Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Source: TechCrunch

Source: TechCrunch

There have been countless blog posts and podcasts all helping to unravel the technical breakthroughs and enigmas that make cryptographic tokens possible. As fascinating as it is to discuss the technology behind tokens, I want to go in a different direction.

What follows is a brief look at a primary way that tokens can function in decentralized organizations. As an investor, deeply understanding the function(s) a token has in its organization is the key to determining how the value of that token will appreciate in relation to the growth of that organization.

To be clear, “token”, in this context, refers to the scarce cryptographic tokens launched on an existing blockchain protocol (most commonly today according to the ERC20 token standard via Ethereum). These tokens, distributed during an ICO, (Initial Coin Offering) function as an (ideally) inherently- decentralized economic foundation for a DAO (Decentralized Autonomous Organization) or dApp (decentralized application). These tokens are custom built and massively versatile, they are also complex in fundamentally new ways. This presents a challenge for both developers and crypto-economists optimizing for specific behavioral outcomes and investors allocating capital to projects that deliver the most value in relation to price.

Once you understand the token well enough, you can more accurately back out its potential value by looking at the projected growth of the tokenized organization and the way that the demand for the token would scale in proportion. This is rather high level and abstract at the moment, I’ll go into a specific example shortly.

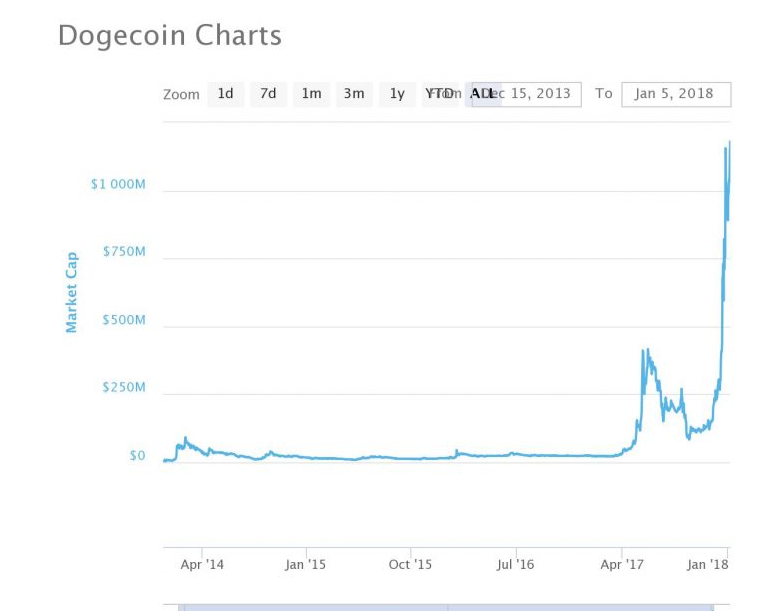

First let me point out that as a hedge fund manager who focuses primarily on ICO investing, I empathize with the view that the valuation approach described above seems a bit idealistic at the moment. Case in point, the speculative frenzy we find ourselves in is so fierce that even self-defined “joke coins” find themselves sporting billion dollar valuations.

The Dogecoin marketcap is up over 1000 % since October

The Dogecoin marketcap is up over 1000 % since October

It is clear the cryptocurrency market as it stands is not known for its fundamental analysis, such as the price to earnings ratio, one finds in the equities market. However, ICO tokens are rapidly emerging as the organizational blueprint for the economy of the future. This is further evidenced by ICO fundraising significantly outpacing early stage venture capital in the second half of 2017. In any case, the bubble will end. And when it does, it is important we have molded our economic intuition to better match this new economic and organizational paradigm.

Now let’s go through a concrete example of tokenomics by first defining what a token means in the context of the organization it is attached to and not in the purely technical sense. The below definition of a token is taken from William Mougayar June 2017 article on a “business guide to tokenomics”(highly recommended reading)

Interestingly, the first half of this definition captures the essence of how tokens differ from stocks, at least in theory. If you’re interested in learning more, I covered this topic in depth in an earlier post.

A general classification of tokens that do not fall under the purview of securities or equity can be lumped into the catch all category known as “utility tokens”. Utility tokens are typically associated with applications (they are also sometimes called “app coins” because of this) and they are tied to a given application in any number of ways. Let’s take a very high profile ICO offering a utility token as a case study: Filecoin.

Filecoin raised $257 million at a nearly $3 Billion Valuation

Filecoin raised $257 million at a nearly $3 Billion Valuation

Filecoin raised a lot of money in exchange for its utility tokens, $257 million to be precise. But what exactly were investors buying and what metrics did they go off of that led them to invest? Well lets begin by first describing Filecoin the application / service then summarize an idealized approach to how one might have come to an informed investment decision in regards to Filecoin:

Filecoin pitched themselves as a decentralized alternative to cloud-based storage. The quick and dirty of Filecoin is that the vast majority of people, as well as organizations, have computers where only a small percentage of their hard-drive storage is in use at any given time. Using a variety of data provenance and distribution techniques, Filecoin demonstrated that, at least in theory, all that unused space could be put to work and used as storage by any stranger anywhere in the world even if the data was highly sensitive.

And the best part? You get paid for it! The only catch is you have no choice but to get paid in Filecoin utility tokens. The same is true if you are purchasing space, you have to pay in Filecoin tokens. The point of all this, of course, is to create a long term market for Filecoin tokens so that the team can sell these tokens in an ICO for funding.

Since Filecoin’s $257 million ICO was limited to accredited investors only, it’s probably safe to assume each investor went through a diligence process that went something like the following:

- Estimate the cloud-storage market share Filecoin would need to capture relative to the fixed token supply to achieve an ROI that compensates for respective risk profile, opportunity cost of of capital, etc.

- Study the results, conclude whether or not the risk-reward tradeoff is where it needs to be to make an investment.

- Proceed accordingly and with reasonable confidence in the long-term value of your investment.

Alas, as we all know, this couldn’t have been farther from the truth. The fact is that most investors don’t even bother to look at the tokenomics of an ICO before investing. They simply trust the team that the value of the token will magically scale as the project or application grows. There is no secret sauce inside cryptographic tokens that defies the laws of economics and supply and demand that ensures this outcome.

Filecoin is not unique in its tokenomic architecture. Numerous high profile projects (e.g. Golem and countless others) have used virtually identical token models to Filecoin’s as a means to conduct an ICO. But there are seriously troubling concerns when it comes to the long-term viability of an economic model with a scarce supply of tokens that are only usable within a single closed marketplace.

When analyzed for market-cap calculations, Ethereum founder Vitalik Buterin argues in this article that the use of an app-coin such as Filecoin’s token introduces an “implicit cost” to holders in the form of opportunity cost that compounds market movements in a way that is highly subject to manipulation and, potentially, rapid devaluation. Most current utility token designs adhere to a strict scarcity of supply model. Usually, there is a single “token generation event” which serves as the only time tokens are created. Unfortunately, a fixed-supply falls short of what, in theory, is necessary to support a robust long-term equilibrium market price for utility tokens, according to Vitalik. In particular, it is crucial to incorporate systematic “supply-sinks” of tradable tokens in order to maintain a steady return to holders in a way not strictly dependant on (unbounded) network growth increasing theoretical token-demand.

Transaction fees, limited liquidity, and high spreads also help encourage holding. That said, all of these friction layers are shaky in their effectiveness at best as the crypto exchange ecosystem is incredibly robust and highly incentivized to innovate. If not carefully designed against, many existing utility token models offer very limited incentives to hold as a speculative asset. Calculating instantaneous market cap of a utility token is done using the same macroeconomic equations that describe the velocity of money, which Vitalik beautifully details in the article linked above. Given this valuation model, it is not hard to imagine a scenario in which a rapid devaluation of a utility token might occur. A scenario facilitated by extremely efficient means of exchange corresponding with a desire to move in and out of said utility token as quickly as possible given the implicit cost of owning it outside of its utility within a specific application.

Of course, there are also many upsides to a well-constructed app-coin that are important to recognize. An entirely new business model enabling new applications crowdsourced in a borderless manner is a powerful innovation. I will continue in future articles to flesh out some of the key characteristics of alternative tokenomic models to app-coins as well as some of the upsides of a well designed token.

On Tokenomics and ICO Valuations was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.