Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

The winter came. It came together with snowy sidewalks, cold weather and more news about investors’ chilling interest in scooter-sharing companies. More precisely, VCs are very cautious about startups’ financials. Vandalism, government regulations, charger fraud — these factors pose a significant threat to the bottom line and the whole phenomenon of electric scooters. But initially, expectations were much more optimistic.

Envisioned in sci-fi

If you take a wider perspective, electric scooters are the reincarnation of self-moving walkways envisioned by sci-fi writers 100 years ago: efficient and sustainable transportation mechanism, a commodity available to everyone at any time. Out of all transport that humankind has invented (apart from airport walkways), electric scooters are the closest to self-moving roads. By stepping on a scooter, user practically steps on a moving platform that gets her from point A to point B in a matter of minutes.

No matter the weather or time of the day, the idea of the service is to run and provide people with value at an acceptable price. And if you have a moving walkway on your street, the government can’t make you put it at home for a night. It’s always outside, always working and reliably transporting people. Sounds too good to be true, but this is the world scooter companies are trying to build.

While we can spend a lot of time dreaming about moving walkways in distant 2050s, the harsh reality meets electric scooters with hostile cities. Surprisingly, there are so many factors influencing your business when you run it in a real world!

One of the most discussed problems is government regulations and vandalism. The first one, albeit a tremendous problem in the short-term, should start to vanish in 2019, as scooter startups are starting to present successful case-studies showing significant benefits to municipalities. The momentum is going to be reinforced by a soon-to-be-announced association of micromobility companies, jointly lobbying for better regulations in the new markets.

Vandalism and missing scooters are more of a financial problem. If vehicles get systematically destroyed before breaking even, the business won’t run long. Bird and Lime already introduced their sturdy custom-made scooters, however, it’s not clear how they will affect the bottom line. If Bird was spending $550 on its $300 Xiaomi scooters, how much does the new Zero model cost? Lime, while expected to roll out fresh sturdy Gen 3 scooters, decided to put on the streets a totally different model, manufactured by a no-name Chinese firm. Weird move, but Ok.

Missing scooters problem got to a whole new level with a $32 kit to convert shared Bird scooter in a personal one. The same source also published ways to “privatize” Lime scooters. That issue is expected to be solved with the arrival of custom-made vehicles.

Stealing a scooter is bad for its company, but buying one is not beneficial either. Retention is the best-kept secret of micromobility sector for a reason: while it was expected that a lot of people will use scooters for commuting, they actually did this. They did it once, they did it twice, three times … and then their personal scooter arrived from Amazon, ending the stream of recurring revenue flowing to the scooter company.

Even though companies are trying to adjust their prices to local markets, their huge costs don’t allow to do it properly. That’s why we have a situation when the average employed person can have:12 thousand rides in Seattle, USA3 thousand rides in Wroclaw, Poland4 thousand rides in Zaragoza, SpainPer year with a gross salary.

Such a pricing strategy creates a conflict out of nothing — one brand with identical marketing and positioning is a premium tool in one country and a commodity in another.

Communicating the value

In my first escooter article I was wondering if people would still use scooter-sharing services when they calculate that it costs $2500 a year to commute with them. Micromobility ecosystem still doesn’t have an answer for that, and that’s the problem of both Marketing and Operations departments.

Users simply don’t recognize that they are paying for mobility and opportunity of not taking care of their scooter. It’s unclear how cool it is NOT to take the vehicle in the metro, or how convenient it is to come to work by bus and go back on a scooter. Only after buying one for themselves, people realize the benefits of the sharing model. But they won’t go back after shelling out $600-$1200.

An electric scooter is not a classic technology product. Although Apple iPhone costs $1000 both in the US and in Mongolia, there is always a cheaper option from Oppo for $100. Such a variety of pricing options is not the case for scooter sharing market and this is not going to change soon.Lime was testing the subscription model called Lime Prime, but the tests have ended months ago. And since we haven’t seen the results, we can assume it was a failure, probably caused by huge charging costs.

Problems with the current model

Currently, it costs about $4–$9 to charge a scooter by contractors — an incredibly high number for 3 mid-range city trips. Can you imagine the bus driver getting $1.5–$3 from each of his passengers during the day?

Chargers of Bird and Lime are trying all the methods to increase own effectiveness. Photos by David Pennington (left) and Grayson C Boley (right)

Chargers of Bird and Lime are trying all the methods to increase own effectiveness. Photos by David Pennington (left) and Grayson C Boley (right)

With a shrinking bounty, charger market transforms from individual actors, collecting 3–4 scooters every other day, into organized teams putting a serious effort in their job. They optimize routes and craft own instruments in order to capture as many scooters as possible in 7 hours that they spend on this “side gig” daily. Isn’t it a sign from the Invisible Hand of the market?

At the end of the day, it doesn’t matter how effective are chargers, since a part-time contractor will never reach an efficiency of the full-time employee.

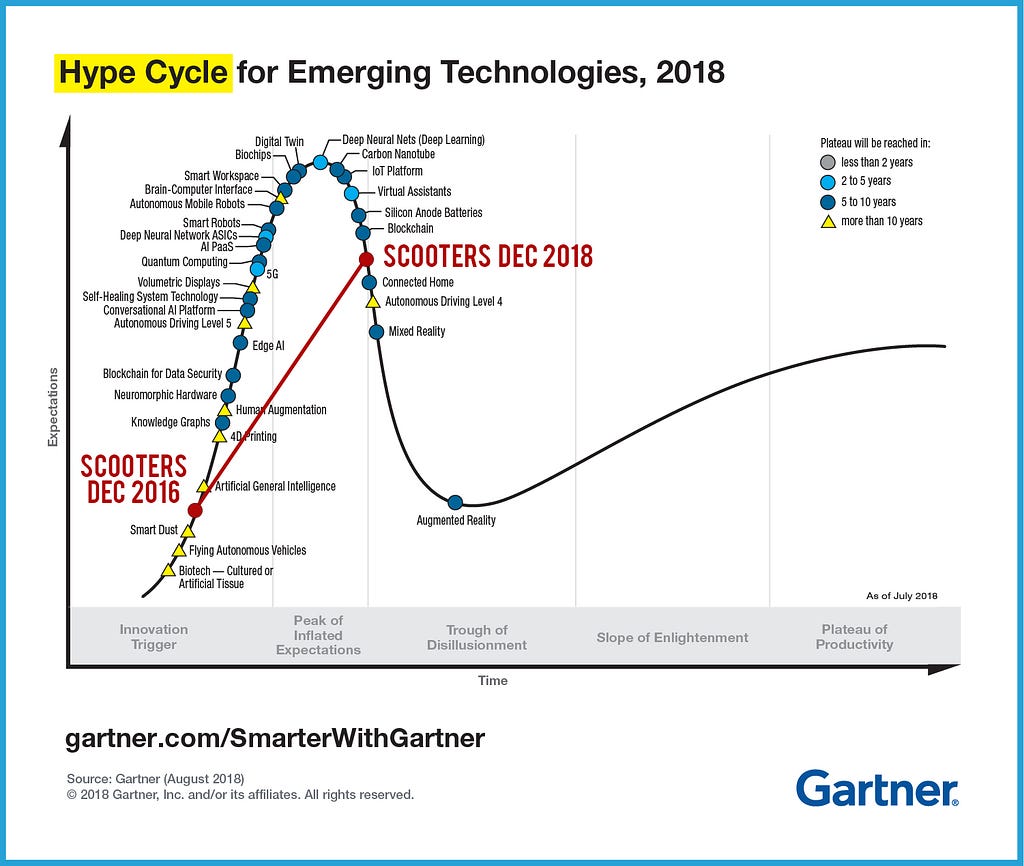

As we start talking about real problems and solutions, the excitement goes down. Check the famous Gartner Hype Cycle in 2018. Micromobility hype was so sudden and the progress was so fast, that no edition of the chart includes it. Scooters are a huge leap, but the process of service improvement is far from being done. So I’m introducing you to another important step in the evolution of electric scooters: efficient charging.

Proposed model

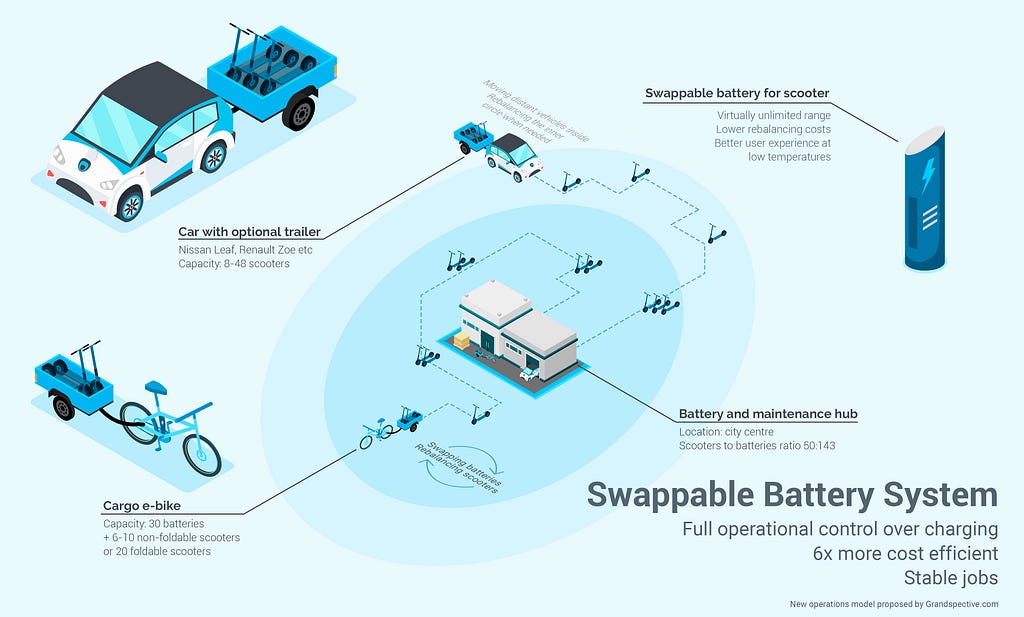

Bearing in mind all the problems affecting the financial stability of companies, I came up with a model based on new scooters with swappable batteries. Replacing all juicers and chargers with full-time employees allows the company to improve efficiency, take control of its city, reduce costs and offer more stable jobs. This win-win model can be 100% vertically integrated, as well as used in a global transportation franchise.

This autumn a lot of scooter companies were focusing on Spain, so calculations were done based on this country.The first new element of the model is the scooter. That vehicle is similar to the one used by Neuron Mobility, Singapore-based startup that launched e-scooter sharing service before Bird. Their dockless scooter lasts 40km and has a swappable battery.

In the proposed model, employees on cargo electric bikes are replacing the batteries in the majority of vehicles every day, while in some of them they change the battery twice a day for operational effectiveness. Same people rebalance 10% of the vehicles in the city.Cargo e-bikes from China start at $500, but, in the proposed model, a long-lasting solution costs $2000.

Scooters that were taken to distant areas outside of the city are collected by dedicated electric cargo cars. A car provides increased speed and capacity, allowing the company to get back the scooters that previously were left on the outskirts. More importantly, the car offers increased safety when it comes to doing operations in inner districts with high crime rate or at the late time.

Currently, scooter, with an empty battery at 14:00, lies on the sidewalk without generating any value. And with the proposed system, public space and scooter resources will be able to reach much higher utilization levels.Geofencing inside dense urban blocks may decrease the costs even further, allowing employees to collect scooters from the sidewalks instead of backyards. Bird is already using similar geofencing to prevent charger fraud.

Financials

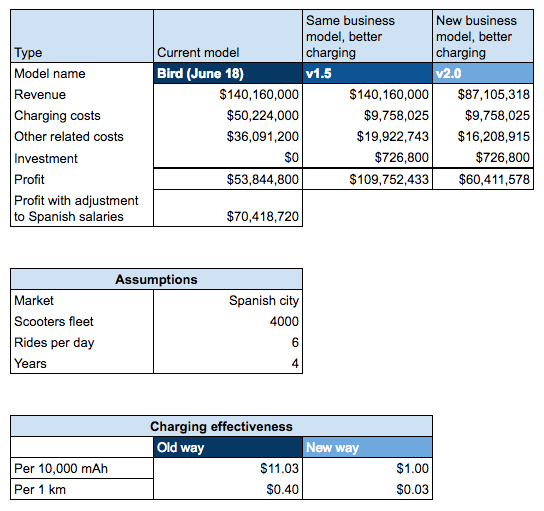

So how the new charging model will affect the bottom line? With the current pricing strategy, v1.5 model doubles the profit. Price per 10,000mAh is down 11 times, while 1 km now costs 13 times less.

This model doesn’t only beat the contractor model used by bigger companies, it also beats $4.5 that some European startups spend to charge a scooter through other operations models. Find the spreadsheet here to get the detailed information and play with the model.

So far we were talking about changing operations in version 1.5. Version 2.0, also presented in a spreadsheet, also offers a new business model — a more affordable solution for thousands of customers who loved escooter experience, and decided to buy a personal vehicle.The new business model has 2 types of tickets: monthly subscription and a casual ride.

Monthly subscription for $100 offers up to 5 trips per day, while casual ride becomes more expensive since now user has to pay $0.25 per minute. CitiBike in New York has 87% trips made by subscribers, so we are using this ratio in calculations. The model decreases the gross margin from 70% to 52% comparing to v1.5, but it makes the service much more affordable to all social layers, therefore increasing the total addressable market. Only at this stage, you can say that scooters compete with walking.

Now, this is an even more operationally intensive business, offering more space for KPI deviation in different cities. At the same time, there are a lot of factors that will improve unit economics even further:

50% gross margin turns into something gigantic with new market penetrationDecreasing excitement around scooters = less vandalismBattery technology is improvingVehicles are becoming sturdierCollecting scooters costs less in cities with higher scooter densityEnormous card processing costs are expected to decreaseCompanies work on camera and lock solutions to increase vehicle lifespanSources of income may expand into ads

Why nobody did it yet?

So if there is a way to cut costs, why scooter companies didn’t do this yet? Part of the answer is that it would be a political move. There was a lot of buzz about sidewalks, a lot of buzz around injuries and so media would be happy to use new information to create even more screaming headlines accusing evil Tech of taking the income from gig economy workers.

Another part of the answer is that some companies already do this. Neuron Mobility is actually swapping the batteries of its scooters to minimize charging costs. The company views itself as operationally flexible, meaning that when the time comes to expand to foreign markets in Asia, they will be able to adjust the operations model to local needs — offering either a dock-based solution or completely different operational paradigm.

As CEO of Neuron Mobility, Zachary Wang put it, answering my question about the future of electric scooters:

“E-scooter sharing is still at very early days… It will take some time to overcome the current lack of regulation in most of the countries, as well as to upgrade the infrastructure and to blend this new mode of mobility into urban design. Road users have to be re-educated about how to co-exist…I believe it’s an irreversible movement that is definitely going to change the future of urban transportation.”

As a product or service, electric scooters are undoubtedly more successful product than Segway. But will they be able to outlast the Segway, or will they follow the path of Chinese bike-sharing? It really depends on the positive change in operations strategy, and we should see some results already this spring 2019.

P.S. Thanks Freepik.com, Vectorpouch, Macrovector, Vectorpocket for help with the graphical part.

What’s the Biggest Threat to Scooter Sharing in 2019? was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.