions. The average MakerDAO loan is overcollateralized with a collateral-to-debt ratio of 150%. As soon as the current collateral-to-debt ratio falls below the collateral liquidation ratio, MakerDAO’s smart contract will liquidate i.e. sell off all of its borrowers’ deposited collateral for Dai or MKR depending on the price of Dai and whether or not it’s at, below, or above its US dollar peg when issued loans are liquidated.

There are two iterations of MakerDAO. The first of which is the current system in which Ether collected as collateral by its smart contract is wrapped i.e. converted into a token in order to make it compatible with Ethereum’s ERC-20 token standard and then pooled together as PETH. MakerDAO’s head of business development wrote a great blog post explaining the current iteration. The first version of MakerDAO also accepts only one cryptocurrency as collateral: Ether. The second iteration, the subject of this blog post, accepts multiple cryptocurrency tokens on the Ethereum blockchain.

MakerDAO’s Price Stabilization Mechanisms

When the price of Dai is below $1, the MakerDAO smart contract will sell the deposited collateral to buy Dai in order to return Dai’s price to $1. And when MakerDAO’s CDPs are undercollateralized its smart contract use newly minted MKR tokens to buy Dai instead of relying entirely on sold collateral to raise the price of Dai back to $1. In either one of the cases in which Dai’s price is below $1, the MakerDAO will burn the Dai that it buys with collateral or newly minted MKR tokens to reduce its supply and thereby raise its price back to its peg. When the price of Dai rises above $1, the MakerDAO smart contract will sell newly minted Dai for MKR tokens to bring Dai’s price back down to $1. Increasing the supply MKR tokens when CDPs are undercollateralized and the value of Dai is below $1 reduces the value of MKR and thereby allows MakerDAO to “punish” MKR holders for bad governance decisions.

MakerDAO’s Stabilization Fees

Maker DAO charges its users a stability fee every time they return their borrowed Dai for their deposited collateral. The stability fee involves burning MKR tokens to reduce their supply and thereby increase their value in the long-run. In other words, the stability fee is the total value of MKR tokens that are burned as payment after borrowers return their borrowed Dai to receive their deposited collateral. The penalty fee, on the other hand, is the portion of returned Dai during the closing of a CDP that is used by MakerDAO’s smart contract to buy and burn MKR tokens. Borrowers pay the stability fee with MKR tokens when they close a CDP position and pay a penalty fee with a portion of the Dai they could have exchanged for their deposited collateral when the collateral-to-debt ratio falls to the point that it reaches the penalty ratio.

In addition to its stability fee (interest cost) on all issued loans, which can only be paid in the MKR token, MakerDAO charges its borrowers a liquidation penalty fee when the value of its users deposited collateral depreciates that is not only below the standard threshold ratio/liquidation ratio of 150%, but also below the minimum collateral-to-debt threshold of 135%. The penalty ratio fee incentivizes borrowers to pay their loans as soon as possible when the value of their deposited collateral is rapidly depreciating.

An Ether CDP could, for example, have a collateral-to-debt ratio of 150%, a liquidation ratio of 140% and a penalty ratio of 110%. The borrower in this case deposits $150 worth of Ether to borrow $100 worth of Dai. If the value of the deposited collateral falls to $140 worth of Ether, MakerDAO’s smart contract will sell off the deposited collateral for Dai or MKR until the loan is paid in its entirety. If the price of Ether continues to fall until the value of the deposited collateral depreciates to $110 MakerDAO will penalize the borrower at a rate of say 10%, for example, of the value of the returned Dai and take a portion of the returned collateral, in this case $10, to sell it off for more Dai or MKR depending on the price of Dai. The borrower will then receive any remaining collateral after the stability and penalty fee has been paid. If the stability fee is 2% then $2 plus $10 will be subtracted from the $110 worth of collateral leaving the borrower with $98 worth of Ether after all returned Dai is burned by the smart contract.

Dai Saving Rate

MakerDAO’s founding team recently introduced an additional price stabilization mechanism called the Dai Saving Rate (DSR), which involves the owners of Dai receiving an annual interest rate of, for example, 3% for simply holding Dai. The DSR is meant to increase demand for Dai in much the same way that Nubit’s parking interest rate was used increase demand for

Weaknesses of CDP-based Monetary Systems

CDP-based monetary systems are considerably less risky than elastic supply economies, which could be undercollateralized at any point in time, but CDP-based economies are also collateral inefficient and create a diminishing rate of return for each round of borrowing in a leveraged position.

A borrower, for example, could deposit $150 worth of Ether for $100 worth of Dai when the collateral-to-debt ratio is to 150% by MKR holders and then use the 100 Dai to buy $66 worth of Ether. At this point in time the borrower would have $166 worth of Ether. He could then deposit $66 worth of Ether for $44 worth of Dai (44 Dai) and continue increasing the size of his leveraged position at a rapidly diminishing rate.

Self-Collateralized Stablecoins

Unlike CDP-based economies, self-collateralized stablecoin economies only allow their borrowers to use the volatile cryptocurrency created by their respective smart contracts or blockchains as collateral in their debt positions. Self-Collateralized economies use debt positions in the sense that they loan their stablecoins into existence when their users deposit the volatile collateral generated by their smart contracts or blockchains.

Bitshares’ Self-Collateralized Economy

Bitshares is a blockchain and a decentralized exchange that was invented in 2013 to give cryptocurrency investors the ability to create market pegged assets (stablecoins) by buying up a certain number of Bitshares, its native volatile cryptocurrency, to generate a certain amount of a stablecoin that is equal in value to the deposited collateral.

Bitshares’ Smart Coins

Bitshares’ users have created a variety of market pegged assets i.e. cryptocurrencies pegged to the value of another currency or asset that are sometimes referred to as smart coins. Bitshares has developed a variety of smart coins over the past few years including: BitUSD, BitCNY, BitEUR, and BitGold.

Bitshares, the first Self-Collateralized and in fact the first stablecoin ever invented, does not charge its users interest in the form of a stability liquidation fee for holding debt that is below a threshold collateral-to-debt ratio nor does it charge its users a penalty fee for holding less collateral than a minimum collateral-to-debt ratio. Like most if not all CDPs and Self-collateralized based economies, Bitshare’s has a pre-determined minimum collateral-to-debt ratio set by the governors of its economy. Its block producers, the governors of its economy, have set the minimum collateral-to-debt ratio to 175% making Bitshares collateral inefficient.

To create 100 BitUSD, for example, a user would need $175 worth of Bitshares as collateral. Users who have a collateral-to-debt ratio of less than 175% would have their Bitshares liquidated in a forced settlement i.e. confiscated by the Bitshares blockchain and sold to Bitshares holders with larger collateral-to-debt ratios.

Like Bitshares, most stablecoins with Self-Collateralized stablecoin economies tend to be even less collateral efficient than CDPs. Synthetix, for example, has a default minimum collateral-to-debt ratio of 500%, which can, however, be changed by Synth token holders.

Bond Redemption Coins

Basis’ Bond Redemption Monetary System

This type of monetary system was popularized by a stablecoin called Basis (formerly called Basecoin), whose economy consists of three cryptocurrencies: The Basis stablecoin, Basis Bonds, and Basis Shares. Like most stablecoins Basis is pegged to the US dollar at a 1:1 ratio and its volatile cryptocurrency (Basis Shares) is the governance token that can be used to change its monetary systems’ parameters. Basis Shares are created at the genesis block and have a fixed supply.

Basis’ Stabilization Mechanisms

When the price of Basis falls below $1, the Basis blockchain asks Basis holders to burn their Basis in exchange for Basis Bonds that can be redeemed for Basis stablecoins at a 1:1 rate when the price of Basis rises back up to $1. When the price of Basis is, for example, $0.8 then its users can burn Basis to restrict its supply in the short-term in order to raise its price back to $1 and make a profit of $0.2 for every Basis they burned when its price rises to $1 and new Basis are minted and deposited into their accounts.

Basis Bonds are like a hybrid form of an option and a futures contract. Like options, Basis Bonds have a strike price i.e. a price at which the options contract, itself a tradeable financial asset, is redeemed for another financial asset: in this case Basis Bonds are redeemed for Basis when the price of Basis reaches the strike price of $1. But Basis Bonds are also like futures contracts to the extent that they are an agreement between speculators who buy them and the blockchain’s smart contract that issues them that speculators will receive a financial asset — in this case the Basis stablecoin — at a specified time in the future at a specific/pre-determined price.

On the other hand, Basis Bonds most closely resemble government issued bonds, because Bond holders are paid in a first-in-first-out (FIFO) order. Bonds bought earlier are thus worth more than bonds bought later, because bond holders would likely want to have their bonds redeemed for Basis as soon as possible if they believe that the price of Basis will rise back to $1. Furthermore, like government issued bonds Basis Bonds also have expiration dates. By default, Basis Bonds have a 5-year expiration date to further incentivize speculators to buy them as soon as possible in order to accelerate the speed at which Basis’ monetary system brings its stablecoin’s price back to the peg chosen by holders of Basis Shares.

Basis Bonds are sold in an open auction run by its blockchain for interested investors to purchase and they therefore exist as a stand-alone cryptocurrency that can be transferred from one account to another. This means that speculators who no longer believe that the Basis stablecoin will rise back to $1 when it falls below its peg may sell their bonds to other speculators who believe otherwise.

Strengths of Bond Redemption Monetary Systems

Bond redemption monetary systems are collateral efficient and unlike elastic supply economies they don’t have to increase their long-term supply in when creating short-term demand in order raise the price of their stablecoins in the short-term. Moreover, bonds unlike interest rates for parking, don’t create a net increase in a stablecoin’s supply i.e. when bonds are redeemed for new Basis, there is no net increase in the supply of Basis stablecoins, whereas when new Nubits are minted for parking fees the total amount of Nubits that exist after parking fees have fallen to 0% and the price of Nubits has risen back to $1 is greater than the amount of Nubits that existed before parking fees were raised to create investor demand for Nubits.

The continuous increases in supply in elastic supply economies when the price of their stablecoins fall below $1 creates an inflationary effect that produces a negative feedback loop in which the increase in supply of Nubits lowers the price of Nubits, which leads to an increase in parking interest rates, which in turn increases the supply of Nubits and the price of Nubits would once again fall in response to yet another increase in supply. So long as the demand or buying pressure created by an elastic supply economy’s parking interest rates in the short-term outweighs or counteracts the selling pressure created by an increase in the supply of its stablecoin in the long-run its stablecoin’s price will be stabilized. Bond redemption stablecoins eliminate the long-term inflationary pressure of elastic supply economies by replacing parking interest rates with bonds as the primary stabilization mechanism.

Weaknesses of Bond Redemption Monetary Systems

Firstly, bond redemption economies may leave investors with worthless bonds, because their stablecoins need to be in constant demand in order for their bonds to be an effective price stabilization mechanism. Moreover, the value of the Basis Bond is tied to the value of the Basis stablecoin and if the price of Basis falls far enough from its peg the majority of speculators may lose confidence in Basis’ ability to return to its peg and the minority of the speculators who bought Basis Bonds may end up with worthless bonds if the blockchain continues to lower the price of bonds for sale in its bond auction.

Basis uses a bond price floor and a bond expiration date to prevent bonds from losing their all their value, but the price floor cannot change the fact that the price of bonds is tied to the price of Basis and a 5-year expiration date may or may not be too long of an expiration time period to be a strong enough incentive for investors to buy bonds as soon as possible. The creators of Basis have not yet revealed how they arrived at the conclusion that the best expiration date for Basis Bonds is a 5-year timespan.

Secondly, a sharp drop in the price of the Basis stablecoin may create a negative feedback loop in which the falling price of Basis causes speculators to shy away from buying bonds, which would in turn allow the price of Basis to drop even further and as the price of Basis continues to drop the price of bonds will once again fall until the value of Basis is so low that all speculators lose interest in buying bonds, which is when the entire monetary system will cease to function.

Thirdly, bond redemption stablecoins requires investors to believe that there always be demand for Basis even when it has over 30 competitors. When the price of Basis rises above $1, the blockchain mints new Basis stablecoins and gives them to the holders of Basis Shares. The holders of Basis Shares can sell off their Basis stablecoins in order to bring down the price of Basis back to $1, but they also have a financial incentive to let the price of Basis rise as much as possible for as long as possible in order to maximize the amount of newly minted Basis stablecoins they receive from the blockchain and sell for short-term profits. Shareholder’s desire to maximize short-term profits from newly minted Basis may lead to short-term price volatility, because it may take some time for non-shareholding speculators to realize that it may in fact be futile to try to profit from Basis’ price movements.

And lastly, it is very difficult ascertain the amount of price-stabilizing collateral that bought bonds generate in the Basis economy. In anticipation of the possibility that purchased bonds may not produce enough short-term “collateral” to stabilize the Basis economy, the founders of Basis planned to use some of the $133 million they raised during their venture capital fundraising rounds to subsidize their trades against speculators trying to profit from Basis’ depegging.

The legal problems of the Basis company further exasperate the problem of insufficient collateral: due to its inability to comply with US securities laws, the Basis company had to shut down its operations and refund its venture capital investors. The United States’ Securities and Exchange Commission (SEC) classifies both Basis Shares and Basis Bonds as unregistered securities that can only be purchased by accredited investors and cannot be resold to the general public until a year has passed since they were first issued.

Even if Basis — with its current design — could survive without having Basis Shares being freely traded, it may not be able to raise enough collateral in the form of bought bonds to stabilize its price in the short-term, which is why the founders of Basis decided to wind down its operations.

Collateral redemption

In much the same way that CDP-based monetary systems loan stablecoins into existence with deposited collateral, monetary systems that use a collateral redemption policy generate their stablecoins when users deposit collateral into their collateral pools. But unlike, CDP-based economies in which users can only ever retrieve the entirety of their deposited collateral, collateral-redemption based economies allow their users to retrieve individual units of their deposited collateral at any point in time without having to pay a stability or penalty fee.

A user in a collateral-redemption economy can, for example, deposit $500 worth of Ether and $500 worth of Bitcoin for 1000 stablecoins and then retrieve only $3 worth of Ether and $2 worth of Bitcoin from the smart contract’s collateral pool after depositing 5 stablecoins, which are in turn burned in order to maintain the desired collateral-to-debt ratio. And unlike self-referential CDP-based stablecoins such as Bitshares, collateral-redeemed stablecoins allow their users to deposit a wide variety of tokens from a single blockchain or a variety of native cryptocurrencies from different blockchains if they have interoperable smart contracts.

Self-collateralized based monetary systems also allow their borrowers to redeem their debt for individual units of their deposited collateral, but their borrowers cannot deposit exogenous capital i.e. collateral that is not natively created by the smart contract or blockchain on which the stablecoin is built on. Collateral redemption monetary systems also differentiate themselves from CDP-based and Self-Collateralized-based economies by providing their borrowers with profit-seeking incentives to deposit collateral when their collateral pools are undercollateralized rather than punishing their borrowers with the threat of liquidating i.e. selling of their debt.

Reserve Protocol’s Collateral Redemption Monetary System

The Reserve Protocol is the first stablecoin to implement a collateral redemption monetary system and it’s the economic system that most closely resembles Credo Coin’s monetary policy. Like the majority of stablecoin designs the Reserve Protocol will be built on the Ethereum blockchain and will use only two native cryptocurrencies: The Reserve stablecoin and Reserve Shares. The Reserve Protocol also maintains a collateral-to-debt ratio of 1:1 or 100% i.e. the amount of Reserve stablecoins in circulation is always equal to the amount of collateral stored in Reserve’s collateral pool smart contract, which is referred to as the Vault.

Reserve Protocol’s Price Stabilization Mechanism

When the price of Reserve falls below its $1 peg to a price of, for example, $0.95 speculators can redeem their Reserve tokens for $1 worth of collateral and earn a profit of $0.05 for every Reserve token they redeem. They will continue buying Reserve tokens until the price of Reserve rises back to $1 and they’re no longer able to profit from the price difference between the Reserve tokens and the collateral backing it. As long as Reserve’s price is below $1, the protocol will burn Reserve tokens in order to reduce its supply and thereby raise its price back to $1.

The reverse happens when the price of Reserve rises above its $1 peg to a price of, for example, $1.05 when speculators can deposit $1 worth of collateral into the Vault for each new newly minted Reserve token they receive in return. In this case, speculators will continue depositing collateral for new Reserve tokens until the price of Reserve falls back to its $1 peg and they are no longer able to profit from the price difference between Reserves in the open market and the collateral stored in the smart contract.

If the Vault’s collateral assets experience a significant drop in value then the Reserve Protocol will use Reserve Shares as collateral, but if the latter assets also fall in value the protocol will initiate a price band, which involves selling and buying Reserve tokens at two different prices. If the price of Reserve falls to $0.95, for example, while all the collateral assets including Reserve Shares have fallen in value, then the protocol will create a price band with a range of $0.05 in which every $0.95 worth of Reserve tokens will be redeemed for $1 worth of collateral and each Reserve token will be sold for $1.05 worth of collateral. In other words, borrowers can only redeem $1 worth of deposited collateral for $0.95 worth of Reserve tokens and they have to deposit $1.05 worth of collateral to receive 1 Reserve token.

The Reserve token will also have a variable transfer fee that will be initially set to 0, but may rise based on whether or not the Vault’s collateral assets and Reserve Shares, the substitute collateral, significantly depreciate in value when Reserve’s price falls below $1. The Reserve tokens collected through the transfer fee may be a source of revenue for the holders of Reserve Shares.

Reserve Protocol’s Collateral Maintenance Mechanism

To prevent short-term price volatility, the Reserve Protocol will sometimes overcollateralize its collateral pool by selling newly minted Reserve Shares for more collateral assets. Overtime, when the Reserve Protocol’s creators believe that the Reserve token is sufficiently stable they will allow the protocol to return excess collateral to the holders of Reserve Shares to maintain the collateral pool’s 1:1 collateralization ratio. Conversely, when the value of the Vault’s collateral depreciates and its collateral-to-debt ratio falls below 100% the Reserve Protocol sells newly minted Reserve Shares for collateral.

Reserve’s Vault is designed to be store at least three non-correlated crypto-assets. The more non-correlated assets that speculators deposit the less likely it is for the Vault to be undercollateralized at any point in time.

Weaknesses of the Reserve Protocol

Firstly, whether the Vault is undercollateralized or overcollateralized, new Reserve Shares will be minted and the Reserve Protocol will never use collateral/Reserve stablecoins to buy Reserve Shares from the open market in order to burn them and raise their price in the same way MakerDAO buys and burns Maker tokens with newly minted Dai when the price of Dai rises above $1. Holders of Reserve Shares can only make money when excess collateral is returned to their accounts unlike the holders of MakerDAO, who can reasonabley expect the price of Maker tokens to rise in value when demand for Dai increases.

When I spoke to the Reserve team on Telegram and asked them about their decision to directly provide the holders of Reserve Shares with excess collateral from Reserve’s Vault, they said that burning Reserve Shares bought with excess collateral may produce negligible increases in their value especially when the protocol first launches.

Secondly, the fact that Reserve Shares are never burned means that speculators have no financial incentive to buy Reserve Shares when the value of Reserve’s collateral assets depreciates or remains roughly the same. The founders of the Reserve Protocol argue that Reserve Share investors financially profit from the appreciate of the collateral assets stored in Reserve’s collateral pool, but there is an opportunity that said investors must forgo when they buy Reserve Shares instead of directly buying the assets stored as collateral in Reserve’s collateral pool. Furthermore, the cost of investing in Reserve Shares and thereby giving some of one’s hard-earned money to the Reserve’s founding team may be greater than the cost of directly investing the assets stored as collateral in Reserve’s vault.

Reserve’s founders also argue that their decision to use tokenized stocks, bonds, and real-estate as collateral as they progressively decentralize the Reserve Protocol ensures that the Reserve Vault is sufficiently collateralized and that Reserve Share investors will profit when these assets appreciate in value, because the price of such assets generally tends to rise over time. But even if the tokenized assets appreciate in value that does not change the fact that Reserve Share investors could have still directly bought the assets used as collateral instead of the share tokens.

Thirdly, Reserve’s variable transfer is similar to the Ethereum’s variable gas fee and is as much a barrier to widespread adoption to said gas fee. Moreover, paying fees twice i.e. once in Ether gas and a second time in Reserve creates an even bigger barrier to mass user adoption than simply having to pay one fee such as the Ether gas fee. But unlike many other collateral-backed stablecoins, Reserve’s founders have decided that the variable transfer fee is an optional rather than a mandatory feature.

And lastly, Reserve has no saving interest rate like MakerDAO and that makes it a less attractive store of value even in the eyes of the citizens of a nation experiencing hyper-inflation. In an interview with the Stable Report,

Multi-Currency Stablecoins versus Single-Currency Stablecoins:

Some stablecoin companies such as Bitshares, Celo, Synthetix believe that the aggregate demand for multiple stablecoins may be greater than the demand for a global stablecoin and that creating regional stablecoins will accelerate the rate at which people across the world adopt their stablecoin systems.

The utility of regional stablecoins depends on the demand for such stablecoins among day-traders on cryptocurrency exchanges and the inflation rate of the regional currencies said stablecoins are pegged to. The most successful regional stablecoins (smart coins) in Bitshares ecosystem were BitUSD — a stablecoin pegged to the US Dollar — and BitCNY — a stablecoin pegged to the Chinese Yuan — because fiat currencies to which they are respectively pegged to are widely used across the world due to their low inflations rates, and the large populations and political power of their issuing nations. Bitshares’ other stablecoins experienced less adoption and greater price volatility.

A stablecoin pegged to the currency of a large developing country such as a Snyth Rupee pegged to the Indian would, for example, not only have less price stability, but would have much less utility for Indians who could save more money if they stored their money in the Synth Dollar, because US dollar’s annual inflation rate of about 2–3% is much lower than India’s annual average inflation rate of 3–5%.

On the other hand, stablecoins that seek to become a global store of value by issuing a single stable currency will likely be less vulnerable to speculative attacks such as the Black Wednesday incident, because any given speculative trader would need more money to launch such an attack on a globally adopted stablecoin than regionally adopted cryptocurrency with significantly smaller trading volume.

Conclusion:

Collateral-backed stablecoins are less risky than their non-collateralized counterparts, but regardless of how they design their respective monetary systems stablecoin start-ups may may have to choose between the utility of a regional currency and the effective stability of a global currency depending on the aggregate demand of multi-currency stablecoins in the long-run.

A Comprehensive Guide to Decentralized Stablecoins was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.