Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

A lot of cryptocurrency enthusiasts and market observers reference websites that measure the digital asset economy by market capitalization. Now there’s a new data website, Coinmarketbook.cc, that calculates a cryptocurrency’s buy support based on order books held on various exchanges.

Also read: US Law Enforcement Wants Surveillance Tools for Privacy Coins

‘Market Cap is a Lie’

There are many analytical websites that record the data of the largest digital assets by value and most of them focus on the total market valuation of each currency. Sites like Satoshi Pulse refer to the total U.S. dollar value of the number of coins that are in circulation. For instance, the price of bitcoin cash (BCH) is about $140 per 1 BCH, with a circulating supply of over 17 million coins, giving the currency a market valuation of around $2.46 billion. That places bitcoin cash markets in the fifth position among 2000+ digital assets within the crypto-economy. But Coinmarketbook measures the value of digital assets in an entirely different way, because it instead focuses on buy support for cryptocurrencies and determines the value of each coin in this manner.

“Market cap is a lie and buy support tells the true story,” Coinmarketbook explains on its front page. “Buy support ratings separate investments from gambles and buy support analytics determine if the current price will hold.”

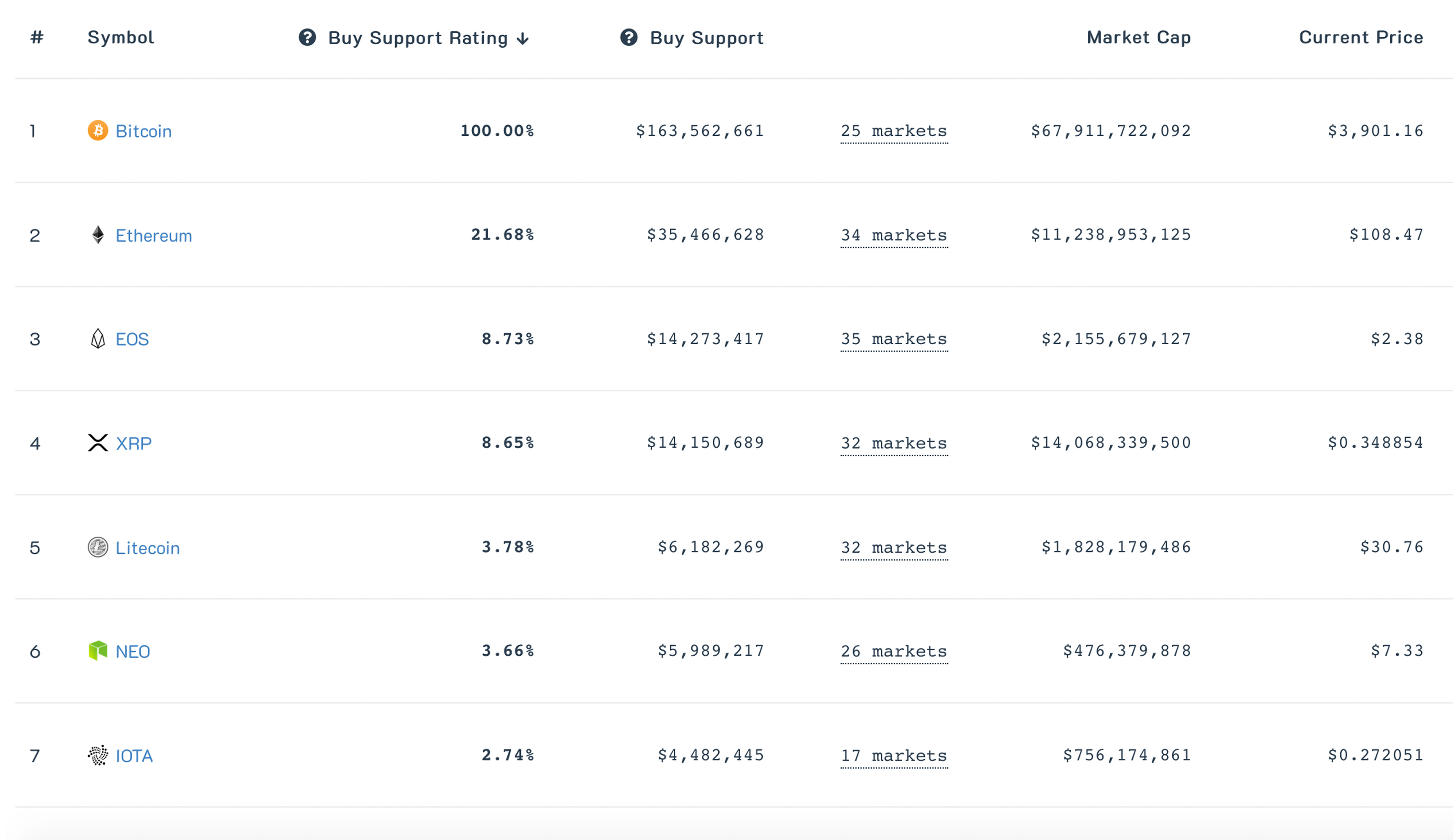

These are the top seven cryptocurrencies according to Coinmarketbook.

These are the top seven cryptocurrencies according to Coinmarketbook.

Coinmarketbook is quite different than data sites that show market caps. At the time of publication, bitcoin core (BTC) was still No. 1 on Coinmarketbook’s list, as it had a buy support rating of around 100 percent. Things get drastically different from standard market-cap sites from there, as BTC is followed by ether with 21.68 percent buy support, eos at 8.73 percent and ripple at 8.65 percent, with litecoin rounding out the top five at 3.78 percent.

The statistics also show how buy support is gauged by the number of markets a coin is listed on. For example, BTC is listed on 25 markets, but other coins have upward of 35 market listings.

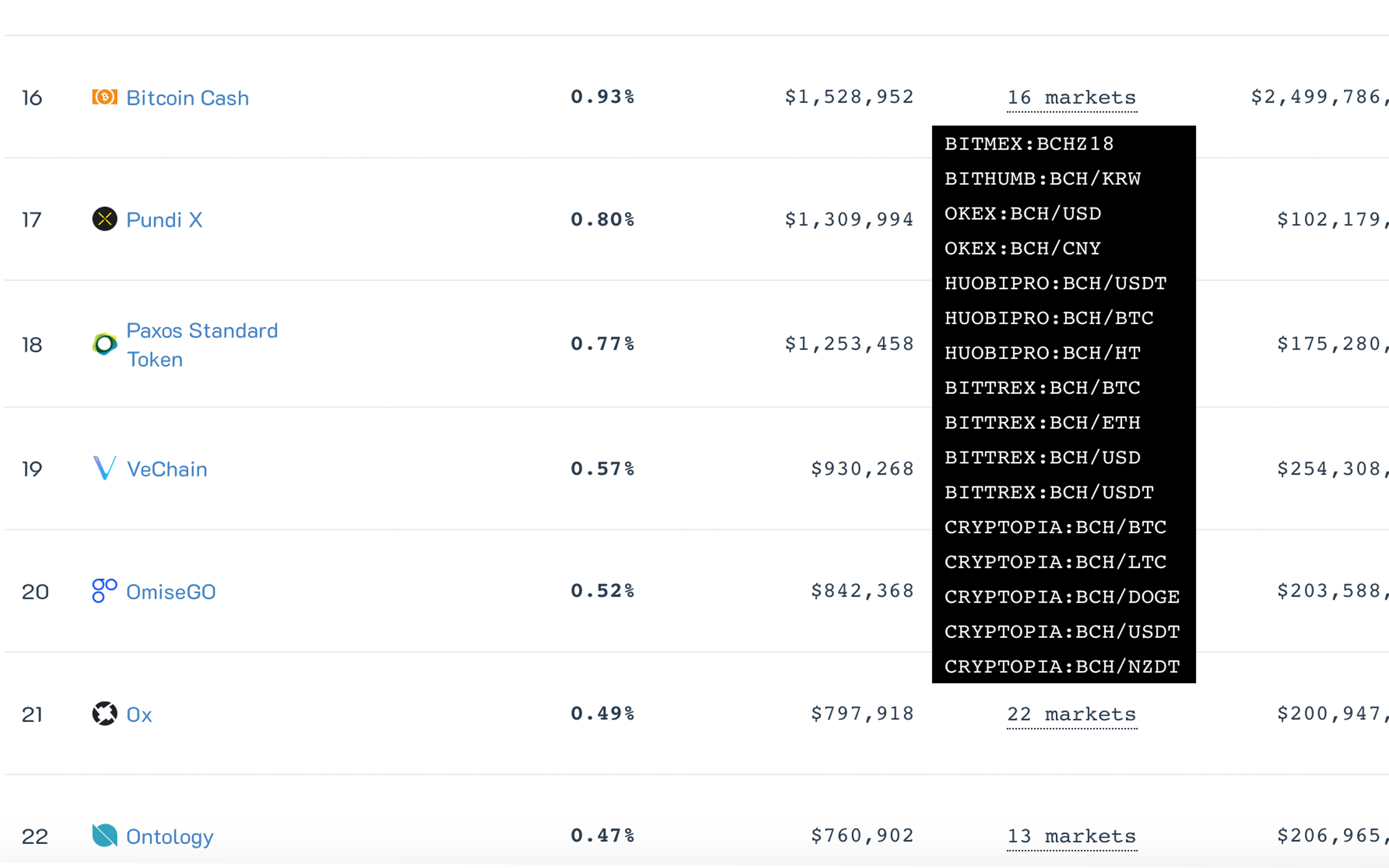

Market Data Variance

Coinmarketbook lists a lot of markets, but it doesn’t quite match the amount of exchange data used on sites like Coinmarketcap.com and Satoshi Pulse. For example, Coinmarketbook lists a total of 16 markets, including exchanges such as Bitmex, Bithumb, Huobi and Bittrex. However, the site is missing information from the top BCH exchanges by volume today, which include Binance ($12.4 million), Coinbase ($4.1 million), Hitbtc ($4 million), Kraken ($3.5 million) and Poloniex ($1.4 million). This is clear to see on Coinmarketbook’s website. However, the creator of the site recently said on Twitter that more exchange data is on the way.

Coinmarketbook lists buy support for bitcoin cash, but the site is missing a lot of exchanges that trade BCH.

Coinmarketbook lists buy support for bitcoin cash, but the site is missing a lot of exchanges that trade BCH.

Coinmarketbook is following the lead of a handful of other analysis sites that rank cryptocurrencies according to different criteria, such as fair market value and “honest” global trade volumes. Coinfairvalue.com, for example, is a platform that evaluates fair market value rather than focusing on speculation.

The creator of the Honest Coinmarketcap spreadsheet, meanwhile, believes that global cryptocurrency trade volumes are often blown out of proportion. Trade volume figures for specific coins such as BTC and ETH are exaggerated by as much as 80 percent, while volumes of digital assets like BCH and XRP are off by 43 to 70 percent, he claims.

Deceptive Order Books

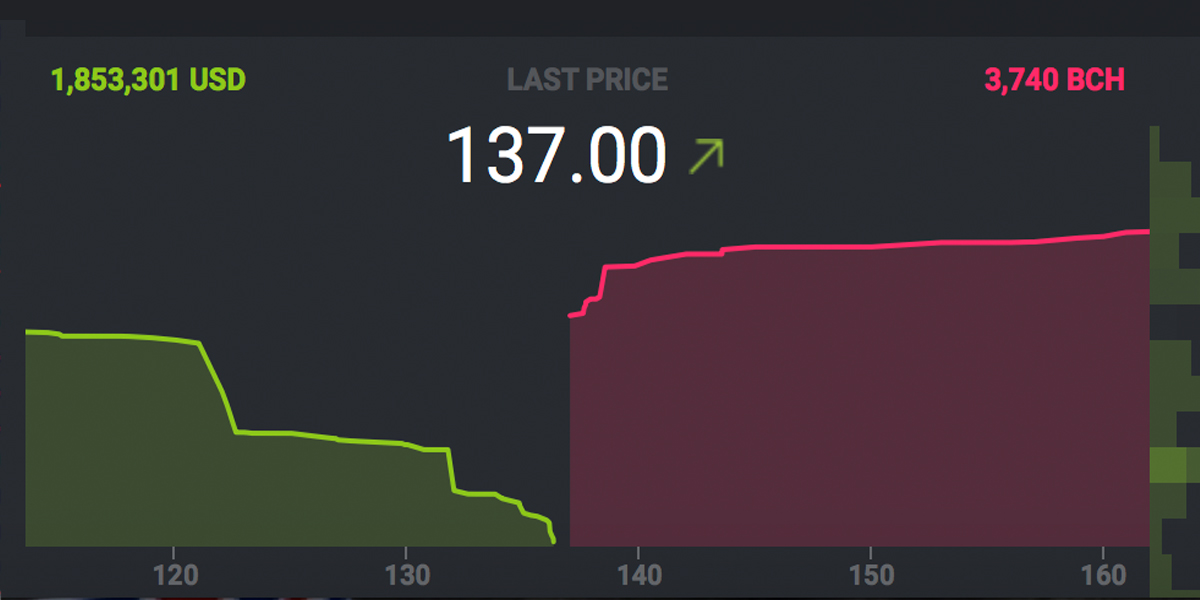

Given that it is missing data from a number of exchanges, Coinmarketbook should probably add more analytics to become more accurate. Cryptocurrency enthusiasts should also take assessments based purely on buy support and order books with a grain of salt. Order books can be misleading, as not all of the buy and sell orders on exchanges are real.

Bitstamp’s BCH/USD order book on Dec. 5, 2018, at 11:00 a.m. EST. Order books are good to observe, but traders should remember that some orders are mere bluffs that won’t be executed.

Bitstamp’s BCH/USD order book on Dec. 5, 2018, at 11:00 a.m. EST. Order books are good to observe, but traders should remember that some orders are mere bluffs that won’t be executed.

Many order books on trading platforms have plenty of orders, but good traders know that some of them are bluffs. An individual may place an order to buy or sell an asset, but that doesn’t mean he or she will execute the deal when the time comes. Some traders use phony orders to make the market move or trend in certain ways, which is why assessing a coin by this kind of so-called support can be misleading. Traders do use order book depth charts for some clues down the road, but depending on them entirely to make trades can be very risky.

What do you think about Coinmarketbook.cc and how it evaluates coins by order book buy support? Let us know in the comments section below.

Images via Shutterstock, Coinmarketbook.cc, and Bitstamp.

Need to calculate your bitcoin holdings? Check our tools section.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.