Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Coinbase vs Kraken

Coinbase and Kraken are two of the most commonly recommended options for buying cryptocurrencies. In this Coinbase vs Kraken comparison, we’ll show you the key differences between both options so that you can choose the right one for you.

Coinbase vs Kraken: Key Information

Coinbase vs Kraken: Instant Buy or Crypto Exchange?

When looking at the key information table above, you probably noticed Coinbase is listed as beginner friendly. However, Kraken is not. Though both sites allow users to buy cryptocurrency, they provide this service in different ways.

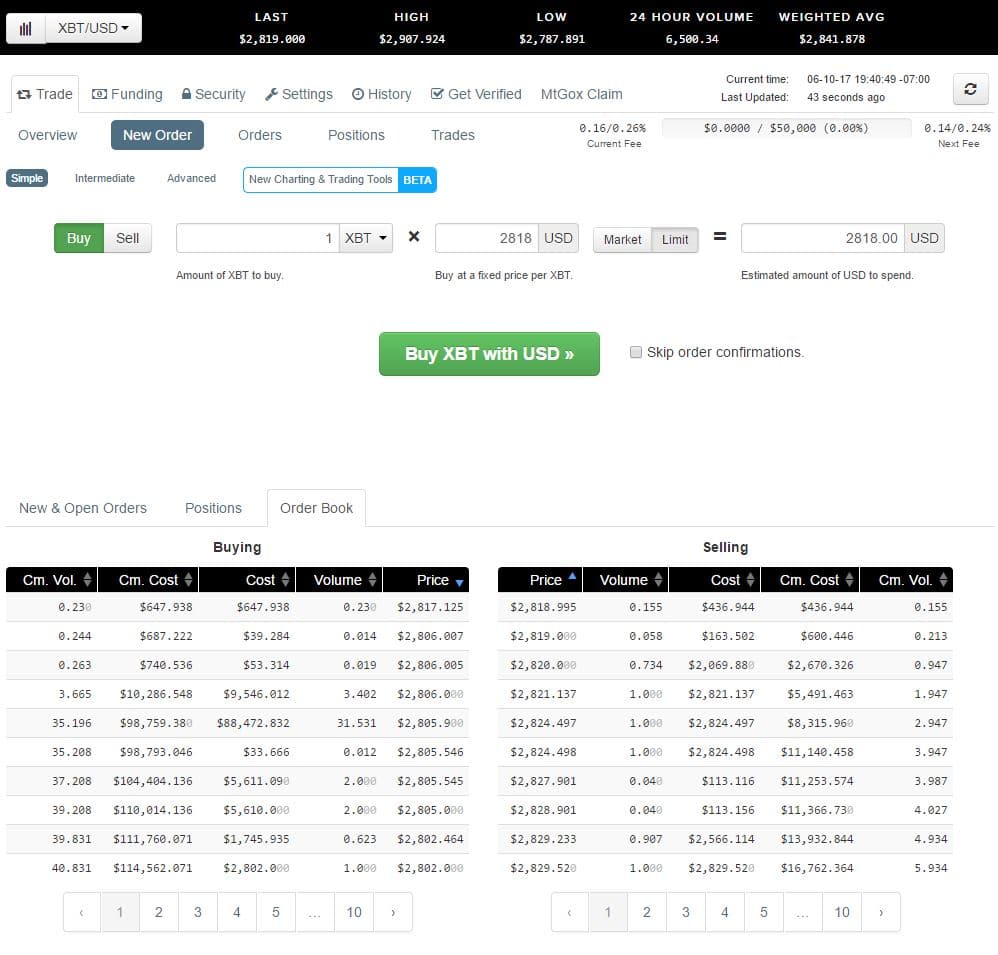

Kraken operates as a cryptocurrency exchange. To explain, you’re able to trade currency pairs with each other, similar to a forex or stock exchange. This design leaves more room for human error than Coinbase does, especially if you have no previous trading experience.

Assuming you’re wanting to trade with fiat currency (USD, EUR, etc.), it will most likely take you longer to purchase your cryptocurrency on Kraken. In order to buy cryptocurrency with fiat on Kraken, you must complete the following steps:

- First, verify your account.

- After that, deposit fiat currency through bank transfer.

- Next, wait for your deposit to hit your account, which usually takes 1-5 business days.

- Finally, trade your fiat currency for cryptocurrency.

As you’ll see below, Coinbase allows you to lock in your price more quickly.

Kraken uses order books making the buying process slightly more complicated than Coinbase.

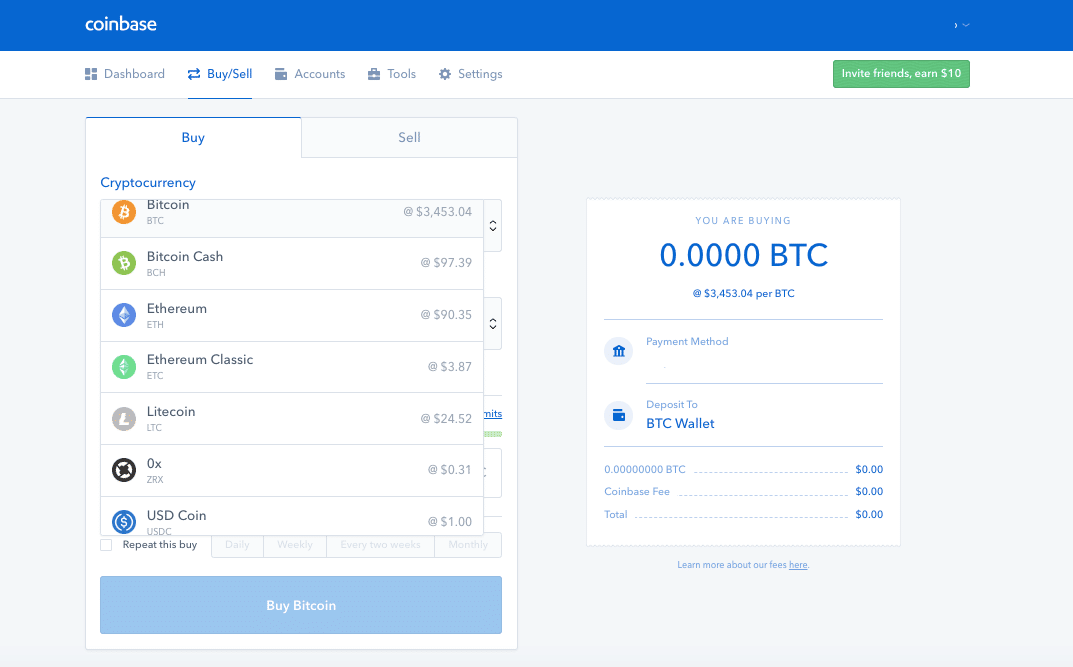

Alternatively, Coinbase simplifies buying cryptocurrency by removing many of the more complex aspects found at exchanges. Even more, it allows you to buy cryptocurrency with both bank transfers (ACH) and debit cards. Below, we’ll show you what the Coinbase buying process is like for each payment method.

Debit Card Purchases

- First, verify your account and debit card.

- Next, instantly buy Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Litecoin, or several other coins at the set price.

Note: Coinbase debit card and bank transfer purchasing limits vary by user. For example, debit card limits are determined by account age, buying history, and verification status. If you’re hoping to purchase larger amounts, bank transfer purchases are a great option, as you can immediately have access to higher limits after verification.

Coinbase Instant Buy Interface

Bank Transfer Purchases

- First, verify your account.

- After that, buy Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Litecoin, or several other coins at the set price.

- Then, you’ll receive the agreed upon amount of cryptocurrency that you purchased after a few days of processing time.

When using a debit card, it’s easy to see the benefits of Coinbase. Not only are you able to use an often-preferred payment method, but you also receive your cryptocurrency instantly.

If you’re looking to lock in a price as soon as possible, you can also benefit when using a bank transfer. Unlike on Kraken, Coinbase allows you to lock in your purchase price before your bank transfer is processed. This can be useful if you’re expecting prices to rise quickly. Note that you cannot transfer cryptocurrency from your account while your bank transfer is being processed.

Regardless of which payment method you use, the price and fees will be clearly shown at the time of your purchase. The price is based on exchange rates, so you can be sure it’s a fair price. Coinbase does charge fees for their service, which you can see in the Fees section below.

Coinbase vs Kraken: Customer Support

Although both platforms struggled with customer support in the past, they’ve made numerous improvements in the past year. So, you shouldn’t have trouble with support on either Coinbase or Kraken.

Coinbase offers customer support through email and phone. While not flawless, Coinbase seems to respond to customer support issues in a reasonable time frame. In our personal experience, Coinbase has responded within 24-48 hours for support tickets. This experience is mostly echoed across online forums, although 24-72 hours may be a more accurate overall mark.

Kraken has typically been known for having good customer service, although there appear to be some complaints surrounding account verification times. Around online forums, users have said they’re struggling to get new accounts verified as well as being unable to get ahold of customer support in a reasonable time frame.

Both Companies Are Trusted by the Community

When observing the community trust of Coinbase vs Kraken, you won’t find much difference. Both have been pioneers in servicing the purchase and sale of cryptocurrency, beginning in 2012 and 2011, respectively.

Both companies are located in San Francisco, California. As U.S. based companies, both sites are fully committed to complying with all U.S. laws and regulations.

Safe and Secure

With millions of dollars being held on these sites, security of funds should be one of their top concerns. Both Kraken and Coinbase adhere to industry best practices for storing both cryptocurrency and fiat currency funds.

- They keep company and user funds segregated, meaning they don’t use your funds for company operational purposes.

- Most importantly, the vast majority of cryptocurrency funds are stored in secure offline cold storage wallets. This type of storage protects these funds from a potential hack or other security breaches.

- Also, both sites offer a variety of methods to secure your personal accounts, including 2-factor authentication.

Additionally, Coinbase provides a few extra precautions. Cryptocurrency funds held online are insured by a syndicate of Lloyd’s of London. On top of that, U.S. customer’s USD wallet balances are covered up to $250,000 by FDIC insurance.

However, if your personal account is directly compromised due to you improperly securing it, neither site will be held responsible for any lost funds.

Coinbase vs Kraken: Fees

If saving on fees is your primary concern, Kraken comes out ahead in this comparison. That being said, you should keep in mind that these two companies offer different services and payment methods.

Kraken’s trading fees are generally below 0.36%, varying by currency pair. For more information, you can view the fee schedule here.

Coinbase understandably has higher fees when you consider:

- They provide additional services that Kraken does not.

- And, they accept debit cards, which naturally carry higher fees. These fees are due to the fees charged by card companies and the risks of fraudulent chargebacks.

On Coinbase, bank transfer purchases typically carry 1.49% fees while debit card purchases carry 3.99% fees.

Coinbase vs Kraken: Available Cryptocurrencies

If you’re hoping to purchase a variety of altcoins, Kraken is likely the better option for you.

Coinbase only offers users the ability to buy and sell Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Litecoin, 0x, USD Coin, Basic Attention Token, and Zcash. Although, they’ve begun adding more cryptocurrencies at a fairly rapid pace.

On the other hand, Kraken allows you to trade the following cryptocurrencies:

- Bitcoin

- Cardano

- Bitcoin Cash

- Bitcoin Satoshi’s Vision

- Dash

- EOS

- Ethereum Classic

- Ethereum

- Gnosis

- Litecoin

- Melon

- QTUM

- Augur

- Tether

- Stellar Lumens

- Monero

- XRP

- Zcash

Coinbase vs Kraken: Final Thoughts

In the battle of Coinbase vs Kraken, there’s no clear winner. Ultimately, it comes down to personal preference. In fact, both sites are good options for buying cryptocurrencies.

If simplicity and time are concerns of yours, Coinbase is the better option for you. Of the two, it’s also the only option that accepts debit cards.

If low fees and a large number of available cryptocurrencies are important to you, then Kraken is a better option.

Editor’s Note: This article was updated on 5.12.2020 to reflect the changes of the exchanges.

More Coinbase Comparisons

- Gemini vs Coinbase

- GDAX vs Coinbase

- Bittrex vs Coinbase

- XAPO vs Coinbase

- CEX.IO vs Coinbase

- Changelly vs Coinbase

More Kraken Comparisons

The post Coinbase vs Kraken | Cryptocurrency Exchange Comparison appeared first on CoinCentral.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.