Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

This article contains some notes on the recent post by Ali Tamaseb:

Land of the “Super Founders“— A Data-Driven Approach to Uncover the Secrets of Billion Dollar…

Ali’s article includes a lot of interesting data and is worth reading. I’m going to focus on the pieces I found to be most interesting.

The original article sets out to answer the question “what did billion-dollar startups look like when they were getting started?”. It “quantifies 65 factors on all 195 startups founded after 2005 until today in the U.S. that at one point passed the 1 billion dollar mark in valuation.”

As Ali notes in his disclaimer, the “data may not be 100% accurate”, but he does his best. An important point to keep in mind is that correlation does not imply causation.

The article is specifically about billion dollar companies. Starting a $50 million company is also a huge achievement. Also, just because this is how unicorns of the last 15 years were built, does not mean this is how the unicorns of the next 15 years will be built.

Let’s get started.

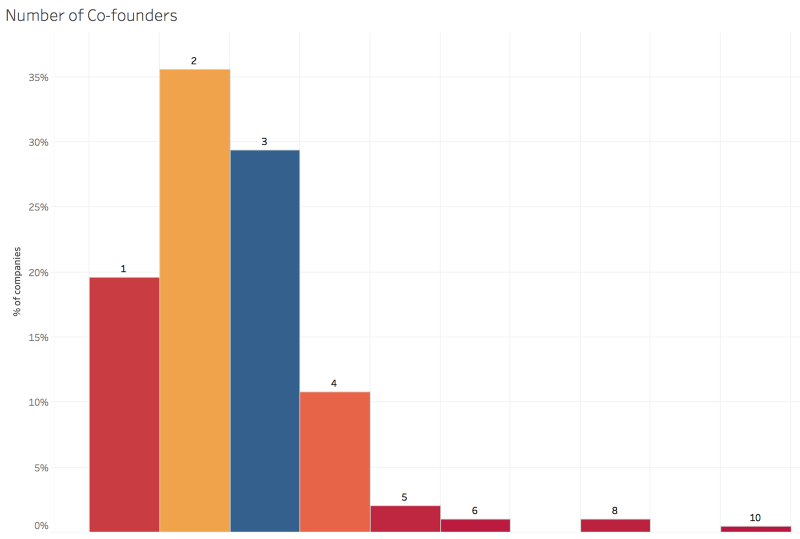

1) Number of Co-Founders

There’s a common misconception that being a solo founder is bad. However, almost 20% of unicorns were founded by solo founders. Throw out the rulebook.

Jeff Bezos was a solo founder. eBay, Ford, Tumblr, Craigslist, Magic Leap, Spanx and may more companies were also all started by solo founders.

I imagine most companies are started with 1–4 founders so the fact that most billion dollar startups fall into this range shouldn’t be surprising either. The data here could well be misleading. If 40% of all companies are started by 2 founders, but only 35% of them became unicorns that may well be a sign that 2 founders is actually a bad number of founders!

Having said that, I think the main point is that the number of cofounders you have shouldn’t matter too much. You can be successful either way and will likely depend on the exact circumstances you’re in as to what makes the most sense for you.

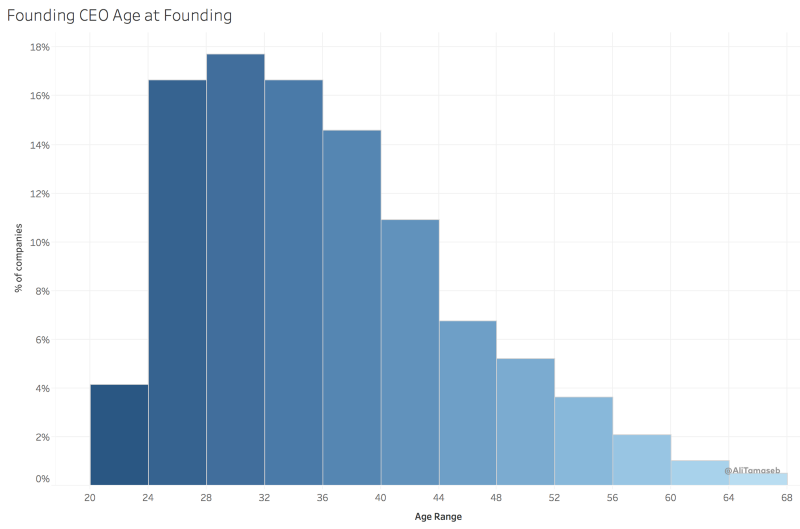

2) Age

Founders can be anywhere between 20 and 70 years old. The most common age group is 28–32 years old. 50% of the companies were started by people aged 24–36. Your 30th birthday is the optimal age to start a company ;).

Looking at the data another way, 50% of unicorns were started by those over 35 years old.

It does seem significantly harder to start a unicorn if you’re under 24 years old.

5) Work Experience

You can start a unicorn with any amount of work experience, but the mode for tech companies is 10 years work experience and for health startups it’s 28 years of experience.

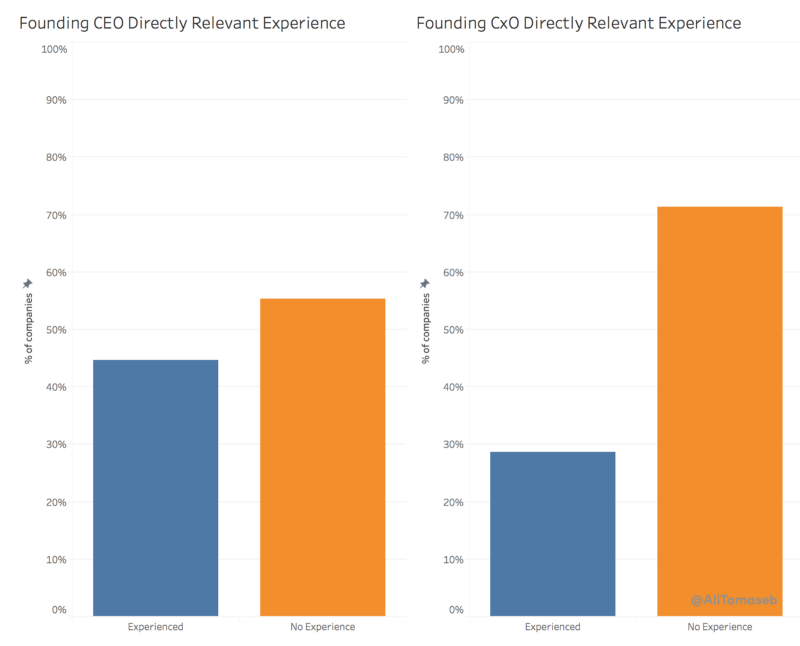

6) You don’t need industry experience

This is a surprising one. You don’t need directly relevant experience in the industry you’re disrupting.

7–10) Repeat Entrepreneurs

Almost 60% of the companies were started by repeat entrepreneurs.

Many were a founder for 2–3 years previously, and some founded multiple startups and led them for 20+ years. For many of them their first or even second startups failed.

Almost 70% of the repeat entrepreneurs had previously founded a successful company with either a $50m+ exit or a $10m+ annual revenue. Of these, 25% of them actually had more than 1 previous successful exit. Very impressive.

If you can invest in a company with a previous super founder, become a co-founder with a super founder, or join as an early employee at a new company being started by a super founder, these all seem like very smart moves with a good chance of a big pay off.

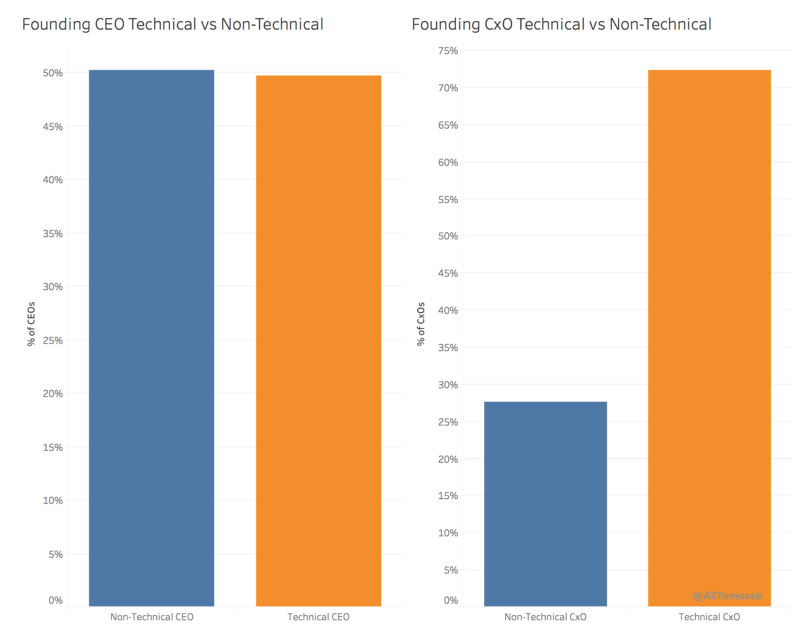

13) Technical vs Non-Technical CEOs

There were an almost equal number of technical and non-technical CEOs.

Mark Zuckerberg, Bill Gates, Sergey Brin, Larry Page are some famous technical founders. Steve Jobs, Richard Branson, Phil Knight are some famous non-technical founders.

There are a lot of misconceptions about what a CEO is supposed to look like. Typically you might imagine it to be a loud salesman. Perhaps a Richard Branson or Alan Sugar type character. In practice, successful startup CEOs are often shy or the nerdy types. The Nike founder Phil Knight was extremely shy for example. Although as a brand Nike does not give off that image at all. Google, Facebook, and Microsoft are other examples of non-“CEO” types creating some of the most valuable companies in the world. Had you met Bill Gates or Mark Zuckerberg at age 20 you likely would not have described them as CEO material.

16) Previous experience working for other startups

70% of unicorn CEOs did not have experience working for another startup. Many did have previous experience working at their own, often successful, startups however.

26) B2B vs B2C

There were an almost equal number of unicorns doing B2B and B2C (slightly more B2C). A mere 1% of unicorns did both.

Lessons 29 to 36 contain some of the most valuable information for founders.

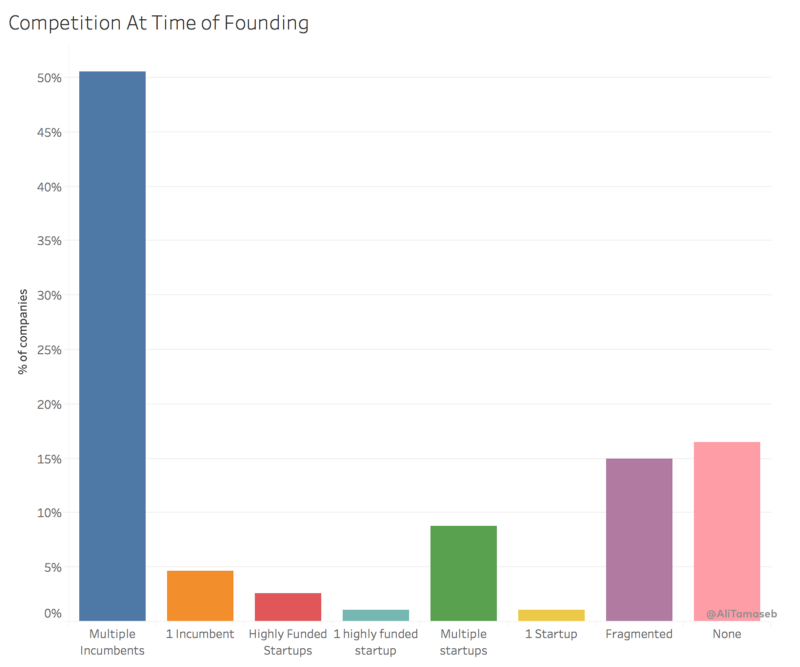

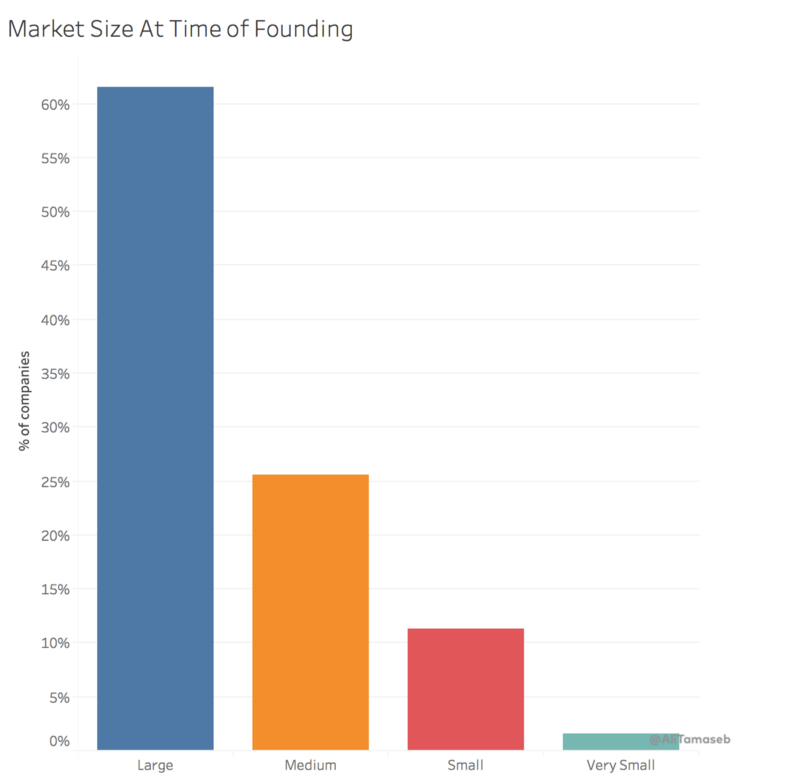

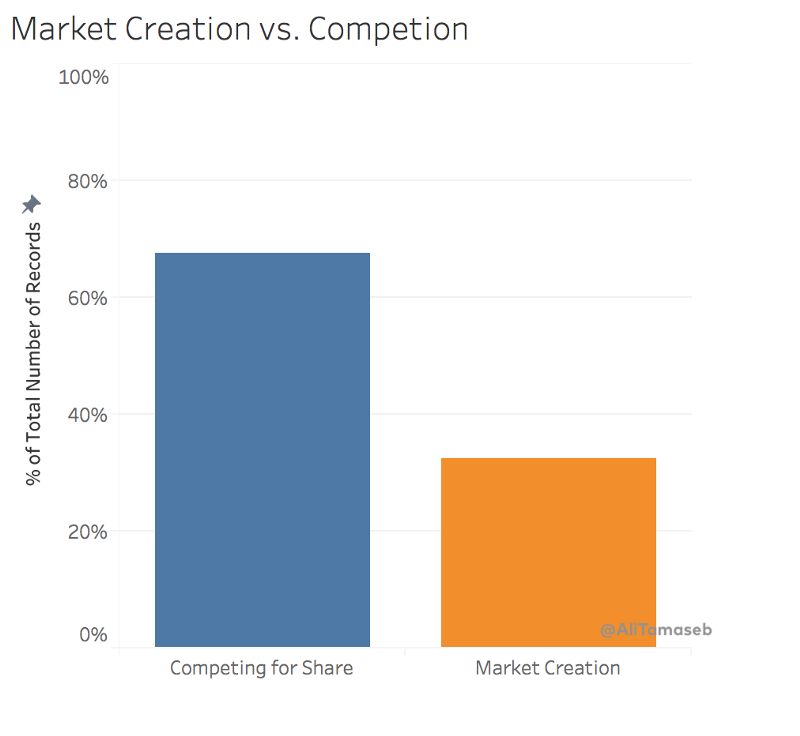

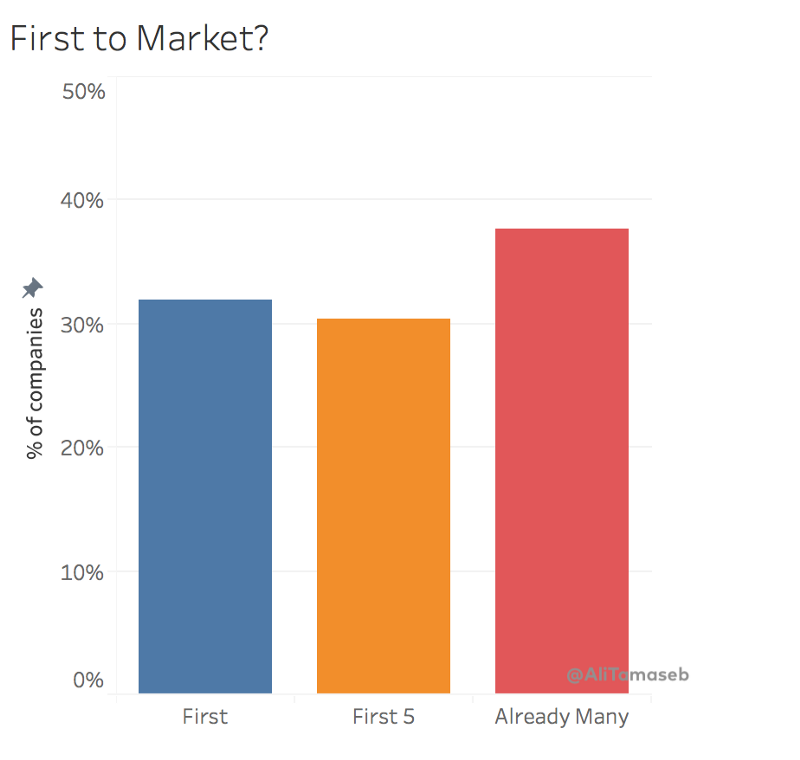

29, 32, 33) Competition and Market Size

Competing in existing, large markets is a good thing.

Seems like competing with multiple large incumbents is a good thing. It is a sign that the market opportunity is large, and the large incumbents have educated the market. However, a startup can use the inefficiencies of incumbents and the benefit of not having a legacy system to win over a market. Fragmented and empty markets are also prime for disruption. The worst case seems to be copying what another startup is doing, specifically where they have recently raised a lot of money recently.

On this topic, I recommend reading the following article by Marc Andreesen on market size:

Pmarchive - The only thing that matters

You will find some differing views on this topic. Peter Thiel in his book Zero to One points to examples such as Amazon, eBay and Facebook that initially started by focusing on niche markets and expanding. Amazon focused on online books. This wasn’t a huge market at the time, but they conquered it and ended up expanding to selling everything.

You could argue that Amazon was going after a huge market, but the strategy was to start off small and then expanding, and this was in fact Bezos’ original vision for the company.

Facebook went after the social media market, not a huge market at the time although things like MySpace did exist. In terms of growth strategy, they started with only Harvard university students, then expanded to other universities, and eventually the world. They dominated each small market they entered one by one.

A good video I’d recommend that covers Peter Thiel’s point of view:

Nonetheless, the data here seems to suggest going after large existing markets is often a very good idea and that competition is not for losers.

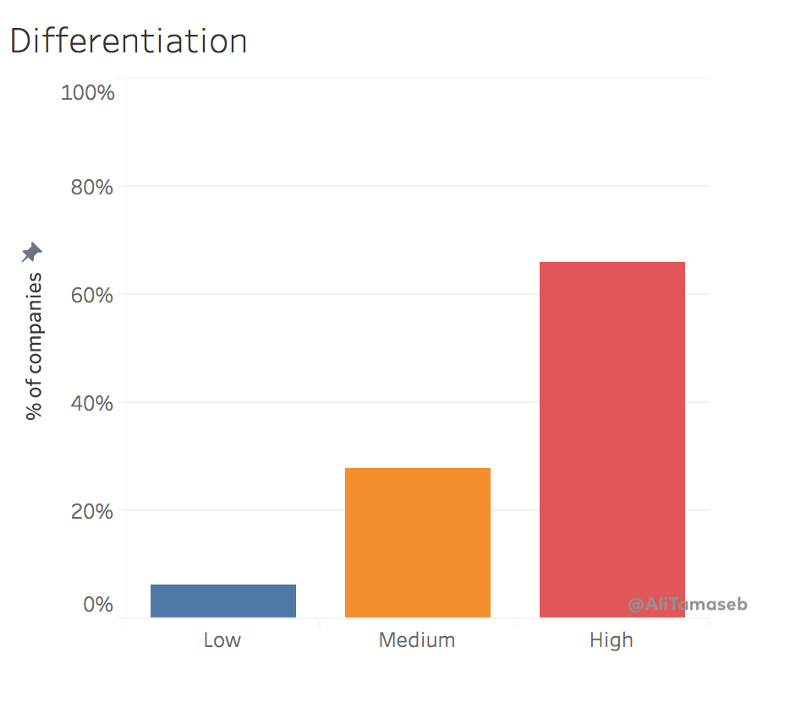

31) Product Differentiation

Despite many of the unicorns going after existing large markets that showed existing demand for products in the space, the unicorns had a large degree of differentiation from the existing solutions.

30) Moats

A moat is something that stops competition from entering your space and displacing your company. The biggest defensibility factor was engineering (think Google’s search algorithm). Other defensibility factors were network effects, IP and brand. Partnerships don’t seem to work well as a moat, although they may well help your business as a whole.

34) Timing

There are so many misconceptions about timing. You can be first, you can be last, you can be in between. Timing is hard to get right, but the fact that you entered a market last doesn’t mean you don’t stand a chance. Nor is being first-mover necessarily an advantage. First movers make the mistakes that second-movers can learn from and fix. For example, Facebook improving on MySpace.

35) Pain killer vs vitamin

Pain killers solve a pain. Vitamins simply make your life better. Both work to create unicorns.

38) Accelerators

90% of unicorns did not go through an accelerator. Of the 10% that did, they were basically all from YCombinator.

43–44) Investors

60% of the unicorns had tier 1 VCs as early investors. Ex-founders make the best angel investors.

47–48) Funding

The companies raised large rounds and did it quickly with a relatively short amount of time between each round. The market realised the potential of these companies and were willing to invest large amounts in them. The takeaway should not be that you have to raise money every 12 months to run a successful company, although that may well be the affect if things are going well early on.

49) Timeline

Over 50% of the unicorns took 4+ years to reach a billion dollar valuation. This shouldn’t be too surprising. What I did find surprising is that a massive 22% of the companies in the study managed to become unicorns within 2 years of founding.

I hope you enjoyed the article. Have any thoughts on the above? I’d be happy to hear in the comments. Happy new year!

Super Notes on Super Founders was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.