Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

The following study will evaluate the performance difference between rebalancing on a periodic interval and holding. By examining different intervals, we can determine which rebalancing frequencies had the largest performance increase over simply holding. This study was set up using the following constraints.

Trades & Data

Data was collected from Bittrex starting on March 15th 2017 and ending on October 20th 2018. All of the data points were collected as exact bid and ask values for each asset. This provides the precise prices that would have been used if trades were actually executed at each time. Additionally, all trades included the .25% fee which is standard for Bittrex. A trade from LTC to XRP would therefore first trade from LTC to BTC (which would incur a .25% trading fee) and then from BTC to XRP (which would incur another .25% trading fee). The result is a fee model that is as accurate as possible.

Rebalance Period

The primary variable for this study is the rebalance period. A rebalance period is the specific amount of time between each rebalance. So, a period of 1 day would result in a rebalance every single day at the exact same time. In this study, the rebalance periods that will be tested are 1 hour, 1 day, 1 week, and 1 month. Learn more about rebalancing for cryptocurrency.

Portfolio Size

The portfolio size for this study has been fixed at 10 assets per portfolio. Learn more about how the number of assets in a portfolio affects performance.

Asset Selection

Constructing each portfolio was done at random. All assets which were available between March 15th 2017 and October 20th 2018 on Bittrex were included during the selection process. This amounts to a total of 110 different assets. The list of assets which were included in this study can be found by navigating to the backtest tab in the Shrimpy application and then selecting the same timeframe as the one mentioned above. Learn more about how to build a strong portfolio.

Backtest

A backtest is the process of using the trade data from the exchange to simulate how a strategy would have performed over a given time period. This is often used to test the viability of a strategy by running it through large data sets. In this study, we used backtests to compare the results of rebalancing to those of buy-and-hold. The number of backtests we ran for each portfolio size and rebalance period pair was set to 1000. Read more about backtests or run your own.

Performance

The performance for each backtest was determined by taking the final rebalancing value and comparing it to the final buy-and-hold value. This was done by using the equation: (Rf — Hf) / Hf, where Rf is the final rebalancing value and Hf is the final buy-and-hold value.

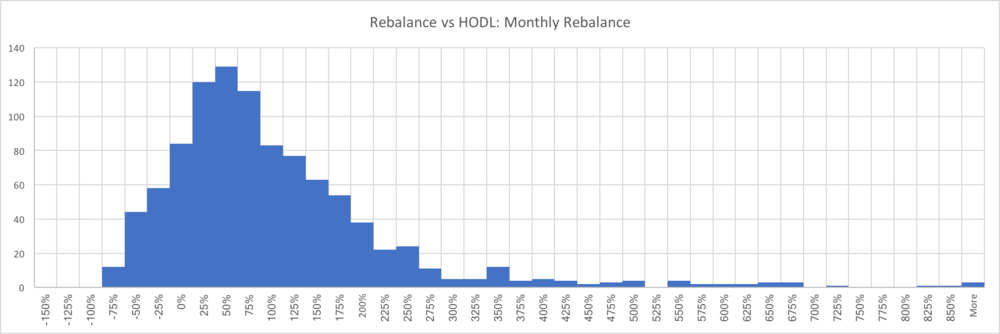

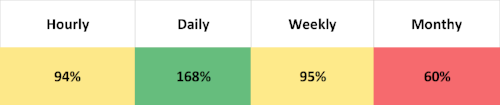

MONTHLY REBALANCES

A monthly rebalance is the longest rebalance period that will be examined in this study. Rebalancing on a monthly basis resulted in a median portfolio performance boost of 60% over buy-and-hold. 80.2% of all portfolios which used monthly rebalances performed better than buy-and-hold.

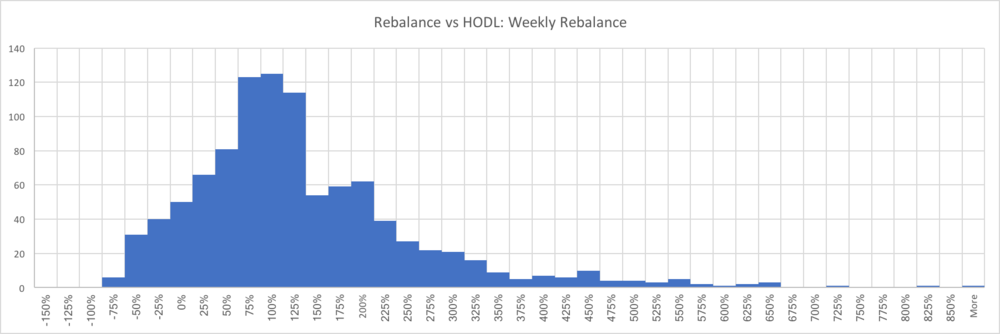

WEEKLY REBALANCES

Rebalancing once every week resulted in a median portfolio performance boost of 95% over buy-and-hold. 87.3% of all portfolios which used weekly rebalances performed better than buy-and-hold.

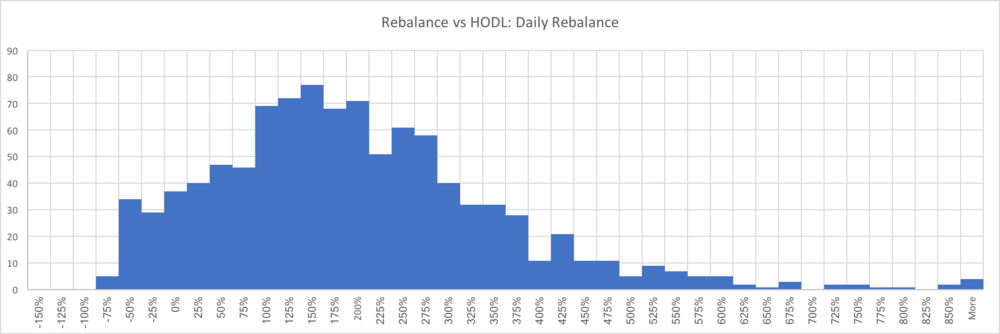

DAILY REBALANCES

Rebalancing once every day resulted in a median portfolio performance boost of 168% over buy-and-hold. 89.5% of all portfolios which used daily rebalances performed better than buy-and-hold.

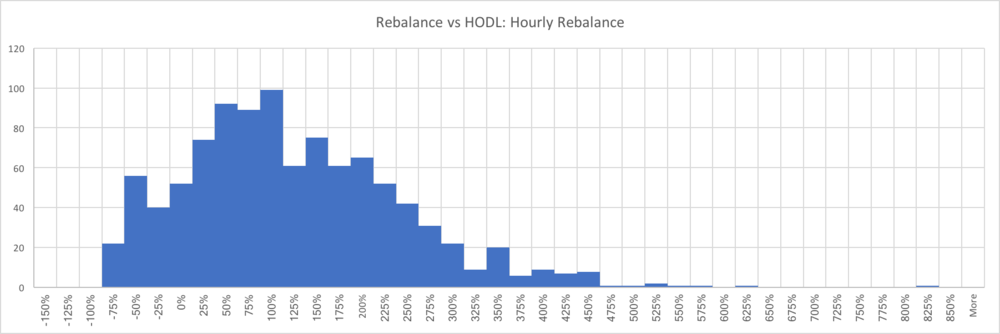

HOURLY REBALANCES

Rebalancing once every hour resulted in a median portfolio performance boost of 94% over buy-and-hold. 83.0% of all portfolios which used hourly rebalances performed better than buy-and-hold.

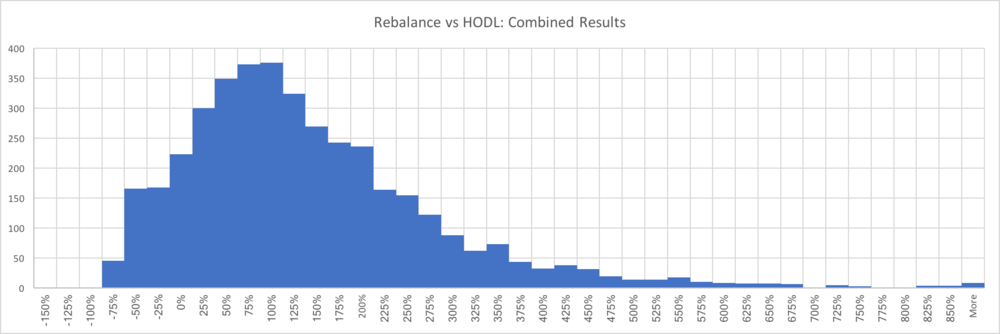

COMBINED RESULTS

Rebalancing on any time period resulted in a median portfolio performance boost of 100% over buy-and-hold. 85.0% of all portfolios which rebalanced performed better than buy-and-hold.

Comparing each of the 4 rebalance periods to each other, daily rebalances has demonstrated the highest performance over the timeframe that was backtested.

CONCLUSIONS

Rebalancing backtests illustrate exciting results in regards to portfolio performance when compared to buy-and-hold. Without time consuming involvement, complex set up, or expensive tools, rebalancing has established itself as a powerful strategy for cryptocurrency users. Simply setting up a portfolio and then forgetting about it with an application like Shrimpy would have provided a median performance increase of 100% across all rebalancing frequencies.

Due to the low resolution of rebalancing frequencies, it would be appropriate in the future to perform a detailed analysis of every possible rebalance period to find the most optimal rebalance period.

REBALANCING WITH SHRIMPY

Shrimpy is a free application which automates the rebalancing strategy. Our dedicated tools for asset allocation, backtesting, and indexing the market are the most powerful in the industry. Whether you are an institution or individual, our solutions are designed to solve the most pressing problems facing portfolio management in the crypto space.

Sign up today by clicking here.

If you still aren’t sure, try out the demo to see everything we have to offer!

Don’t forget to check out the Shrimpy website, follow us on Twitter and Facebook for updates, and ask any questions to our amazing, active communities on Telegram & Discord.

Leave a comment to let us know your experiences with rebalancing!

The Shrimpy Team

Originally published at blog.shrimpy.io.

Cryptocurrency Portfolio Rebalancing: Bittrex Analysis was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.