Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

What Is Binance Coin?

Binance is currently the world’s second largest cryptocurrency exchange, with around $6 billion in assets traded in an average seven day period. Binance’s rise to the top has been swift. Since its launch in July of 2017, Binance has grown at a rapid rate. Even in the current bear market users continue to sign up with the exchange. Binance was one of the first exchanges to reactivate user registrations at the peak of the 2017 bull market.

Binance is also the name of a cryptocoin (BNB) traded and used on the Binance exchange. Since the ICO, the value of BNB has risen with the growth of the exchange. BNB is now among the top 30 cryptocurrencies in the world by market cap.

What about Binance makes it so compelling? Why are so many people signing up to use this exchange? In this article, we’ll dive into those questions and more. The answers are surprisingly simple. The simplicity of Binance’s business model has been the key to its success so far, and it bodes well for future success. In this guide we’ll discover the following:

- How Exchanges Work: Understanding Binance’s Advantage

- Using the Binance Exchange

- The Binance Coin (BNB)

- Binance Coin Trading History

- Where to Buy BNB

- How to Store BNB

- Conclusion

- Additional Binance Coin Resources

How Exchanges Work: Understanding Binance’s Advantage

First, it’s worth understanding the basic mechanics of a currency exchange before we go any further. Solving some technical problems with exchange software is among Binance’s key competitive advantages.

Matching

A typical exchange works as a market maker for buy and sell orders. It’s important to note that the exchange itself does not buy and sell your currency when you make an exchange. Instead, the exchange matches you with another user who is willing to buy your asset at the price your asking. This matching of buy/sell orders is the key function of an exchange. When an exchange matches buy/sell orders and completes a trade, it charges a transaction fee to both parties for the service of finding a match. That’s how exchanges make money.

This order matching creates a bottleneck for many cryptocurrency exchanges. If you have more trade requests than your matching software can handle, orders will be delayed. With the popularity of Bitcoin and altcoins right now, users are submitting millions of trade requests per minute on the most popular exchanges. Delayed trades might be the difference between capitalizing on an investment opportunity and missing it.

Binance’s major innovation is their matching engine, capable of 1.4 million trades per second. This makes their trading platform one of the fastest available on the market. As such, many crypto investors have flocked to Binance for its processing speed.

Liquidity

The other critical component of an exchange is liquidity. Liquidity is the amount and frequency with which assets move around the exchange. In order to quickly find a match and complete an order at a competitive price, there needs to be a lot of activity on the orderbook. An exchange with a quiet orderbook is not a good place to invest your money. However, Binance has the busiest orderbook in the world, making it a safe, competitive market for transactions.

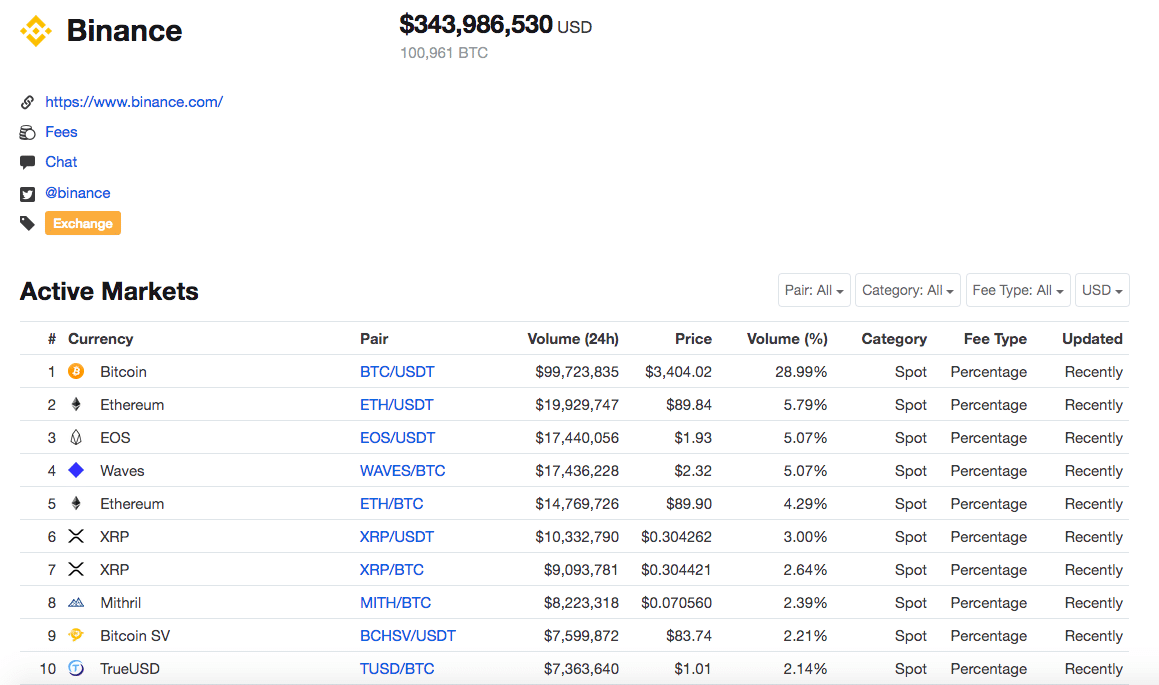

Most traded asset pairs on Binance in the past 24 hours

Binance has high liquidity in many different assets, not just Bitcoin and other top coins. Bitcoin is by far the most-traded asset on Binance but altcoins also feature decent volume. The altcoin advantage is a virtuous cycle for Binance, and new coins often choose to list with Binance over competing exchanges. This includes many coins from Asia that may not be available from Western-based exchanges. The wide array of assets available is another key reason for Binance’s rapid rise.

Using the Binance Exchange

Binance does not support fiat currencies, so you can’t convert dollars, yen, pounds, euros, etc. on the exchange. (The name Binance is actually a combination of “Binary Finance,” suggesting that they only deal in digital assets.)

If you want to use Binance, you’ll need to already own cryptocurrency. Once you do, registration and setup are fairly easy, as is funding your Binance account.

User Experience & Interface

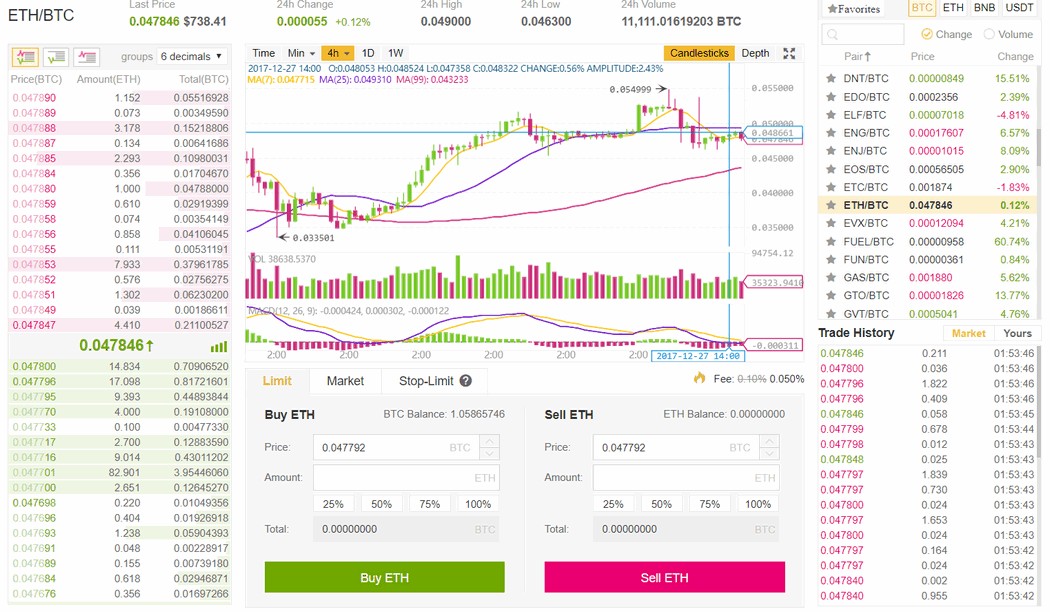

Binance’s User Interface

Binance has done a great job building an intuitive user interface without sacrificing the charts, graphs, and other information you need to make informed investment decisions. Trading is easy and only requires a few clicks to select the currency pair you’d like to trade and create the order. The user interface is available online and also as a mobile app for iOS and Android.

Another factor contributing to Binance’s rapid growth is its availability in fourteen different languages. The exchange supports users that speak English, Chinese, Japanese, Korean, Russian, Spanish, French, German, and several other major languages.

Low Fees

The final key to Binance’s success is the competitive trading fees it charges. It’s free to fund your account, and orders are charged a simple 0.1% trading fee. The trading fee means you’ll want to limit how frequently you make trades since you’ll lose 0.1% every time you transact. However, we’ll see in a minute that Binance makes it possible to reduce these transaction fees. If you consider how much Binance makes off its transactions, it’s clearly a profitable business model. Only 0.05% of daily volume still translates into millions in revenue every day.

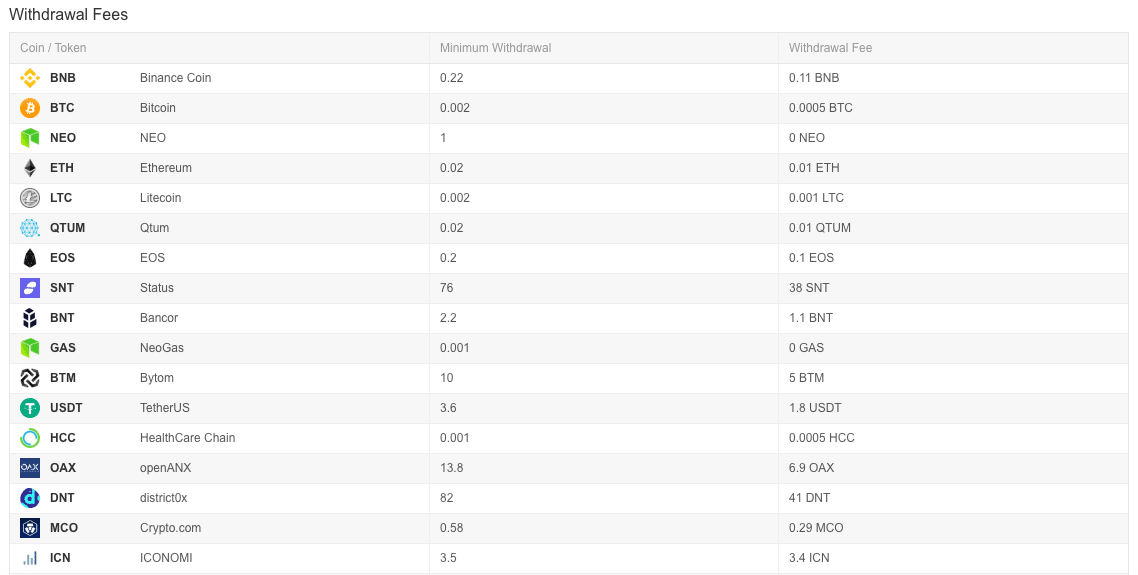

Binance also charges withdrawal fees for moving assets out of your account into private wallets. The withdrawal fees vary by the coin, but they are flat fees, not percentage-based.

Example of Binance Withdrawal Fees

The Binance Coin (BNB)

Along with the launch of the exchange, Binance launched an ICO. BNB is an ERC20 token built on Ethereum. The total supply is limited to 200 million BNB, after which no more coins will be created.

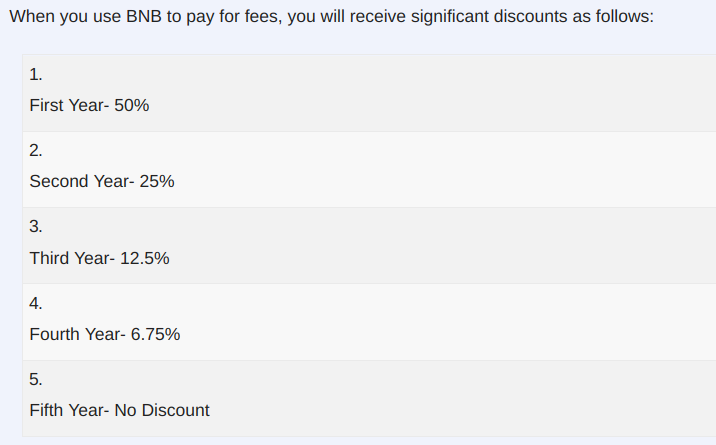

You can use BNB to pay your fees on the Binance exchange. While you can still choose to pay your fees in the cryptocurrency you’re exchanging, Binance offers a rebate as an incentive to pay fees in BNB. In your first year of membership on Binance, fees are discounted 50% when paid in BNB. With every subsequent year of membership, the fee discount decreases. By your fifth year using Binance, there is no longer a fee discount for paying in BNB.

Binance Fees Over Time

Since the fee rebate decreases every year, the value of the BNB token is also expected to decrease over time. To combat this depreciation, Binance also destroys BNB tokens over time, reducing the total supply of BNB from 200 million to 100 million. Contracting the money supply in this way should counteract the effects of the decreasing discount. The goal being a stable price for BNB coins over time.

While fee payment is the primary purpose of the BNB token, you can also use it to invest in certain ICOs that participate in Binance’s Launchpad program. Once the ICO is over, these new tokens will automatically list on Binance, creating a seamless marketplace between ICO and exchange.

The Future of the BNB Token

Binance is promoting the adoption of the BNB token in the hopes that it will drive customer loyalty. The rebate, of course, is a nice perk for lowering trading fees. But even after the rebate decreases, users are still likely to own leftover BNB that they might as well continue to use. As a dominant cryptocurrency exchange, we can expect Binance’s coin to continue to circulate widely. The more its adoption grows, the more valuable and useful it becomes.

Right now, BNB’s primary value is within the exchange. This makes BNB unique among most new coins since it already has a practical use case. Most investors will get the highest ROI out of cashing in on the BNB rebate. However, in the future, it’s possible the value of BNB could grow as an asset. For the earliest investors, they’ve already seen a large return on BNB. It’ll be interesting to see if investors continue to take the rebate or hold BNB in hopes that it will appreciate.

If Binance sees continued success on its current level, it will certainly implement more features and programs. These new capabilities and add-ons will all likely use the BNB coin. Their ICO Launchpad is one early example of an added feature using the BNB coin. There are likely to be many more.

Background & Team

The team that makes all the magic happen

Binance is a Chinese company, originally started in Shanghai and now based in Malta. Its founder, Changpeng Zhao, is the former CTO of OKCoin, another prominent Chinese cryptocurrency exchange. Zhao’s company, Beiji Technology, owns and operates Binance.

In August 2017, shortly after launch, Binance announced that Yi He would join the team. Yi He was one of the original co-founders of OKCoin. She’s widely recognized for her ability to grow technology products and gain user adoption. Zhao, He, and the Binance team have grown the company into one of the biggest exchanges in the world in a fairly short period.

Competition

Until recently Binance held the number one spot by volume for cryptocurrency exchanges worldwide. It has since been overtaken by the Bitmex exchange which trades almost three times in volume. Bitmex, however, is an unregulated exchange which also allows margin trading. This is in direct opposition to Binance which is regulated and does not allow users to borrow funds and leverage their trades.

Margin trading is a riskier way to trade and many traders blow up accounts in the hope of getting rich quick. Bitmex also allows traders to go short Bitcoin. In other words, traders can borrow Bitcoin in the market, sell them, and then buy dollars in the hope of buying BTC back at a lower price, therefore, making a profit. This may be the reason why Bitmex is generating more business in the current bear market.

Binance Coin Trading History

Altcoins have really suffered in the 2018 bear market. Fortunately, Binance has a good business model which incentivizes traders to continue using BNB to pay for their trading fees. This has largely kept the price up as traders hold BNB instead of dollars. BNB initially traded around $0.10 before rapidly shooting up to $2.80 in 2017.

At the height of the mania in 2017, it traded as high as $24. It currently trades around $4.60 which highlights the depreciation of the overall altcoin market. Nevertheless, if you had bought when it was first launched you would still be in pretty good shape.

Where to Buy BNB

Several exchanges other than Binance list BNB though the liquidity is low and there is little point in buying it anywhere else. Most users hold it to cut their trading costs and any coin supported on Binance is available as a trading pair with BNB.

How to Store BNB

If you’re interested in holding BNB as an investment, you should move it off the exchange into a wallet. As an ERC20 token, your BNB can be stored in any Ethereum address via MyEtherWallet. For improved security, you can also use a hardware wallet like the Trezor or Ledger Nano S.

Conclusion

There’s a reason why Binance has seen such massive growth and success over the past year and a half. It’s fast, reasonably priced, and available worldwide. If you already have an exchange that you use and like (that charges similar fees), then there’s no need to switch to Binance. In particular, if you often need to convert to fiat currency, Binance won’t be useful for you at all. However, if you’re unhappy with your current exchange, need lower fees, or are looking for the fastest processing times available, then a move to Binance could be right for you.

Editor’s Note: This article was updated by Ryan Smith on 11 December 2018 to reflect the recent changes of the project.

Additional Binance Coin Resources

Stay up top date with the latest developments at Binance on the following channels:

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.