Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Mining centralization remains a hot topic in the cryptocurrency community. Knowledgeable members continue to point out that Bitmain’s growing market share in Bitcoin (and other proof-of-work cryptos) is a major source of concern. The SC1 miner was recently launched and the company behind the rig is taking a hardline approach against monopoly ASIC suppliers. Obelisk is bringing an alternative approach to ASIC mining, but can it put the power back into the hands of the people?

Who Is Obelisk?

Obelisk is the same team behind Siacoin, the decentralized cloud storage solution taking on the likes of Microsoft and Amazon. Sia also uses proof-of-work to secure its network and is consequently facing some of the same mining problems as Bitcoin. To that end, the team at Obelisk hopes to challenge supply dominating companies like Bitmain by building their own ASICs for both the Sia and Decred mining markets:

Announcing the Obelisk Sia ASIC miner presale! Presale begins Wednesday at 2pm EST, will be open for 7 days. https://t.co/CgbwRKCsIc

— Sia Tech (@SiaTechHQ) June 23, 2017

The Problem

Bitcoin is a fast, trustless method of exchanging value worldwide. But a decentralized currency makes little sense if the infrastructure used to secure it is not. Bitmain is one of the major, if not the leading supplier of ASIC mining hardware. Their powerful position, however, has also earned them a rather notorious reputation in crypto circles.

Zach Herbert, one of the core members of Sia, highlighted some of the problems that centralized mining can causein a post earlier this year (2018):

Bitmain has a strong track record in Bitcoin of actively working to undermine core development, blocking important network upgrades (Segwit), backing contentious forks (Bitcoin Cash), building in backdoors (Antbleed), and much more. We consider Bitmain a bad actor in the cryptocurrency space.

His words came after Bitmain surprised the entire Siacoin mining market with the announcement of the Antminer A3. A rig designed specifically to mine Siacoin and compete with Obelisk’s offering:

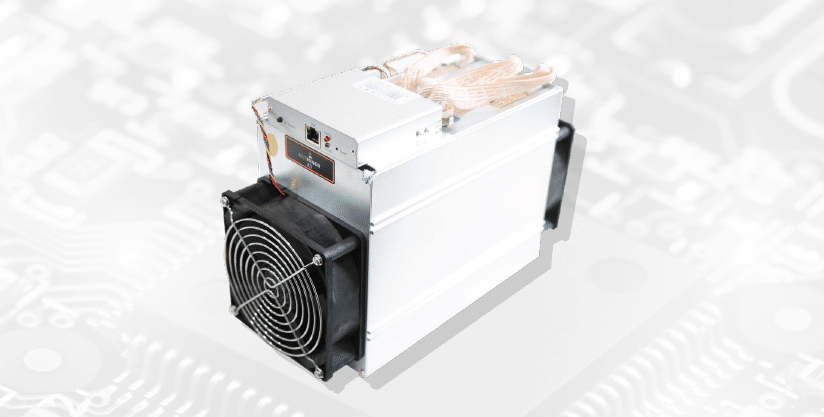

Bitmains A3 Antminer. A surprise launch to compete in mining Siacoin.

Naturally, this did not go down well with Siacoin miners who had already pre-ordered Obelisk ‘s miner half a year earlier. To add to that slap in the face, Bitmain was offering customers a 10 day delivery time on their orders. This effectively allowed A3 buyers to start bringing in profits almost six months before SC1 buyers even received their rigs. If ever there was a declaration of war in cryptocurrency mining, this was it.

Furthermore, in the wait to receive their SC1s, profitability continues to decrease as more miners secure the network and the algorithmic difficulty goes up. You see the predicament. What’s a manufacturer to do? Well, Obelisk may have a solution. Or so they say.

Launchpad

Launchpad is a relatively new service from Obelisk that aims to fix the issue of large-scale miners undercutting new players into the market. Obelisk intends to develop, in partnership with new coin creators, a unique mining algorithm and subsequent mining hardware for that algorithm.

This service should allow coin developers to control the launch of their own coin by hiding the hardware and algorithmic details up front. Once the coin launches, ASICs can be distributed evenly to the community to ensure that the processing power is not controlled or secretly mined by a few large players like Bitmain.

Obelisk miners for the Siacoin and Decred networks

What’s more, Obelisk aims to keep the playing field level by open-sourcing the designs to the public on launch. This will allow competing manufacturers to bring their own versions to market in time. It’s a rather grand vision but Obelisk believes that these may be the first steps to creating an industry-wide standard for mining hardware that has decentralization as a core principle.

Sounds great. So what’s the catch? Well, the service will set you back a hefty $10 million to get your very own Launchpad. The theory goes that a unique ASIC and algorithm should give the first generation of miners a four-month head start. This would theoretically be enough time to recoup costs and continue competing until better ASICs hit the market.

The Drama Continues

Despite a rather noble attempt at tackling mining centralization, Obelisk continues to face a few of their own controversies. The original SC1 miner spec in July of 2017 was announced with a hash rate of 800 GH/s+. In May of this year (2018) the team announced that chip testing only revealed speeds of around 550 GH/s. Obelisk was unfortunately not able to deliver on their initial hash rate promises and is currently selling the final product via their website at 550 GH/s.

To add to the drama, many users didn’t actually receive their orders on time and Obelisk had to compensate customers for lost mining revenue. Finally, and perhaps most controversially, the team recently decided to fork the Sia network in an effort to block competition from the likes of Bitmain and Innosilicon. This move clearly benefitted Obelisk’s customers. A rather amusing move if you consider that to prevent monopoly influence they have now created their own.

Obelisk Miner: A Model for the Future or Passing Fad?

Despite Satoshi’s vision of a more equitable future for finance, it appears that the struggle for power and control continues. It’s clear that Bitmain continues to do, well #bitmainthings. So it’s understandable where the team behind Sia and Obelisk are coming from.

That said, however, Obelisk by their own words admit that Launchpad will initially be centralized around a single ASIC manufacturer in the beginning. Furthermore, apart from their promises, how will the community actually know if they haven’t held back a number of rigs to secretly mine coins for themselves?

Respected advocates of crypto such as Andreas Antonopolous have previously pointed out the harmful effects that ASIC resistance can actually bring. That won’t deter the hardcore Siacoin fans though. With so many challenges in this space, can the obelisk miner be a model for the future? Who knows. For now, mining centralization will remain a hot topic.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.