Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

An ICO or an initial coin offering is a form of funding through cryptocurrencies. Here, new projects sell their tokens in exchange for Ethereum or bitcoin. It is quite similar to the popular initial public funding where people purchase the shares of a company. Well, a token often gives access to the product that a certain company wants to bring to the market after getting the funds they require, often known as a utility token. It can ideally act as a virtual asset or a digital representation of the material.

An initial coin offering can be very tempting, but it calls for a lot of work to start one and successful. According to reports, over 80% of ICOs are deemed to be scams. This calls for a proper strategy if you are going to be launching one.

Investment in initial coin offerings has become more and more complex and calls for more from those who are entering the arena. That implies putting together a proper strategy has become vital.

That being said, here are the steps that you need to properly follow in order to become successful in the world of ICOs.

Add Value to The Blockchain Community

The reasons why you need an initial coin offering is the first thing to consider. This can get you funds over a few weeks or months, but it is imperative to understand that your token should match with a product that you’re developing and one that can add value to the blockchain. Simply put, if your token is just another cryptocurrency, then chances of succeeding are meager.

Where to Launch Your Initial Coin Offering

The location is very crucial when launching an ICO as different countries have varying policies in regards to running such fundraising. Countries that are known to be ICO-friendly include Singapore, Hong Kong, Switzerland, Cayman Islands, and the British Virgin Islands. It’s ideally crucial to bear in mind that if you offer tokens to United States residents, you will be subject to the SEC( U.S. Securities and Exchange Commission). Ideally, you may want to avoid naming your token security as it will instantly become subject to investigation. You should ensure you pick a good brand name to start with too.

Create a Skilled Team

This is an essential aspect of launching an ICO as you can only take your company as far as your team can run. You will need individuals responsible for developing the products, others for marketing purposes and an array of other things that come with launching a new product or project. Your core team should include developers and engineers with expertise and experience in blockchain as well as contributors to open source community. Apart from the core team, you’ll need a number of advisors too. Have at least one who has a degree in law and experience in helping ICOs. Other advisors should include financial experts, public figures with a great reputation, founders of successful ICOs and experts in crypto.

Your Project’s Roadmap

The primary reason for launching an ICO is your product. That’s why a clear and articulated roadmap is essential in creating an image of a promising initial coin offering. A roadmap can take your vision and transform it into a product that generates revenue.

Creating a Whitepaper

This is a document that has become a must-have thing for any team that’s planning to launch an ICO. A white paper goes into detail on how your project is to proceed, the manner in which you will develop projects and what people can expect. This triggers a high sense of credibility in the investors of your project.

Before you even reach out to the crypto community, the white paper is the first thing that you should post on your website. That is because serious investors first look for this document before they even think of proceeding further.

Building and Contributing to Your Crypto-Community

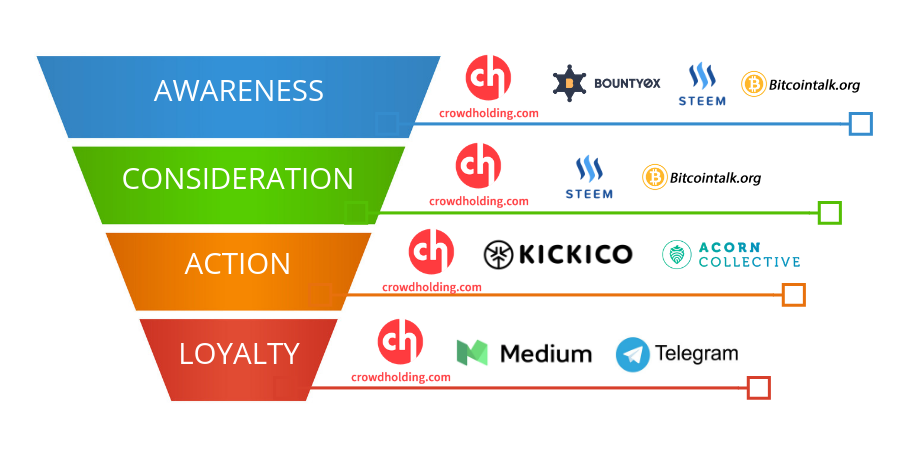

Another particularly important step! Effective actions need to be put in place to make your ICO is known to crypto investors, conventional investors and the general public. It is important to start with this order because you will initially address a connoisseur and receptive audience and then go after a public less familiar with the ICO. It would be imprudent to spend large sums of money to advertise your highly technical ICO to an unsuspecting public who will not even understand what an ICO is.

Recommended Article:

- 4 Primary Reasons Why ICOs Fail

- The Best Marketing Strategy for Blockchain Startup Without Facebook, Twitter and Google

So, you need to decide on a budget to talk about the launch of your ICO. Websites specializing in crypto-currencies and ICOs are a great way to get the public’s attention to your project. You can also get closer to Youtubers specializing in cryptocurrencies or financial investments who can talk about your project in their communities.

The ideal would be to have a team of marketing professionals to support you: A marketing director, a web-marketing manager, a community manager. It will be necessary to think about the different channels of acquisition (Adwords, Specialized Website, Facebook, Twitter, Television, Radio, etc …) and their respective budgets.

It is also interesting to involve your community to help you know your ICO. For this, there are different ways to encourage your investors to talk about the project such as Airdrops that reward the users who make you known. You will have to let them know of your project via marketing channels such as BitcoinTalk forums, Reddit or a professional company that can help you in reputation management for your ICO launch. You’ll also want to ensure that you have a public Slack, Discord, and Telegram where you can keep in touch with your supporters.

Choosing a Token Sale Method

Most initial coin offerings happen on the Ethereum blockchain as it supports smart contracts. These are the basic tools for automatic generation of tokens and distribution. You will ideally have to use some terms such as:

Soft Cap- the minimum amount of money that the ICO requires to become successful.

Hard Cap- This is the maximum amount of money that is allowed for raising.

Dutch Action Approach- This is a process that doesn’t set the price of a token in advance.

Hybrid Approach- Involves combining various sales models.

Smart Contract and Mint Tokens Development

For tokens to be generated and for automation of distribution to happen, you will require a smart contract. ERC20 is the standard in the industry, and you should ideally audit the contract before submitting it to the Ethereum blockchain.

Launching Your Initial Coin Offering

When the big day arrives, your ICO will start automatically as you programmed it in the smart contract. It’s advisable to have a web interface for people to follow the progress of the ICO. From there on, your company will be monitored closely by ICO listing sites, blockchain experts, investors, and social media followers.

Ensure that you regularly communicate with the community as this assures them that you still have faith in the development if your envisioned products.

Recommended Article:

The Next Generation Trading Platform for Crypto Traders

Insider Tips for Launching a Successful ICO was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.