Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

What’s the Role of Cryptocurrency Exchanges?

Disclaimer: Article sourced from InWara. This is not financial advice.

With Bitcoin, Ethereum and almost all cryptocurrencies making headlines every day and despite the market being plummeted, more and more people are jumping into the crypto bandwagon. And, they are doing it through a cryptocurrency exchange.

Why exchanges?

Liquidity is the simple answer!

Be it retail or institutional investors, everyone invests with an end goal to achieve maximum returns on their investments. For the professional traders with access to institutional grade trading tools, it is only pragmatic to invest in an exchange that requires an exhaustive KYC process, has a legit adverse media and unassailable security hacks to begin with.

Types: Centralized vs Decentralized exchanges

Blockchain technology is envisioned to be an open-source initiative where a decentralized distribution of power exists instead of concentrating it all in a single central authority. However, there is an exception of the development team having the significant say in the project roadmap. In defiance to blockchain’s vision, there exist centralized and decentralized exchanges.

Centralized exchanges directly defy the blockchain values as the assets are controlled by a single central entity that raises serious trust issues. To put it simply, the key to access all your assets/funds is with the exchange but not with you and a single security breach or even a technical breakdown of the platform may vanish all your funds in the hot wallet.

Currently, in crypto space, centralized exchanges (such as Coinbase, Kraken, Binance, Bitfinex etc) contribute to the larger share of the market. However, there are a number of companies like Binance that have come to realize the importance of decentralization and are working on launching their decentralized platform soon.

On the other hand….

Decentralized exchanges (such as IDEX, Stellar DEX, Bisq, Openledger DEX, Radar Relay etc) adopt blockchain technology and operate on a peer to peer protocol. This means that the system is based on the number of independent nodes that will ensure the functionality of the platform in case of single point of failure.

Centralized vs decentralized exchanges

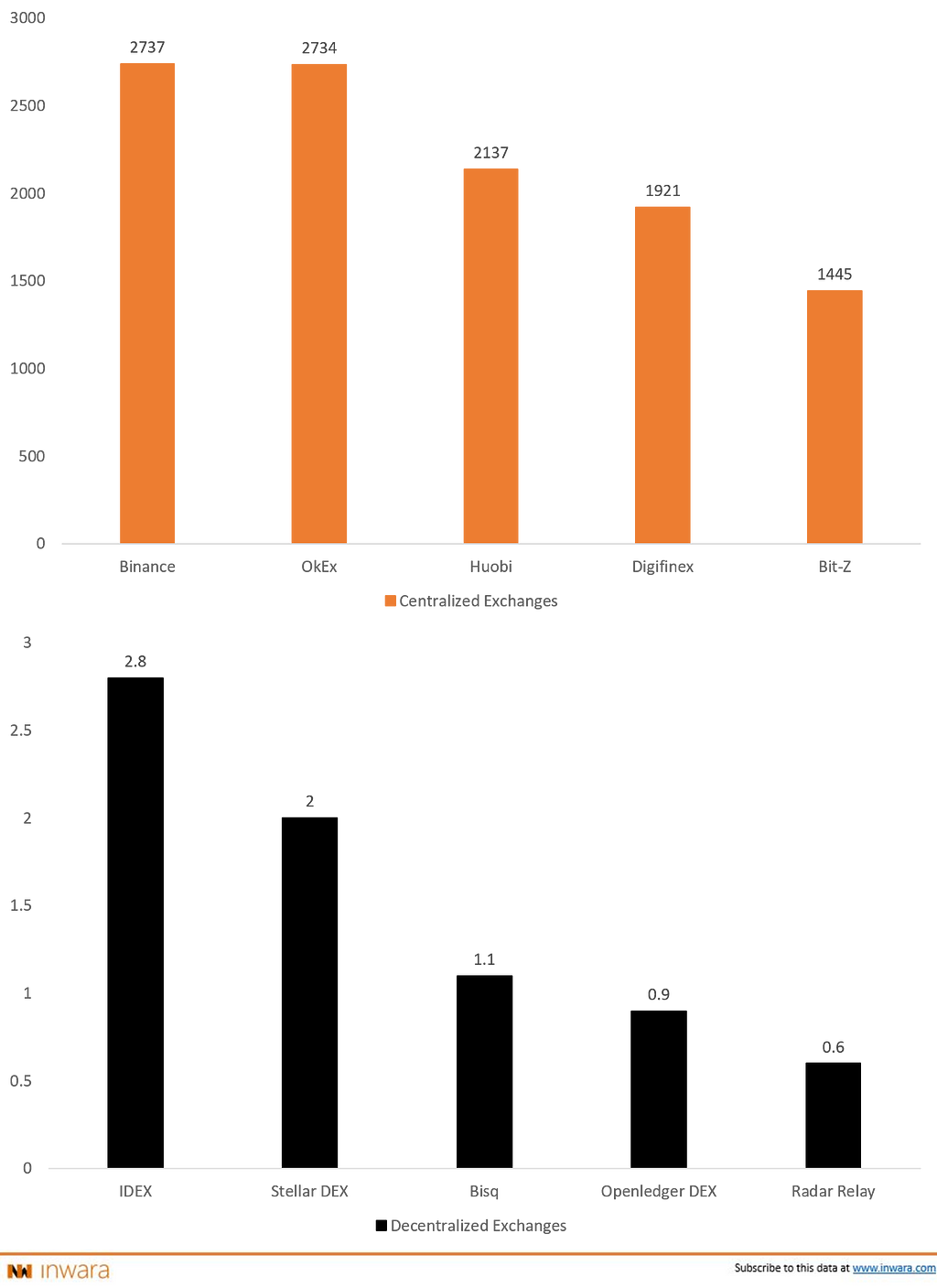

Liquidity is one of the major issues with the decentralized exchanges. Currently, on decentralized platforms, there are not enough market makers who could attract a fair amount of takers which is why there is not enough liquidity to compete with centralized platforms.

Top 5 Centralized and Decentralized exchanges, trading volumes (in $MM) compared!

Trading volumes in $MM (Source: InWara’s crypto exchange database)

Trading volumes in $MM (Source: InWara’s crypto exchange database)

How to choose an exchange?

Unlike the NYSE or other exchanges which operate in specific time zones, cryptocurrency is traded around the world 24x7 which is one of the main reasons for its volatile nature. It is wrongly presumed that to know about the cryptocurrency alone will suffice to ensure good returns but most of them miss out the fact that it is also vital to know in and out of an exchange which you will be using for investing/trading.

Crypto investments are nothing similar to investing in banks, credit unions or traditional stock exchanges that you may be familiar with. Unlike them in cryptocurrency exchanges, there are virtually no fail-safes in place to protect your assets and even a small mistake can cost you everything.

There is no hotline that you can call when you are stuck or there are no corporate headquarters that you can reach out to if you lose your funds and there is no backing from FDIC insured banks on these investments, which sums up to the fact that one can lose all the funds at once to cyber attacks with no recourse at all.

Ways to define credibility of an exchange

- The security measures followed by an exchange should be good enough to withstand the breach attempts from the hackers. It is crucial that an exchange takes extensive measures like the 2fa verification, password strength, anti-phishing code feature, captcha measures and more.

- For institutional grade investors and venture capitalists, it is vital to have the data on trading volumes offered by each exchange to pick an exchange that meets with their investment criteria.

- On a general note, the exchange is considered to be on the top if the trading volumes offered are high.

- Transparency is another parameter that defines the credibility of an exchange. Adverse media data of a particular exchange is crucial in making the choice.

- It is vital to know the location of an exchange and it’s a red flag if you can’t pinpoint the location of an exchange. It is going to be tough to find the right jurisdiction where you can sue the people in case of foul play activity.

- In crypto space, the number of exchanges that trade in fiat currency is under 10% which may pose a concern for the retail investors who does not own any digital tokens yet, in which case they will have to look for an exchange that operates with cash (like Kraken, Coinbase, Gemini, Bitstamp etc).

- Often the transaction rates are higher for the more secure exchanges but it all makes sense when the fees is weighed against protection.

- Not all coins are traded on all exchanges so it is best to know the exchanges that are listing the coin of your choice.

InWara’s Crypto exchange database is the single largest cryptocurrency exchange database globally. This database provides information on the security measures opted by each exchange, their KYC process details, transaction fee limits, trading volumes, and accepted payment methods and more.

It is an exhaustive and verified database of over 200 cryptocurrency exchanges with 100+ data points covered in each exchange. Data points including adverse media, security hacks, live tracking and updatesof trading volumes, transaction fees, and KYC process.

Top Crypto Exchanges | An ultimate guide to choosing the best cryptocurrency exchange was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.