Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Red Pulse is a blockchain-based intelligence platform covering China’s economy and capital markets. It aims to simplify and streamline the vast amount of news and information that circulates around the Chinese markets. Following a token swap in 2018, the native token of the system is now PHX.

In this guide, we will cover:

- What is Red Pulse?

- How Does Red Pulse Work?

- Coin Supply and Staking Mechanism

- History and Team

- Trading History

- Competitors

- Where to Buy PHX

- Where to Store PHX

What is Red Pulse?

Red Pulse is essentially a content curation platform, with a specific focus on research and information on the Chinese markets. It makes use of artificial intelligence and game theory to provide up to the minute information services to financial analysts and researchers.

Red Pulse homepage

In the sector of financial market data and information, there are a small number of global players providing “terminal services.” Within institutional investment organizations, you’ll find a computer terminal 100% dedicated to churning out a feed of aggregated news and information from the worlds financial markets. These terminals are provided by news outlets like Bloomberg or Thompson Reuters.

The founder of Red Pulse recognized that within the Chinese market, the information market domination by big players is failing to deliver. China is a massive and highly technologically developed country with vast, fast-moving and complex markets. For this reason, there is an overwhelming volume of news and information that comes from the Chinese markets. For example, a rumor can start in the morning, and by afternoon, it’s reported as false information. Furthermore, this may happen several thousand times each day.

Now, imagine a human financial analyst sitting in front of a Bloomberg terminal tasked with coming up with meaningful insights to help make investment decisions. The problem becomes evident.

Sharing Economy for Research

Red Pulse aims to solve this information overload. It works from the premise of being a “sharing economy for research” with a specific focus on the Chinese economy and capital markets. Industry experts, researchers, and market analysts can contribute their insights and information to the platform. Submissions are curated by a combination of machine learning algorithms, natural language processors and human analysts. The platform uses more than 4,000 metatags to categorize and sort the data.

Red Pulse was the first application launched on the NEO blockchain, initially under the ticker RPX. However, PHX tokens replaced RPX after a significant upgrade in 2018 called Phoenix.

How Does Red Pulse Work?

When someone contributes information or research to the platform, Red Pulse assigns them a credibility score. This score is based on the accuracy of their submissions determined by readers, the Red Pulse team and the overall popularity of their contributions. Contributors earn PHX tokens for their submissions.

Anyone accessing information on Red Pulse pays in PHX tokens. Furthermore, if a researcher wants to find out more about a particular market development, they can make a request on the platform. Then, anyone in the know can respond to the request and earn PHX tokens for their efforts.

Coin Supply and Staking Mechanism

You cannot mine PHX tokens. Instead, the platform operates a staking mechanism for node holders. Don’t get confused with proof-of-stake, as Red Pulse uses the NEO delegated Byzantine Fault Tolerance (dBFT) consensus algorithm.

Anyone holding PHX (Phoenix) tokens can become a staker. To do so, they must convert their PHX to PHF tokens (Phoenix Fire) tokens in their user dashboard. The conversion is on a 1:1 ratio. Red Pulse calls this “firing up.”

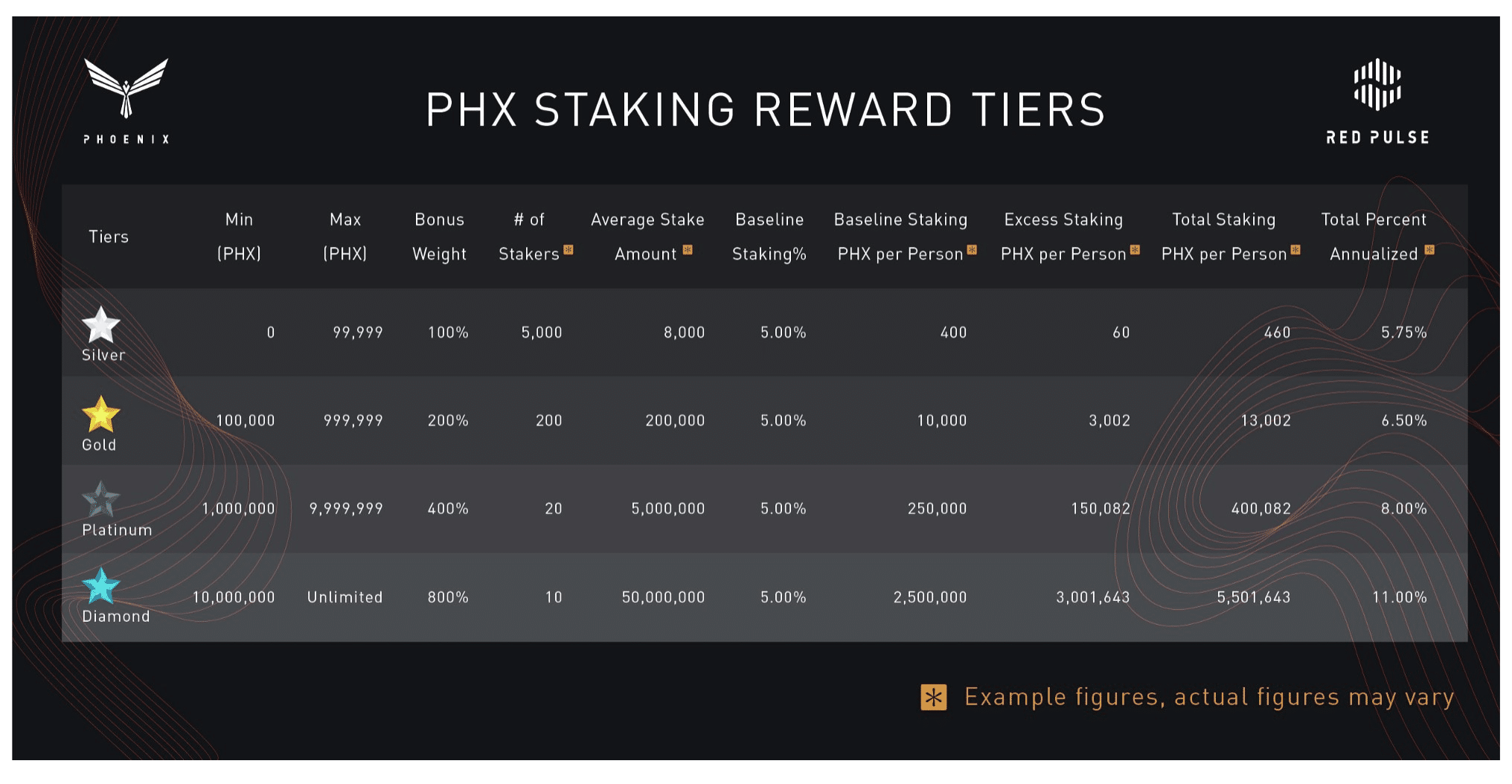

The staking reward process is a little complex. The total supply of PHX increases by 10% each year. The newly created coins are split 50/50 between rewards for data contributors and rewards for stakers. The rewards for stakers are calculated based on a tiered model where those staking the most get the biggest rewards. All stakers earn a base rate of 5% per year. The difference between this payout, and the newly minted coins reserved for staking rewards go into a pool. Stakers get a share of this pool according to their tier level.

The below chart illustrates the kind of rewards that stakers could earn at different tier levels depending on the number of stakers involved.

There is a total supply of 1.36 billion PHX tokens, with 829 million in circulation at the time of writing.

History and Team

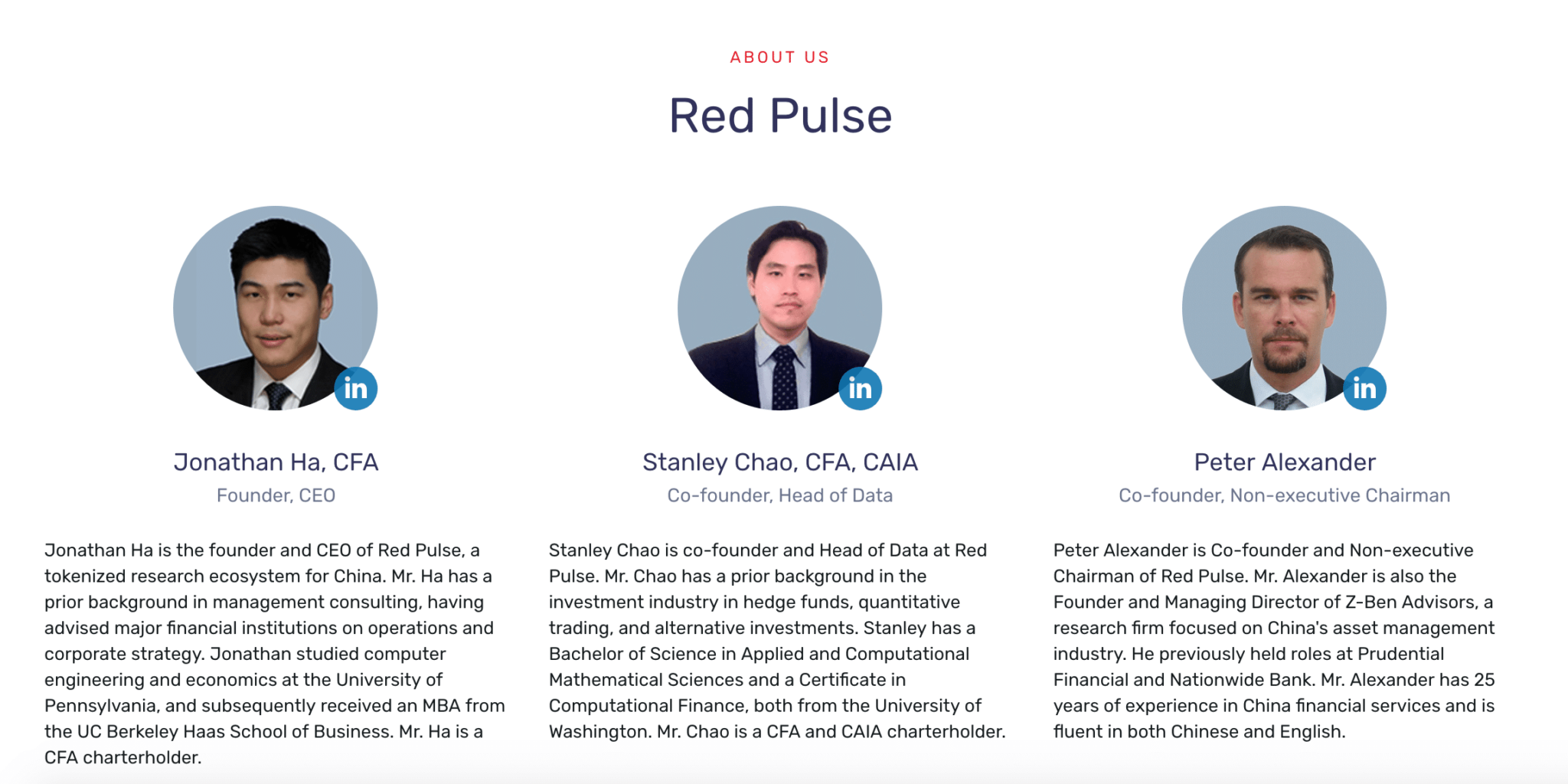

Red Pulse was founded by Jonathan Ha back in 2015. Ha had a vision of overcoming the myriad issues with the financial data markets in China. He co-founded the company with Stanley Chao and Peter Alexander. All three have a background in management and IT consulting.

The founders of Red Pulse

Advisers to the project include Hongfei Da of NEO and Tony Tao of the NEO Global Capital Fund.

The company underwent an initial ICO in 2017, raising $15m. There was a significant upgrade in 2018 called Phoenix, which introduced enhanced smart contract functionality. This upgrade includes proof of creation and ownership of content, alongside regulatory compliance and intellectual property protection. At that time, the project swapped out the initial RPX token for the Phoenix (PHX) token.

Red Pulse put significant marketing efforts into the upgrade, conducting a roadshow in various Asian countries.

Trading History

The price of Red Pulse follows a similar pattern to most cryptocurrencies, with its biggest bull run happening during the Bitcoin price spike at the end of 2017. There was a brief rise around April/May 2018, which corresponds approximately to the timing of the announcement of the Phoenix upgrade.

Competitor Analysis

Red Pulse is the only project of its kind focused entirely on researching and analyzing markets specifically in China. From the perspective of pure content curation, Steem is a similar platform. There are other projects aimed at financial analysis but tend to focus on cryptocurrency markets, such as Cindicator.

Where to Buy PHX

Naturally, PHX features on the big Asian exchanges so you can buy it through Binance, Huobi, and Kucoin.

Where to Store PHX

For cold storage, you can keep your PHX tokens in the Ledger Nano S. The official NEO site also offers several wallets for NEO tokens including PHX.

Conclusion

Red Pulse is the first mover into a potentially very lucrative market. Institutional investors are willing to pay for market intelligence and insights. Therefore, the market is ripe for disruption.

Given the scale and pace of development in China’s economy, it’s an excellent place to start. Although Red Pulse hasn’t yet given any indication that it plans to extend its geographical scope, if its strategy succeeds in China then there is every chance it could be successful in other markets. This potential, combined with a solid existing business model and a trustworthy team, means that Red Pulse is undoubtedly one to watch in 2019.

Additional Resources

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.